When WhyQ first launched its residential hawker food delivery service in Singapore, it quickly made headlines—and for good reason.

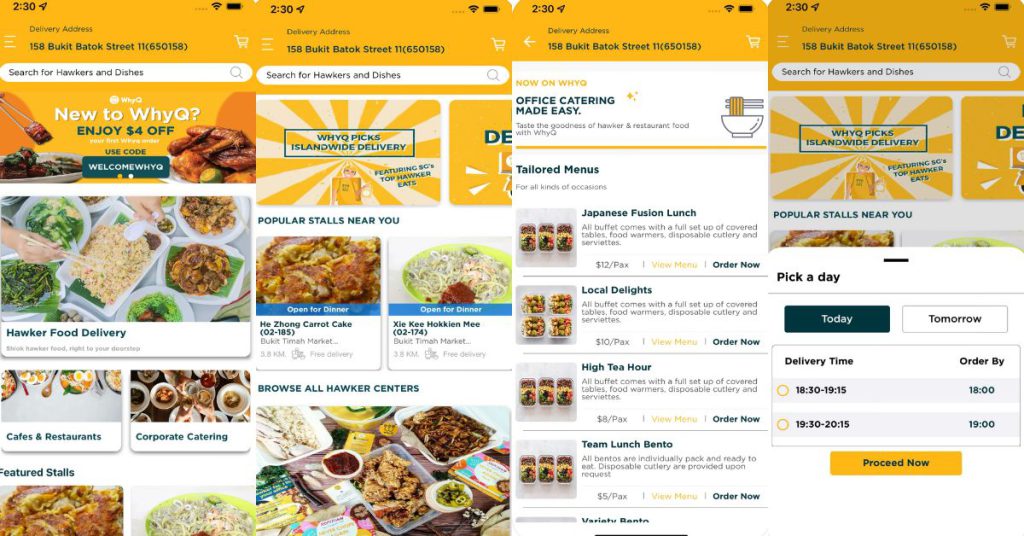

What’s not to love about getting your favourite local hawker fare delivered to your doorstep for just S$1.50 per meal, with no minimum order?

But things seem to have taken a sharp nosedive for the platform since then.

From disgruntled users filing complaints with the Consumers Association of Singapore (CASE), to former employees alleging delayed salary payments, WhyQ has found itself in troubled waters.

Coupled with multiple pivots in business direction and contradictory statements from its founders, questions now loom over the startup’s strategy and whether it can remain viable in the long run.

How WhyQ started

WhyQ was first launched in 2016 and initially focused on delivering hawker meals within Singapore’s Central Business District (CBD) during lunch hours.

The idea was born out of co-founders Varun Saraf and Rishabh Singhvi’s own lunchtime struggles during their early careers in corporate banking: long queues, limited time, and a lack of affordable delivery options.

The duo invested S$100,000 of their savings to make WhyQ happen, and the startup received its first round of funding, amounting to S$150,000, from three angel investors in January 2017.

By 2018, they had raised another S$1.2 million. Later that year, WhyQ expanded islandwide, extending its delivery service to residential areas and adding dinner and weekend deliveries.

This expansion occurred at least a full year before the pandemic hit the city-state’s shores (Singapore’s first recorded COVID-19 case was in January 2020); however, when Vulcan Post reached out to Varun recently, he claimed that residential deliveries were only introduced in response to COVID-19.

Frankly, residential deliveries [were] never something we planned to do, but we undertook [it] during the pandemic because of the demand from Singaporeans and to try and increase our hawker outreach.

Varun Saraf, co-founder of WhyQ

Better unit economics?

Conflicting timeline aside, WhyQ was quite well-positioned in a burgeoning market.

When the company first launched, most food delivery apps at the time were mainly focused on restaurants, cafes, and fast-food chains, leaving hawker fare largely untapped.

In addition, it kept delivery fees low, and for customers craving affordable local eats, it was a no-brainer.

Naturally, such low fees have raised questions about the platform’s profitability; however, in previous interviews, WhyQ maintained that its unit economics were “much better” than other players in the space.

