Senheng is building an all-in-one lifestyle app, here’s how M’sians can benefit from it

A few years ago, super apps, which are basically all-in-one platforms, had been all the rage, though the hype seems to have died down a little now.

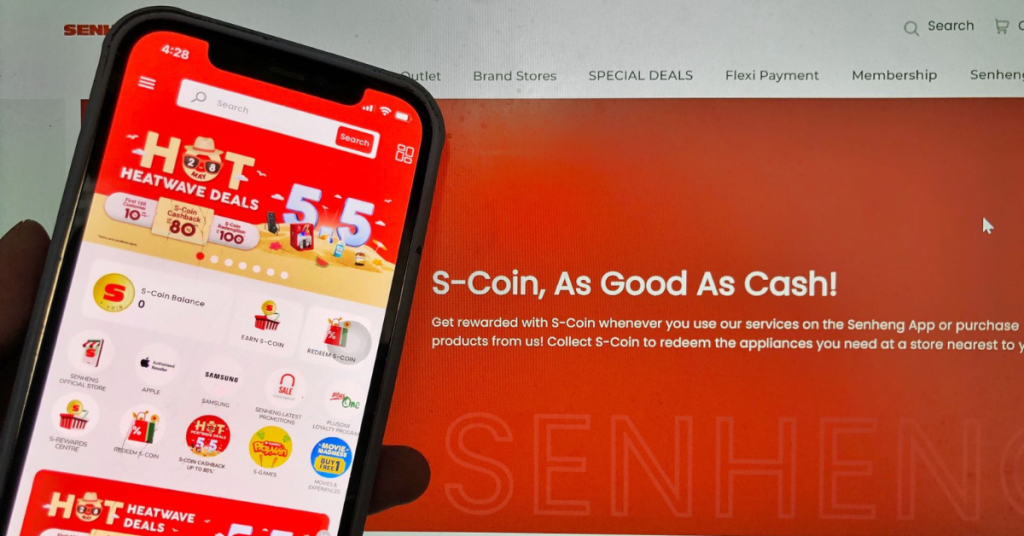

However, one app that still seems to be on the up-and-up is the Senheng App, which first launched in 2022.

Now, I know what you might be thinking. Senheng? Isn’t that a consumer electronics brand? What could their app possibly offer to the average Malaysian who isn’t an avid shopper for electronics and home appliances?

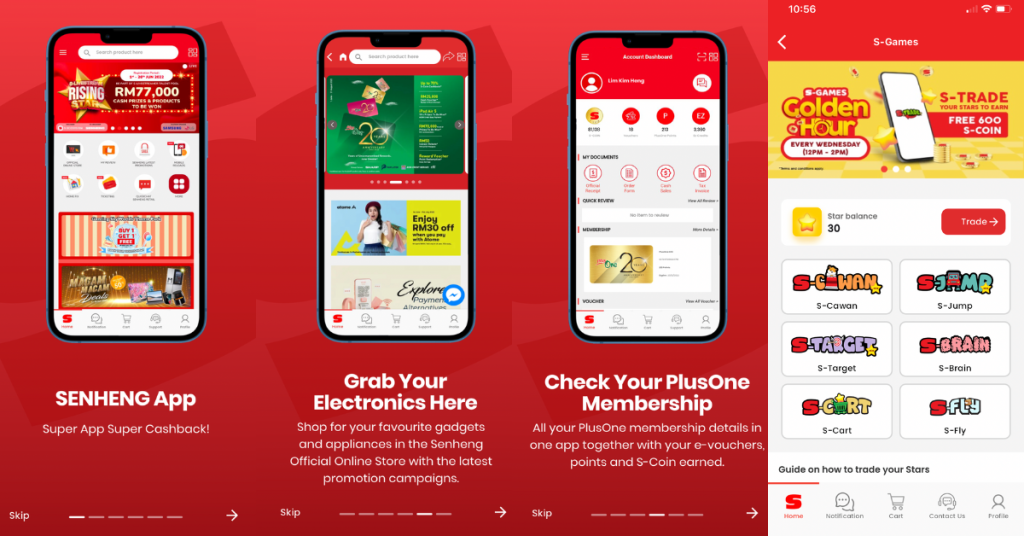

Well, the app actually goes beyond electronics. Through teaming up with various partners, it lets you buy movie tickets, shop for groceries, and play a whole range of games on the Senheng App.

