Valued at over US$100 billion, Sea Ltd — the parent company of Shopee and Garena — is Singapore’s largest company by market capitalisation.

However, just three months ago in mid-October, it was valued at around US$200 billion — more than all Singaporean banks (DBS, OCBC and UOB) combined.

As I reported earlier, Sea’s leading growth driver, Shopee, has been doing exceedingly well in 2021, beating expectations and even eclipsing Alibaba’s entire international (ex-China) ecommerce business, consisting of brands like AliExpress, Lazada and Trendyol (combined).

So, what’s going on with Sea? Is the company losing steam as the world is trying to live with Covid-19? Has it lost confidence of investors, taking their money to greener pastures? Does that spell trouble for Shoppe?

Not at all.

Its situation, however, provides an excellent lesson on why companies should not be judged by their stock market capitalisation.

It’s a far cry from what bank analysts predicted just two months ago, with expected prices ranging between US$380 and US$416 per share as recently as mid-November.

In fact, the slump is so bad that it has completely erased the gains recorded over the entire 2021, putting the company 20 per cent below the level it started the year at in mid-January of 2021.

As of 2022, then, Sea got back to roughly where it closed 2020.

This is despite the company’s good performance throughout the year, and no new information has been released which would significantly change that. At least no new information about Sea itself…

A rising tide lifts all boats…

…but the opposite is true as well. When the tide recedes, all boats go down with it.

Stock price is only partly dependent on the company’s performance. The other huge factor is general market environment — and for the greater part of the past two years it has been, paradoxically, very favourable.

Since the slump in early 2020, governments around the world unleashed fiscal and monetary stimuli, desperately trying to prop up the economy.

Much of this freshly minted cash, particularly in America, found its way into the stock market and cryptocurrencies (in the absence of other good investments).

Between the bottom of the pandemic-induced trough in March of 2020 and the current peaks, the index tracking America’s largest 500 companies jumped by over 100 per cent. That’s less than two years.

To find how long it had previously took it to record a similar gain, peaking in February of 2020, we would have to go back to autumn of 2013.

In other words, American stock market has ballooned between 2020 and 2022, as much as it had previously gained between 2013 and 2020 — and it has done it in the middle of a global pandemic and the worst disruption to human activity in a century.

Some of the companies have clearly been excellent performers, benefitting from provision of digital services, while millions of people stayed locked at home or had a greatly reduced outdoor activity. But in general, stocks have largely been disconnected from the underlying economic trouble.

Not anymore.

Where does that put Sea, exactly?

Sea Ltd. is one of the biggest winners of the pandemic, as both its digital entertainment and e-commerce arms benefited from the pandemic, since the internet was the only window to the world open to people.

Its performance confirmed that with sales figures growing rapidly, even if the company is still losing money in pursuit of market share.

Quarterly sales of Shopee more than tripled in a year and a half / Data Source: Annual Reports

However, just as its growing sales and Shopee’s debuts in new markets in Europe and India have fueled interest in the company, it has unquestionably benefited from the excess money sloshing around the marketplace, which has elevated its stock to close to US$400 per share.

Today, as inflation bites many developed markets — including the US, where it reached seven per cent in 2021, the highest since 1982 — money seems to be receding from the stock marketplace, particularly as American Fed is raising interest rates and will likely start rolling back its quantitative easing program, instituted after the crisis in 2008/09 (which was largely an unorthodox money printing operation).

As a result, headlines like the one below from Bloomberg started appearing this January:

As you can see, then, Sea is not alone. In fact, very nearly half of the Nasdaq index listed companies (40 per cent of them so far) have lost 50 per cent or more off their highs recorded in 2021 – i.e. just a few months ago.

In other words, it’s not Sea that has a problem, but the entire stock market.

How does that affect Sea’s future?

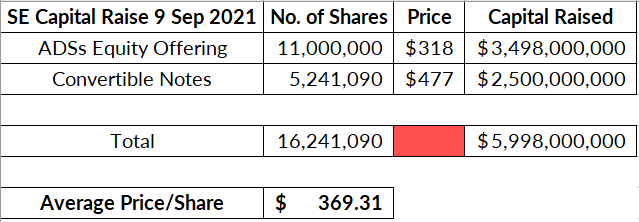

If the company is fine, relatively speaking, what does it mean for the coming years? Well, it has successfully raised approximately US$9 billion since late 2020, which is enough to keep it going for the next few years.

It has used its high valuation to the full, by raising capital around its peak share prices, preventing unnecessary dilution of ownership, just before the market took a nose dive.

At this point, the current stock prices won’t be their primary concern, particularly as everybody else is affected too.

A greater challenge — though still one that would end up hurting everyone — is a possibility of an economic downturn, as governments around the world feel the brunt of high inflation and are bound to fight it.

A stock market crash — which isn’t outside the realm of possibility in the next year or two — would certainly bring about a greater economic crisis, affecting millions of people, leading to reduced spending, still long before Shopee is able to break even (or turn a profit).

Thus far, the platform is doing well in terms of getting a foothold in its new markets, as indicated by the traffic figures to its respective websites:

Timing is everything

Success in business isn’t about being the first or the greatest, but about timing your moves right.

Some of the world’s biggest brands have ultimately collapsed. Some of those who are first to the market failed before successors took over (Facebook wasn’t the first social media site, Google wasn’t the first search engine, Apple was neither the first or the biggest personal computing company).

In case of Sea, it certainly isn’t the first e-commerce platform, but it seems to be one that is timing its activity perfectly well, even when its huge competitors are struggling (like Alibaba-owned Lazada and Alibaba itself).

The Singapore startup has made the most of the pandemic, using it to catapult itself among the world’s largest companies and raising significant amounts of money just before the opportunity to do so cheaply closed.

As a result, no matter what the immediate future has in store for all of us, it is one of the (young) businesses best prepared to tackle it.

Shop and support the best homegrown brands on VP Label now:

Featured Image Credit: Reuters