A growing number of businesses are going belly up in Singapore, with more companies going through compulsory liquidation in the first half of 2025, surpassing figures from the past five years.

Compulsory liquidation is a legal process where a company is forced to wind up, usually initiated by creditors through a court order, due to the company’s inability to pay its debts. Its assets will then be sold off to repay outstanding liabilities, and the business will be dissolved.

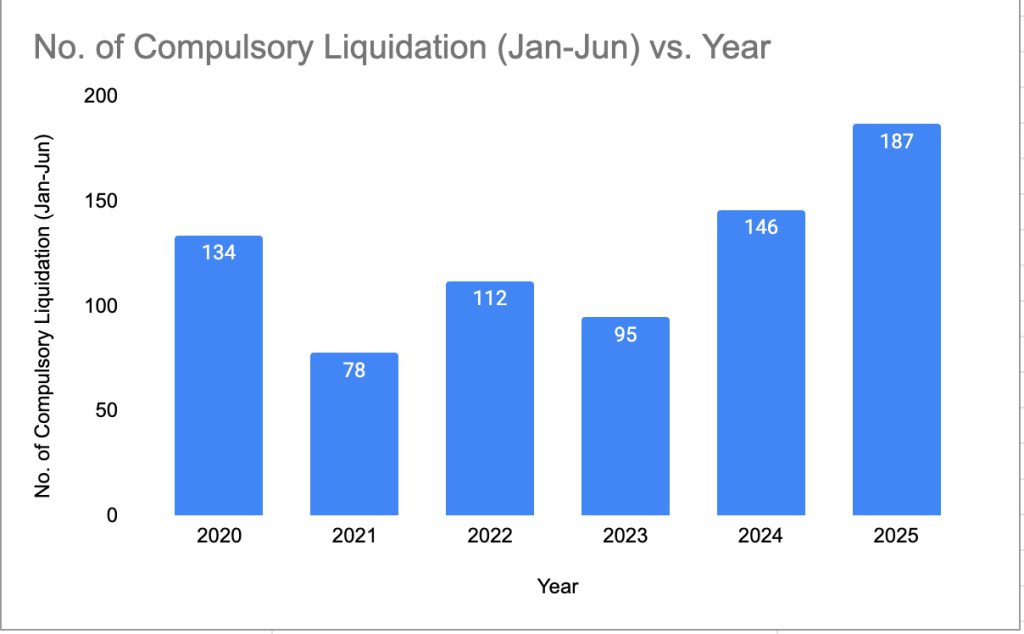

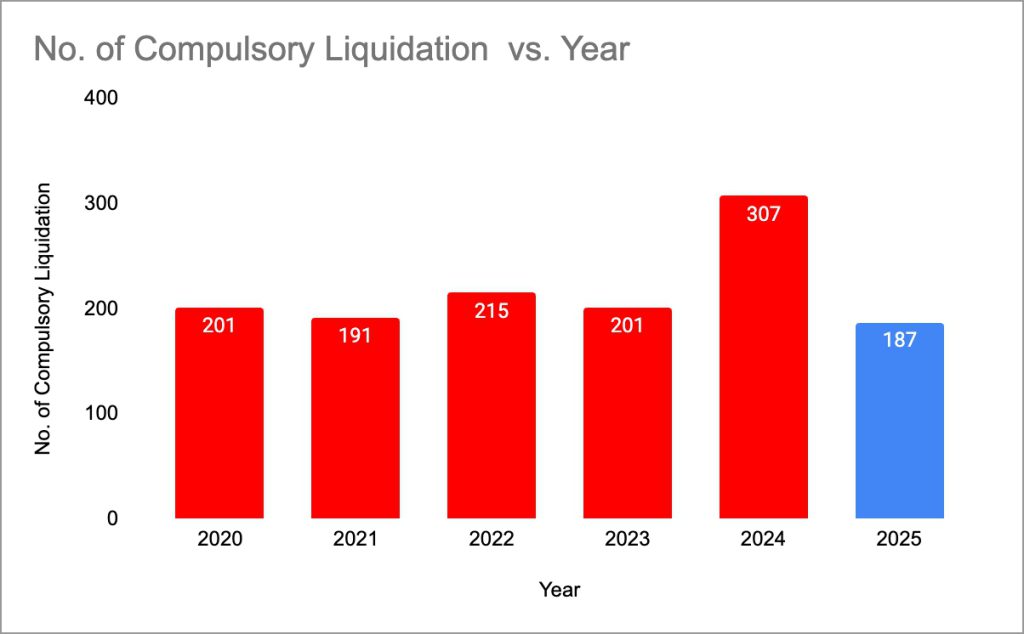

According to data from the Ministry of Law, 187 companies have undergone compulsory liquidation from January to June, marking a stark increase from 146 in the same period last year and just 95 in 2023.

This statistic also follows the city-state hitting a new record high of 307 companies undergoing compulsory liquidation for the whole of 2024.

Pressure is building up on businesses

In a televised interview, CNA reporter Sherlyn Seah said that these trends are indicators of the growing pressures that businesses are under amidst a tough operating environment, which has persisted for the past couple of years.

As the liquidation process does require time to expedite, there is a lag effect that could take months or years, before economic stress translates into formal company closures.

Based on her interviews with liquidators and analysts, Seah shared that cash flow problems are a key cause of this phenomenon. “These companies don’t have enough money coming in to cover all the money that they owe, even though they may have a lot of assets on paper.”

She also pointed out the rising interest rates from 2022 to 2024, which, although had eased earlier in 2025, left many companies struggling due to the withdrawal of COVID-19 business support and the lingering effects of a weak economy during that period.

Another factor that has dealt a blow to businesses is the rising operating costs, such as rent and product expenses, according to Sean Lee, business development manager at Assured Debt Recovery. When a business faces potential liquidation, debt recovery firms like his step in, deploying debt enforcement officers to recover outstanding amounts before the liquidation process begins.

