MDEC linked M’sian startups with Thailand’s tech scene & identified deals worth RM200M so far

[This is a sponsored article with MDEC.]

In the dynamic landscape of Southeast Asia’s digital economy, Thailand has become a hub for tech innovation. The nation has a growing startup ecosystem, with over 13,000 startups and an influx of venture capital investment, making it a prime target for cross-border collaborations.

Recognising this, Malaysia is expanding its technological footprint through DEX Connex Thailand 2024. This initiative is part of the Malaysia Digital Economy Corporation’s (MDEC) Digital Export (DEX) facilitation programmes.

It’s part of MDEC’s GAIN (Gateway, Amplify, Invest, Nurture) initiative, which empowers high-potential Malaysian tech companies to broaden their regional and global reach.

Connecting startups across borders

DEX Connex Thailand is a platform designed to connect Malaysian tech companies with potential partners in Thailand.

This initiative aims to boost cooperation between Malaysia and Thailand and promote digital exports. It does so by providing access to a strong support network, including channel partners, government agencies, corporate associations, and venture capital firms.

In simple terms, it means that Malaysian tech companies get the connections and resources they need to grow, like introductions to key partners and opportunities for funding.

This year, DEX Connex Thailand partnered with True Digital Park, which is a key MDEC ecosystem partner in Thailand.

To further increase the network effect, MDEC also partnered with Techsauce, one of Thailand’s leading tech publishers, which hosted the Techsauce Global Summit 2024 on August 7-9 at True Digital Park, Bangkok.

DEX Connex brought together 51 Malaysian tech companies and more than 40 Thai partners. This was made possible with backing from the Malaysian Embassy in Bangkok, Malaysia External Trade Development Corporation (MATRADE), and Thailand’s Digital Economy Promotion Agency (depa).

According to MDEC, the summit attracted around 16,000 visitors from over 60 countries, centred on the theme, “The World of Tomorrow with AI”.

Fostering growth partnerships

The DEX Connex Thailand programme was packed with key events and activities that facilitated cross-border collaboration. One of the highlights was the Malaysia Diaspora Night, a networking event that brought together the Malaysian diaspora in Bangkok including Thai-based Malaysian technopreneurs, Malaysian tech companies, and Thai tech leaders to build stronger relationships.

Partners like True Digital Park and depa played a role in driving the digital economy collaboration between Malaysia and Thailand.

The Memorandum of Understanding (MoU) exchanged between MDEC and depa further solidified this partnership, paving the way for more local technology companies to penetrate the Thai market.

The main event at True Digital Park featured the MoU and Partnership Exchange Ceremony, where 10 agreements were signed between Malaysian and Thai companies. They include:

- CapBay (Malaysia) and SleekEV (Thailand): To promote sustainable mobility solutions through dealer financing.

- CapBay (Malaysia) and AccRevo (Thailand): To provide integrated financial solutions for SMEs.

- Tala Records (Malaysia) and Nimit Nation (Thailand): To focus on ASEAN cultural content creation.

- Intelligence Traceability (Malaysia) and S.M.S Solutions (Thailand): To enhance traceability in the food and pharmaceuticals industry.

- EasyStore Commerce (Malaysia) and Lalamove (Thailand): To improve delivery efficiency for SMEs.

- EasyStore Commerce (Malaysia) and Sunmi Technology (Thailand): To enhance payment processing for SMEs.

- CTH Commerce (Malaysia) and T.R. SIAMPUN (Thailand): To integrate PayRecon’s solutions with TRCloud’s accounting solution to support Thai SMEs.

- MODELLO Search (Malaysia) and GoFluence Thailand (Thailand): To expand operations in Thailand.

- Dattel Asia Group (Malaysia) and depa (Thailand): To support SMEs with digital marketing and AI solutions.

- ReSkills (Malaysia) and The ATTA (Thailand): To expand ReSkills’ subscriber base in Thailand through engagement with corporations, universities, and lifelong learners.

