Disclaimer: Unless otherwise stated, any opinions expressed below belong solely to the author. Data comes from the Singapore Economic Development Board and the Singapore Department of Statistics.

Singapore’s Economic Development Board (EDB) and Department of Statistics (DOS) have released their quarterly business sentiment reports for the manufacturing and services sectors for the second half of the year and employment outlook for the third quarter.

While the overall mood is significantly better than earlier in the year, when companies were gripped by the uncertainty triggered by Trump’s tariffs, this optimism is not distributed evenly.

Strong positive rebound

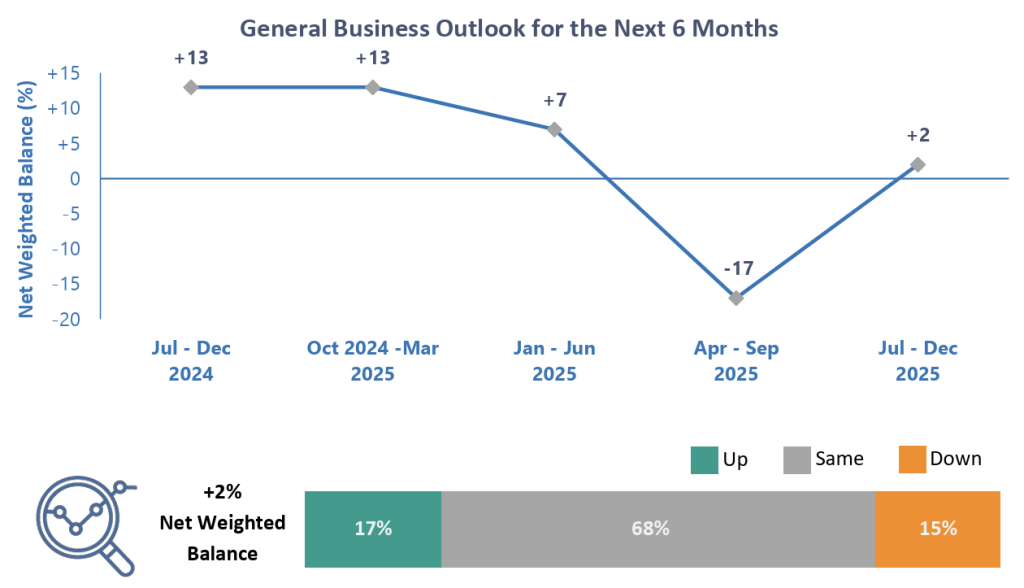

After being properly spooked by Trump’s unpredictable tariff threats, businesses in Singapore are showing signs of relief about the future now. A net negative outlook of 17% in the last quarter has transformed into a 2% positive.

15% of local companies are pessimistic about the next six months, 17% are upbeat, and the vast majority of 68% do not expect significant changes.

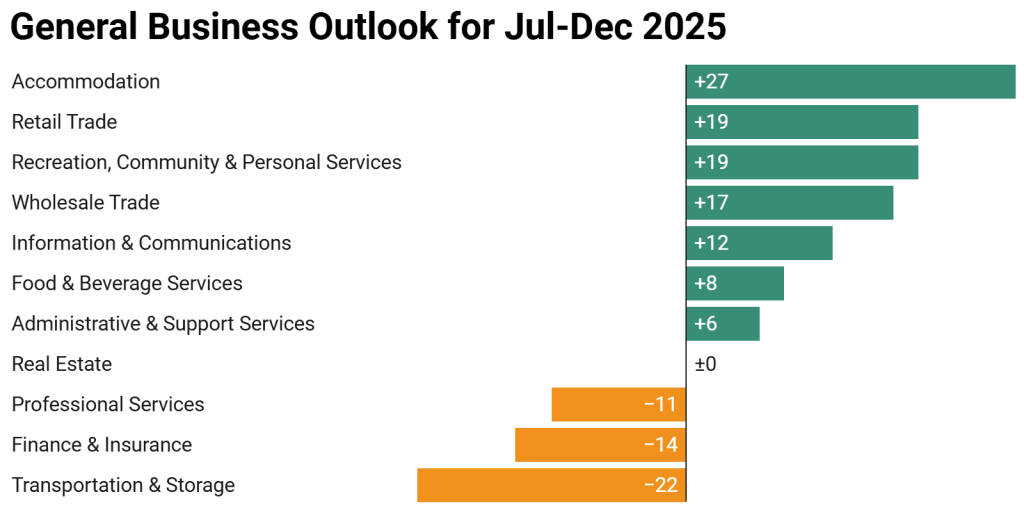

Despite the appearances of a safe equilibrium, the general business outlook sees significant disparities between different industries within the services sector (which employs 85% of Singaporeans). Three of them expect a downturn in the second half of the year.

