Over a year has passed since Singapore announced the emergence of its four successful digital bank contenders.

Digital banks have recently emerged as disruptive players in the global financial arena, captivating consumers worldwide with their promises of convenience, lower fees, and seamless user experiences.

However, in the case of Singapore, a city-state renowned for its technological advancements and innovation, the reception of digital banks has surprisingly been lacklustre.

What are the underlying reasons behind this subdued response to digital banks in Singapore?

The introduction of digibanks in Singapore generated tremendous anticipation and excitement, and were touted as potential game-changers.

When the Monetary Authority of Singapore (MAS) first announced the digibank licenses, it emphasised the importance of innovative business models that would cater to underserved segments.

Expectations were high, with hopes that these new players would bring a fresh approach to banking and address the needs of individuals and businesses that had been overlooked. Unfortunately, reality has fallen short of these lofty expectations.

The entry of digibanks into the market has been underwhelming, leaving many questioning their true impact and value for the average consumer. Have digibank players in Singapore truly been innovative and capable of filling a gap, or have they struggled to establish a niche in an already saturated market?

Who are the digibank players so far?

MAS awarded four digital bank licences in December 2020.

The first two digital full bank licences went to Grab-Singtel’s GXS Bank and Sea Group’s MariBank, which serve retail customers. Currently, both GXS Bank and MariBank offers its service to employees as well as the public on an invite-only basis.

Trust Bank, a joint venture by NTUC and Standard Chartered, also obtained a full bank licence from MAS that same month — this was an additional licence secured by Standard Chartered, apart from being awarded the Significantly Rooted Foreign Bank (SRFB) status.

The other two digital wholesale bank licences were bagged by Ant Group’s ANEXT Bank and Greenland Financial Holdings-backed Green Link Digital Bank, catering to small and medium-sized enterprises and other non-retail segments.

One pattern that’s clear to see is that the five Singapore digibanks are all offshoots of larger companies, highlighting Singapore’s limited tolerance for disruption. Furthermore, smaller startups simply lack the financial resources to meet the rigorous capitalisation requirements set by MAS.

However, this doesn’t imply that all five banks chosen by MAS are identical. In fact, their diverse backgrounds have played a crucial role in enabling each digital lender to focus on specific and distinct market segments.

GXS Bank, for instance, is dubbed as a “Gen Z digital bank“. According to Charles Wong, CEO of GXS, the bank “supports the needs of the entrepreneurs, gig economy workers, and early-jobbers in our community.”

On the other hand, Trust might be more appealing to those who are regular shoppers at FairPrice Group. Trust not only offers attractive interest rates on its savings account, but also helps to reduce everyday living expenses thanks to its tie-up with NTUC Linkpoints Rewards system.

Fading interest in digital banks among Singaporeans

Singapore, known for its advanced financial services industry, has seen a decline in interest among Singaporeans regarding digital banks.

Despite the convenience and technological advancements offered by digital banks, a survey conducted by Singapore Management University’s Institute of Service Excellence (ISE) revealed that customers, particularly those aged 18 to 34 and those aged 60 and above, are becoming less willing to try digital banks compared to the previous year.

One possible explanation for this trend is that customers in Singapore are generally satisfied with their traditional banks.

The ISE survey results indicated that physical banking services remain important to Singaporeans, even though a significant percentage of banking customers have recently used digital channels. This satisfaction with traditional banks suggests that customers do not perceive a strong need to switch to digital-only banks.

The survey also highlighted that customer satisfaction was highest for banks that demonstrated a genuine concern for their customers’ best interests and provided products and services according to their needs.

In particular, DBS led the survey in customer satisfaction, followed by Citibank, OCBC, and UOB. The positive sentiments toward these banks, along with the steps taken by traditional banks to enhance digital banking security, could explain the lacklustre interest in new digital-only banks.

Neeta Lachmandas, the executive director of ISE, noted that traditional banks have robust digital products, which further reduces the incentive for customers to explore digital-only banks.

While customers have shown specific interest in current and savings accounts offered by digital banks, Lachmandas believes that it is still too early to draw concrete conclusions about Singapore’s digital banking prospects.

While Singaporeans may exhibit waning interest in digital banks, digital banking services continue to gain momentum globally. A separate study projected that the number of people using digital banking services would increase from 203 million in 2022, to 216.8 million by 2025.

How sustainable are its sign-up incentives?

The current landscape of digital banks in Singapore presents some challenges in terms of attracting customers and standing out from the competition. While these online lenders offer certain incentives, such as subsidies and simplified fee structures, the overall appeal may be limited due to existing offerings in the market.

Eye-catching subsidies, such as the daily interest rates offered by GXS Bank, may initially attract customers. However, the sustainability of these policies in the current macroeconomic environment, characterised by central banks tightening monetary policies to combat inflation, raises concerns.