Unlike operating on an on-demand business model like other food delivery platforms, WhyQ required customers to pre-order meals, enabling it to batch orders, optimise routes, and minimise manpower. This ultimately allowed it to reduce delivery costs and eliminate minimum order requirements.

And for a while, it seemed like the business model was working.

By the end of 2019, the company claimed to have already partnered with over 2,200 hawkers across more than 35 hawker centres, with a customer base of 200,000 and reported annual revenues of S$9 million.

Then came the pandemic, and with it, the platform’s biggest break.

During the early days of the COVID-19 lockdowns, inquiries poured in at almost four times the volume they used to get via email, and WhyQ saw a staggering 300 to 400% increase in both users and orders.

However, cracks soon began to show.

First signs of trouble

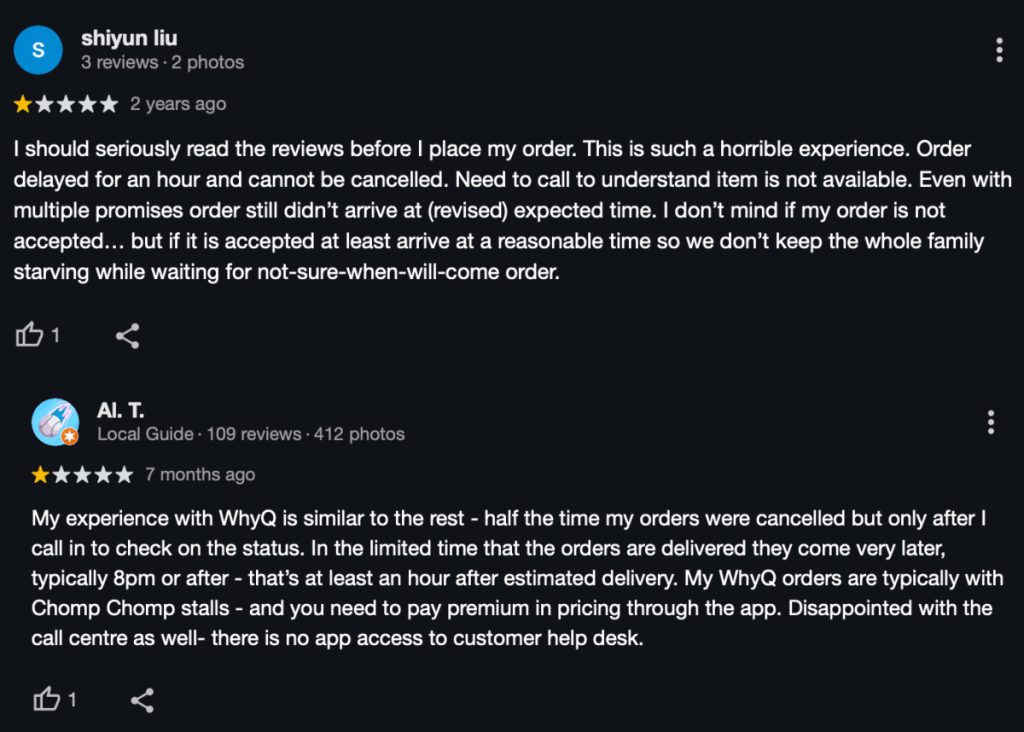

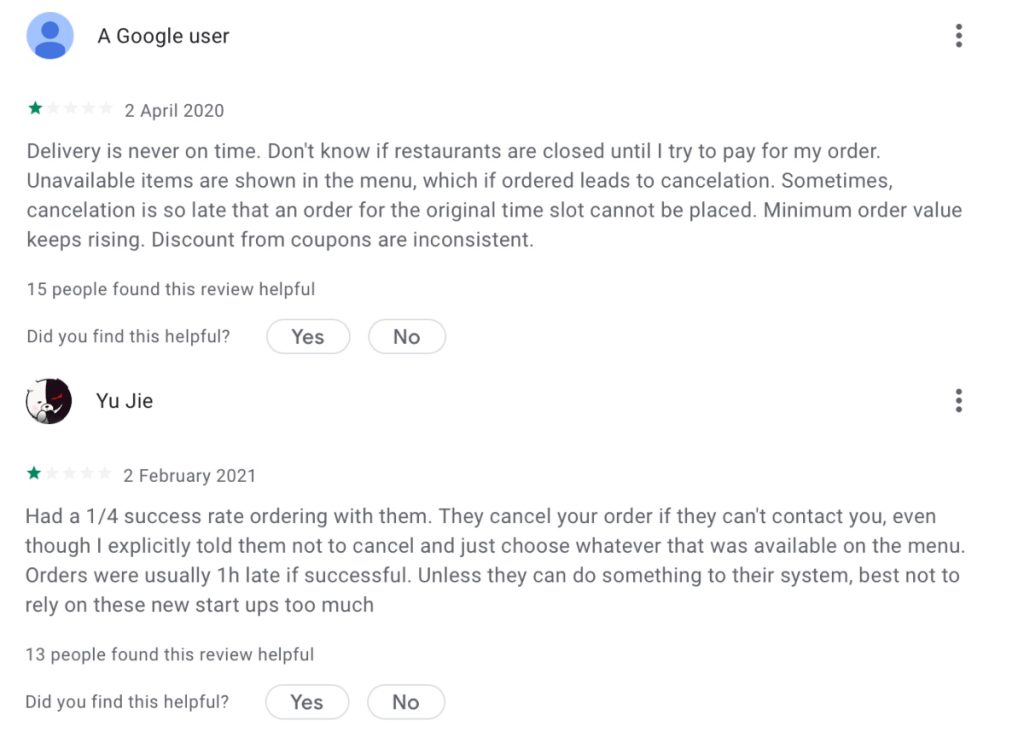

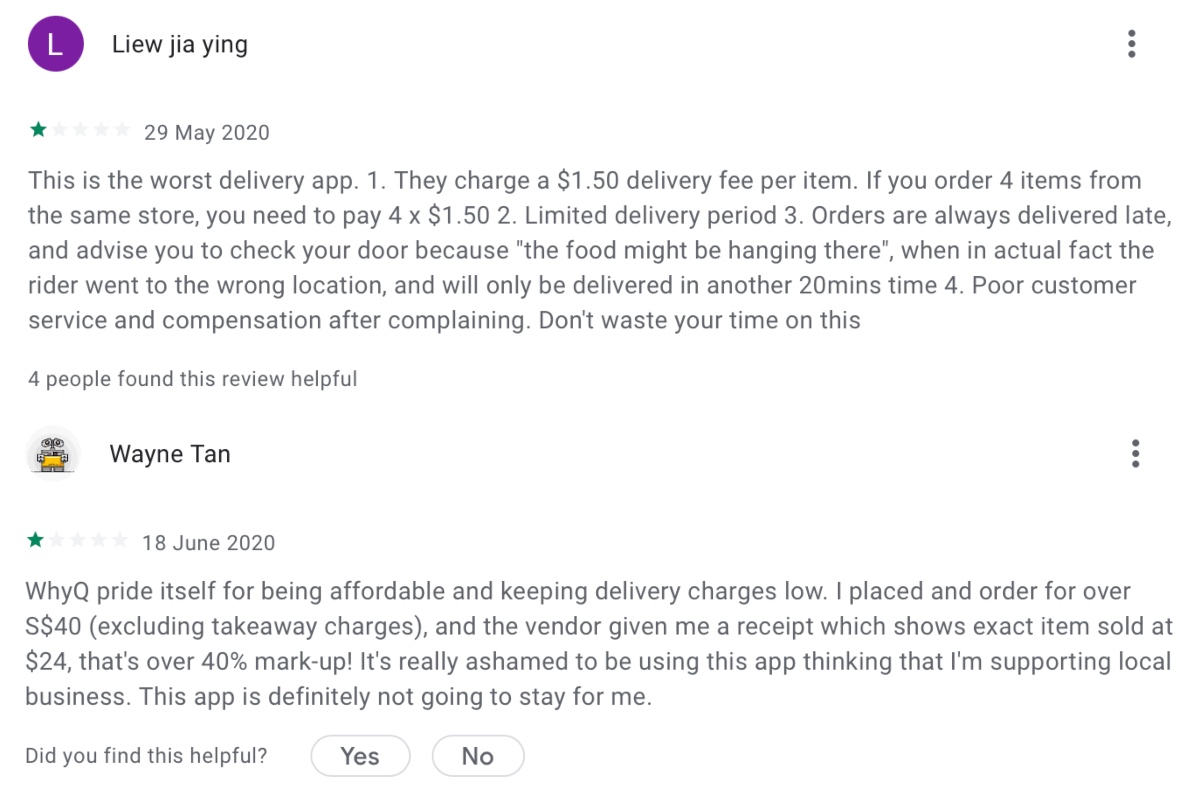

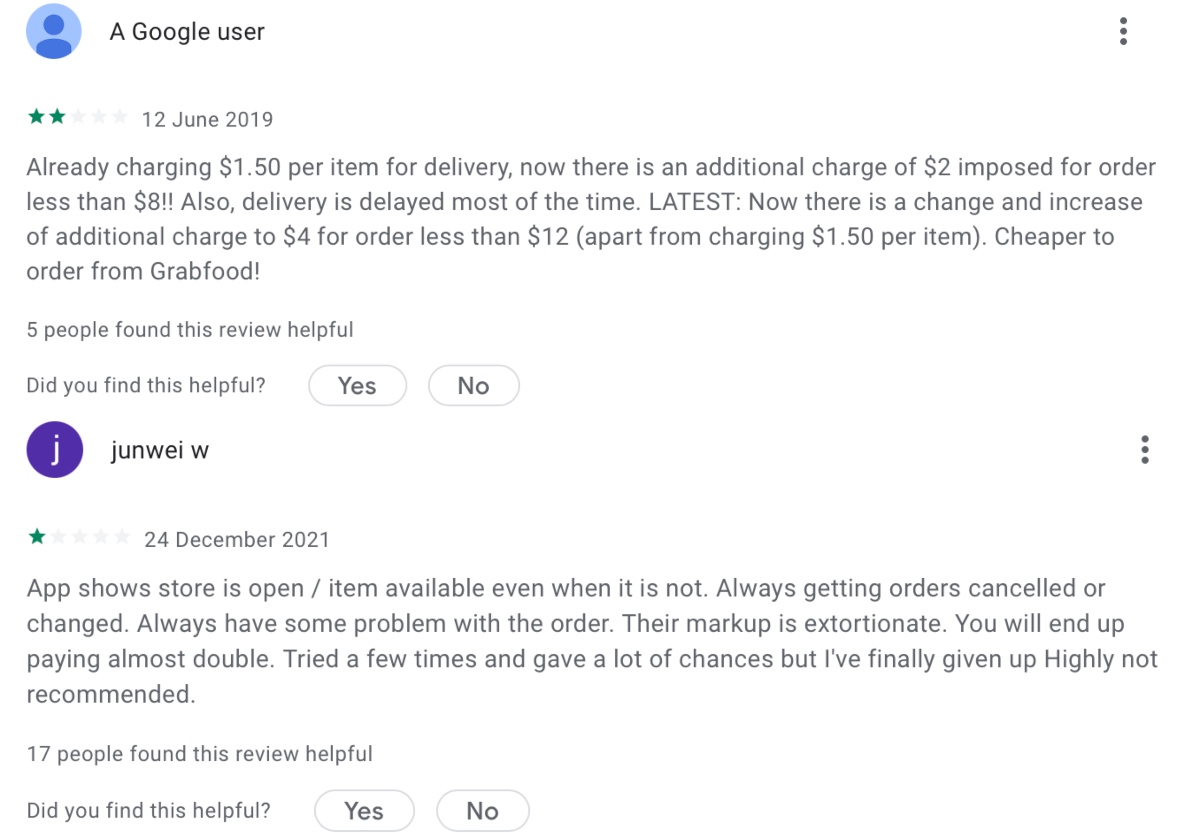

From 2020 onwards, the platform faced a wave of disgruntled users reporting everything from hour-long delivery delays to last-minute order cancellations—and perhaps most frustratingly, a nearly unreachable customer service team.

