DBS Bank was the first and only bank in Singapore to launch a digital asset exchange back in December 2020.

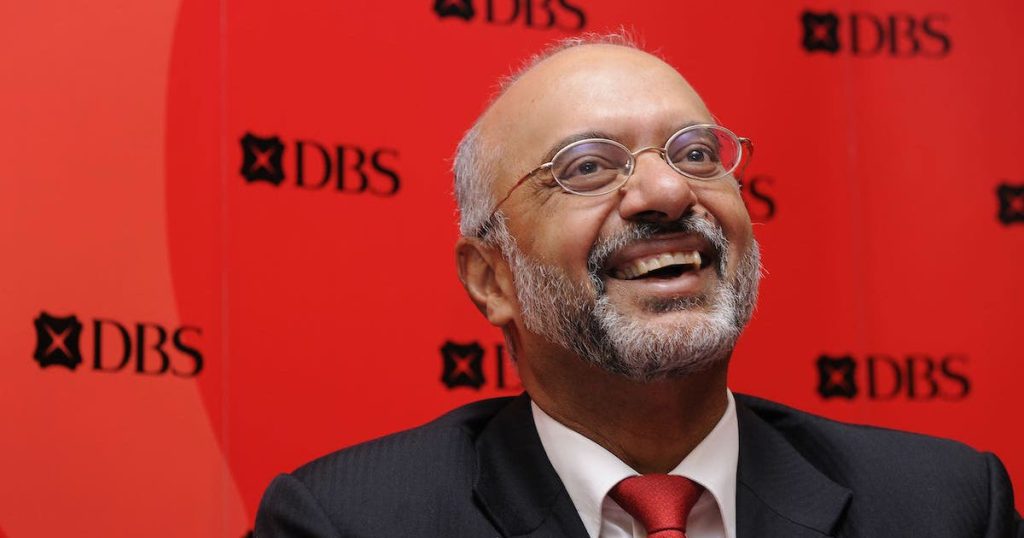

In an earnings call earlier today (February 14), Piyush Gupta, the CEO of DBS Bank, revealed that they are planning to expand its digital assets trading offerings to retail investors.

This expansion plan was first announced on 5 November 2020 during the bank’s third-quarter results briefing. Gupta had said then that DBS is looking to open its members-only crypto exchange to the broader retail market this year, but this was “subject to regulatory approvals”.

Today, Gupta said that the bank will focus on making the “access to the digital assets (in the accredited investors space” a lot more convenient in the first half of this year. Currently, users are required to call a banker and speak to them over the phone.

The first order of the day is to make it online, make it self-service, make it instant, and make sure that the processes are robust and able to support that.

At the same time, we’ve started doing the work to see how we can in a sensible way take it out and expand it beyond the accredited investor base. And that includes making sure we have the appropriate thinking about suitability (and) potential fraud, (among other things).

– Piyush Gupta, CEO of DBS Bank

He added that DBS is looking at “the end of the year” before they finally nail all of these things down and potentially take it to market.

A recent decision by the bank to roll out a 24-hour offering on its digital exchange has caused crypto volumes to surge, with trading totalling more than S$1 billion in 2021.

In the last quarter of 2021, its trading value was approximately US$595.5 million (S$800 million), which was over double the trading value for the three prior quarters.

DBS witnessed strong business momentum

DBS Group has flagged strong business momentum after its profit rose to a record last year.

DBS, the first Singapore bank to report this season, said net profit for October to December rose to S$1.39 billion and follows a particularly weak pandemic-hit year when profit tumbled to a three-year low in the fourth quarter.

DBS’ fourth-quarter profit was 18 per cent lower than the previous quarter’s. However, earnings for the full year surged 44 per cent to hit a record S$6.8 billion.

DBS said this restores “a trend of consecutively higher earnings that the pandemic disrupted in the previous year”.

“We look forward to the coming year with a prudently managed balance sheet that is poised to benefit from rising interest rates,” said Gupta, adding that the bank expects mid-single-digit loan growth or better this year, after reporting a nine per cent increase last year.

Shop and support the best homegrown brands on VP Label now:

[iframe_vp_product src=”https://vulcanpost.com/label/embed-all/” id=”iframe1″]

Featured Image Credit: Bloomberg via Getty Images