Disclaimer: Unless otherwise stated, any opinions expressed below belong solely to the author.

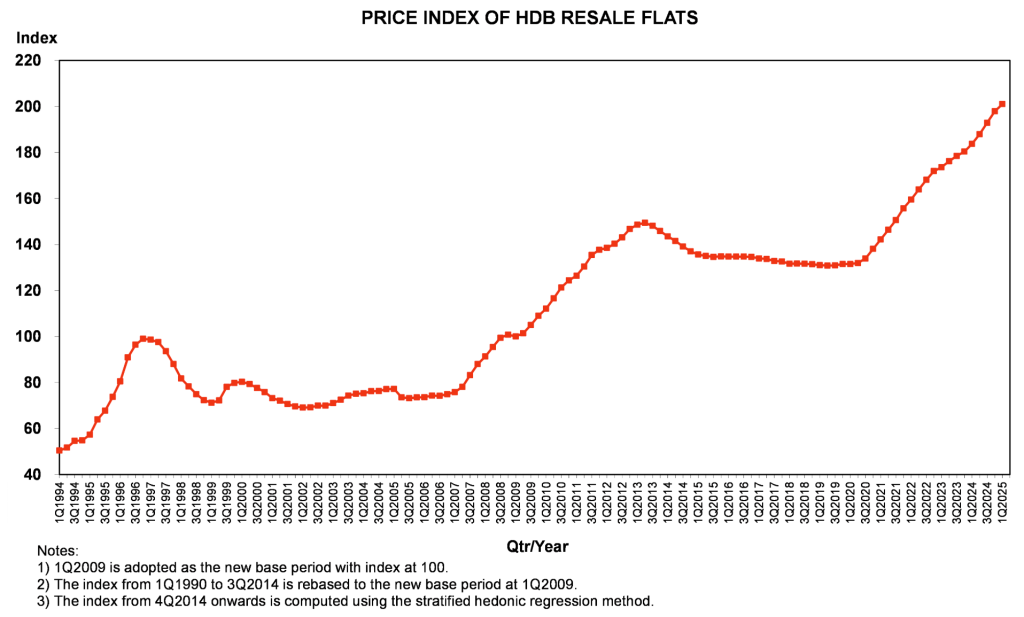

The HDB Resale Price Index has hit over 200 points for the first time ever in Q1 2025, as growing prices in the resale market continue to be a major topic in Singapore.

Cumulatively, they have increased by over 50% since 2020, causing much alarm not only among Singaporeans but the government as well.

And yet, despite all the complaints and cooling measures, inflation in the housing market continues unabated. But why?

If everybody is complaining, then why are Singaporeans still paying?