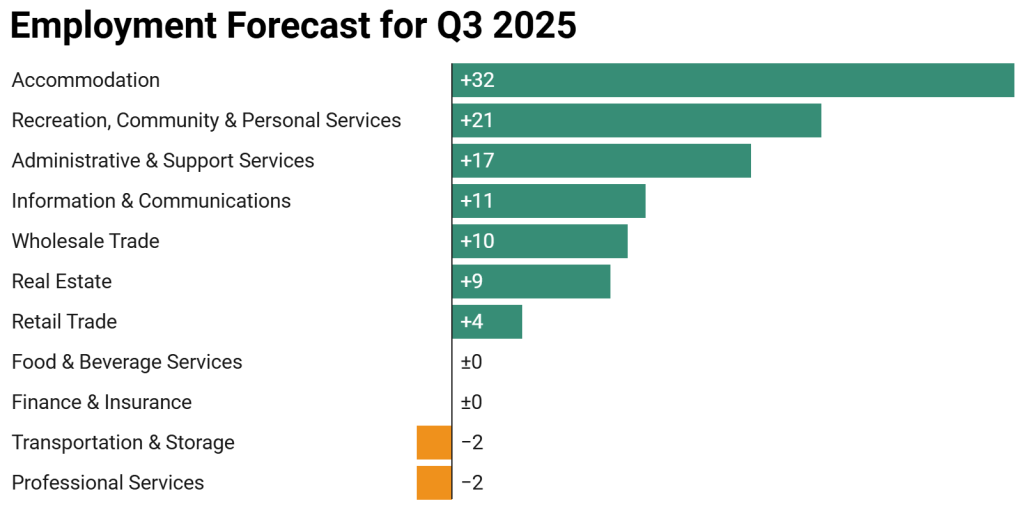

Fortunately, however, these low expectations should not result in significant layoffs. Only two of the affected industries have a negative employment forecast for the coming quarter, and in both cases, it’s quite small at just 2%.

Of course, you have to bear in mind that it’s a net figure, so the companies planning to cut jobs slightly outweigh those who might be hiring. Still, reductions should be relatively small.

On the opposite end of the spectrum, hiring is very strong. In three cases, it’s a net of either close to 20% or well over it—in Accommodation, Recreation & Personal Services as well as Administrative & Support Services.

Furthermore, IT, Wholesale Trade and Real Estate all have a healthy ca. 10% positive net employment outlook for the quarter.

Together, that’s six industries in the services sector which are hiring strongly, against just two with small expected reductions.

That’s not too bad at all, given the turbulent international environment we’re in at the moment.