Some companies have tried borrowing from external sources to stay afloat, but many were unsuccessful, leading to closures, Lee added.

Assured Debt Recovery has observed a 30% jump in companies that owe debt and are closing compared to a year ago. The amounts they owe have also risen from the S$20,000 to S$60,000 range last year to over S$100,000 in 2025.

Similarly, JMS Rogers, another licensed debt collection firm, has reported a 20% to 30% spike in monthly cases.

Leroy Frant Ratnam, CEO of JMS Rogers, shared one case of a client who was a major food supplier to multiple restaurants in Singapore. The client approached the firm with almost 120 debtors to go after, which accumulated to almost S$2.5 million in debt, and stated that his cash flow was badly affected.

Ratnam also highlighted that liquidation is usually considered a last resort, as it often recovers only a fraction of the amount owed—sometimes as little as 10%.

Before creditors take drastic measures and head to court to force a company into liquidation, it’s highly likely that the company has already exhausted all possible means to recover its debts.

“[The debtors] still want to run [their businesses] legitimately, they want to honour their debt, but they are in a situation where their financial hardship disallows them from doing so,” he said.

When liquidation becomes the only option, it involves selling off assets to generate cash—often through urgent or drastic measures. Firms and liquidators usually advertise these items for sale online or in newspapers, but they are often sold at heavily discounted prices.

Unsold products may be handed over to contracted junk disposal companies that try to salvage whatever they can, though this usually results in significant losses.

-//-

That said, there is still some strong momentum and optimism in new business formations. The total number of registered companies for the first half of this year has surpassed figures in 2024, according to data from ACRA.

However, business owners, especially those in sectors more prone to higher operational costs or global demand shocks, will need to measure certain long-term risks such as rental and geopolitical tensions.

- Read other articles we’ve written on Singaporean businesses here.

Featured Image Credit: Jason Goh/ Pixabay