Author’s Blurb: Cashless payment apps, to me, are like debit and credit cards. I’ve always only sorted my cashless payment apps into a folder where I can easily access them, pretty much like a wallet. My actual debit and credit cards on the other hand, I’d keep in my Apple Wallet. It all seems quite convenient to me until I have to switch back and forth between app tabs just to make a payment.

With the growing landscape of e-wallets in Malaysia, especially during the pandemic, how does one manage them beyond a simple folder organisation?

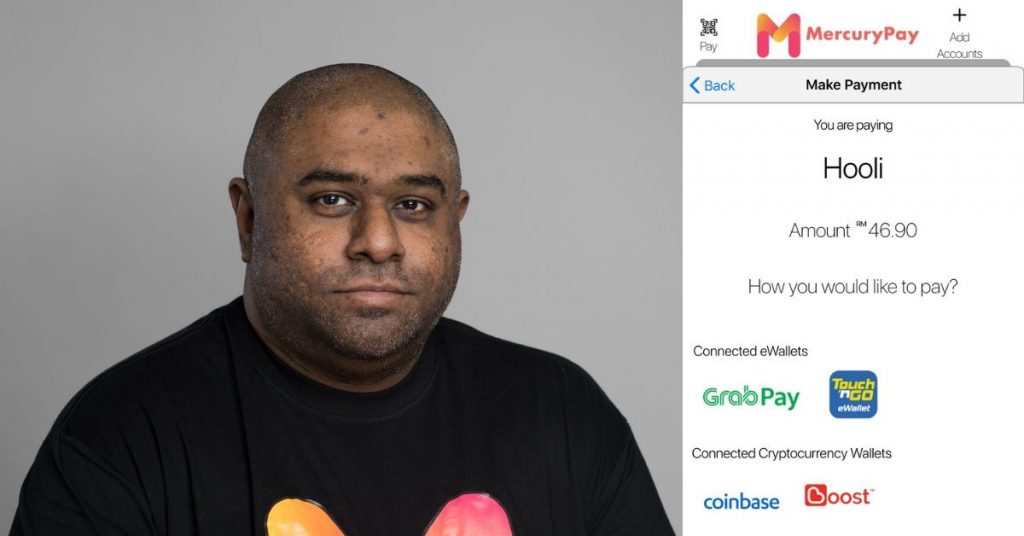

Joel Wijesuria saw the pressing need to address that issue and hence, MercuryPay was born.

Started out as a simple e-wallet aggregator, MercuryPay is now a universal cashless payments platform core with a fintech marketplace built around it.

It serves as an umbrella wallet for not only your e-wallet apps but also your cryptocurrency wallets, debit and credit cards, as well as your online banking.

Essentially, it lets you surpass the issue of merchants who don’t take your favourite e-payment method.

More E-Wallets =/= Choice

While we have an abundance of payment apps to choose from, Joel doesn’t see this as a blessing but rather an illusion.

He believes that the power of choice is taken away as the mode of payment is prescribed to us by merchants.

Think about how sometimes you want to pay with a specific e-wallet, but a merchant says they don’t accept it. In the end, you either pay with cash or your debit card.

“MercuryPay gives that power of choice back by allowing consumers to connect their favourite ways to pay in the app, and making sure that those ways to pay work consistently at all our participating merchants, and the merchants on the Visa network,” said Joel.

Convenience aside, the team wants to go beyond the recognition as an umbrella wallet.

A fintech marketplace is currently being built into the app, where fintech products and services can plug into.

Moreover, this new feature would also incorporate financial management like a tab of your assets and liabilities as well as a robo-advisory service.

This one-stop shop experience does come with a price, though.

While MercuryPay intends to provide the accessibility of financial convenience for its market, this service is subscription based.

Subscriptions include a physical card, virtual cards, single-use cards, and eventually special personal and comprehensive insurance, all charged at a nominal subscription fee payable, either monthly or annually.

Making Adoption By Merchants Just As Easy

Although the app is created on the basis of elevating the consumer’s power in the e-wallet scene, it is simultaneously built to support merchants as well.

To achieve that equilibrium, MercuryPay is changing how merchants are receiving transactions.

Merchants would only need two accounts, one with MercuryPay and one with their own bank.

Upon signing up, merchants can opt for a static printed QR code or receive a dynamic QR code.

“By mid-2021, we will have implemented several key pieces of technology that will allow users and merchants to make and receive payments without the use of a smart device and without the use of a data or other internet connection,” Joel shared.

Merchants are currently already receiving payment alert notifications through SMS, removing the need for a smart device with data or an internet connection on premises.

This innovation is due to a few limitations they recognised on the merchant’s end:

- Renting or buying hardware or software solutions,

- Maintaining the above solutions,

- The poor quality or lack of internet connectivity.

If MercuryPay demanded these of the merchants, it may pose as a barrier to its adoption.

Hence, these innovations were made to target merchants anywhere from the most remote of areas to the high density ones.

The Inner Workings Of MercuryPay

Having a universal platform for all things finance related that isn’t your own bank can be daunting given the novelty of such an app.

So, we asked Joel how MercuryPay would inspire user confidence.

“I can’t go into too much detail about the security features we’ve designed into the app at the user level, but at the infrastructure level we’re using a distributed, highly available architecture that will keep different types of customer data in different places, all encrypted with different encryption keys,” Joel shared.

For instance, user transaction data will not be stored in the same place as user profiles, which won’t be stored in the same place as user accounts.

“Credit card details are stored in a highly secure vault, and for additional security, are transmitted directly from the user’s app on their device to their vault. Customer payment card details never traverse our infrastructure at all,” he added.

According to Joel, MercuryPay is certified as PCI-DSS compliant, GDPA and PDPA compliant, and compliant to local privacy laws across Southeast Asia.

The Future Of Financial Inclusion

MercuryPay doesn’t exactly fit into any of the existing regulatory and licensing frameworks in Malaysia and across the SEA region.

When regulators become more well-versed with a financial service as such and impose restrictions, MercuryPay may no longer find itself cruising through calm waters.

Currently, they are communicating with regulators and central banks more on their system to help them understand the app’s place in the market.

“What we envisage is MercuryPay becoming a pioneer in helping to define and design a new wave of regulations that make Asian payments and the cashless ecosystem safer and more inclusive,” Joel said.

The team also wants to lead in fintech accessibility for underserved and even unserved communities across SEA.

“Our goal is to reach out to and include these ‘forgotten’ communities in the modern financial ecosystem starting with payments adoption and financial literacy,” he added.

To accomplish this, they’re currently communicating with international and local organisations working with these communities to see how they can assimilate into their livelihoods.

Bottom line: I think it’s really interesting learning about how this team constantly finds different ways to grow. A great example is making their transactions offline. A lot of current fintech solutions still exclude those in remote areas, so by addressing the underserved and unserved, MercuryPay has potential in bridging the gap.

- You can read more about MercuryPay here, and register for its current pilot programme here.

- You can read about other Malaysian startups here.

Featured Image Credit: Joel Wijesuria, CEO of MercuryPay