Before Lazada and Shopee, many Singaporeans were doing their online shopping on Qoo10, an e-commerce platform that once reigned supreme in Singapore.

Back in its heyday, the site used to consistently nab the top spot as the e-commerce platform that received the most website traffic.

However, according to online shopping aggregator website iPrice, it was later dethroned by Lazada at the end of June 2019.

Here’s a look at the milestones of Qoo10, and how it evolved to become Singapore’s top e-commerce site before lagging behind new entrants the likes of Shopee and Lazada.

Qoo10’s early days

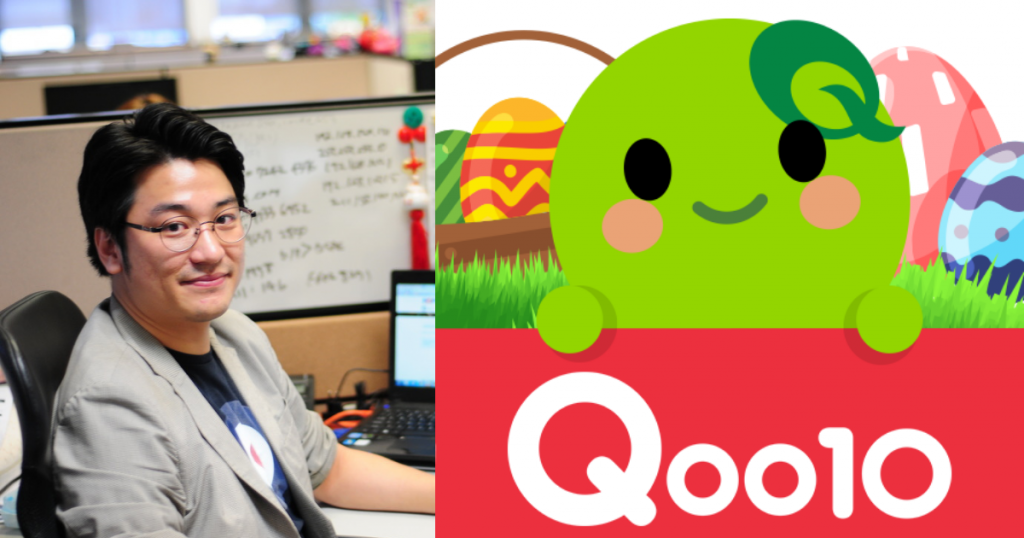

Qoo10 was founded in 2010 as a subsidiary of Qoo10 Pte. Ltd by Giosis Pte.Ltd. as a joint venture between GMarket founder Ku Young Bae and eBay.

Young Bae started out as an oil and gas field engineer, but eventually ventured into the e-commerce sector in 2003 to start e-commerce platform GMarket in South Korea, as he found the options there lacking.

In three years, the group became the fastest-growing and most innovative e-commerce company — big enough to be listed on Nasdaq in the United States.

However, the financial crisis hit and the company was later sold to eBay for about US$1.2 billion in 2009. The entrepreneur then decided to start Gmarket in Japan and Singapore in 2010, which was later rebranded to Qoo10 in 2012.

Qoo10 caught on quickly, enticing Singaporean consumers with products that were previously difficult to get online. Items such as Korean cosmetic products and Australian bath towels became easily accessible to Singaporeans.

The company also offered fresh produce and food, long before delivery apps came along.

According to data from Euromonitor, Qoo10’s share of Singapore’s online shopping space more than quadrupled to 38.2 per cent from 2013 to 2018.

In 2018, Young Bae sold Qoo10’s Japanese business to eBay for an undisclosed sum, which gave the company the finances to expand in Southeast Asia. Since its inception, it raised US$230 million (S$310 million) from investors.

That year, it also launched a blockchain-based free-to-use e-commerce platform QuuBe to tap into Southeast Asia’s largely unbanked population.

Facing the competition

Qoo10 is one of the oldest e-commerce platforms in Singapore, boasting of a three-year head start before its first major competitor entered the market. It gradually faced tougher competition as new e-commerce sites started popping up in Singapore over the years.

Zalora entered the city-state in 2013, with Lazada following the next year. Shopee later entered the market in 2015, and finally, Amazon in 2017.

| E-Commerce Site | Year of Launch | Monthly Web Visits (Q1 2021) |

| Qoo10 | 2010 | 4,290,000 |

| Zalora | 2013 | 873,100 |

| Lazada | 2014 | 7,296,700 |

| Shopee | 2015 | 12,013,300 |

| Amazon | 2017 | 6,450,000 |

Despite the arrival of new entrants, Qoo10 sat comfortably in the top spot in both desktop and mobile traffic between the third quarter of 2017 and 2019.

This can likely be attributed to the early mover advantage that the company had, since Qoo10 had successfully entrenched itself in the market before the Internet and online shopping revolution took place.