Essentially, the app is a digital platform that not only extends the shopping experience of Senheng retail stores online, but one that also expands on the experience overall.

And people seem to be resonating with that. Between Q1 of 2023 to Q1 of 2024, Senheng has seen downloads for the app double. With that, the increase in the Senheng PlusOne Membership registrations has more than tripled.

At a media session with the Senheng App team, I got to witness exactly why this might be the case.

A rewarding experience

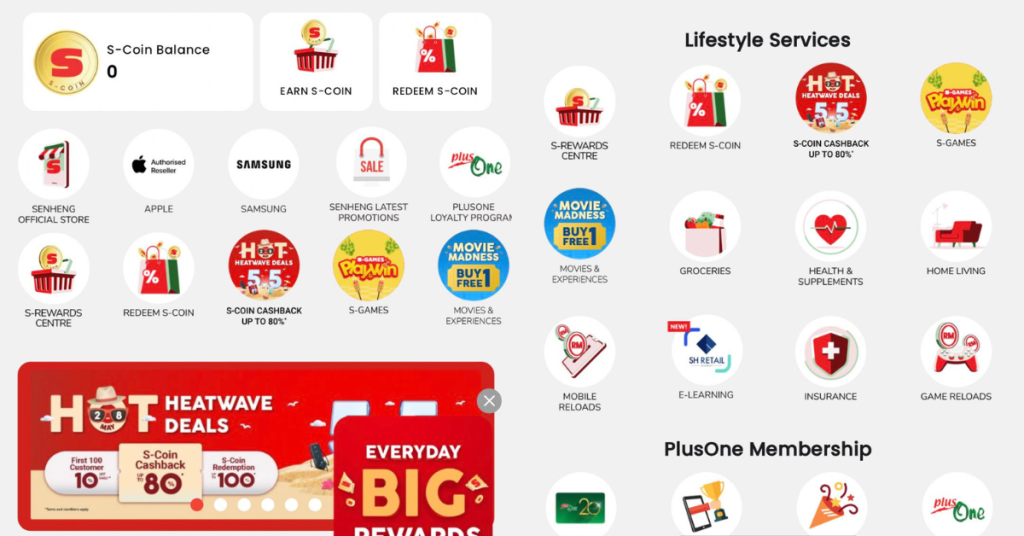

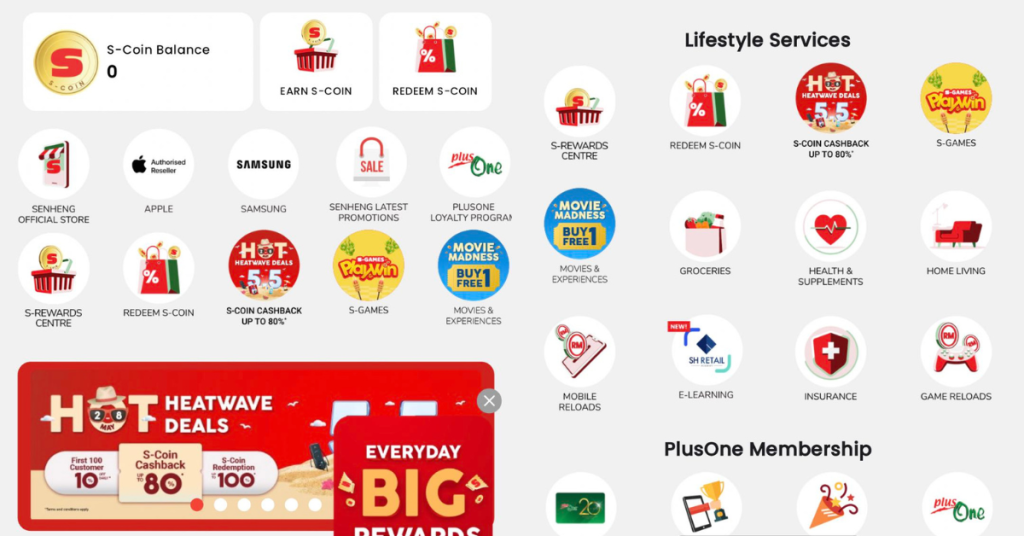

One of the key incentives of using the Senheng App is something called S-Coins, which are basically reward points.

But what’s so special about a loyalty programme?

It comes down to how the points can be earned, and how they can be used.

You can earn points, of course, by shopping from Senheng’s vast range of products and services, which includes groceries, fashion, homeware, or even entertainment tickets as well as mobile and game reloads. The app currently has over 30,000 SKUs across 16 categories—and that number will only increase going forward.

On top of that, points can be earned by playing S-Games. Comprising various mini games, the S-Games was honestly quite addictive and engaging when I gave them a go.

There’s also something called S-Livestream, which as its name suggests, facilitates livestreams and community engagement.

The S-Coins can then be redeemed for discounts on a wide range of products and services. 100 S-Coins is equivalent to RM1. The team repeatedly emphasised that this rate is something they are committed to and will do their best not to devalue the coins.

However, in order to actually redeem the S-Coins, you’ll need to become a paid PlusOne member. That means you can continue to earn points as a free member, but in order to make good on those S-Coins, you need to pay a membership fee.

There are a few different tiers of memberships available, starting from a 2+2 year membership at RM24.

The friction right now is that you need to visit a physical Senheng store in order to sign up to be a paying member. However, the Senheng team told Vulcan Post that users should be able to apply online by Q3 this year, making the process more seamless than ever.

Not an ecommerce app, but a lifestyle one

