Most of us, especially when we’re still young, don’t prioritise saving and budgeting. But in the end, it’s an important lesson we all learn: you have to keep track of your spending, pre-plan your expenses, and manage your habits, one way or another. It’s a tough practice to cultivate yet a necessary one for financial stability.

So, how do you start?

For 36-year-old Anis, she chose to launch a financial-based Instagram page (@budgetwithanis).

Money talks

Known as finsta accounts, these pages typically share knowledge and tips on how to better manage your finances. This includes sharing their spending habits, income, and investment portfolios.

Inspired by local finsta account @myringgitbook, whom Vulcan Post previously interviewed alongside other financial bloggers on why they would willingly expose their finances online, Anis began documenting her journey online.

She likened her page to a journal with the purpose of recording her financial journey and keeping herself accountable. “At the time, I just started saving and I saw a lot of international accounts did this too. So I thought why not start a page for myself?” she quipped.

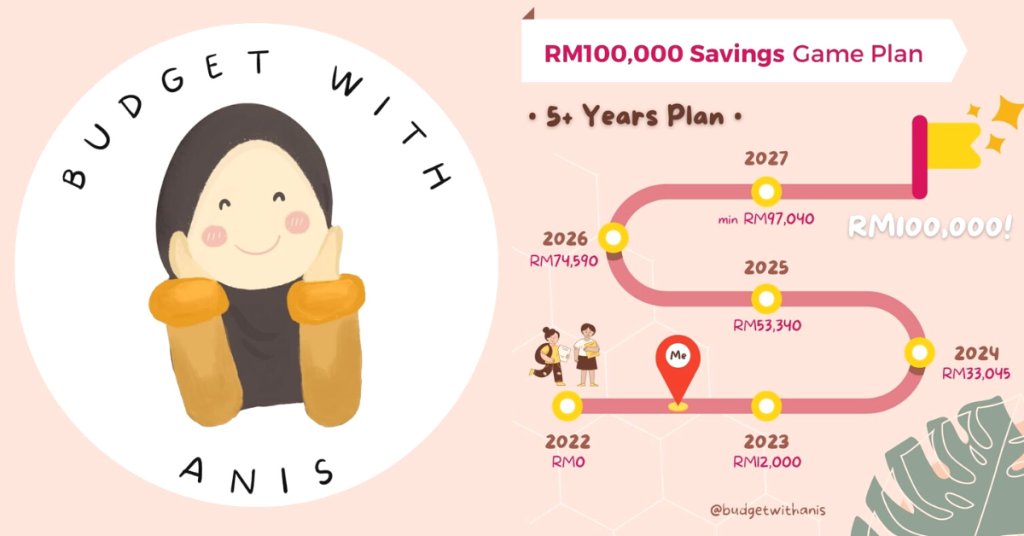

The goal she’d set out for herself was to save RM100,000 by 2027, a total of five years since first starting in May 2022. When asked why such a specific amount, Anis said, “I believe it is the minimum that everyone should at least have before they turn 40. From my calculations, it is achievable with some sacrifice.”

This theory is supported by other financial advisors and the maths quite literally adds up, according to The Simple Sum. By saving up about RM1,000 each month from your earnings, you should be able to hit the RM100K savings milestone in about seven years.

However, Anis takes this a step further by reducing the usual seven years needed to reach that amount. She came up with her own budgeting plan that focuses on her investment and saving efforts, as well as snowballing her debts away. Having a stable 9-to-5 job at a maintenance company makes it possible for Anis too.

Dictionary time: The debt snowball method is a debt-reduction strategy where you pay off debt in order of smallest to largest. When the smallest debt is paid in full, you roll the minimum payment you were making on that debt into the next-smallest debt payment.

Source: Ramsey Solutions

Surprisingly, this wasn’t in her earlier life plans

Anis first entered the job force the moment she stepped out of high school. The thrill of earning and spending on items evoked a sense of happiness in her, something that others can surely relate to. When she settled down, this lifestyle continued as her husband took care of household expenses.

“I was only in charge of the cats and other small bills. I was living from paycheck to paycheck with no savings plan in mind,” she explained.

But then life came knocking on her door.

The pandemic and its effects on the economy caused her husband to be laid off. Money became tight and Anis started chipping in for larger payments. When the government allowed Malaysians to withdraw from their retirement funds (EPF), Anis ended up splurging out of habit, something that financial bloggers we interviewed on the topic definitely advised against.

“Instead of saving it, I ended up spending half of it on I-don’t-know-what and was scammed out of my money. I lost RM12,000 within a year because of my greediness,” she disclosed.

It was shortly after her husband was back on his feet that she discovered the minimalist movement. Moving away from the consumption mindset, Anis began practising mindfulness and reordering every aspect of her life.

“I started decluttering, throwing away unimportant items in my phone, and my room, and organising my digital files. Eventually, I came to tackle my finances too.”

Girls just wanna have funds

Cash stuffing was the first method she ventured into and has continued to stick with, specifically the viral RM100 challenge. She finds that practice has been so successful because it’s a channel to keep all the extra cash in one place. It’s also easier to track as you can physically see it, unlike money in the bank.

“The tracker keeps me on my toes. Once I have ticked the box, there is no coming back and I would never touch the money until it is completed,” she shared.

Anis also invests in unit trusts and gold funds, such as AHB (Amanah Hartanah Bumiputera) and Tabung Haji. As she’s still new to the game, she recommends others like her to look into lower risk investments first before making a big commitment.

If you’re still unsure where to start your savings journey, you could try the zero-based budgeting template that Anis created. It’s easy-to-follow and customisable, and the best part is that it’s completely free.

“I wanted to give something to my followers,” she explained. “I plan on monetising other downloadable templates in the future as a passive income funnel for @budgetwithanis. But those I created to be given away for free is my way of giving back to the community.”

Just by scrolling through her Instagram page, you’ll notice that Anis has been trying to have a child for awhile now. Curious, we asked her how she plans to stay on track with her RM100K goal if her family does expand within these five years.

“Having a baby at this time will affect my journey, though achieving RM100k is not the end goal. If we are blessed with a child during this period, I already had planned a few side incomes to back up the financing and keep my goal on track,” she shared.

A newfound “career”

What started out as a hobby to pour out her thoughts became a passion project. Although having a full-time career can be restricting, she’s amused by the blogging sphere.

“I love hearing from people and I am constantly motivated to keep updating when I hear their kind words and encouragement. It is my source of strength to keep updating. I hope that it will turn into something fruitful in the future.”

As for financial advice, Anis admitted that she’s not a licenced professional, but has a few recommendations for people wanting to start.

The basics is to start tracking by listing down all your incomes, expenses, and debts. Having them in a sheet helps to make sure you don’t miss out on anything important.

The next step is to budget and control your spending. It’s important to pay yourself first (by saving) before planning your other expenses, not the other way around.

Lastly, Anis echoes the philosophy of minimalism by advising to live moderately and “enjoy the process”.

- Learn more about Budget with Anis here.

- Read other articles we’ve written about personal finance here.

Featured Image Credit: Budget with Anis