Public housing in Singapore is still affordable

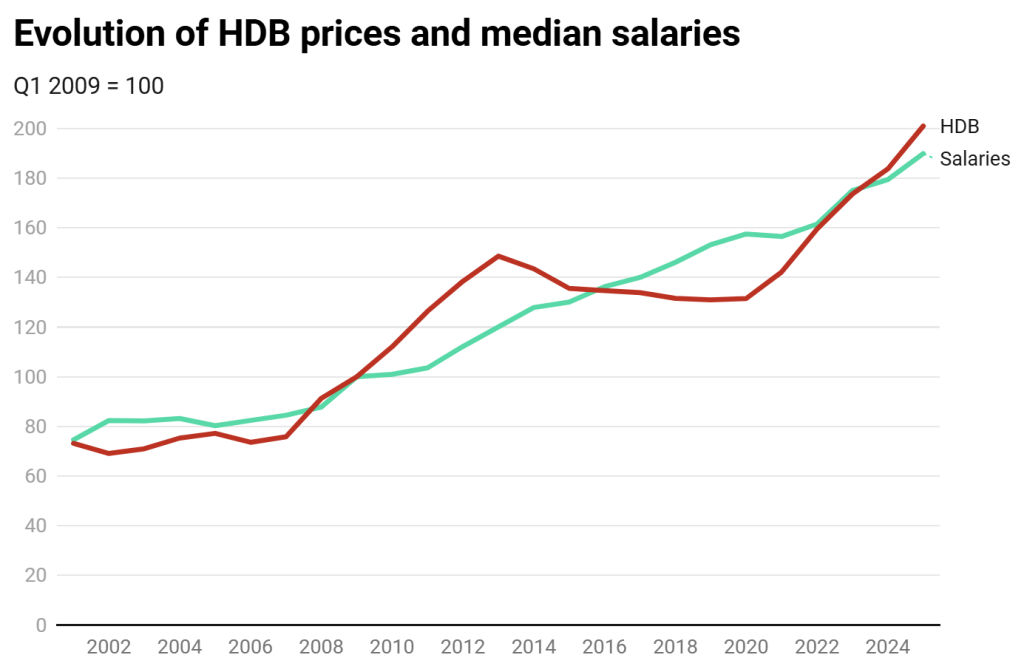

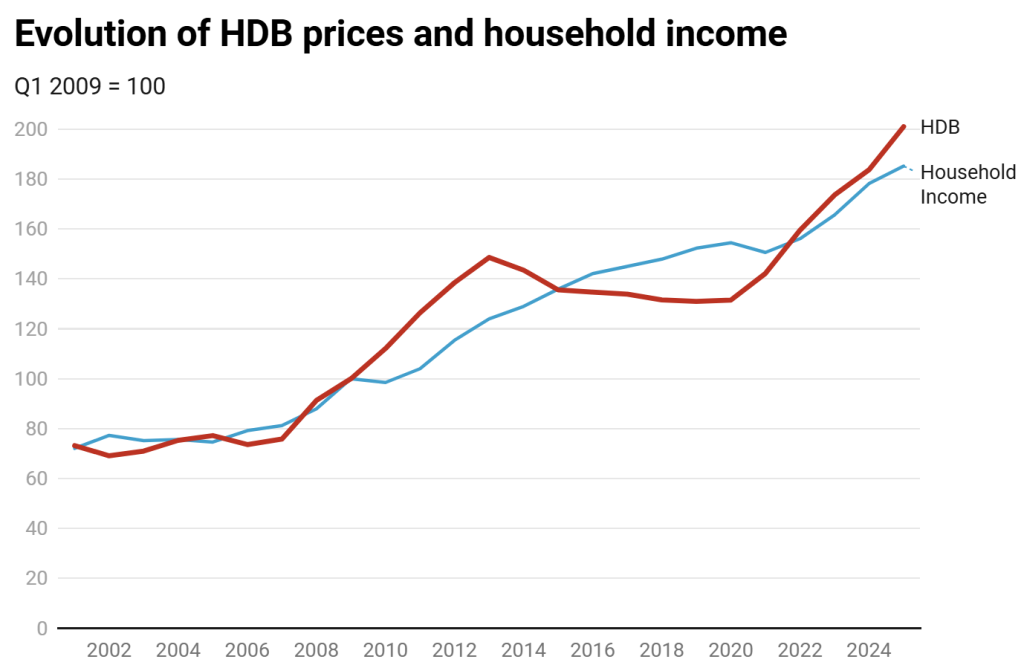

Everybody seems to be upset about the continued inflation, but these perceptions are warped by the long period of stagnation in the HDB market, which made apartments relatively cheaper vs. growing incomes.

For six years between 2014 and 2020, the prices remained relatively flat, if not trending slightly downward.

However, when you compare them, for example, to the base year in 2009, when the index read 100 points— so, half of what it is today—local incomes also were about half of what Singaporeans are paid now.

The median gross monthly income of Singapore residents has increased by 90% between 2009 and 2025. Meanwhile, resale HDB prices have gone up by 96% (from Q4 of 2008 to Q4 of 2024)

Median household income is currently lagging a few percentage points behind, having grown by 85% to 96% for resale housing—but it’s still a far cry from the 24.6 point difference recorded in 2013, before government measures put a lid on inflation and froze the market for a few years.

The swings in either the incomes outpacing HDB prices or the other way around reached around 20 to 25% in 2013 and 2020.

This suggests that Singaporeans may still exhibit an appetite for buying at rising prices for the next few years, before the current gaps could multiply in size and become untenable, or the government enacts new measures to slow them down.

Prices to slow in 2025, but might still grow rapidly

Following the 1.6% bump in Q1 of 2025, property analysts are anticipating annual growth of between 3 to 8%—lower than 9.6% reported in 2024 but still high (and much higher than consumer inflation, which has currently dropped under 1%).

With salaries expected to receive a boost by around 3 to 4%, this would continue to expand the gap between incomes and HDB prices.

However, even under extreme conditions, assuming continued 8% growth in HDB prices and around 3% increase in median salaries, it would take three to four years for us to arrive at where we were in 2013.

This is an indicator of tolerance for financial pain that Singaporeans had to accept 12 years ago, showing that demand for resale HDBs is not likely to drop organically anytime soon without even stricter government intervention, a significant boost to supply, or a rebound in mortgage rates making borrowing more expensive (as it was one of the drivers of demand after the financial crisis of 2008/09, which triggered a global slide in interest rates).

Chee Hong Tat, the new Minister for National Development, is expecting a moderation in prices from 2026 onwards when resale supply is expected to receive a boost and when the apartments built after the pandemic delays begin reaching their MOP period.

I believe this situation will improve, and we will see a moderation of resale flat prices when more of the new flats that we have built in the last few years reach the five-year minimum occupation period starting from 2026. Once we see more supply coming in, and also coupled with more new BTO flats entering the market, I think we will see moderation in the resale flat prices in the years ahead.

Chee Hong Tat

The truth is that Singaporeans are buying because they can.

Despite continued complaints, incomes are increasing, mortgage rates have moderated (making cheap financing widely available), while ever younger, more modern apartments are entering the market, becoming a competition not only to older housing but to private condominiums.

Even with regulatory obstacles aiming to slow the demand down, the truth is that buying an HDB apartment remains both cheap and easy.

And with hybrid work arrangements, allowing thousands of people to spend part of their time working from home, space has now become an investment in improved livelihood—that Singaporeans are both willing and able to pay for.

- Read other articles we’ve written on Singapore’s current affairs here.

Featured Image Credit: Muhd Asyraaf / Unsplash