Manufacturing is back on track too

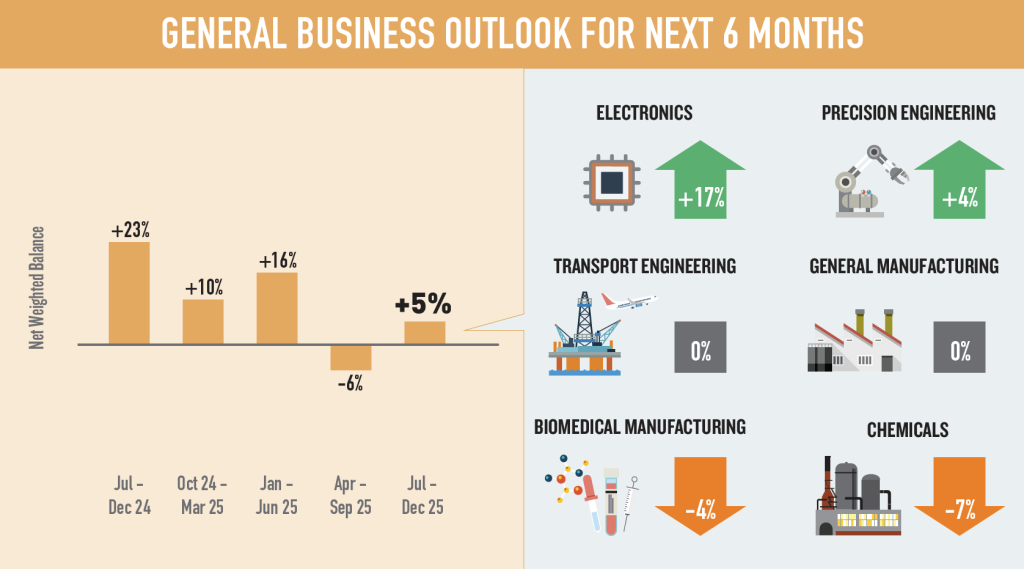

In spite of the reported drop in exports to the US in the second quarter, Singapore’s manufacturing sector has also swung back towards cautious optimism.

It might not be as positive about the future as it was last year, when a net of 10 to 23% of companies expressed feeling good about the next six months at various points in time, but it is back from a net negative recorded just last quarter.

Not all verticals within manufacturing feel the same way, of course, and it is, perhaps surprisingly given the tariff threat, the electronics industry that is pulling the average up.

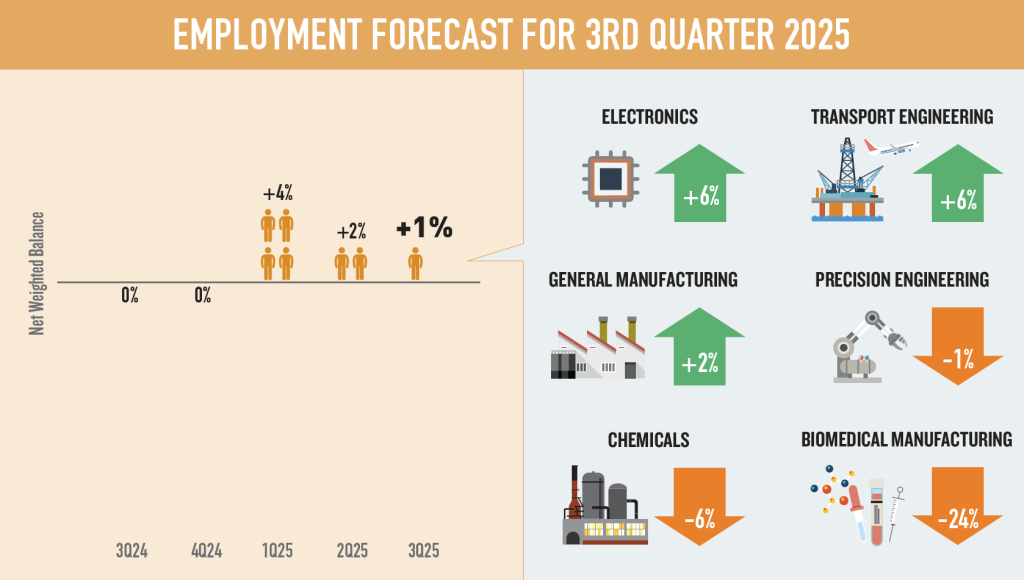

On the whole, there is still work to be found in production this quarter, and the overall forecast is a net positive—albeit by just a single percentage point.

However, those employed in biomedical manufacturing should take note, as almost a quarter of companies are expecting headcount reductions there. Small cuts can also happen in precision engineering and chemicals.

The worst seems to be over

While many expected economic implosion following Donald Trump’s tariff upheaval, it is now turning out that the fears may have been overblown. Yes, some areas are affected and exports to the US are down, but the overall economic situation is looking good.

Following another strong quarter, with Singapore’s GDP growing a very good 4.4%, following 4.1% in Q1, the Ministry of Trade & Industry updated its pessimistic projections of 0 to 2% GDP growth this year, to a much more positive 1.5 to 2.5%.

And if the momentum is retained in Q3, we might be looking at even more than that.

While certain industries are less optimistic than others, mass layoffs are unlikely, and any cuts that happen should be very limited (with the exception of the biomedical branch of manufacturing, perhaps).

- Read other articles we’ve written on Singapore’s current affairs here.

Featured Image Credit: depositphotos