Disclaimer: Unless otherwise stated, any opinions expressed below belong solely to the author. The following article is not financial advice and the author did not hold a stake in any of the assets mentioned at the time of writing.

2024 was a year of crypto and artificial intelligence (AI) in tech, which is reflected in the prices of digital currencies and stocks of many tech companies in both markets.

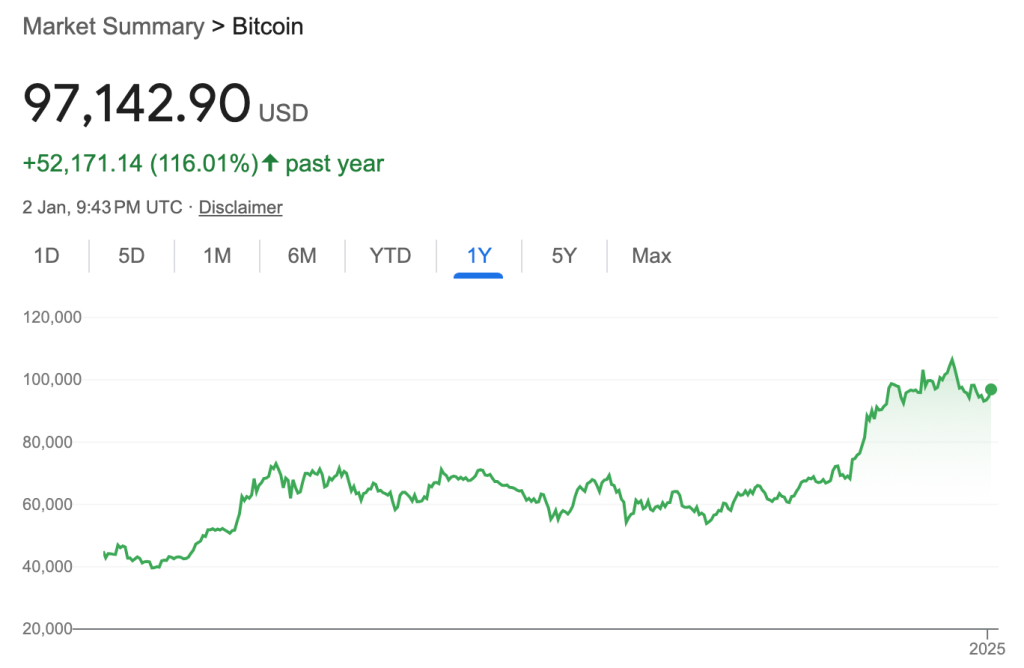

Bitcoin (BTC) surged to record highs, finally piercing the US$100,000 milestone, while the leading GPU manufacturer selling the hardware that is the backbone of AI revolution, Nvidia, broke through to the US$3 trillion club, contesting the title of the most valuable company in the world with Apple and Microsoft.

If you put money in either of them, you would have more than doubled your investment by now, with BTC’s 116% surge still solidly beaten by Nvidia’s 178%.

But while tech press has spent the past year tracking the latest developments in AI and the resurgence of crypto—both of which elevated many assets to record highs—much less attention was given to a somewhat unexpectedly strong performer based in Singapore.

One that we all know very well: Sea Ltd.

Forget about Bitcoin

Many people are kicking themselves for losing yet another crypto wave but really, if anything, you should be upset about forgetting about Sea (if you did), which would have provided a much higher return and a share in something more tangible than a digital coin.

Yes, Shopee’s parent company, which in late 2023 sank to a 90% loss from its peak valuation in 2021, has just closed a remarkable year, rising by over 175%, only marginally behind Nvidia and considerably ahead of Bitcoin.

