Disclaimer: Unless otherwise stated any opinions expressed below belong solely to the author. Inflation data sourced from the Monetary Authority of Singapore.

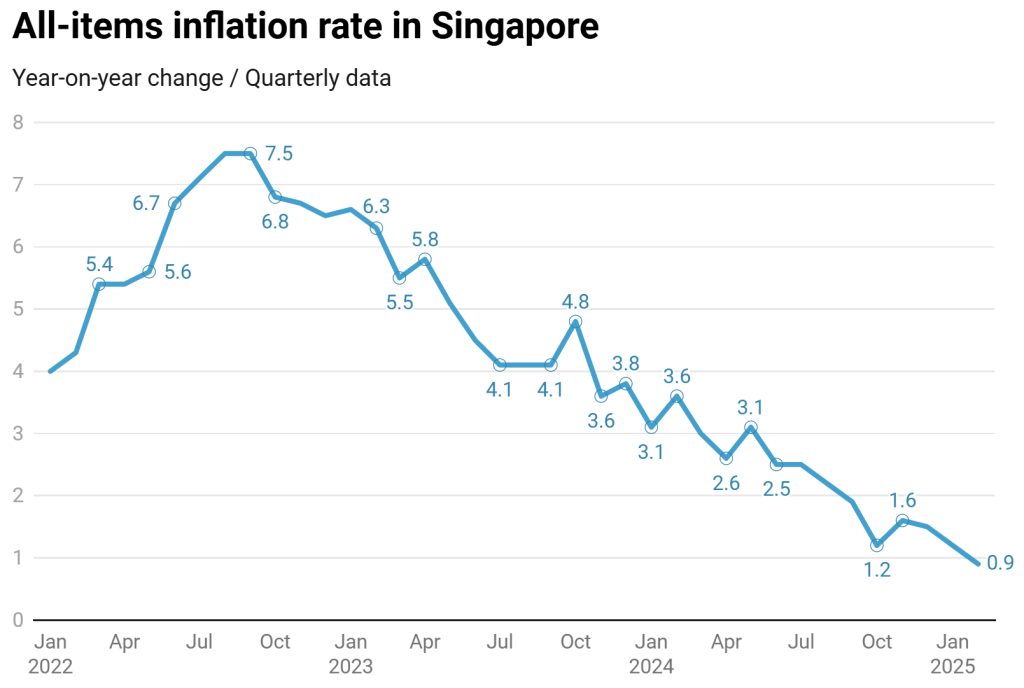

It’s finally over! Despite projections putting the inflation rate for the full 2025 at between 1.5 to 2.5%, the all-items headline inflation rate for February stopped at just 0.9%.

This is significantly below the long-term average of about 2%, which is the unofficial guiding figure for the Monetary Authority of Singapore. Essentially, then, goods & services prices in Singapore have flatlined.

This is also the lowest reported rate in four years, since before the Russian invasion of Ukraine and the wave of price hikes following the pandemic stimulus packages, which first appeared in national statistics in 2022.

As a result, MAS has already corrected its full-year forecast to between 1 and 2%—that is, the balanced norm we have grown used to before 2020.

