With the new US tariffs set to come into effect tomorrow (April 9), all eyes are peeled to see how global countries are going to react to the tariffs.

Earlier today, Singapore’s Prime Minister Lawrence Wong told Parliament that tariffs would hurt the city-state’s economy, businesses, and workers.

“Singapore may or may not go into recession this year. But I have no doubt our growth will be significantly impacted,” he said.

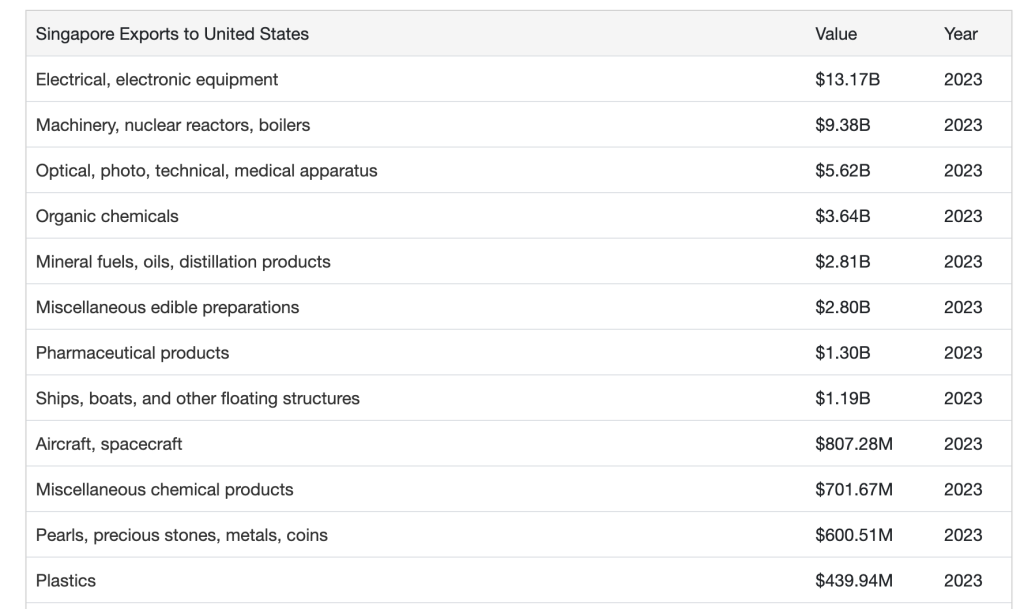

According to Trading Economics, semiconductors were Singapore’s top export to the US in 2023, valued at US$13.17 billion—and they make up about 30% of total exports to the US.

Singapore also produces 11% of the world’s semiconductor equipment, making the industry a key contributor to our GDP.

A 10% tariff on all imports will drive up prices, reducing demand. The electronics sector makes up over 9% of Singapore’s GDP, hiring 60,000 employees. A drop in electronics demand would have an impact on the economy and jobs in the sector.

Key companies in this sector include Infineon Technologies and Micron Technology, both of which are featured on the EDB industry page.

Singapore serves as Micron’s global operations headquarters, leveraging its strategic location to efficiently serve customers across Asia. The company has been operating in Singapore since 1998.

Beyond semiconductors, DBS chief economist Taimur Baig also identified the pharmaceutical industry as another sector that could be heavily impacted by the tariffs.

He warned that if the US imposes separate tariffs of up to 25% on semiconductor and pharmaceutical imports, the blow to Singapore’s economy could be far worse than current projections.

According to EDB, Singapore’s biopharmaceutical sector employs over 9,000 skilled workers—more than twice the number in the early 2000s. Four of the world’s five largest pharmaceutical companies have manufacturing facilities in Singapore.

Some notable companies in this industry include GlaxoSmithKline (GSK) and Merch Sharp & Dohma (MSD).

If tariffs reduce demand in these industries, growth in these sectors will slow.

PM Lawrence Wong, who is also Finance Minister, shared in Parliament that slower growth would lead to fewer job opportunities and smaller wage increases.

“And if more companies face difficulties or relocate their operations back to the US, there will be higher retrenchments and job losses.”

Besides sector-specific effects, the broader economy will also be impacted. Global growth is expected to slow, which will reduce external demand for Singapore’s goods and services.

As a result, retrenchments and job losses are likely to increase.

A new task force is also being set up to address uncertainties following the announcement of new US tariffs. Chaired by the deputy prime minister, the task force aims to help businesses and workers manage uncertainties, build resilience, and adapt to the changing economy.

- Read other articles we’ve written on Singapore’s current affairs here.

Featured Image Credit: The White House