What to know about the new EPF Account 3 & how it’ll impact your retirement savings

When that paycheck hits your account at the end or start of the month, there’s a fleeting moment of joy for many working adults.

But in Malaysia, a portion of that happiness is reserved for the future because of the Employees Provident Fund (EPF).

Established in 1991 by the Malaysian government, the EPF is like a financial safety net, ensuring that a slice of your earnings goes towards your retirement fund.

But there’s been a recent restructuring in the EPF scheme, leaving many scratching their heads. Let’s break down what you need to know about EPF Account 3.

What’s changing?

So, what’s all the fuss about? Well, brace yourself for a three-account system. Say goodbye to the old two-account setup; it’s now three accounts for better financial planning. Here’s the breakdown:

- Akaun Persaraan (Account 1): Accumulates savings that will serve as income during retirement.

- Akaun Sejahtera (Account 2): Meets the various needs throughout life stages to enhance overall quality of life in retirement.

- Akaun Fleksibel (Account 3): Offers versatility for immediate financial requirements. Funds within this account can be withdrawn at any time according to members’ needs.

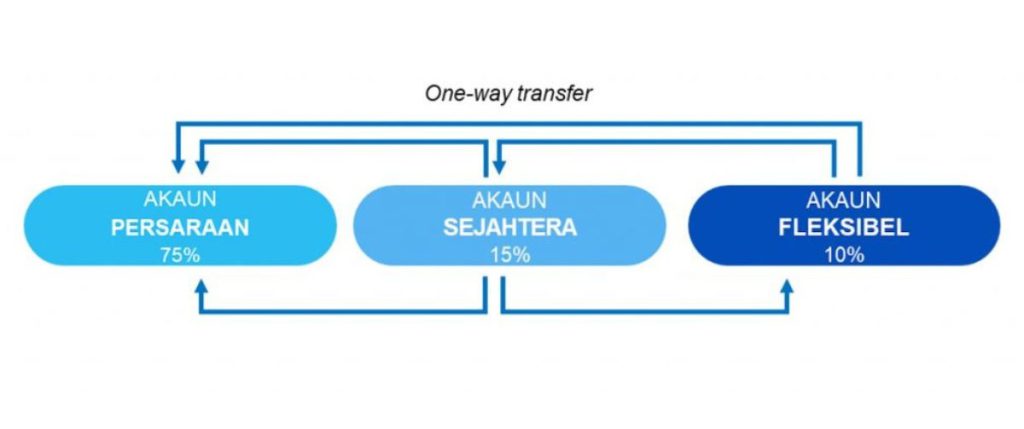

To maintain clarity, we’ll retain the original numerical labels for these accounts. Additionally, all EPF contributions will be divided into three portions based on these percentages:

- 75% will go into Account 1

- 15% will go into Account 2

- 10% will go into Account 3

Why the change?

EPF’s transformation serves not only to add heft to your retirement savings but also to align with the various stages of your life. Here’s what it aims to do:

- Increase the funds in your retirement account to provide greater security for life after work.

- Align short, medium, and long term requirements with members’ life cycle and lifespan.

- Develop EPF Schemes that factor in the evolving work trends shift, demographic shifts, and members’ present and future needs.

- Tackle short-term financial needs that may affect members’ well-being during retirement.

What will happen with the funds in my current EPF accounts?

Overall, there will be no changes to them. This means that all the current savings in your Account 1 and Account 2 will remain untouched, while the new Account 3 will begin with RM0.

Will the new EPF account impact the dividend rate?

According to KWSP, the dividend rate for EPF 2023 stands at 5.5% for conventional savings and 5.4% for Shariah-compliant savings.

Rest assured, the current policy governing dividend rates remains unchanged despite the restructuring. The dividends for Account 3 will be the same as for Account 1 and 2.

However, it’s worth noting that the more a contributor withdraws, the lower the dividend rate.

Conversely, keeping Account 3 untouched, even after opting for the one-time transfer, will ensure the contributor’s dividend rate remains unaffected.

When does it kick in?