These partnerships resulted in more than RM200 million worth of engagements, highlighting the programme’s role in promoting Malaysian technology and innovation on the global stage.

Notable Malaysian companies such as Carsome, Macrokiosk Thailand, and Ashisuto Global Technologies also participated in DEX Connex Thailand.

They too exchanged MoUs during the event, each focusing on expanding business opportunities and fostering collaboration between Malaysian and Thai tech companies.

For example, Carsome has injected a major investment to refurbish its centre in Samut Prakan to solidify its presence as a top player in Thailand’s car ecommerce market. The Malaysian unicorn also has Thai-based platforms—One2Car and Autofun Thailand—which attract millions of visitors every month.

Macrokiosk Thailand, which has been active since 2004, has formed a strong partnership with a major Thai holding company. They’re working together across mobile retail, food and beverage, asset management, and property development.

Meanwhile, Ashisuto Global Technologies has partnered with RICOH Thailand to launch DocKITA® services. They’re focusing on helping SMEs with targeted social media campaigns and exhibitions.

Setting up the next stage

DEX Connex Thailand 2024 has played a vital role in strengthening the tech collaborations between Malaysia and Thailand, driving the digital economy across Southeast Asia.

As MDEC continues to support Malaysian tech companies in expanding their global footprint, the success of DEX Connex in Thailand sets the stage for future collaborations. MDEC is now setting up their next initiative, DEX Connex Vietnam, and they’re looking for participants.

If you’re growing a startup that’s ready for global expansion, join MDEC’s growing network by applying for Malaysia Digital (MD) status and expose your startup to the rest of SEA and beyond. Through the MD national strategic initiative, MDEC is transforming the country’s digital landscape by leveraging technology and innovation to drive sustainable economic growth

DEX Connex Vietnam will begin on November 14-15, alongside the Vietnam Innovation Summit.

Also Read: 5 scenarios in which you would appreciate having the reliable ASUS Vivobook 16 for work

Featured Image Credit: MDEC

How this Malaysian SME overcame financial hurdles to grow their business with this 1 solution

[This is a sponsored article with Syarikat Jaminan Pembiayaan Perniagaan (SJPP).]

In high-risk industries like oil and gas, ensuring worker safety isn’t just important—it’s essential to saving lives. That’s exactly what Berkat OSH Services (BOSH) has been committed to since its inception.

Under the leadership of Dr Sabariah Said, BOSH has grown from a single occupational health clinic in 2007 to becoming a leader in occupational health (OH). The company now boasts a team of 20 occupational health doctors and advisors, providing services to renowned companies including Petronas, Shell, and Mubadala Energy.

BOSH has also evolved beyond being just the leader of OH; it has transformed into a comprehensive in-house Remote Medical Services (RMS) provider. This includes delivering medical personnel and services to remote areas, managing disaster response through a 24/7 in-house call center for MEDEVAC, and supporting affected individuals in their recovery to return to work. Their approach addresses both physical and mental health needs.

However, behind their success lies a story of overcoming financial roadblocks, a challenge that many SMEs can relate to.

A rocky road to expansion

Dr Sabariah founded BOSH with a simple goal: to create safer workplaces for people in high-risk industries. Starting out with just one occupational health clinic, BOSH expanded over the years, becoming a key player in the field of emergency medical services, remote medical support, and employee wellness programmes.

However, like many SMEs, scaling up presented its own set of challenges.

As demand grew, so did the need for more equipment, staff, and operational clinics. Dr Sabariah knew she needed financing to support this expansion, but securing a bank loan turned out to be a bigger hurdle than expected.

Faced with high deposit requirements from the bank, Dr Sabariah shared that it really strained their cash flow. The banks also demanded stringent requirements the company wasn’t always able to meet.

The approval process was long and stressful, as Dr Sabariah detailed, “Some banks take more than three to six months for the loan application to be approved and another two months of disbursement upon approval.”

The longer approval process caused a delay in BOSH’s growth plans.

Finding the right support

Amid these challenges, BOSH found a solution through Syarikat Jaminan Pembiayaan Perniagaan (SJPP), a government initiative designed to help SMEs like theirs.