These complaints surfaced across various platforms, including app stores and Google Maps, with some users even creating dedicated Reddit threads (like this one) lamenting their frustration.

[Note: When Vulcan Post looked through the reviews, it appeared that some users were already experiencing similar issues during WhyQ’s corporate delivery phase, but the problems intensified significantly during the COVID-19 surge due to overwhelming demand.]

WhyQ also appeared to have backtracked on its no-minimum-order policy, with reports of exorbitant markups and users being charged S$1.50 per item rather than per meal, making WhyQ’s delivery fees higher than those of competing platforms, and undermining its original mission to offer affordable hawker fare.

Things got serious enough that complaints were even filed with CASE, which confirmed to Vulcan Post that it had received two reports against WhyQ in 2021. In both cases, customers complained that they were not refunded, despite not receiving their orders.

Internally, the company faced turmoil as well.

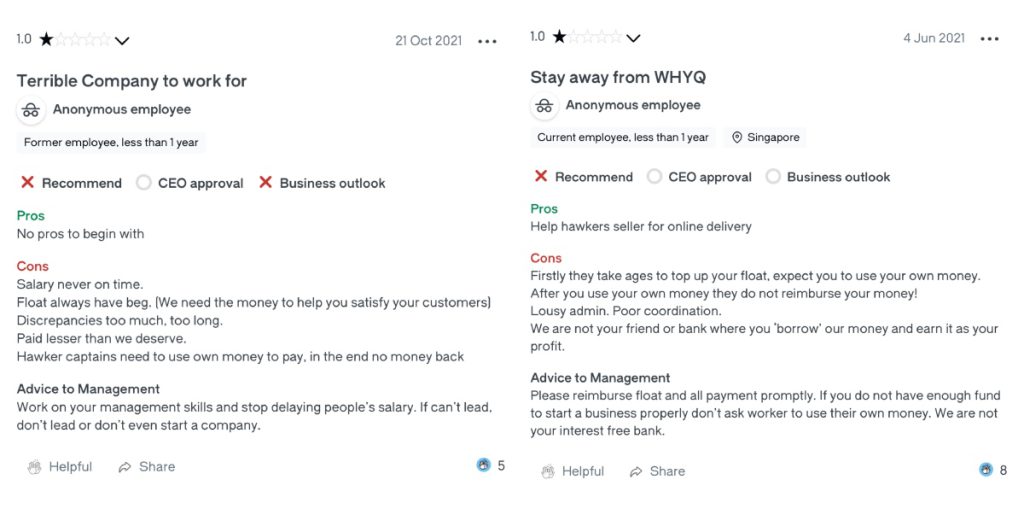

Numerous reviews on Glassdoor, though few are positive, paint a picture of discontent, with allegations of delayed salaries, unmet promises of bonuses, and inconsistent compensation.

When asked about the delivery issues, Varun said that the platform depended on “third-party delivery services like Lalamove, which were not 100% reliable” as it lacked the capacity to build its own delivery fleet in residential heartland areas.

And as for the delayed salary payments, he claimed that the only ones impacted were delivery riders and part-time hawker captains, not full-time employees.

“[Any delayed payments] used to be for delivery riders and part-time hawker captains, because sometimes we needed time to calculate their final amounts based on their jobs done.”

An unclear business direction

Despite the mounting challenges on its consumer-facing front, WhyQ, at that time, had also identified opportunities to help hawkers and micro, small, and medium enterprises (MSMEs) digitalise their operations.

Over the years, the startup had partnered with agencies such as IMDA and NEA, among others, to advance this initiative.

Independently, the startup also made several attempts to launch its own solutions—though the success of these efforts remains uncertain.

One initiative aimed to aggregate raw material suppliers on a single app, simplifying procurement for hawkers who typically rely on multiple vendors for ingredients like vegetables, meat, and dry goods. It was slated for launch in Q2 2020, but it’s unclear if it ever went live.

In 2021, WhyQ doubled down on its efforts in the space, raising S$3.6 million in a Series A2 round led by Delivery Hero, Chope, Angel Central, and RB Investments.