Mark your calendars for May 11, 2024. That’s when EPF 3 steps into the ring. But, it’s not just for locals; non-Malaysians under 55 are in on the action too. The last day of the one-time transfer application is on August 31, 2024.

Got a lump sum? Here’s the deal.

EPF is permitting a one-time transfer from Account 2 to Account 3 between May 11 and August 31, 2024.

However, it’s important to note that you can’t withdraw any amount that you like. The withdrawal amount is contingent upon your current balance in Account 2.

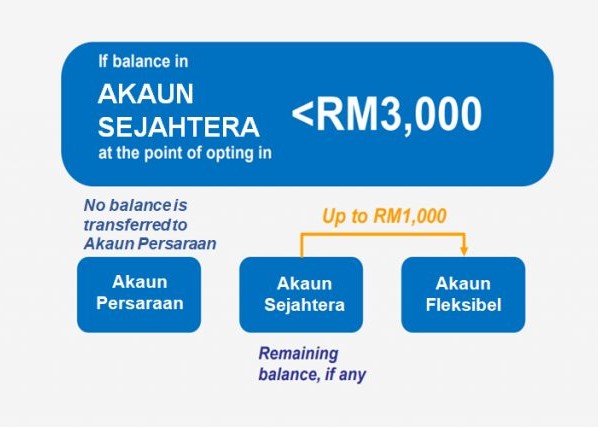

If the balance in Account 2 is RM3,000 or higher, one-third of the balance will be moved to Account 3, and another one-sixth will be allocated to Account 1. However, if the balance in Account 2 is less than RM3,000, the process varies slightly:

- For balances of RM1,000 and below in Account 2: All savings will be transferred to Account 3.

- For balances above RM1,000 but still below RM3,000 in Account 2: RM1,000 will be transferred to Account 3, while the remainder will stay in Account 2.

How to make transfers

You can apply for this one-time transfer through these options:

- Online: You can apply through the KWSP i-Akaun app.

- In person: You can also do it via Self-Service Terminals at all EPF branches nationwide.

Transfer options and rules

Got some funds you want to shuffle around? Here’s how you can do so.

- From Account 3 (Fleksibel): You can move funds to Account 2 or Account 1.

- From Account 2 (Sejahtera): Funds can hop to Account 1 or be used to kickstart your Account 3.

- From Account 1 (Persaraan): Transferring money out is not permitted.

However, once you’ve transferred money from Account 3 to Account 2 or Account 1, you can’t reverse the transfer. Additionally, you must personally visit an EPF branch to submit your transfer application.

Option to opt out

If you’re unhappy with the new three-account format and wish to stick with the current two-account setup, unfortunately, there’s no option to do so.

EPF will roll out the new account structure this May for all members under 55 years old without providing an opt-out choice.

In any case, if you have the privilege of leaving your EPF funds untouched until retirement, that would still be the most beneficial choice, and these structural changes shouldn’t affect you or your savings.

Also Read: 3 GenAI use cases with the potential to take off in M’sia, based on global examples

Featured Image Credit: Vulcan Post

Islamic fintech isn’t just for Muslims, here’s why M’sian consumers & startups should tap in

Malaysia is the third largest Islamic finance market after Iran and Saudi Arabia. Why does this matter, you may ask?

Because the Islamic finance industry has been expanding rapidly over the past decade. Global Finance Magazine reported earlier this year that the industry has been growing about 10% to 12% annually. This growth is more advanced compared to its conventional counterparts.

Today, shariah-compliant financial assets are estimated roughly at US$2.5 trillion covering bank and non-banking financial institutions, capital markets, money markets, and insurance.

Despite the industry being spread over more than 80 countries, the bulk of it is concentrated in very few markets with Malaysia being one of them.

In other words, we stand to gain tremendously from our position as a key global player in the landscape. Some benefits are:

- Economic growth by attracting investment and fostering business activities

- Financial inclusion to serve a broader segment of the population, and

- Enhancement of international reputation which could strengthen economic ties

But what role have we been playing in the market so far and where do we go from here?