With the government acting as a guarantor through SJPP, BOSH was able to secure the loan they needed to continue expanding. This guarantee schemes provided banks more confidence in approving the loan, easing the financial strain on the company.

Dr Sabariah explained that although they didn’t work directly with SJPP, their guarantee schemes made all the difference in securing financing from the bank. The financial security allowed BOSH to invest in more clinics, hire additional staff, and purchase essential assets like ambulances and telehealth equipment.

Strengthening businesses’ credibility with banks

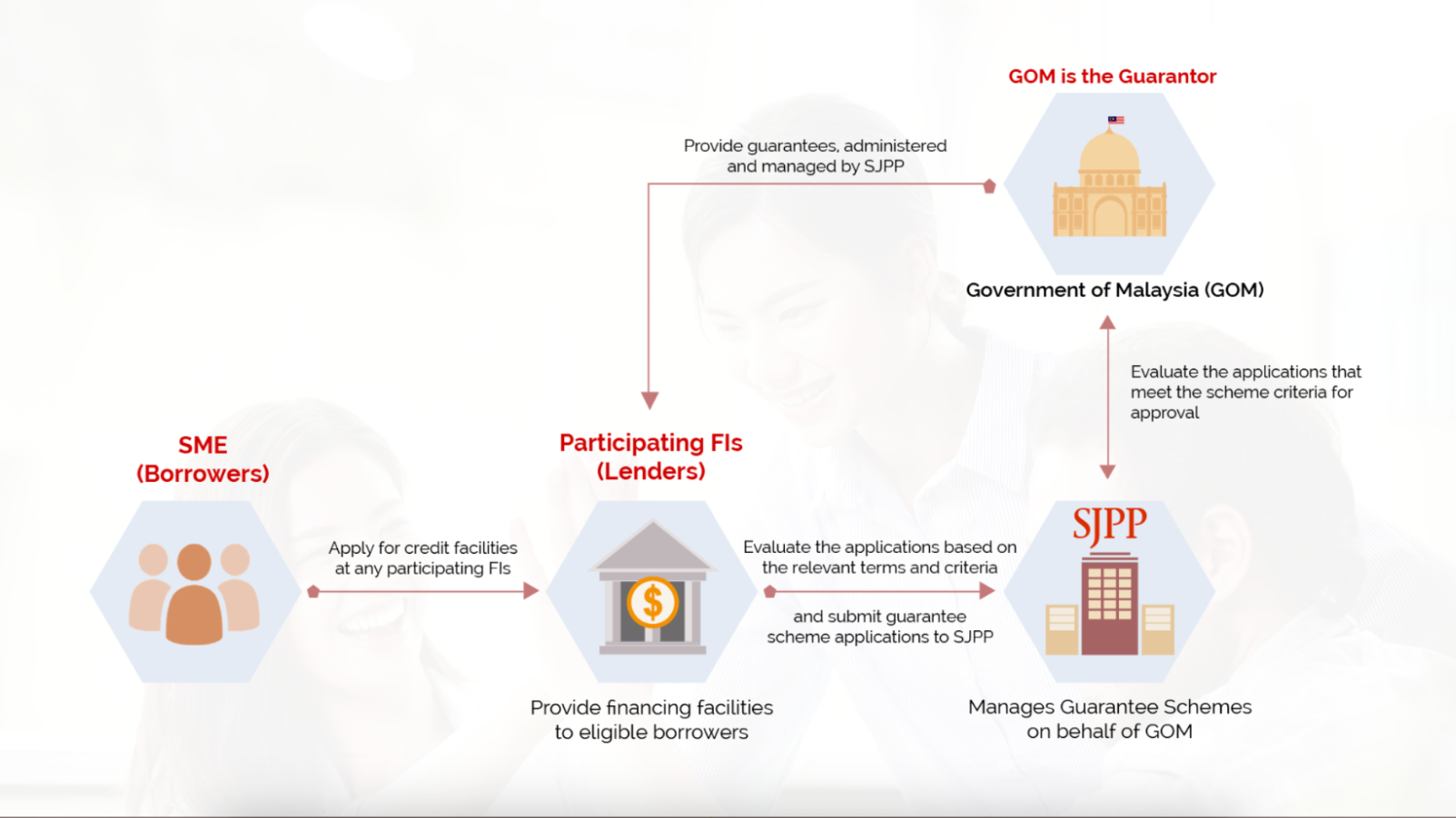

It’s important to note that the government’s role as a guarantor through SJPP doesn’t involve providing direct funds.