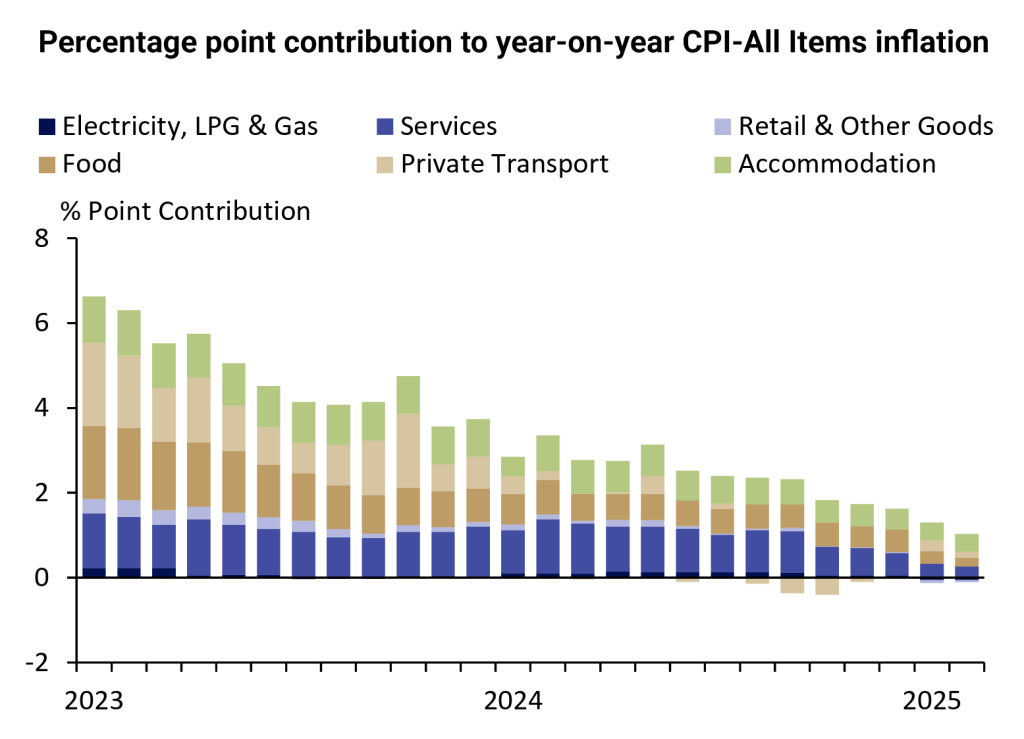

Retail and energy prices go down

Not only has price growth slowed down, but prices of certain items have also reported a decline. While food has gotten a bit more costly, prices of retail goods dropped in the first two months of the year, followed by even bigger drops for electricity and gas—at minus 3% year-on-year.

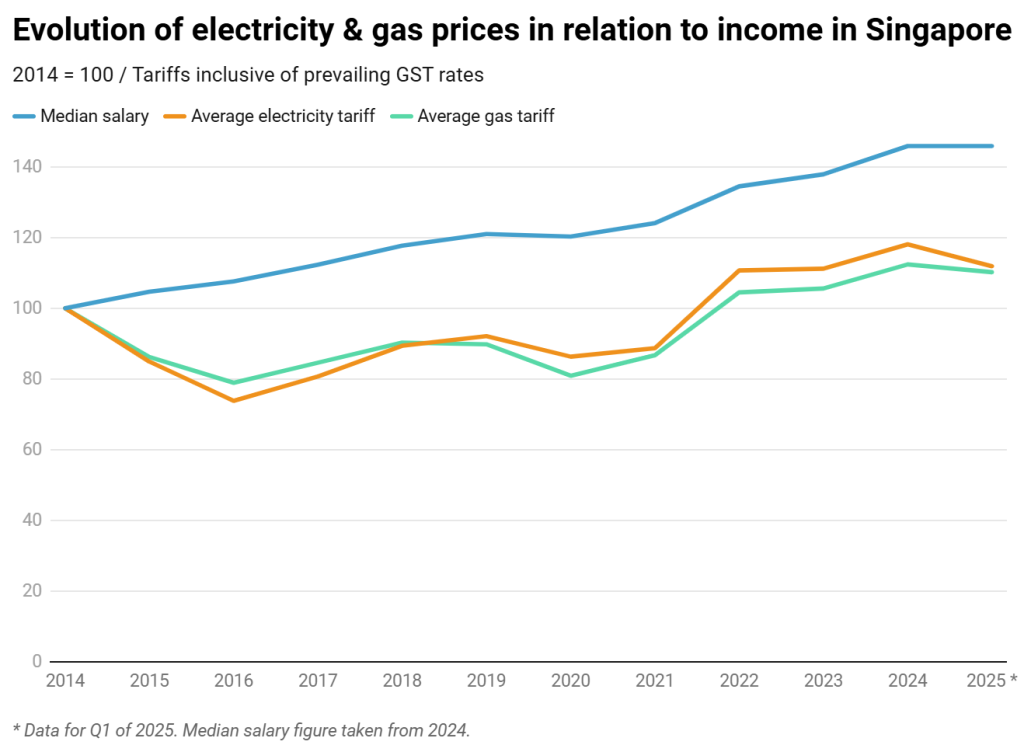

It may seem that this drop is relatively small as energy prices remain inflated, but we have to remember two important things:

- Singaporeans have gotten used to several years of unusually low rates following a significant drop in 2014.

- While current tariffs remain high, the income growth has outpaced them significantly, meaning that relative to earnings, energy is cheaper than before.

To illustrate the point, I plotted the evolution of energy prices compared to how median salaries in Singapore have changed over the past decade.

Electricity and gas may be about 10 to 11% more expensive than in 2014, but incomes in the city-state have gone up by over 45%.

Dark clouds ahead?

While inflation is typically a monetary problem resulting from too much money in circulation (which is why it followed a period of generous pandemic handouts by governments around the world), both prices and relative affordability of goods and services may be affected by other events.

One such example was the Russian invasion of Ukraine, which shook the energy markets around the world, making power consumption needlessly more expensive.

While this war may end in the not-too-distant future, the prospect of an international trade conflict between the US and China, as well as Europe, the Americas and most of Asia, is certainly unnerving.

It may be unlikely that Singapore will find itself on the receiving end of any direct tariffs, considering that the city-state has a trade deficit with the US; any disruptions to trade will impact the operations of local manufacturers and, of course, Singapore’s harbour and airport.

Both are logistical nodes that facilitate trade in goods, and it’s hard to anticipate what the impact of the new trade order may be.

Before that happens, however, let’s enjoy this moment of long-awaited calm after three years of chaotic inflation. Prices have finally flatlined, so now our incomes have a few months to catch up to them.

- Read other articles we’ve written on Singapore’s current affairs here.

Featured Image Credit: depositphotos