But how does Senheng intend to compete with giants like Shopee and Lazada?

To that end, the team pointed out that they serve different purposes. Where Shopee and Lazada serve as marketplaces, Senheng wants to be more than an ecommerce app, but an all-in-one platform that is supported by its ecosystem of over 100 physical retail outlets.

“We have the synergy between our retail outlets and also online, so we can provide a kind of customer experience that is both online and offline, it’s like a seamless experience rather than just a purely online experience,” YY Lim, the Chief Marketing Officer at Senheng App, said.

And Senheng only aims to continue growing the ecosystem going forward.

Sharing about their plans, Senheng said that they will be adding repair services to the app. That means users can easily hire service providers for various appliances, even if they weren’t purchased from Senheng.

When asked about whether Senheng aims for their app to be deemed as a super app, Lew Wai Hoong, the Chief Technology Officer, said, “Super app is a very bombastic word. For us in Senheng, we focus a lot on serving our PlusOne members, so we treat it like a lifestyle app.”

So, no, perhaps Senheng is not quite a super app, at least in the usual sense of the term. However, with all the benefits that it’s offering, we do hope to see it growing to be a superb app, giving Malaysians more bang for their buck.

Also Read: How financial institutions & universities are reshaping their network through AI-native solutions

Featured Image Credit: Vulcan Post

Keeping quality high & prices low, Airbot plans to grow its physical presence in Malaysia

[Written in partnership with Airbot, but the editorial team had full control over the content.]

If you’ve ever shopped for household appliances online, one option you might have come across is a brand called Airbot.

Airbot features a robust range of products, including handheld cordless vacuum cleaners, mopping vacuum cleaners, air fryers, air purifiers, and robotic cleaners.

A Singaporean brand, Airbot was founded back in 2008 by mechanical engineer Jensen, product designer Marc, and precision engineer Ong Chun Hong.

According to their website, the team used to spend 14 hours per day in the research lab to develop exciting technology, fuelled by a shared dream to change the world.

“We want to revolutionise the way people interact with their living spaces. We noticed a lack of innovation in the local home cleaning sector, despite the proliferation of smart devices and automation. Traditional vacuum cleaners remained largely unchanged in their functionality and user experience.”

Sharing this with Vulcan Post was Ong Chun Hong.

Ong obtained his Bachelor’s Degree in Industrial & Management Engineering. He spent six years in the precision engineering industry, and is also the founder of e-scooter company O-Ride in Singapore.

Then in 2019, he had been a part of the effort to bring Airbot into Malaysia, and is now also the director of Airbot Malaysia.

Affordability for all

Some might find Airbot’s products to look comparable to Dyson’s. While that might be true, something the brand certainly doesn’t have in common with Dyson is their price tags.

Where Dyson boasts a premium price point, Airbot is committed to offer affordability, believing that cutting-edge technology should be accessible to as many people as possible.

“We employ a multifaceted approach to ensure that our products remain within an economical price range without compromising on quality or performance,” Ong shared.

In order to keep prices low, one key strategy they employ is having efficient supply chain management. This involves optimising the sourcing of components and materials, streamlining production processes, and minimising overhead costs.

Additionally, the company also leverages economies of scale to negotiate favourable pricing with suppliers, allowing them to pass on the savings to customers.

Venturing across the Causeway

While Airbot was originally founded in Singapore, Airbot Malaysia got its start back in 2019, spearheaded by Ong.

They’ve quickly grown their local presence in the past four years, having been consistently ranked among the top five best-selling items in multiple sales festivals on both Shopee and Lazada.

“This strong performance across major ecommerce platforms demonstrates the trust and popularity Airbot has garnered among Malaysian consumers,” Ong elaborated.

To ensure that they cater to the local market, Airbot utilises regionalised strategies. That involves different product prices to ensure affordability for the local crowd.

“We believe in local stock availability and after-sales service, so for Malaysia and other regions we enter, we also ensure a local warehouse, marketing team, and after-sales service team are available,” Ong added.

Compared to our Singaporean neighbours who more readily embrace online purchases, Malaysians still prefer physically interacting with products prior to purchasing them, the Airbot team noticed.

Recognising this, Airbot is exploring a potential expansion of its physical presence in Malaysia.

There are principles that consumers, no matter what region, will appreciate though. That involves trust, speedy delivery, and excellent after-sales service—all things that Airbot strives to do.

Becoming a household name globally

It’s been 15 years since Airbot started their journey, but it’s clear that they’re not slowing down anytime soon.

The brand’s ambition is to solidify their position as a leader in the home appliances industry.

“In the short term, we aim to expand our product line, enhance our brand visibility, and deepen our customer engagement through targeted marketing initiatives and strategic partnerships,” Ong explained.

To continue keeping prices low, they’re also focused on further optimising operations while maintaining uncompromising quality standards.

Looking ahead to the next five to ten years, Airbot has ambitious yet attainable plans, Ong said. For one, they envision expanding their global footprint.

Currently, their products are already in China, Japan, Hong Kong, Singapore, Thailand, Indonesia, and of course, Malaysia. At the same time, the Airbot trademark has already been registered in the United Kingdom, the United States, the European Union, and other areas in Asia, priming them for success across the globe.

To cater to all sorts of consumers, Airbot will also need to diversify their product offerings. As such, the business will work on developing innovative solutions beyond the robotic vacuum cleaners they’re known for, such as smart home devices and AI-powered appliances.

Airbot is also committed to ESG initiatives, striving to minimise their environmental footprint while maximising their positive impact on society.

As for Airbot’s goals in Malaysia specifically, they plan to continuously enhance their customer experience, believing that building strong relationships with users is how they can continue to grow.

“This dedication to customer satisfaction is our driving force, and we hope to win the hearts of Malaysians by consistently exceeding their expectations,” Ong concluded.