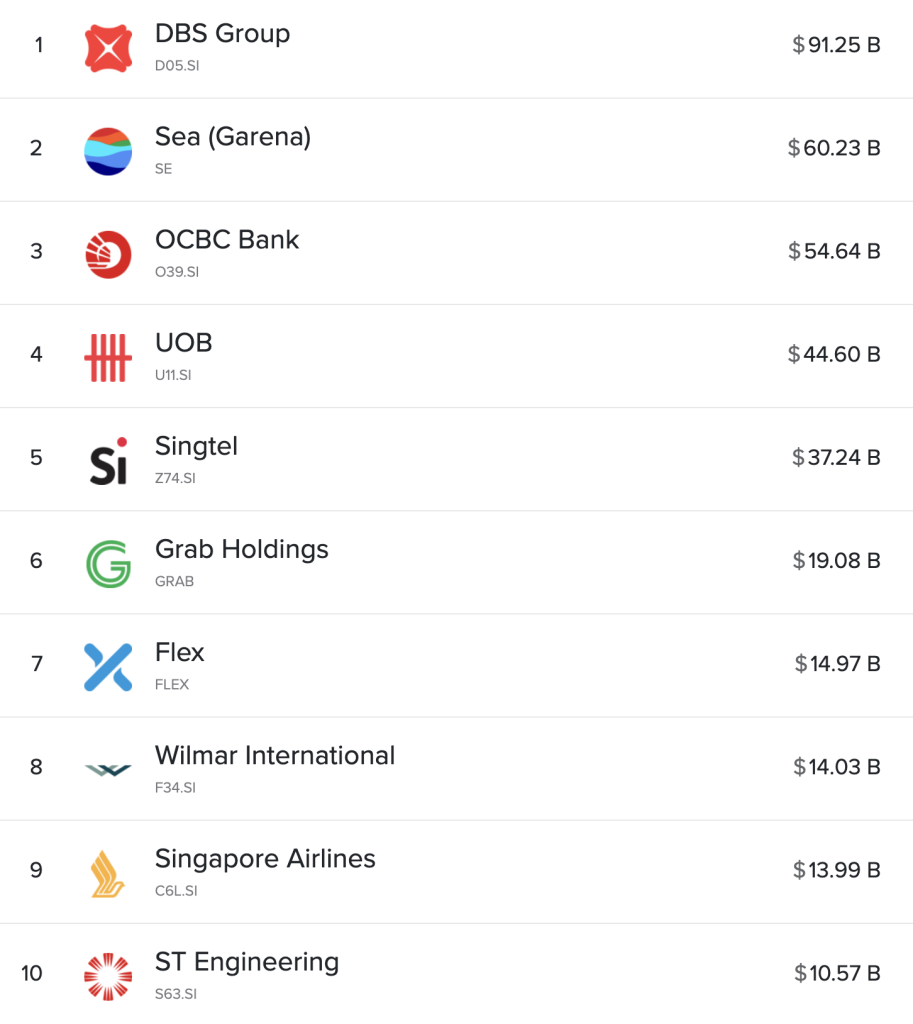

Hitting over US$100 per share has pumped Sea’s market capitalisation to over US$60 billion, elevating the company back to no. 2 among the largest in Singapore, currently outranked only by DBS.

Returning to the ecommerce Premier League

Sea’s rally was not only a feat compared to other high performers in tech, but blew out of the water most of its international competitors.

There were some respectable performers like Amazon or Japanese Rakuten, rising by around 40 to 50% in 2024, but nobody in the industry has come close to tripling their value over the past 12 months.