Furthermore, Qoo10 had introduced various buying models such as group buys and auctions, which were a novelty back in the day and not offered by any other platforms yet.

Group buys are consolidated community purchases of items which give consumers the benefit of receiving a discount when multiple people purchase the same item, while auctions give consumers the option to bid on a product.

Since Singaporeans are price-conscious shoppers, the cost of items plays a large factor when making purchases. According to a 2019 article by KrAsia, Qoo10’s daily deal promotion led it to gain a competitive edge over Shopee and Lazada when it came to pricing.

The firm also possessed an efficient cross-border logistics network and a local delivery service that could get a package to a customer’s door in as short as three hours.

How Shopee and Lazada overtook Qoo10

After Shopee was launched in 2015, it quickly climbed the ranks and went from being a new entrant to taking the crown as the most-visited e-commerce platform in Singapore by the second quarter of 2020.

Although both Lazada and Shopee were introduced into the market later, both platforms grew quickly, taking the first and second spot in the industry.

They were especially strong in amassing users for their mobile apps, and were constantly in competition for monthly active users on their apps since the first quarter of 2018.

Shopee’s success can be largely attributed to its mobile-first approach, as it took a different strategy early on by launching as an app first to tap on Southeast Asia’s high mobile penetration rate.

The e-commerce giant also predicted that mobile — not desktop — would be the main battleground for e-commerce in the future. Moreover, app users tend to be more loyal and spend more money per order than web users.

To add on, both Shopee and Lazada saw huge success in of in-app entertainment features.

Lazada rolled out ‘Laz Live’ in June 2019, allowing sellers and invited hosts to conduct live streaming shows to engage with their users. In the same month, Shopee also launched the same feature — Shopee Live — which covered the same markets as Lazada as well as other markets.

In 2019, Lazada managed to amass 5.5 million viewers around the region for ‘GUESS IT’, a professionally produced, live-streamed game show where popular local personalities invite customers to guess the price of featured products.

“Not only do brands and sellers have more opportunities to engage their customers, their customers can also shop while being entertained. As a result, the platform enjoys more visitors on both the app and website,” said a Lazada spokesperson.

Shopee also did not stop at Shopee Live. It launched ‘Shopee Quiz’, an interactive game show hosted by familiar faces of local influencers. To gain more traffic, it gave away Shopee Coins and multiple products from participating brands as well as allowed users to invite participants.

Subsequently, it also introduced Shopee Feed, which replicated the ‘Instagram experience’ on Shopee, allowing brands to hold giveaways, and enabling users to comment and ‘like’ posts.

These tactics employed by Shopee and Lazada were instrumental in giving it an edge over Qoo10, by providing customers with an incentive to keep visiting the app, while keeping engagement rates high.

While Qoo10 has similar features, it has not been publicised on the same scale that Shopee and Lazada has.

The two e-commerce stalwarts have also released marketing campaigns featuring icons and celebrities that are highly loved by their users.

For example, in 2020, Korean actor Lee Min-ho fronted Lazada’s 11.11 Shopping Festival campaign as their first regional brand ambassador.

Similarly, Shopee’s 9.9 shopping event in 2019 featuring Cristiano Ronaldo and Baby Shark saw three times more orders than the year before.

Last year, Shopee’s campaign featured mascot Phua Chu Kang, with his familiar Singlish accent as he bantered with viewers and urged them not to miss the good deals on the campaign’s online and offline channels.

The use of these personalities in these viral marketing campaigns are successful in drawing attention to the respective e-commerce platform, while also converting the ad views into sales.

On the flipside, such advertorials from Qoo10 are uncommon, if any.

Coming in fourth

As of the first quarter of 2021, Qoo10 was ranked as Singapore’s fourth e-commerce player, based on its average quarterly traffic, mobile application ranking, social media followers and number of staff.

As new players trickled into the market, Qoo10 found its early mover advantages gradually eroding.

A joint study between Google and Temasek Holdings last year predicted that SEA’s digital economy will triple in size by 2025, reaching US$240 billion. As a key driver of this economy, e-commerce is expected to be valued at US$102 billion in gross merchandise in the year 2025 as well.

This presents Qoo10 with a host of opportunities to expand its e-commerce and marketplace offerings to target Southeast Asia — the world’s fastest-growing internet region in recent years.

By 2023, mobile commerce in Singapore is projected to become a S$6.52 billion market. Furthermore, 75 per cent of Singaporeans aged 18 to 29 use mobile devices to shop online.

Qoo10 can thus capitalise on its mobile offerings, and perhaps follow in the footsteps of Shopee and Lazada to create more interactive features to encage users for longer periods of time.

Since Qoo10 is already known for being a wallet-friendly platform, it can also leverage on more sales, auctions and group buy opportunities to win customers back.

Featured Image Credit: Techcrunch / 99 images

VP Label from Vulcan Post puts together all the best local products for you to discover in one place. Join us in supporting homegrown Singaporean brands: