Last Sunday (June 12), Celsius Network temporarily paused all withdrawals from its platform. The team cited extreme market conditions as a reason for the move, but this itself triggered selloffs of cryptocurrency assets across the board.

When Celsius first started operating, they were adamant that they offered a better deal for people than the banks. Slogans like “unbank yourself” and “banking is broken” were commonplace.

With this recent announcement, the irony is almost impossible to ignore.

So what happened with Celsius?

First of all, we should understand Celsius’ business model. It is a platform that functions much like a bank for cryptocurrency assets — users can deposit their cryptocurrency assets on the platform, and earn interest on these deposits.

And in the cryptocurrency world, interest rates are notoriously high. Celsius promised more than 18 per cent interest per annum, and protocols like Anchor actually offered higher interest rates at around 20 per cent.

For comparison, depositing funds in traditional banks like DBS offer around 0.4 to 1.6 per cent interest per annum, while a 10-year government bond in Singapore yields around three per cent interest.

With these funds, banks make investments, paying the interest and pocketing the difference as a profit.

Celsius apparently does something similar, further depositing users’ assets on higher interest protocols, and earning the difference as profit.

Given that Anchor offered a higher interest rate than Celsius, it made sense for Celsius to deposit assets on the Anchor protocol, which is what they allegedly did. This meant that some of their assets also became caught up in the UST crash that occurred last month.

On top of this, Celsius also offered some of the highest interest rates in the market for Ethereum, one of the largest cryptocurrencies in the world. Yet, Celsius was not backing these loans with their own Ethereum. Instead, they were relying on a derivative of Ethereum, known as staked Ethereum.

This derivative, called stEth, represented Ethereum coins that were locked up by validators of the Ethereum blockchain as part of their proof-of-stake consensus protocol.

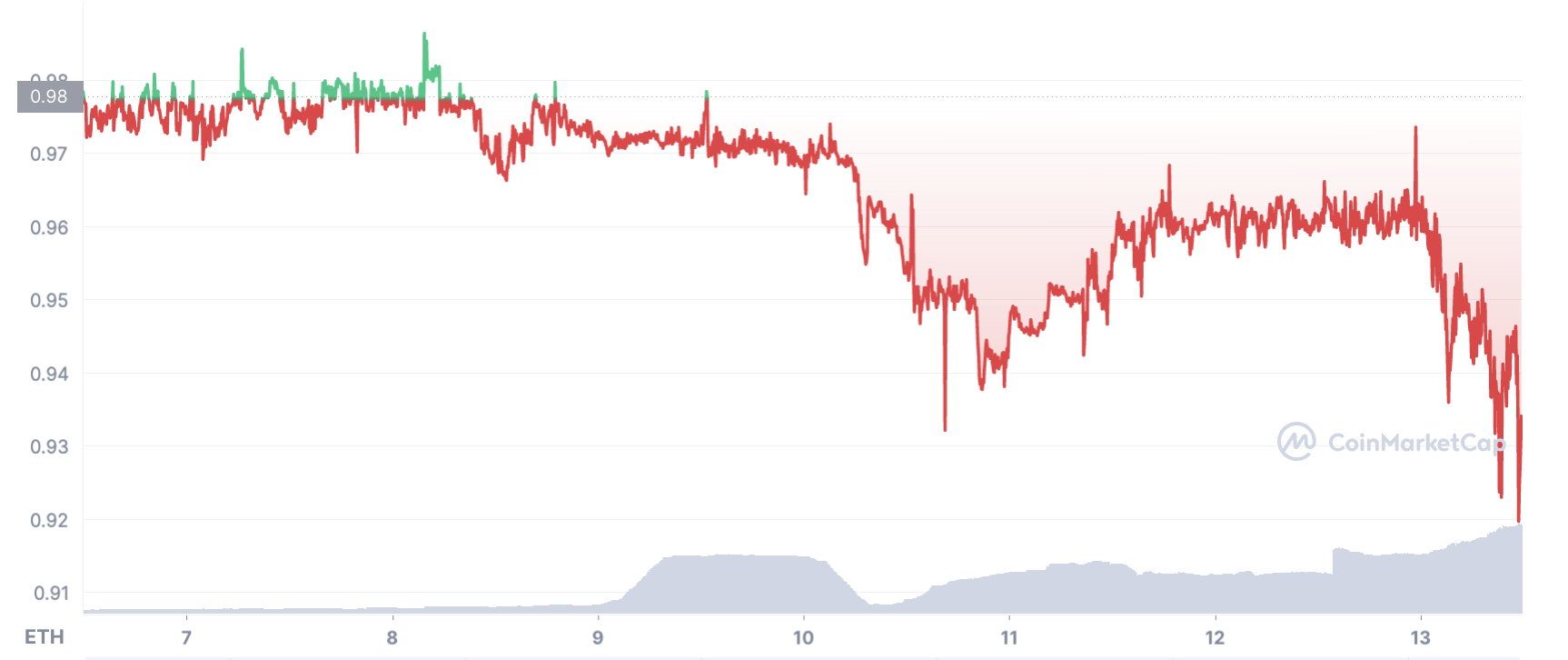

Celsius was using stEth to repay creditors when withdrawals were requested, but while stEth often traded at a 1:1 ratio with Ethereum, stEth cannot be redeemed directly for Etherum. This meant that when stEth began trading below the ratio, the panic started.

Since Celsius did not have sufficient funds, they effectively had to stop withdrawals since not all withdrawal requests could be honoured, and the requests would have likely resulted in the demise of the entire Celsius platform.

Deja vu?

If this sequence of events sounds familiar, you might very well be right. What essentially happened was that a bank was listing unrealised revenue as profits, and marketing them as foolproof.

In the leadup to the 2008 housing crisis, banks like Lehman Brothers and Morgan Stanley were doing much the same — with mortgage-backed securities and derivatives of those securities known as collateralised debt obligations.

Clearly, Celsius founders are not students of history.

But Celsius is likely more culpable than those banks for this current crisis — it was effectively trying to make money out of a form of economic arbitrage.

Banks like Lehman Brothers and Morgan Stanley may have been unethical in failing to do their due diligence when lending to property buyers, but there was at least some real value in the mortgage-backed securities that these banks sold, which was the value of the properties themselves.

In contrast, what fuels the yields on crypto lending platforms like Celsius, aside from the differences in interest rates that platforms are offering?

Revamping crypto lending

Celsius will likely not be the last protocol to face this outcome. The crypto space lacks institutions like central banks and governance institutions that are able to effectively protect lenders and consumers alike.

This is a gross oversight, meaning that crypto lending platforms like Celsius wield almost unlimited power when it comes to the management of their creditors’ funds and their debtor’s terms. In fact, Celsius has already shown what this power allows them to do.

On Monday (June 13), Celsius presented their debtors with a choice: top up their collateral, or be liquidated.

There is no institution that is capable of telling Celsius that this is, on many levels, inhumane and irresponsible. The reason that Celsius is effectively insolvent is not because debtors have taken out more than they have put in; instead, it is the bad bets that Celsius has made in its attempt to make money off market inefficiency.

In banking terms, what Celsius is doing might be akin to predatory lending.

What the crypto space increasingly needs is some form of regulation, as contrary to the ethos of the crypto community as it might seem. In its current state, the crypto space is an anarchists’ heaven, especially in the crypto lending space.

But what can be done to protect these future debtors and creditors?

For one, it might be prudent for everyone to understand that reinventing the wheel does not actually constitute innovation. Celsius, and many platforms like it, are the crypto equivalent of banks, with all of the risk and not much of the oversight.

One type of institution which has not migrated to the blockchain ecosystem is rating agencies. These institutions serve to independently analyse the banks, business models, and the like, and provide professional opinions on how safe certain securities and loans are.

Such a system put in place in the crypto ecosystem might serve as a source of stability to some extent — they can call out extremely risky projects such as Celsius’ arbitrage, and encourage genuine innovation.

Another innovation that the crypto world might benefit from would be akin to a central bank. These banks function as lenders of last resort, and provide loans to banks during times of crisis when banks simply do not have the liquidity to cover withdrawals.

Of course, some caveats must be made here — central banks do not unconditionally provide loans. Their loans often have conditions attached that ensure the same practices that drove a bank to insolvency are not allowed to be recreated. In short, platforms such as Celsius will not be able to receive loans since they simply relied on arbitrage.

The crypto world, as of late, has been facing increasing scrutiny — primarily for its volatility, but also for its governance. And this, I argue, is the primary flaw of the crypto ecosystem.

Without laws and protections, the individual is vulnerable, and is often taken advantage of by larger entities like Celsius. Unless these issues can be resolved, anyone in the crypto world must constantly be on guard.

When the philosopher Thomas Hobbes wrote that without security, life would be solitary, poor, nasty, brutish, and short, he was referring to man in the state of nature without governance and protection.

And while in the crypto world, our lives may not be at stake, our livelihoods sometimes are. Today, the crypto world is not particularly unlike Hobbes’ state of nature. And to ascend beyond that, as contrary to the ethos of the crypto world as it would be, governance may soon become necessary.

Featured Image Credit: Financial News London