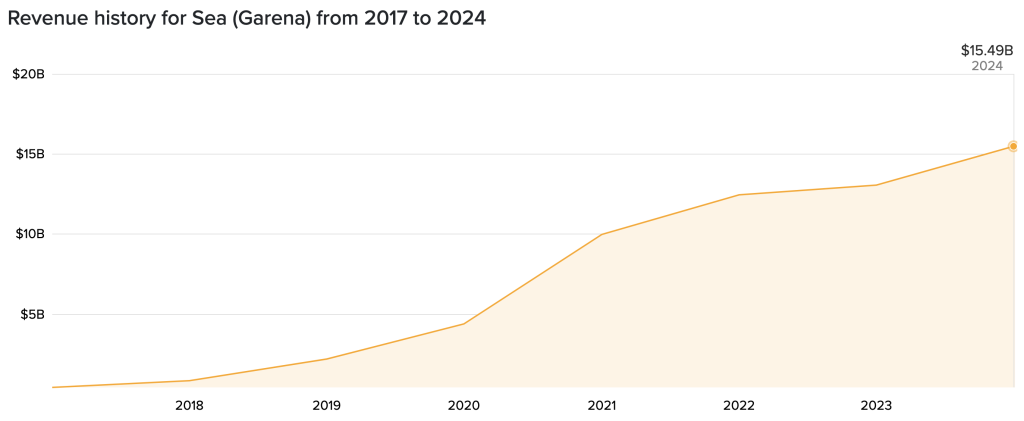

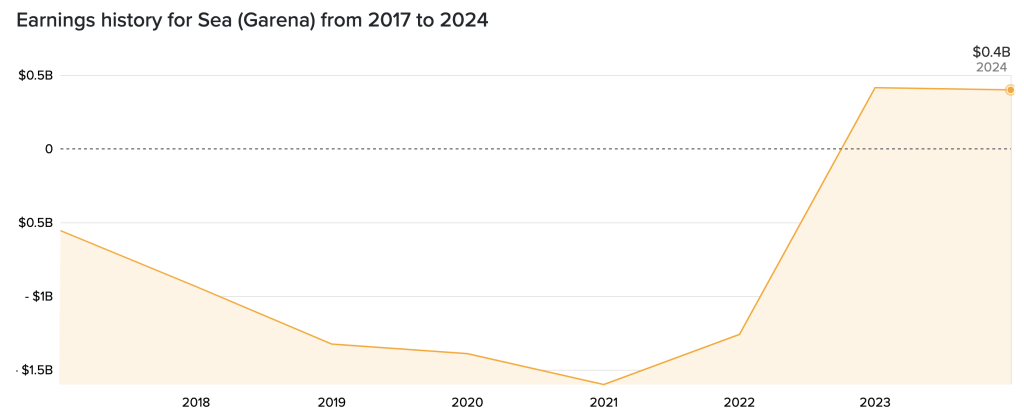

This is a testament to Sea’s resilience and a return to the ecommerce Premier League, showing renewed investor trust in a company whose survival was not entirely certain just two years ago before it proved it could turn a profit and not rely on spending borrowed money to fuel its growth.

While it isn’t exactly a cash cow yet, the fact that it is self-sustainable has reassured investors that the company is here to stay and will not suffer the fate of e.g. Wish.com.

It is also reasonably diversified, thanks to its digital entertainment arm Garena and gradually growing financial services provided by SeaMoney.

What’s in store for 2025?

Sea has completed its transformation from a promising startup to a solid, stable, big tech company. With around US$10 billion in the bank and good performance of all three of its constituent businesses, it’s certainly expected to keep growing.

Perhaps it can even afford to resume its international expansion into markets on other continents, as it intended before cheap cash supply was interrupted by a bout of global inflation, which made raising capital and borrowing money much more expensive.

When it comes to stock performance, however, it remains anybody’s guess, since how a company is priced does not rely solely on what it does but how the entire investment environment looks like.

With Donald Trump returning to the White House this month, elected i.a. on promises of raising tariffs adding fuel to the fire of international trade wars, it’s hard to say how particular ecommerce-heavy businesses are going to be impacted and whether investors choose to realise their gains or stick for the long haul.

The American stock market has had a rather excellent two years, with the S&P 500 index rising by over 20% in both 2024 and 2023—for the first time in a quarter of a century—and that raises questions whether this pace can be sustained in 2025.

How the American Fed handles interest rates amid slowing inflation is another unknown. There are just too many factors overlapping this year to predict a stock’s future performance with any degree of confidence.

What we do know for sure, however, is that Sea is past the period of uncertainty and its survival is not under threat any longer.

Featured Image Credit: Sea Ltd.