NTUC FairPrice has come a long way from its humble beginnings.

Originally named NTUC Welcome, its roots trace back to 1973, when it was established as a cooperative founded to moderate the cost of living during a time of inflation and food insecurity. The supermarket offered fair prices and quality goods, helping everyday Singaporeans stretch their dollar.

In its early years, Welcome merged with other union-run stores to form NTUC FairPrice. This consolidation gave the organisation greater economies of scale, allowing it to lower prices even further and strengthen its social mission.

Since then, NTUC FairPrice has expanded its retail footprint, introducing new concepts to cater to changing consumer preferences.

But the real inflection point came in 2019. That year marked a strategic shift with the formation of FairPrice Group, which enabled the organisation to break new ground by integrating food court dining, loyalty rewards, and digital payments into one cohesive ecosystem.

Today, FairPrice Group operates across a broad spectrum, serving over 500,000 shoppers and facilitating more than one million online customer interactions daily.

But how did it grow from its modest beginnings into the industry leader it is today, and what were the key drivers behind FairPrice Group’s growth?

Here are the three pivotal moves that have shaped its transformation over the last decade.

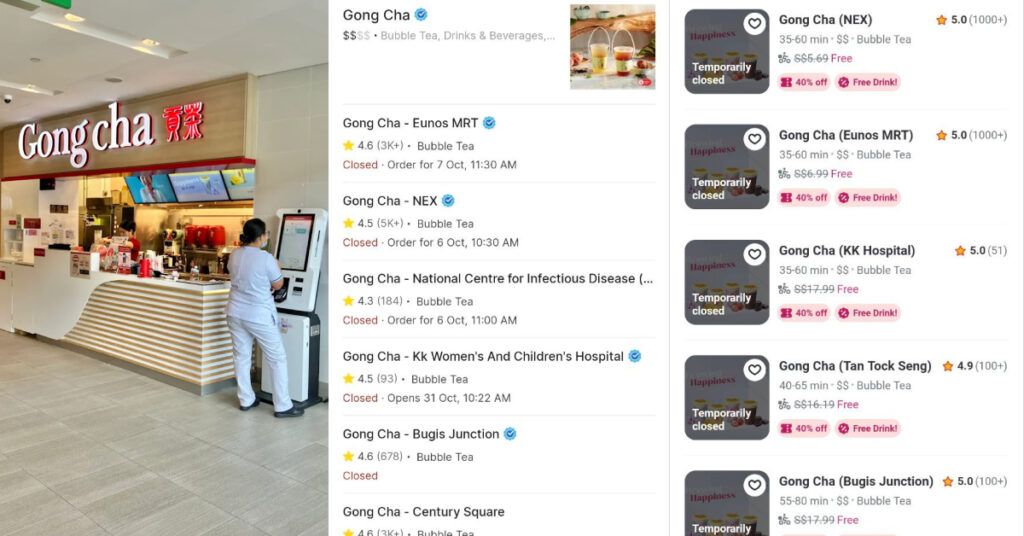

1. Launching an all-in-one mobile app

In 2018, FairPrice introduced its mobile application, originally branded as FairPrice On, as part of its expansion into the ecommerce space.

It underwent a significant transformation the next year, following the formation of FairPrice Group, marking a major milestone in the Group’s digital evolution.

The revamped app was designed to serve as an all-in-one touchpoint for everyday needs, offering a seamless omnichannel experience that brings together all of FairPrice Group’s offerings, including grocery shopping, dining, and rewards, within a single, integrated platform.

For instance, customers could grab a meal at a Kopitiam food court, pay using the app, and automatically earn Linkpoints—the loyalty reward currency of the NTUC Link Rewards programme. Later, those same points could be redeemed for groceries at a FairPrice supermarket or used for online purchases.

To enhance convenience, FairPrice has continually expanded the app’s features over the years. This includes Scan & Go—launched in 2020, it allows customers to scan and pay for items directly through the app, bypassing checkout lines. Today, 17 of FairPrice’s 164 supermarkets support the feature.

