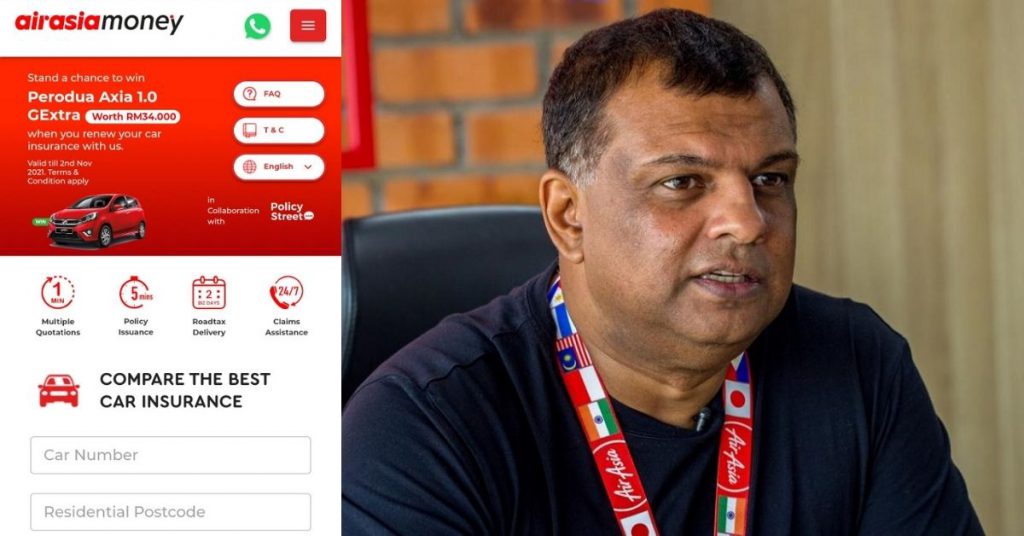

AirAsia today announced that it will be offering a digital car insurance service via the airasia money site and airasia super app.

This is made possible through a partnership with PolicyStreet, an insurtech startup with car insurance and road tax deals with price comparisons as some of its offerings.

Here’s how it works

To renew your auto insurance, you can visit airasia money’s motor insurance page or the app and fill in your details like the car plate number, IC number, residential postcode, phone number, email address, and marital status.

Via JPJ’s system, the service will be able to trace your vehicle’s details including car make, road tax expiry date, and their No Claim Bonus (NCB) discount.

Dictionary Time: No Claim Bonus or NCB is a reward given by an insurance company to an insured for not raising any claim requests during a policy year. The NCB is a discount ranging between 20%-50% and is given to the insured while renewing a policy.

Insurance quotations will then be instantly listed for you to compare. Overall, you’ll find instant quotes from up to 10 different brands available on the site, which currently consist of:

- AXA Affin General Insurance Berhad

- Etiqa General Takaful Berhad

- Berjaya Sompo Insurance Berhad

- Syarikat Takaful Malaysia Am Berhad

- RHB Insurance Berhad

- MSIG Insurance Berhad

- Tune Protect Group Berhad

- Zurich General Insurance Malaysia Berhad

- Pacific & Orient Insurance Co. Bhd

- Allianz General Insurance Company (Malaysia) Berhad

For insurers that are not currently listed, airasia money via PolicyStreet will also offer quotations, but they won’t be instant.

You can also estimate the cost of your final premium with add ons and road tax with a simulator calculator to compare the coverage and prices that best suit your budget and needs.

Upon purchase, an e-Policy will be sent to your email within five minutes, airasia money claims. For the road tax renewal service, your documents will be delivered to your home between 2 and 5 working days via MYEG.

The service is beneficial for car owners who simply don’t have the time or energy to research and compare auto insurance prices online, or make the trip to a post office to renew their road tax. As the service provided can be completed within 5 minutes from your device, it conveniently lets one skip the hassle of an otherwise lengthy process.

PolicyStreet assures that its online road tax and insurance renewal service is safe, as the company has been audited, verified and approved by JPJ and the Malaysian government.

Not the only one

Malaysians aren’t lacking in choices when it comes to auto insurance and road tax renewals online, with players like Bjak, Fincrew, FatBerry, and MYEG already offering these services for years. I’ve recently used Bjak to renew my car insurance and road tax, and although it provided me with choices of up to 5 insurers offering varying packages at different price points, the process wasn’t as instant as AirAsia’s, which only gave me 2 choices.

PolicyStreet clarified that the limited choice on airasia money was because car insurance policies can only be renewed or purchased within 60 days of the expiry date. Hence, if you request quotes from your car when your insurance policy is more than 60 days from expiring, you’ll get limited recommendations. According to the team, the system has been structured intentionally as such.

Editor’s Update: The above paragraph has been updated to reflect greater accuracy of statement.

With the pandemic shifting user behaviour online, there will be more demand for online services to fulfil transactions like these, and customers appreciate convenience and choice.

This partnership points to AirAsia sticking to its plan to strengthen its digital offerings, alongside its other services. According to reports in April 2021, the company plans to raise US$300 million to grow airasia Digital.

Rather than starting an auto insurance service from scratch, leveraging on PolicyStreet’s existing strengths will likely cut down costs for the company to execute this plan. In return, PolicyStreet can leverage AirAsia’s large user base to grow its brand awareness.

“Our goal is to be a one-stop centre for all financial solutions for airasia super app users. Partnering with the best online insurance platform, PolicyStreet, we aim to provide simple, easy, and affordable insurance service to over 36 million airasia super app users and car owners,” said Mohamad Hafidz Mohd Fadzil, head of airasia money.

According to him, airasia money’s expansion plan is on track to launch its offerings in Indonesia in Q4 2021, more insurance and investment offerings in Malaysia in Q4 2021, and make digital car insurance premium installment plans available in Q1 2022.

- You can learn more about airasia money’s digital car insurance offerings here.

- You can read more AirAsia-related content here.

Featured Image Credit: AirAsia