Instead, it works behind the scenes, reducing the risk for banks by guaranteeing a certain percentage of the loan. This reduced risk makes banks more willing to offer financing to SMEs, even those with limited collateral.

SJPP offers a range of schemes designed to support businesses in various sectors.

For instance, the Government Guarantee Scheme MADANI (GGSM) offers up to 90% loan coverage for businesses in high-priority sectors like high technology, agriculture, manufacturing and tourism.

Bumiputera-owned businesses can also benefit from the Working Capital Guarantee Scheme (WCGS-B), which provides financing with up to 80% loan coverage.

These schemes aim to lower financial barriers, offering companies like BOSH the support they need to grow.

You don’t need a unique struggle to get support

Reflecting on her experience, Dr Sabariah emphasised the importance of not relying solely on one financing channel.

“Diversifying your financing sources is crucial,” she said. “It’s [also] important to maintain open communication with your bank officers and have a strong business plan to improve your chances of securing a loan.”

BOSH’s journey with securing financing highlights a common struggle that many SMEs can relate to—the hurdles of high deposit requirements, stringent requirements, and lengthy approval processes, among other things.

The beauty of SJPP is that you don’t need to have extraordinary struggles to benefit from its support.

Whether your business is trying to expand its operations, invest in new equipment, or simply grow, SJPP’s government guarantee schemes can help remove financial obstacles and offer a reliable solution to obtain the necessary loans.

Also Read: SDEC 2024 will explore the latest trends in semicon, AI & ecommerce, here’s how to join

Featured Image Credit: Dr Sabariah Said, CEO of Berkat OSH Services

ZUS Coffee successfully raises RM100K for Gaza relief through its new in-app donation feature

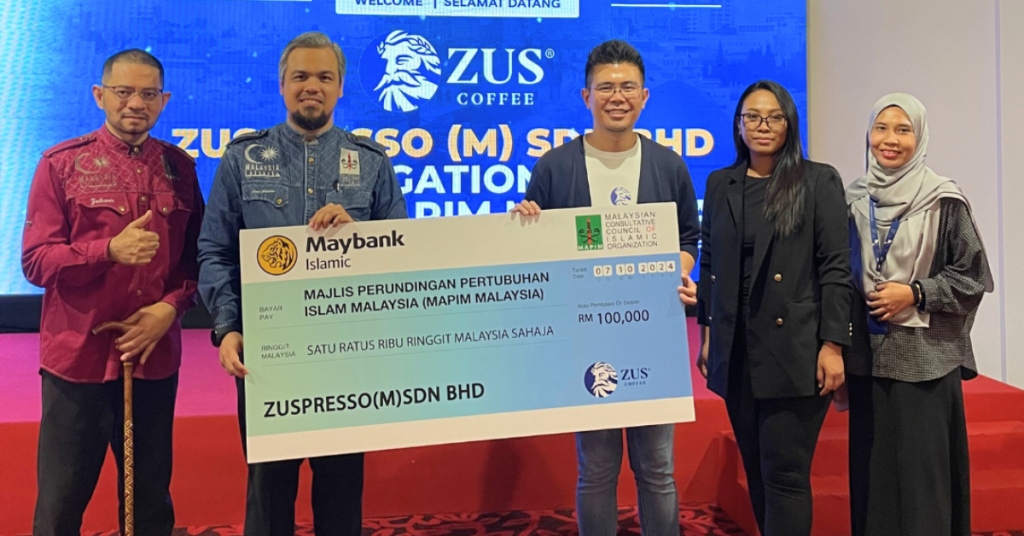

Using technology to drive meaningful impact, Malaysian coffee chain ZUS Coffee has raised RM100,000 through the innovative donation feature on its app. This was done in collaboration with the Consultative Council of Islamic Organisations of Malaysia (MAPIM).

ZUS Coffee will be contributing the money to Tabung Gaza, where the funds will go into providing hot meals, medicine, and water supply to victims in Gaza.

According to a press release, this marks just the beginning of ZUS Coffee’s commitment to social responsibility. The tech-led coffee brand aims to broaden its initiative’s reach and support local and international communities in need.

“We are honoured to stand in solidarity with the people of Gaza, and none of this would have been possible without the compassionate spirit of our ZUS community,” said Venon Tian, the COO at ZUS Coffee.

“At ZUS Coffee, we always strive to find innovative ways to give back. Our technology allows every purchase to be part of a meaningful contribution and movement, demonstrating how simple acts can drive real change.”

ZUS Coffee first introduced its donation feature in August as part of its 1,000,000 Supporters Campaign.

Through the ZUS Coffee app, customers to easily add RM1, RM5, or RM10 to their orders before checkout.

“Just as we believe that coffee should be a Necessity, not a Luxury, so is the compassion we show to those in need,” the donation page on the app stated. “Your kindness is more than just a donation, it’s a lifeline.”

As of October 3, 2024, ZUS Coffee’s total donations raised had reached RM143,616, according to the app.

Actions speak louder than words

In June 2024, ZUS Coffee had already donated RM100,000 to MAPIM to provide necessities like clean water and hot meals to victims of the siege in Deir al-Balah, Khan Younis, and Gaza City.

This followed some backlash in May, when ZUS Coffee participated in an Adidas event.

Adidas itself has found itself embroiled in controversies, having dropped model Bella Hadid who was outspoken about her pro-Palestine stance. As such, Adidas has been one of the brands that Malaysian consumers have been boycotting.

After receiving criticism for working with Adidas, ZUS Coffee initially made a post on May 16, saying, “We hear you. We should have known better.”

In that statement, they explained that the participation was a one-off activity, not a collaboration. They also shared that they would “never knowingly associate ourselves with war and unequivocally condemns any acts of violence against humanity”.

They stated that the company would exercise greater vigilance and care in their conduct, in the activities they undertake, and the brands they associate with.

On May 17, they released a second statement acknowledging that their previous one was not “sufficiently clear” in addressing their stance against “the act of genocide in Palestine”.

In that statement, ZUS Coffee stated that it stands in solidarity against genocide, advocating for a free Palestine. They pledged to be more mindful in their decisions, ensuring they “always reflect our values as a homegrown Malaysian brand”.

It’s great to see that ZUS Coffee hadn’t just made that statement in a time of crisis, but actually backed up its words through real actions.

Also Read: 5 scenarios in which you would appreciate having the reliable ASUS Vivobook 16 for work

Featured Image Credit: ZUS Coffee

Singaporeans now hold the title of Asia’s richest & rank 4th wealthiest worldwide

A new report from Allianz has revealed that Singapore residents hold more financial assets than most of their peers around the globe, securing the city-state’s position as one of the world’s wealth leaders.

According to the Allianz Global Wealth Report 2024, Singapore ranks fourth globally, with net financial assets per capita at a staggering €171,930 (S$246,000).

This figure places Singaporeans well ahead of other high-performing nations in the region, as they continue to build their wealth through a diverse range of financial assets such as cash, stocks, and bank deposits, based on data from the end of 2023.

Globally, the United States leads the pack with €260,320 in net financial assets per capita, followed closely by Switzerland at €255,440.

Denmark just edged Singapore out of the top three with €172,200, meaning Singaporeans are right on the heels of the world’s wealthiest countries.

Leading the wealth race in Asia

When it comes to Asia, Singapore stands head and shoulders above the rest. The report confirmed that Singapore has the highest gross financial assets per capita among all Asian countries.

Taiwan follows behind, ranking fifth globally with €148,750, while Japan sits in 12th place at €91,940.

Singapore’s success is fuelled by strong income growth for private households, as the country’s gross financial assets surged by 5.8% in 2023.

This is almost double the growth seen in 2022, pointing to the robust economic momentum of the city-state.

Stocks and savings are key

What’s driving this financial growth? The report shows that the main drivers were securities and bank deposits, which saw substantial gains.

Singaporeans are continuing to invest in stocks and keep savings in the bank, contributing to the nation’s overall wealth growth. However, insurance and pension assets lagged slightly behind in terms of growth.

While life insurance and pension assets grew in 2023, Allianz noted that the increase was still below the long-term average.

This may signal that Singaporeans are cautious about long-term investments, or it could reflect broader economic trends, like rising interest rates.

Debt is in check, but inflation bites

One standout element of the report is Singapore’s impressive control over household debt.

Despite the global economic pressures, liabilities in Singapore only grew by 1% in 2023. The debt ratio—a key indicator of financial health—dropped to 54.1%, down by a massive 20 percentage points compared to a decade ago, The Strait Times reported.

This shows that Singaporean households are not only increasing their financial assets but also becoming more prudent with their borrowing.

While financial assets grew nominally, when factoring in inflation, the real growth rate was just 0.9% in 2023. This is still higher than pre-pandemic levels but lower than the rapid growth seen in 2021.

Inflation continues to nibble away at the real value of assets, making it a constant challenge for savers and investors.

What’s next for Singapore’s financial future?

Looking ahead, Allianz predicts that insurance and pensions will remain central to Singapore’s financial landscape.

These asset classes already make up nearly half of residents’ financial wealth, and their importance will only grow with the ageing population.

As Singaporeans focus more on long-term financial planning, insurance and pension products will play an even bigger role in securing future wealth.

With a rapidly ageing population, preparing for retirement will likely become an even more significant priority.

Despite inflationary pressures and modest real growth in 2023, Singapore’s financial outlook remains strong.

The city-state continues to lead the region in wealth accumulation, with cautious borrowing habits and a robust portfolio of financial assets. If the current trends continue, Singapore is well-positioned to maintain its place as one of the wealthiest nations in the world.

Also Read: 5 scenarios in which you would appreciate having the reliable ASUS Vivobook 16 for work

Featured Image Credit: iStock

OpenAI is launching 1st S’porean office in 2024, aims to hire up to 10 local talents to start

OpenAI, the parent company of ChatGPT, will be opening its first office in Singapore later this year.

This comes just a few months after the San Francisco-based company expanded to Asia with the launch of its Tokyo office in April.

As OpenAI’s fourth international branch, the Singapore office will be focusing on advancing regional collaborations. The aim is to help strengthen OpenAI’s relationships with partners, governments, and customers.

Part of this includes working with AI Singapore, the national artificial intelligence (AI) programme, on generative AI models that are more reflective of Southeast Asian cultures.

During its announcement at Tech Week Singapore, OpenAI shared that its expansion reflects Singapore’s leadership position in various sectors. Namely, technology and AI, as well as the Asia Pacific region’s growing demand for advanced AI tools.

Sam Altman, the company’s CEO, stated that they’re excited to partner with Singapore’s government and the local “thriving AI ecosystem”.

“Through the partnership, OpenAI will provide up to US$1 million to help develop resources, including open datasets, to ensure AI models are better suited to Southeast Asia’s diverse languages and cultures,” Channel News Asia reported him saying.

With the upcoming opening of its second Asian office, the company confirmed plans of hiring between five to 10 employees before 2025. The roles are related to sales, security and solutions engineering, among others.

OpenAI also reassured that they’re committed to hiring locals and tapping into Singapore’s tech talent pool to deepen its roots here.

The Straits Times reported that its regional operations will be led by Oliver Jay, who serves as Managing Director for its international markets. Prior to this, Oliver was Chief Revenue Officer of software firm Asana.

