Bank Negara Malaysia (BNM) has today unveiled the consortiums that will be getting a digital banking licence in Malaysia, as approved by the Ministry of Finance (MoF).

The names chosen have been split into two categories:

- Financial Services Act 2013 (FSA): three licencees;

- Islamic Financial Services Act 2013 (IFSA): two licencees.

Three out of the five consortiums are majority-owned by Malaysians, namely Boost Holdings and RHB Bank Berhad; Sea Limited and YTL Digital Capital; and KAF Investment Bank.

So, who are Malaysia’s digital banking licence holders?

Under the Financial Services Act 2013 (FSA)

We’ve got:

- Boost Holdings and RHB Bank consortium;

- GXS Bank and Kuok Brothers consortium;

- Sea Group and YTL Digital Capital consortium.

Boost-RHB Bank

Boost Holdings (Boost) is the fintech company under Axiata, the Malaysian telecommunications conglomerate.

Launched in 2017, Boost was one of the first cashless e-wallet apps to have been widely adopted in Malaysia, presumably due to its attractive cashbacks. It then expanded to offer other convenient services such as paying for bills, insurance, online shopping, top-up mobile credit, and purchasing travel tickets, to name a few.

RHB Bank (RHB) is one of Malaysia’s largest banks incorporated in 1994, with 194 physical branches in Malaysia (as of 2013). It is looking to ramp up its digitalisation efforts, indicated by its hackathons held in 2021 and 2022, with the latter rewarding winners from its RM26,000 prize pool.

The bank is targeting to achieve 95% of digital transactions and 50% of digital sales by 2023 as part of its digital strategy outcomes.

Axiata’ subsidiary Boost will lead, owning 60% of the consortium, and RHB owning 40%.

Leveraging Boost’s existing resources in digital payment solutions, and RHB’s resources from customers and their data, the consortium is in a strong position to develop personalised products to fulfil BNM’s push for financial inclusion as a digital bank.

GXS Bank-Kuok Brothers

GXS Bank is the Grab-Singtel consortium (presumably an abbreviation for Grab X Singtel) that was granted a digital banking licence in Singapore.

In Malaysia, it was also vying for a digital banking licence, and we last predicted that they’d be chosen as part of BNM’s five picks. It was where we last reported that Grab is in a comfortable monetary position to grow its financial services if chosen as a digital bank.

Currently, Grab Malaysia offers financial products like a BNPL service, GrabPay Later, and in Singapore, a micro-investment service, AutoInvest.

If the latter is localised for the Malaysian market, it can benefit local gig workers along with micro SMEs. This will fulfil the expectations of a digital bank serving unserved and underserved markets in the country, as outlined by BNM.

As digital banks are imagined to offer all banking services online, there will not be any retail presence such as physical bank branches for GXS Bank. Thus, it is likely that GXS Bank will offer deposit account openings without a minimum amount or a low minimum threshold.

Kuok Brothers started in 1949 in Johor Bahru. It was founded by Robert Kuok, the richest man in Malaysia with a net worth of US$11.7 billion (RM49.3 billion).

Over 70 years, the Kuok Group has grown to become one of Asia’s largest multinational conglomerates. It has operations spanning six continents in sectors ranging from logistics and maritime, to properties and hospitality.

In our last predictions piece mentioned above, we acknowledged that Grab-Singtel may face challenges in the fact that it doesn’t apply to one of BNM’s digital banking criteria. It highlighted a preference where the controlling equity in the licensed digital bank is held by Malaysians.

Perhaps joining a consortium with the Kuok Brothers has alleviated this issue, though it is unknown how much of the digital banking ownership will be held by each party.

Sea Group-YTL

Sea Group has already secured a digital banking licence in Singapore. It’s widely known as the parent company of Shopee, with fintech ventures in Malaysia such as ShopeePay and SPayLater.

Partnering with conglomerate YTL, its activities span hotels, property, technology, infrastructure, and more. The group’s core business has US$17.1 billion in total assets.

Shopee Malaysia amassed approximately 54 million users per month, indicating its relevance and strong brand presence in the local market, as of Q2 2021. This implies that the platform has large data sets of customer behaviours and trends on how Malaysians spend their money.

With such mass data, Sea Group will have few issues creating personalised financial solutions that will be applicable to the needs of Malaysian consumers. Being in a consortium with a local conglomerate implies funding for new tech developments would be a breeze.

Under the Islamic Financial Services Act 2013 (IFSA)

We’ve got:

- AEON Financial Service Co., Ltd., AEON Credit Service (M) Berhad and MoneyLion Inc. consortium;

- KAF Investment Bank consortium.