Also Read: Airbot’s new self-cleaning robot vacuum boasts 3 promising features, we test each one out

Featured Image Credit: Airbot

5 things M’sian fintech entrepreneurs can’t ignore if they want to propel their startups

As Malaysia gears up for the next big leap in financial innovation, the spotlight is on fintech companies poised to flip traditional banking and investment practices.

And in the fast-paced world of finance, you can’t just brush off how much technology can shake things up.

Looking back over the past four decades, we’ve witnessed a remarkable evolution in how we approach technological advancements. We’ve gone from mapping out space to driving environmental sustainability, all thanks to constantly adapting to technological advancements.

Here are some key insights on how fintech can keep riding that wave in Malaysia, according to KL20 Summit 2024 industry players.

1. Digitalisation is a must have, through AI and automation.

The shift towards digitalising financial services isn’t just a passing fad—it’s become a must-have.

Cyfirma founder and CEO Kumar Ritesh pointed out how the shrinking costs from digitalisation benefit both businesses and customers alike.

“By observing the shrinkage in costs for today’s methods, it leads to the observation of intriguing patterns in monetisation from India or China, which may be applicable in Southeast Asia,” he said. This can also help with defining potential investment opportunities.

He added that fintech firms must leverage digital solutions to streamline processes, enhance efficiency, and deliver seamless user experiences.

That means diving headfirst into artificial intelligence (AI) and automation to amp up their game and keep up with the evolving needs of consumers.

2. It’s not so much about money moves anymore, but consumer behaviour.

Understanding consumer behaviour has always been important for businesses, but in the future, it will be paramount.

Fintech companies must pivot towards a consumer-centric approach, prioritising the needs and preferences of their clients, according to Presto Digital fund director Alan Soh.

“If you see, in the past five years, there has been a shift away from focusing solely on monetary transactions. It’s not just about money moves anymore; instead, it’s about getting inside consumers’ heads and using that insight to up your business game.”

“This change in focus underscores the importance of adapting to consumer behaviour and preferences rather than solely focusing on product features or monetary gains,” he said.

Alan also said that by tapping into data analytics, firms can gain valuable insights to tailor personalised solutions, driving customer satisfaction and loyalty.

3. There’s demand for fintech solutions that address cybersecurity too.

Cybersecurity’s shot straight to the top of the to-do list with the rise of cyber threats lurking about. Opportunities lie in wait for fintech solutions that can hunt down and help address these cyber threats.

“How do we gain access to vulnerable individuals, whether they are consumers, financial institutions, or even individuals within the same organisation?” Alan asked as a starting point.

“Upon identifying potential vulnerabilities, such as those highlighted by the WIPO, where cybercriminals are known to target behavioural patterns within our systems, it becomes imperative to analyse environmental factors,” he said.

Alan’s solution for fintech success is to invest in robust security measures to safeguard sensitive data and protect against cyber attacks.

For example, implementing advanced authentication systems and staying vigilant against whatever threats the hackers have up their sleeves.

4. Digital assets and the tokenisation of real-world assets unlock more opportunities.

The emergence of digital assets and tokenisation of real-world assets is reshaping the financial landscape.

Fintech firms are already leveraging blockchain technology to tokenise assets, providing individuals access to previously inaccessible investment opportunities.

Through such solutions, Alan said, “Firms can reach underserved populations and provide them with essential banking services, thereby fostering economic empowerment and social inclusion.”

In short, this democratisation of finance fosters greater financial inclusion and accessibility.

5. Collaboration and consolidation are drivers for growth and innovation.

According to B Capital founding general partner Kabir Narang, collaboration between fintech startups and established financial institutions can drive mutual growth and innovation.

But it’s not just about collaborations within the finance industry, it’s also about those outside of it.

“That’s a common trend we are seeing in cybersecurity, with mergers and acquisitions shaping the competitive landscape.”

He explained how companies like Apple, with their wide array of products and services, effectively manage financial transactions.

Kabir said this interconnectedness between technology and financial operations shows the close relationship between consumer spending and technological advancements.