The location of its Singapore office is still being finalised.

This expansion follows a recent announcement that OpenAI is considering becoming a for-profit benefit corporation, as shared by The Guardian. This means it’s an entity that makes profits but is committed to the social and public good, and won’t be controlled by its non-profit board.

Doing so raises a few ethical concerns, such as how the company collects data for training purposes.

But at the time of writing, the startup remains a non-profit that has a profit-making subsidiary supported by Microsoft.

- Read other articles we’ve written about Singaporean startups here.

Also Read: 5 scenarios in which you would appreciate having the reliable ASUS Vivobook 16 for work

Featured Image Credit: Neowin / The MOM Trotter

5 horror games by Malaysian studios to play this Halloween for spooks & shivers

It’s October, so you know what that means. It’s spooky season!

While Halloween culture in Malaysia isn’t as strong as, say, the US, I’d say that we certainly have an appetite for all things horror. At least, if you’re not a scaredy cat…

In any case, we’ve compiled some proudly Malaysian-made horror games here for those who want to lean into the season with some scares.

1. Cellar Vault Games’ Paper Ghost Stories: Third Eye Open

Cellar Vault Games has finally released their long-awaited title, Paper Ghost Stories: Third Eye Open after four years of being in development.

Featuring a unique papercraft aesthetic, this game is visually mesmerising, and the plot is certainly intriguing, too.

This is the follow-up to the studio’s well-received title Paper Ghost Stories: 7PM, which Vulcan Post reviewed back when it was called Short Creepy Tales: 7PM.

Cellar Vault Games has definitely established itself as a must-watch studio, especially when it comes to spine-chilling games.

This indie game developer has actually released other spooky demos on itch.io as well, if you’re interested to play more of their creations. These include The Plight, The Spookey Sugary Saloon, and Short Creepy Tales: The Long Road Ahead. Could we possibly be seeing any of these titles turn into full-length games?

Where to get the game: Steam

Price: RM30

Ratings: Positive

2. Nimbus Games’ CHIYO

Released early this year, CHIYO is a first person, hardcore escape room-styled puzzle game set in an Edo era Japan horror background.

The game is set in the same universe as Malice, which was also developed by Nimbus Games. The Vulcan Post team has actually bravely played and reviewed this horror co-op game in the past.

The founder of the studio, Joseph Teng, actually has experience creating escape room designs and even owned a few escape rooms. This expertise is certainly something he leverages in creating his games.

Despite the negative reviews the game had gotten (which we later got clarity from the studio about), we actually quite enjoyed the game, so we have high hopes for CHIYO. After all, the game did win Best Audio Design at Level Up KL 2023.