The recent increase in the U.S. Federal Reserve’s benchmark interest rate highlights the challenges faced by digital banks relying on such incentives.

Despite these challenges, some digital banks have made progress in attracting customers. Trust Bank, a partnership between Standard Chartered and FairPrice Group, has reported reaching over 500,000 customers and achieving an almost 10 per cent market share in Singapore within seven months.

Trust Bank’s strategy includes offering simple and tangible rewards, such as digital coupons for FairPrice and its other partners (such as Burger King, Gojek and ZALORA), as well as 1kg bags of rice.

During their first month of launch, Trust gave out almost 60 tons of rice and over 11,000 breakfast sets – each worth more than S$2, according to the bank.

“We know that banks spend inordinate amounts of money on acquiring clients, [giving away] phones, electronics, cash gifts. Ours is a bit simple, yet why it works so well is because it is something that helps customers bring down their cost of living [and] moderate their cost of essentials,” said Dwaipayan Sadhu, CEO of Trust Bank.

GXS Bank, on the other hand, has reached significant milestones in terms of its financial growth. Charles Wong, CEO of GXS Bank, shared in April that they are closing their deposit cap of S$50 million, demonstrating strong customer confidence and trust.

He added that the invitation spots for GXS Bank are oversubscribed, leading the company to temporarily pause further sign-ups. On top of that, they have a significant waitlist of customers as well.

What’s impressive is that they are able to achieve these with very little acquisition costs — close to zero dollars — and with very little amount of marketing.

Unlike Trust Bank, GXS Bank does not offer sign-up gifts for customers. “When you sign up, you sign up because it’s relevant to you or you are a Grab or Singtel customer, and it is going to make it easy for you to make payments,” Wong told CNBC.

“Yes, you get additional rewards as you spend, which makes sense because you’re spending within the ecosystem.”

Wong reasoned that the success of its approach can be attributed to GXS Bank’s integration within the Grab and Singtel “powerhouse ecosystem”, which grants them access to millions of customers on a daily basis.

He admits that having “two wonderful parents” is indeed an advantageous aspect, which grants them the opportunity to leverage their capabilities and resources effectively.

Both banks also differentiate themselves from traditional banks by not charging annual fees, foreign transaction fees, cash advance fees, or fees for card replacement. It also eliminates the requirement for a minimum balance in its savings account.

While these incentives and cost-saving measures may attract customers in the short term, the long-term challenge lies in customer retention. Digital banks need to ensure that they can consistently provide value and keep customers engaged beyond the initial acquisition phase.

Traditional banks often offer welcome gifts such as Apple watches because they expect to be profitable over time, recouping costs through interest payments and late fees. As such, digital banks need to carefully balance their incentives and rewards programs to attract customers while maintaining profitability.

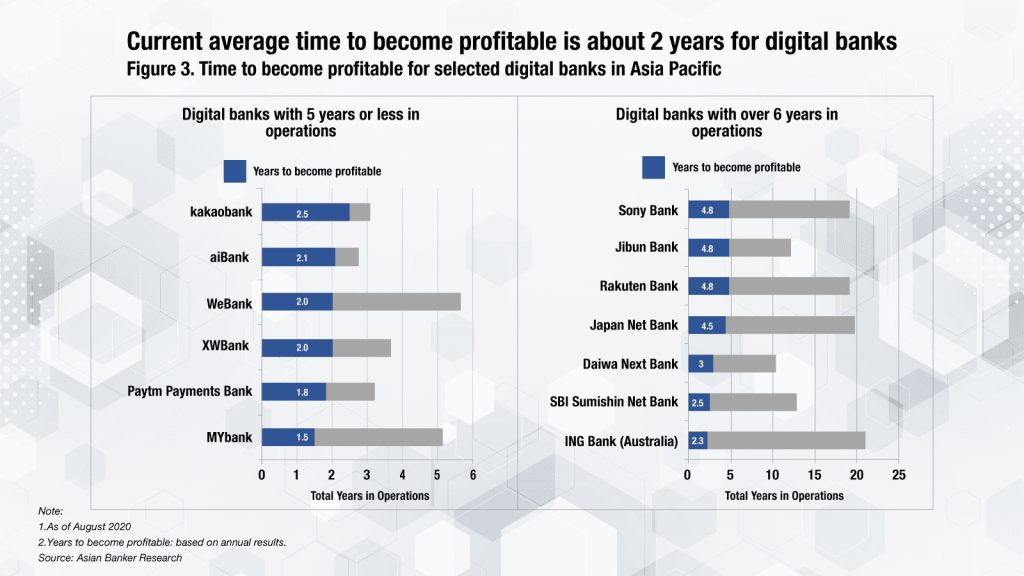

In fact, a 2022 analysis by Simon-Kucher revealed that out of the 25 largest digital banks, only two of them have managed to attain profitability. A separate study by Asian Banker Research found that it takes an average of about two years for digital banks to become profitable.