In 2023, FairPrice phased out physical Kopitiam cards, fully digitising them within the app. And more recently, it integrated MyInfo, allowing users to auto-verify their CHAS (Community Health Assist Scheme) eligibility and receive applicable discounts during online purchases.

These initiatives have clearly paid off, and the seamless experience appears to have resonated with customers.

When it was still known as FairPrice On, it had just 400,000 users, but today, the FairPrice app boasts close to 1.7 million users. At the same time, NTUC FairPrice now counts 2.4 million Link Rewards members, underscoring its strong digital engagement.

2. Integrating Trust Bank into the FairPrice ecosystem

In 2022, in collaboration with Standard Chartered Bank, FairPrice launched the nation’s first digital bank, Trust Bank—an instrumental step in advancing FairPrice’s omnichannel strategy, extending value beyond retail into financial services.

Trust Bank is integrated into the FairPrice Group ecosystem by offering rewards and rebates across various touchpoints, including NTUC FairPrice supermarkets, Kopitiam food courts, Cheers convenience stores, and Unity pharmacies.

With a Trust Bank account, customers can enjoy enhanced value—it is also the only way to accelerate Linkpoint accumulation and redemption within the FairPrice Group ecosystem.

This synergy results in stronger loyalty and incentivises shoppers to return more often and spend more, while reinforcing their connection to the FairPrice brand.

The strategy has clearly paid off: Trust Bank saw over 100,000 sign-ups within just 10 days of its launch, proving the strong appeal of combining everyday retail with financial rewards. Today, it has surpassed the 1 million user mark and is now the fourth-largest retail bank in Singapore by customer numbers.

3. Driving in-store innovation with technology

While FairPrice has made major strides in digital platforms, it has also modernised the physical shopping experience.

As early as 2011, NTUC FairPrice introduced self-checkout counters as a solution to ongoing manpower challenges and to reduce customer wait times—a move that paved the way for further automation.

Today, more than 80% of FairPrice’s 164 supermarkets have self-checkout counters—and one, the FairPrice Finest outlets at Sengkang Grand Mall, even runs entirely on self-checkout technology.

More recently, in May, FairPrice started trialling 10 smart shopping carts at the same outlet.

These cloud-connected “Smart Carts” are designed to enhance the in-store experience by guiding shoppers with real-time navigation, highlighting nearby promotions, and offering personalised product recommendations. Customers can also use the Smart Carts’ built-in scanners for convenient scan-and-pay transactions.

FairPrice Group’s tech developments are not slowing down anytime soon.

Earlier this month, the organisation launched its Store of Tomorrow initiative, and according to its Chief Executive, Vipul Chawla, a budget “in the millions” has been allocated to pilot more than 20 new technologies annually over the next three years, until 2028, to enhance the supermarket’s omnichannel shopping experience.

As part of this initiative, FairPrice’s upcoming supermarket in the Punggol Digital District, slated to open in August, will serve as a testing ground for innovations such as smart shopping carts, smart price tags, and virtual store shelves.

But not every move has paid off

While FairPrice Group has made bold strides in recent years, not all of its expansions have succeeded, particularly overseas.

In Malaysia, its presence fizzled out after initially expanding there in the 1990s.

A more costly setback came in China, where its ecommerce joint venture Nextmall (2003–2005) ended in failure, with losses exceeding US$40 million.

Even on home ground, not every concept has resonated.

FairPrice’s Liberty Market, with its array of American products, opened in Plaza Singapura in 1998 and Jurong Point in 2000, but once the American appeal wore off, the outlets shuttered a few years later.

Most recently, FairPrice shuttered its Warehouse Club in 2024. Launched in 2014 as a membership-based megastore modelled after global warehouse chains like Costco, the concept offered bulk-buying at discounted rates. Despite initial interest, it failed to gain sustained traction with local consumers.

Still, despite these setbacks, FairPrice Group continues to show strong momentum.

With strong digital engagement, continued investments in innovation, and a customer base that spans generations, it appears well-positioned to shape the future of retail in Singapore.

- Read other articles we’ve written on Singaporean startups here.

- Read other articles we’ve written on Singapore’s current affairs here.

Featured Image Credit: ArDanMe /Shutterstock.com