Where to get the game: Steam

Price: RM32

Ratings: Mostly positive

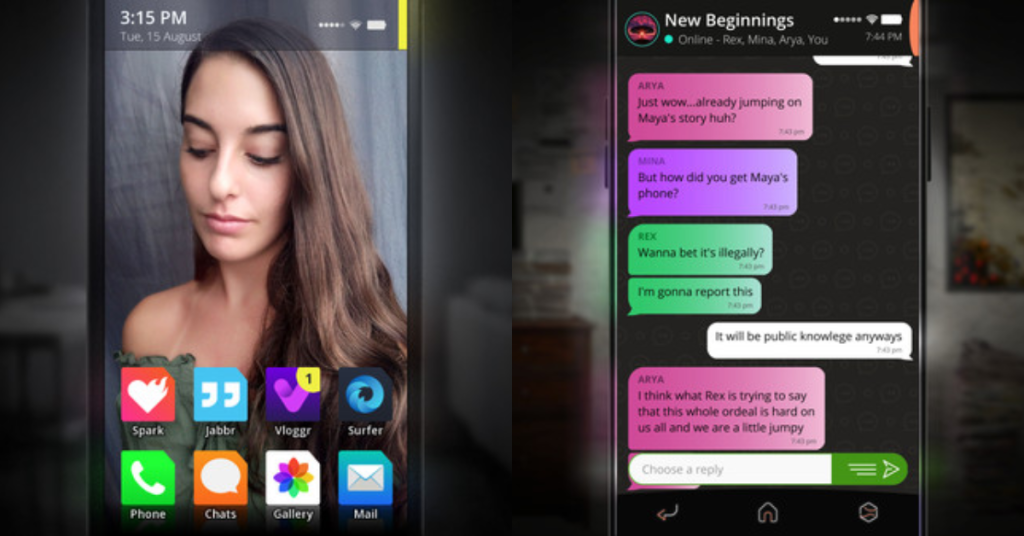

3. Kaigan Games’ Simulacra trilogy

Somewhat a cult classic, Simulacra got its rise to fame after notable YouTubers such as jacksepticeye and Markiplier played it. It follows the “found phone” format and encompasses three games in its series (Simulacra 1, Simulacra 2, and Simulacra 3).

Basically, each of these interactive horror games play out through a phone, which belongs to a missing victim, that was found by the player.

The franchise’s third instalment was released last year, which we’ve played and reviewed.

Although Kaigan Games is best known for the horror franchise, the studio has also been working on some upcoming games Nullspace and Deadly Rehearsal.

Nullspace is not a horror title, but Deadly Rehearsal does seem to have a spooky edge to it, so we’re super excited to see more about it.

Where to get the games: Steam

Price: RM49.95 for the Trilogy Bundle

Ratings: Very Positive for Simulacra 1 and Simulacra 2, Mixed for Simulacra 3

4. Cerebral Games’ Yan魇: Parasomnia

While only a demo for now, we couldn’t leave this game off the list for how promising it looks.

The developer had posted about the demo on Reddit a few months ago, garnering over 2,000 upvotes. And it seems like many users have had positive things to say about the demo so far.

The game follows the Wan siblings who are exploring their childhood home after a simple funeral wake. From there on, a darker plot begins to unravel.

The game is actually created in collaboration with Nimbus Games. There’s not much about Cerebral Games online, but from Reddit comments left by the developer online, it’s likely that they have previously worked at Nimbus Games, having mentioned that they worked on Chiyo.

With that background, we cannot wait to see what spooky horrors await with Yan魇: Parasomnia.

Where to download: Steam

Price: Free (demo)

Ratings: N/A (for now)

5. Persona Theory Games’s Kabaret

Indie studio Persona Theory Games is perhaps best known for its narrative-driven approach to games, having made its debut with a visual novel, Fires at Midnight. But before that, they were actually also involved in Sara Is Missing, the precursor to the Simulacra games.

Their sophomore title, Kabaret, delves into a world where monsters from Southeast Asian myths and folklores dwell. Practices from the region such as tea ceremonies and traditional games like congkak are explored in this title.

To be fair, the game isn’t really a horror title, but it does have dark and spooky themes, which to me can be just as frightening (if not more) compared to jump scares.

Having played it ourselves, we can vouch for the game’s visual appeal. Unfortunately, the game might be marred by some controversies that the studio has faced.

Last year, the studio came under fire with allegations of toxic workplace behaviours as well as sexual harassment. According to an article by Virtual SEA, in late 2023, the company implemented “significant changes” such as new management, committed to cultivating a positive and inclusive workplace culture.

Where to get the game: Steam

Price: RM49

Ratings: Mixed

Putting Malaysia on the map with horror games

It’s worth noting that many of these games we listed actually feature Malaysian elements. For instance, Yan魇:Parasomnia is set in Ipoh, while Kabaret has a glossary that explains Malay words.

It’s awesome to see how indie studios are able to tap into our culture and local settings to create unique experiences for gamers everywhere.

After all, fear is a universal feeling. As such, we hope these games not only spook local players, but global horror fans too.

- Read other articles we’ve written about gaming here.

Also Read: 5 scenarios in which you would appreciate having the reliable ASUS Vivobook 16 for work

Featured Image Credit: Cellar Vault Games / Nimbus Games / Cerebral Games