In today’s landscape, the survival of digital banks hinges on their ability to achieve profitability. The presence of high inflation and interest rates has an impact on the cost of capital and credit, posing challenges for digital banks in operating with narrow profit margins.

Additionally, the reduction in venture capital funding for digital banks makes it difficult for them to sustain growth without generating consistent profits. Furthermore, regulatory authorities are intensifying their scrutiny of digital banks’ profitability, necessitating the demonstration of a sustainable business model.

Other challenges faced by digital banks

In a market like Singapore, where only two per cent of the population do not have bank accounts, digital banks face significant challenges in gaining traction and competing with established traditional banks.

Several factors contribute to these obstacles, including trust issues, regulatory limitations, a lack of product differentiation, and concerns over security.

One of the primary obstacles faced by digital banks in Singapore is the deep-rooted trust and familiarity that traditional banks have built with consumers over the years. Established banks have long been seen as reliable and secure institutions, backed by robust regulations and a track record of stability.

This trust and familiarity make it challenging for digital banks, as they struggle to gain the same level of trust from consumers. Many people remain hesitant to entrust their financial assets to unfamiliar digital banking platforms, particularly given the sensitivity of financial transactions.

Another challenge for digital banks is the association with Big Tech companies. While technology giants have made significant advancements in various sectors, their reputation in handling user data and privacy concerns has faced scrutiny.

This lack of trust in Big Tech companies extends to their financial services offerings. Many consumers question whether they should trust these companies with their financial data when they already have established relationships with traditional banks. The association with ride-hailing services, food delivery platforms, or e-commerce companies may deter Singaporeans from embracing digital banks for their financial needs.

Furthermore, the MAS has taken a cautious approach to digital banking regulations. While this stance is aimed at safeguarding consumer interests and maintaining financial stability, it has resulted in stringent licensing requirements for digital banks.

The limited number of licenses granted by MAS and the rigorous criteria, such as strong capitalisation, a clear value proposition and a credible business plan, have made it challenging for digital banks to enter the market and compete with established players.

In a highly competitive banking sector, product differentiation is crucial for success. However, digital banks in Singapore often struggle to distinguish themselves from their traditional counterparts.

Many digital banks offer similar features such as mobile banking apps, low fees, and attractive interest rates. Without a unique value proposition, digital banks find it difficult to capture the attention of consumers who are already content with their existing banking relationships.

“The market is just over-banked and the differentiator of these new digital banks doesn’t really move the needle much in terms of what they are offering,” said Kapron.

Despite advancements in technology, security remains a top concern for consumers when it comes to digital banking. The fear of data breaches, identity theft, and fraudulent activities lingers in the minds of individuals, impeding their willingness to adopt digital banking solutions.

Digital banks must prioritise robust cybersecurity measures and educate the public about their stringent security protocols to alleviate such concerns. Building trust in their ability to safeguard sensitive information is crucial for digital banks to overcome this obstacle and gain wider acceptance.

Moreover, in response to the growing dominance of digital adoption propelled by COVID, the incumbent banks have fought back by enhancing their digital interactions and expanding their array of digital touch points, products, and services.

Can they dethrone the incumbents?

While digital banks face challenges in penetrating the market dominated by established institutions, they hold significant potential to reshape the financial industry and cater to the evolving needs of Singaporean consumers.

To differentiate themselves, digital banks must focus on innovation and offer unique value-added services.

By leveraging emerging technologies such as artificial intelligence, machine learning, and blockchain, digital banks can provide personalised financial advice, advanced risk assessment, and seamless integration with third-party platforms. These innovations have the potential to redefine the banking experience, attracting tech-savvy consumers seeking convenience and innovation.

Additionally, since trust remains a critical factor for the success of digital banks, they need to invest in educating the public about the benefits, security measures, and regulatory safeguards associated with digital banking.

Robust awareness campaigns and community engagement can address misconceptions and build confidence in digital bank platforms. Providing comprehensive information on security protocols, data protection measures, and dispute resolution mechanisms is vital to instil trust in potential customers.

That said, taking a global perspective into account, it’s undeniable that digital banks would face an enormous challenge in achieving significant market penetration. Currently, there are approximately 250 digital-only banks operating worldwide, and their total assets represent only 0.4 per cent of traditional banks, as reported by Moody’s Investors Service.

However, rather than attempting to replace traditional lenders, it might be best for digital banks to play a complementary role in the financial ecosystem and reduce the dominance of Singapore’s “big four” banks.

By providing customers with secondary alternatives and a broader range of offerings, digital banks contribute to market dilution and foster healthier competition. This can prompt traditional banks to reevaluate their own approaches to digital banking, ultimately benefiting consumers.

Featured Image Credit: GXS Bank / MariBank / Trust Bank / ANEXT Bank