AEON Credit Service, AEON Financial Service, and MoneyLion

AEON Credit Service is a non-bank financial institution (NBFI) that has been operational in Malaysia since 1996. It provides services such as the issuance of credit cards, easy payment schemes, personal financing, and insurance.

It has an ecosystem of 205 outlets that cater to various lifestyles, pointing to the massive reach the corporation has when it comes to rolling out its digital banking services down the line.

Having already built a solid foundation, the company will likely continue providing its current financial services with improved integration between those and its sales channels.

Its parent company AEON Financial Service holds a 60% stake in the consortium. Meanwhile, US-based fintech company, MoneyLion offers lending, financial advisory, and investment services to consumers. Among its co-founders is Malaysian Chee Mun Foong.

MoneyLion went public through a merger with SPAC Fusion Acquisition Corp in September 2021, and the fresh capital from its listing will bolster its digital banking ambitions.

KAF Investment Bank

This is one consortium that you could say flew under the radar amidst all the predictions about Malaysia’s digital banking applicants.

The only type of news we could find about KAF Investment Bank that was related to digital banking was its July 2021 investment in a local remittance-focused fintech company, MoneyMatch, which was one of the 29 reported digital banking applicants.

KAF Investment Bank has been operating since 1975, dealing with money market instruments and trading in debt securities. Its diversified portfolio includes offering services like investment banking, stockbroking, Islamic banking, research, investment fund management, fund advisory, and trustee services.

We’re not sure what other organisations are part of this consortium, but we can see how KAF Investment Bank’s vast and long-standing expertise has made it one of BNM’s five picks.

-//-

Following this announcement, the successful applicants will undergo a period of operational readiness that will be validated by BNM through an audit before they can commence operations. This process may take between 12 to 24 months.

In line with the five strategic thrusts stated in the Financial Sector Blueprint 2022-2026, BNM will continue to work with the relevant players and stakeholders. This is to continuously enhance access to financial services throughout the country and across all segments of society.

- Read other articles we’ve written on digital banking here.

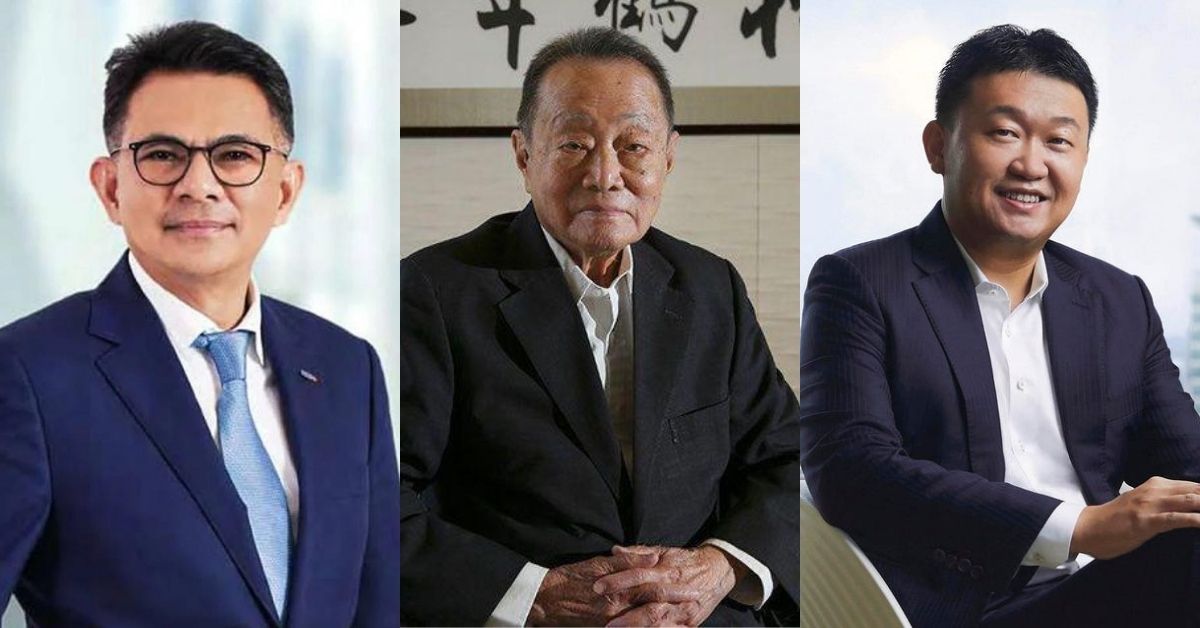

Featured Image Credit: Rashid Mohamad, CEO of RHB Bank / Robert Kuok, founder of Kuok Brothers (photo by Forbes) / Forrest Li, CEO of Sea Group (photo by Forbes)