We’re no experts in the field but we picked up some notable points from a panel session at the recent KL20 Summit. TV3 host Nadia Azmi was in charge of moderating and picking the brains of those actually in the Islamic finance industry for answers:

- Junaid Wahedna, founder and CEO of Wahed (an American online halal investing platform),

- Dr. Jasmine Begum, Regional Director of Legal, Corporate & Government Affairs for ASEAN at Microsoft,

- Dima Djani, Group CEO of Hijra (an Indonesian fintech firm), and

- Adnan Zaylani, Deputy Governor at Bank Negara Malaysia (BNM).

It’s not like conventional fintech

Capital Markets Malaysia defines fintech as the application of disruptive technology to traditional financial services. This includes digital investment management, equity crowdfunding, peer-to-peer financing, and digital asset exchanges. Combine those with Islamic principles and you’ll get Islamic fintech.

The concept itself doesn’t change with the only difference being that Islamic fintech observes shariah guidelines. For context, shariah is the Islamic law branch dealing with transactions in the economy.

At its core lies the significance of shared risk in capital raising and the avoidance of riba (interest) and gharar (uncertainty).

Junaid Wahed explained this well by stating that it’s more asset-based, not liability-based. Companies don’t lend money at interest and instead participate in the business venture as a partner, sharing both profits and losses.

“We (Wahed) try to solve every single financial product without doing any lending but instead use equity. [For example], instead of a mortgage, it’s an investment,” the CEO of Wahed elaborated. “Lending is risk-based and creates inequality.”

This approach protects consumers from the risk of incurring high levels of debt. Contracts also must be transparent with the terms and conditions clearly defined to avoid ambiguity.

Together, these help to promote better financial stability to all parties involved. It also allows Muslims to make responsible financial decisions without compromising on their values and beliefs.

Serving the underserved market

That said, you don’t have to practise the faith to be a consumer of Islamic fintech. This is great news for a number of reasons such as its ready integration of ESG (environmental, social, governance) frameworks.

Islamic finance in general is more sustainable and achieves at least half of the United Nations’ Sustainable Development Goals (SDG), such as reducing poverty (SDG 1) and spurring broader economic growth (SDG 8 and SDG 9).

A large part of this is due to its enhancement on financial inclusion that overlooks social standing. Dima Djani shared that this provides a level playing field for conventional finances and the potential to utilise tech in the field is immense.

Communities are able to grow and climb their way out of social inequality, making it a suitable platform “to serve the underserved”, as Nadia put it.

As for how Malaysia benefits from this, Dr. Jasmine said that we have the ideal marketplace thanks to our easy entry model and strong entrepreneurial ecosystem support.

Unlike other nations, we have various initiatives to foster innovation and business development. Both government and private entities actively promote the industry through funding support, mentorship programmes, and accelerators.

A good ecosystem alone isn’t enough

But more than that, we already have a well-established Islamic finance ecosystem and market demand.

The International Federation of Accountants shared that part of this is due to the constantly upgraded regulatory infrastructure. This is overseen by BNM and the Securities Commission Malaysia.

Ethis, a local equity platform for investors, stated that the mature Islamic finance ecosystem helps draw Islamic fintech players to Malaysia. Fintech players can depend on various shariah advisory firms to vet products and services, while Islamic banks can provide comprehensive Islamic finance services.

However, the panellists noted that there are still improvements to be made to ensure the industry flourishes even more.

“Technology is moving so fast, policies that are made [with] five-year and ten-year master plans will not be able to catch up. We need agile policies that will allow for innovation and not impede it,” Dr. Jasmine remarked.

Adnan Zaylani from BNM added that regulatory frameworks are there to protect consumers and businesses, which can sometimes come with trade-offs like speed. But the government institution has been looking to simplify processes like eligibility assessments to make it easier for Islamic fintech startups.

Dima also chimed in, sharing that a challenge he’s been facing as a digital banking player is accommodating to new demands in a regulated industry. For example, consumers of Hijra are requesting tech for QR payments, but it takes time to add new features like this.

So both the industry and consumers need to have realistic growth expectations.

More education and awareness is needed

According to the Global Islamic Fintech Report 2022, the Islamic fintech market size is anticipated to reach US$179 billion by 2026 at a compounded annual growth rate (CAGR) of 17.9%. In comparison, the overall global fintech industry is expected to only develop at a CAGR of 13.5% over the same time period.

Malaysia currently hosts headquarters for over 15 Islamic fintech companies, including du-it, MadCash, Koha, Kestrl, and Wahed. Many more are probably keen on tapping into this emerging market while it’s still young.

That said, a concern is whether the opportunities to tap into the Islamic industry is exclusively for Muslims. This didn’t get brought up during the summit, nor were we able to easily find answers online.

Regardless, though, you’ll need a deep understanding of Islamic finance principles and compliance requirements to do this. Another challenge would be gaining the trust of of Muslim users, if the founder isn’t a Muslim themselves.

In any case, we believe there’s still a lot more education and awareness needed in the industry to really propel it forward.

- Read articles we’ve written about Malaysian startups here.

Also Read: Airbot’s new self-cleaning robot vacuum boasts 3 promising features, we test each one out

Featured Image Credit: Vulcan Post

Amazon to invest S$12bn into S’pore to expand cloud computing and AI capabilities

At the AWS Summit held at Marina Bay Sands earlier today (May 7), Amazon Web Services (AWS) announced that it will invest S$12 billion in its existing cloud infrastructure in Singapore from 2024 to 2028 to meet the growing customer demand for cloud technology and services in the city-state.

This marks the tech giant’s largest investment in the city-state, bringing the company’s total sum invested to S$23.5 billion. This is more than double the amount it invested here from 2010, when the company’s cloud computing division set up its regional headquarters here for its cluster of data centres, to 2023.

According to a new AWS Economic Impact Study (EIS), the company’s investments are expected to contribute S$23.7 billion to the city-state’s Gross Domestic Product (GDP) by 2028 and support an average of about 12,300 full-time equivalent (FTE) jobs in local businesses annually.

This investment will create a ripple effect across Singapore by increasing economic growth and cloud adoption. It also brings additional contributions to the local economy by AWS, such as upskilling the local digital workforce, developing renewable energy projects, and creating a positive impact in the communities where AWS operates.

Priscilla Chong, Country Manager, Singapore, Amazon Web Services

Contributing to Singapore’s National AI Strategy (NAIS) 2.0

Apart from the investment, the company also collaborated with the Infocomm Media Development Authority (IMDA) for the launch of AWS AI Spring – a new flagship programme aimed at partnering with the Singapore government, public sector organisations and businesses to help them spur the adoption of AI and Generative AI across the city-state.

As part of the programme, the company will offer workshops and consultations for organisations across six pillars as follows:

- AI Spring Public Sector – helping the local government and its agencies

- AI Spring Workforce – provides a series of AI skilling and professional certification programmes

- AI Spring Enterprise – drives AI adoption for local businesses

- AI Spring Startups – focuses on developing core AI startups

- AI Spring Communities – leverages AI to contribute to community development

- AI Spring Research and Development (R&D)

To date, AWS has trained over 400,000 people in Singapore in cloud skills since 2017. According to Chong, the company will “continue to invest in upskilling and improve productivity” across the country.

Speaking to The Straits Times, Elsie Tan, Country Manager, Worldwide Public Sector at AWS Singapore, expressed her enthusiasm for future collaborations with the local government and businesses, adding that she hopes that the programme will accelerate Singapore’s Smart Nation vision and goal to become a leader in the international AI field.

By leveraging AWS’s broadest and deepest set of artificial intelligence and machine learning services, cloud infrastructure, and network, AWS will empower local organisations and students with technology and skills to tackle unique challenges, unlock new opportunities, delight customers, and scale in a secure, resilient, and sustainable manner.

Elsie Tan, Country Manager, Worldwide Public Sector at AWS Singapore

Featured Image Credit: Wall Street Journal

Also Read: S’pore govt unveils AI-powered search engine to provide easier access to Parliament records

Sick of her day job, she quit to focus on her baking biz that now has a physical cafe in PJ

Since childhood, Lakhshmi Priya, alongside her sister Dhivya Dhyana and cousin sister Vidyalakshmi, shared a deep passion for baking fostered by their mother’s loving tradition of baking cakes for birthdays and family gatherings.

What began as a childhood pastime bloomed into a full-fledged business venture, taking shape as Ministry of Cakes.

The inception of Ministry of Cakes traces back to 2015 when the trio, fueled by the unexpected demand for their homemade creations, embarked on a journey of entrepreneurship.

“While we were studying and working part-time, we started baking and posting all the cakes we would bake on Facebook and to our surprise, we got a bunch of enquiries from friends and family asking if we were taking orders.”

“Without much experience or knowledge on starting a business, we started taking orders for our closest friends and family,” said Priya.

Initially named “Caked,” the business underwent a rebranding in 2017, evolving into what it is today.

As Priya took the reins of the business, her sister Dhivya delved into her medical career, and Vidyalakshmi navigated her own professional path.

From home baker to cafe owner

Opening a physical store wasn’t just a business move; it was a big leap for Priya.

From baking cakes at home for two years, while juggling a job in architecture, she never imagined she would own a bakery one day. But as she lost interest in her day job and found solace in baking late at night, she knew it was time for a change.

Then, the opportunity arose to visit her fiancé in the United States, offering her a chance to break free from the monotony. During her travels, she explored renowned cafes in New York, London, and Paris which ignited a spark within her.

With each delicious bite and aromatic sip, she felt a longing to create something more, something tangible. The allure of owning a brick-and-mortar bakery became irresistible.

Supported by her fiancé and mother, she quit her architecture gig during the pandemic and dove headfirst into planning and preparation for opening her own bakery.

Even though she struggled to find the right spot within her budget, she kept at it and eventually stumbled upon a gem that exceeded her expectations.

She shared that she was initially looking for shop lots in more popular places with heavy foot traffic but after scouting around, she realised her business had thrived online for over six years.

This realisation shifted her perspective on location needs; foot traffic wasn’t crucial since she could rely on third-party delivery services or customers picking up orders. This understanding led her to her current location.

Her knack for interior design came in handy as she mapped out her dream bakery. From designing the layout to overseeing the renovation process, she left no stone unturned in ensuring her store reflected her creativity and passion.

Nestled in the heart of Petaling Jaya, Priya adorned her new space with touches of pastel colours and with the glass windows all around, the place basks in warm sunlight, giving it comfy and homey vibe.

Crafting sweet offerings & experiences

Since the pandemic, there’s been a surge in home bakers nationwide, making it challenging to stand out.

Despite offering similar products, her bakery distinguishes itself by specialising in customised buttercream cakes made from premium ingredients.

She also experiments with flavours while maintaining a selection of popular choices. Their top-selling item, the Gulab Jamun Cheesecake is a fusion of Indian and Western influences.

But what truly sets her cafe apart is probably its aim to foster a sense of community. With a kitchen, a studio for classes, and a cafe area, her bakery is more than just a place to buy cakes.

Ministry of Cakes also serves as a space for learning new skills and hosting private events.

With glass windows allowing patrons to observe workshops in the studio while dining, it creates a unique and engaging experience.

One cake at a time

Building her business wasn’t all sunshine and rainbows. It took literal blood, sweat, and tears to turn her dream into reality.

Priya grappled with the complexities of licensing, inventory management, and team building.

Finding the right team proved difficult, with turnover hindering growth. Research and development also posed challenges, navigating what sells and experimenting with new items.

Even with these hurdles, she remained hands-on, baking alongside her team and ensuring quality control.

With her mother’s support, they managed the daily operations, but she struggled with delegating tasks, having been a one-woman show for so long. However, she remained hopeful, aiming to build a strong team to share the load in the future.

While additional locations may not be on the immediate horizon, Priya envisions expanding her business ventures, including launching a line of bottled iced coffee and ready-to-bake items.

