Three years into a lawsuit filed by the US Securities and Exchange Commission (SEC) – alleging that the XRP crypto token issued by Ripple was an unregistered securities offering – Ripple finally enjoyed a partial victory in court earlier this month.

The presiding judge ruled that the sale of XRP on crypto exchanges did not violate securities law. This decision echoed across the crypto sphere, sparking a rally which has since seen XRP’s value jump by over 50 per cent.

While this is a landmark moment – for both the company and the wider crypto industry – there’s still a long way to go before Ripple finds itself in the clear. This boils down to a lack of regulatory clarity in the US.

“In jurisdictions like Singapore, Japan, and Hong Kong, regulators are willing to sit down and have a conversation with you. You understand exactly what’s regulated and what’s not regulated,” says Rahul Advani, Ripple’s Policy Director in the Asia-Pacific (APAC) region. “The US doesn’t have that clarity.”

Unlike the world’s crypto-friendly regulators, the SEC has gone down the route of “regulation by enforcement”. Companies risk being blindsided by regulatory action, with little notice as to where they might be going wrong.

As per Cornerstone Research, the SEC has filed 24 crypto-related cases this year alone, targeting companies including Binance and Coinbase.

“[It’s a case where companies] have tried to be transparent and aboveboard but regardless, the regulators have come after [us] with an enforcement action,” Advani adds. He believes such an environment could drive crypto companies away from the US in the future.

Ripple builds in Singapore

“We remain hyper-focused on building our teams outside of the US,” Advani says, speaking about Ripple’s growth in Asia. “We established our Singapore office in 2017 to serve as an APAC headquarters. We’ve consistently grown and this has since become one of our highest performing regions.”

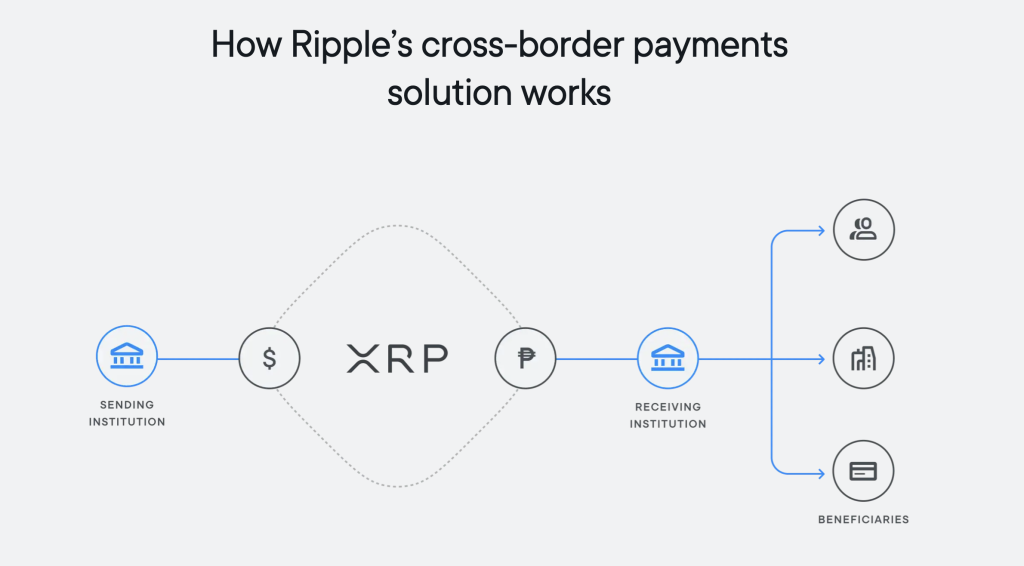

In 2022, Ripple’s On-Demand Liquidity (ODL) service – a solution which makes instant cross-border payments possible, by using XRP as a bridge between fiat currencies – saw a majority of transactions flow through Singapore.

With a five times increase in volume seen over the course of the year, Ripple’s decision to build here looks to be paying off. “We doubled our headcount [in Singapore] in the past year and we plan to continue increasing our presence to match the opportunities that we see in the region.”

That being said, Ripple remains wary of growing at a sustainable pace – a concept which has eluded many in the crypto industry over the past few years. “We’ve been one of the longest players in the industry,” Advani says, making clear the company’s ability to negotiate market cycles. “We try to make our investments very carefully and strategically.”

Going forward, Advani doesn’t expect the headcount to double every year. It’ll come down to business growth and regional demands. All signs seem to be pointing up though, especially with the Monetary Authority of Singapore (MAS) granting Ripple in-principle regulatory approval earlier in June.

Evolution of the regulatory landscape

With a license on its way, Ripple can continue to develop in Singapore and across the APAC region. “This will enable use to better support and scale the use of our ODL solution,” says Advani.

In doing so, the company will need to keep up with local crypto regulations, which are set to evolve further in the coming years.

As it stands, the MAS’ views on blockchain technology have been favourable for the company. “It’s very clear that MAS focuses on supporting use cases that enhance efficiencies and solve frictions.”

While companies built around crypto speculation have had a tough time operating out of Singapore, those working on real-world use-cases, such as Ripple, have found calmer waters. “MAS is very clear that they don’t want to see crypto speculation,” Advani says. “It’s all about the utility.”

Currently, the MAS is looking into guidelines to help protect investors. This could include requirements such as segregation of customer assets, holding assets in a trust, and daily reconciliation. Such measures could prove integral in building trust and driving blockchain adoption in the future.

The need for real-time settlement

As such, regulators are set to play a significant role in enabling Ripple’s vision of frictionless cross-border payments.

“The current landscape for cross-border payments continues to be burdened by legacy financial infrastructure that is complex, fragmented, capital-intensive, and does not offer you real time atomic settlement.”

Advani agrees that in the future, real-time settlement will become essential for financial institutions to remain competitive. Beyond cross-border payments, there are a number of scenarios where this can be of use.

Consider the securities markets – in this day and age, why should you be looking at T+2 or T+3 settlement cycles? Why can’t you have real-time atomic settlement? Look at the carbon credits market, commodities, trade finance – there’s a lot of friction in all of these markets. We believe that digital assets are well positioned to address these pain points.

– Rahul Advani, Policy Director APAC, Ripple

Featured Image Credit: Brookings Institution

Also Read: “Singapore is ahead of the curve”: Ripple executive on global crypto regulations