Strategic partnerships can allow startups to leverage the resources and expertise of incumbents, while established players benefit from the agility and innovation of startups. It’s a win-win all around.

Tips for investors who want to ride the fintech wave

As Malaysia embraces the digital revolution, the opportunities for fintech companies and investors alike are boundless.

The fintech sector offers attractive investment prospects, especially in AI, cybersecurity, and digitalisation.

Despite the appeal, Alan advised investors to be savvy.

“While investing in public markets or equities typically requires time-consuming processes to gather information for company revaluation, in the blockchain space, you get data live,” he said.

He likened it to a company releasing daily financial reports, enabling investors to track volume trends, buyer behaviour, and transaction sizes instantly.

It becomes all the more important that investors must carefully evaluate projects, considering factors such as return on investment (ROI) potential, market trends, and regulatory landscapes.

Besides, it’s not just about throwing money around—it comes back to the point about collaboration, in which investors play an important role too.

Also Read: How financial institutions & universities are reshaping their network through AI-native solutions

Featured Image Credit: KL20 Summit 2024

S’pore ranks 4th wealthiest city in the world – 4 out of 100 residents are millionaires

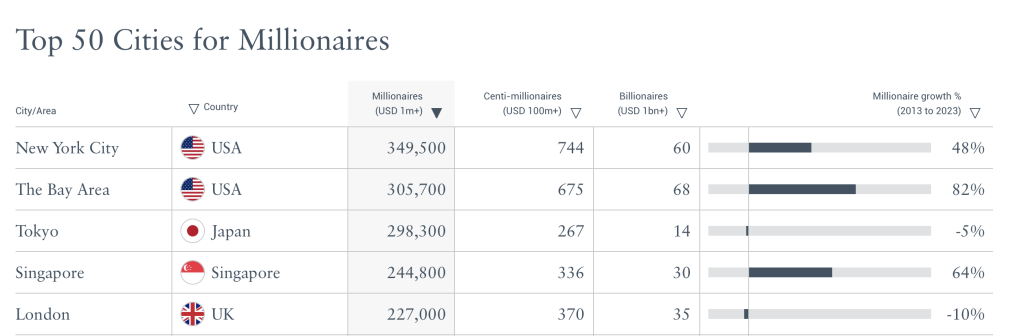

Singapore has been ranked the fourth wealthiest city in the world, with 244,800 millionaires, 336 centi-millionaires, and 30 billionaires residing in the city-state.

This means that about four out of 100 people in Singapore is a millionaire, without taking into account the number of centi-millionaires (people with a net worth of at least US$100 million) and billionaires.

According to the 2024 World’s Wealthiest Cities Report by Henley & Partners, Singapore has seen an “impressive” 64 per cent increase in the number of millionaires over the last decade. In 2023 alone, a staggering 3,400 high-net-worth individuals (HNWI) have migrated to the city-state.

“Widely regarded as the most business-friendly city on earth, Singapore is one of the world’s top destinations for migrating millionaires,” noted the British investment migration consultancy on Tuesday (May 7).

Singapore has overtaken London and is set to unseat Tokyo

The report listed New York City as the leading wealthy city, with wealth held by its residents exceeding US$3 trillion. It is followed by Northern California’s Bay Area, and Tokyo in third place.

However, Singapore is looking set to unseat Tokyo as Asia’s wealthiest city very soon.

Tokyo, which led the pack as the world’s wealthiest city a decade ago, has suffered a 5 per cent drop in its resident HNWI population over the past decade and now sits in third place with 298,300 millionaires, 267 centi-millionaires and 14 billionaires.

Meanwhile, London, the wealthiest city in the world for many years, has continued to tumble down the rankings. It now sits in fifth place after being overtaken by Singapore this year, with 227,000 millionaires, 370 centi-millionaires and 35 billionaires— a decline of 10 per cent over the past decade.

Featured Image Credit: Adobe Stock

Also Read: Forbes 2024 billionaire list: Who are the richest people in Singapore right now?