Whatever she will pursue, her overarching goal remains clear—to realise the full potential of Ministry of Cakes and continue to sweeten lives.

- You can learn more about their business here.

- Read other articles we’ve written about Malaysian startups here.

Also Read: 3 GenAI use cases with the potential to take off in M’sia, based on global examples

Featured Image Credit: Ministry of Cakes

This M’sian quit banking to learn how to bake polo buns so he could start a HK-style eatery

Hailing from Taiping Perak, Chester Lee always wished to have a café or restaurant before turning 30.

And in 2019, the year he turned 30, he did just that.

Before that, Chester had been a mortgage loan banker by trade.

“Mortgage sales is a high-pressure job because you always have to deal with a lot of high-end customers,” he described the career.

Working mainly with foreigners, Chester would often travel to Hong Kong, which was great as he’s loved Cantonese movies and music since young.

The banker is also a fan of Hong Kongese food, which is why he chose to specialise in it when he made the decision to pivot.

“Among all the HK food, I choose polo bun to be my signature dish because in Malaysia [we] don’t have many polo bun choices,” he claimed.

Polo buns are also known as pineapple buns, but they have nothing to do with the tropical fruit in terms of flavours. Rather, they’re called that because of their similar appearance.

The popular pastry is featured in many Hong Kong-styled restaurants in Malaysia, but it’s not typically the hero item.

Plus, Chester shared that he hadn’t been able to find any polo bun in Malaysia that was to his liking.

So, five years ago, Chester quit his banking career and launched All Day Polo Bun with a bootstrapped capital of around RM200,000.

Learning from the masters

Committing to the business, Chester went all the way to Hong Kong to learn the art of polo buns from a famous sifu.

“This is P&C,” he answered when asked about who that sifu was. “What I can disclose is my Sifu [has been] working in HK’s famous cha chan teng called Tsui Wah (翠華) for more than 10 years.”

Following his polo bun baking steps to a tee (but replacing pork lard with butter), Chester was able to gain confidence that All Day Polo Bun would stand out in the marketplace.

“I think no one in Malaysia can beat my polo bun,” he proudly said. “And All Day Polo Bun is not only a restaurant that sells HK food, we sell HK culture too.”

Being skilled in making the dish doesn’t necessarily mean being skilled in running a full-fledged business, though. This is especially the case as Chester has never been involved in F&B entrepreneurship.

“Banking line is totally different with F&B,” he mused.

But Chester believes that being an outsider also gives him fresh ideas, especially when it comes to designing his business in terms of the menu and marketing.

Essentially, he feels like he isn’t tied down by the old-school thinking or rules in the industry.

“I think this is my advantage and this is the difference between me and other F&B owners,” he said.

All day, every day

While polo buns are the name of the business, All Day Polo Bun also offers an assortment of other Hong Kongese dishes.

This means Chester’s restaurant must compete with other Hong Kong-styled establishments, which aren’t all too rare in the Klang Valley.

But Chester is not too concerned about the competition, believing that the core principle of sustaining a restaurant is simply ensuring that the food is good—which he says All Day Polo Bun has achieved.

After all, that’s what allowed the team to grow to a second store in SS18, which opened in March 2023.

Chester reveals that by aggregating the orders from both stores, they can hit up to 1,000 buns per day on weekends.

To support this volume, All Day Polo Bun has a total of 20 staff members for both stores. Chester now focuses more on the central kitchen’s food preparation as well as marketing.

Given his success, the founder confidently shared that he has no plans on returning to the banking world. Rather, he’d like to fully invest in growing his F&B business, an effort that would require his full focus and concentration.

Aside from opening the third All Day Polo Bun outlet this year, Chester intends to amp up marketing—not just for their own branding, but for Hong Kong and Cantonese culture overall.

- Learn more about All Day Polo Bun here.

- Read other articles we’ve written about F&B businesses here.

Also Read: 3 GenAI use cases with the potential to take off in M’sia, based on global examples

Featured Image Credit: All Day Polo Bun