The same year, it expanded into Malaysia, aiming to help businesses there transition into the digital space by introducing two free tools: an eBiz app (WhyQ EBiz) and a digital bookkeeping app (WhyQ Kira Kira).

Two years down the road, the startup had raised an additional S$1.4 million in a Series A2 extension round, claiming that it had established itself as a “leader” in the Malaysian market.

However, checks revealed that the products it offered are no longer available, and related websites are down.

Today, WhyQ appears to only offer its “HawkerOS” app, which only allows hawkers to receive and manage orders online, though it hasn’t been updated since November 2023.

What’s really happening at WhyQ?

WhyQ’s trajectory has raised several questions about its strategic focus and overall viability.

Despite raising substantial funds, which possibly should have been sufficient to develop a viable proof of concept, the company has spent years pursuing multiple ventures with limited visible success.

We repeatedly tried to contact WhyQ for clarity, but only received a single response from co-founder Varun Saraf via LinkedIn, with no answers to our follow-up questions.

On its food delivery service, Varun admitted that post-pandemic, the “unit economics” of serving residential areas no longer worked due to “high labour and customer acquisition costs.” It became clear that WhyQ’s operational model was better suited for CBD deliveries.

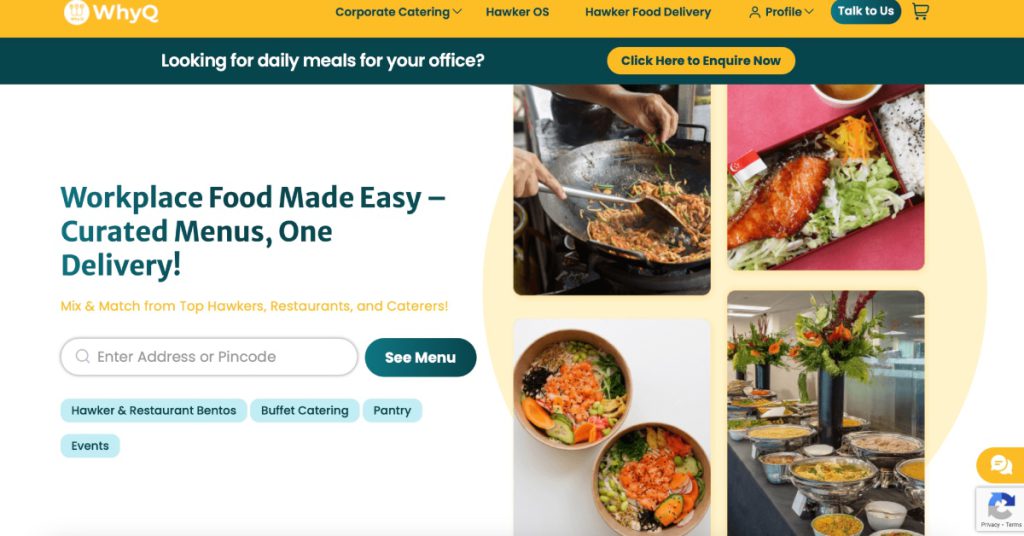

Over the past year, Varun shared that WhyQ has pivoted to focus primarily on B2B corporate deliveries. It now offers a customisable meal program where companies can set budgets and menus from a selection of hawkers and restaurants for their employees.

This model uses “significantly fewer delivery riders,” solving the startup’s previous logistical challenges and salary delay issues.

Varun also claimed that since this pivot, WhyQ has achieved a 99% on-time delivery rate with its in-house fleet servicing Singapore’s CBD and other business districts.

“We have 100% customer retention amongst our corporate clients… and we deliver over 2,000 meals daily to corporate offices,” he added.

Residential deliveries now constitute less than 5% of WhyQ’s business. Yet, its app and website still allow residential orders—if the segment is no longer strategically relevant or economically viable, why keep the infrastructure running?

Regarding its workforce, Varun said, “We have a small team of seven employees in Singapore, and all their payments are done on time.”

So what became of the team in Malaysia and the company’s efforts there—are they still operational? For now, these questions remain unanswered.

- Read other articles we’ve written on Singaporean startups here.

Featured Image Credit: WhyQ/ Business Today