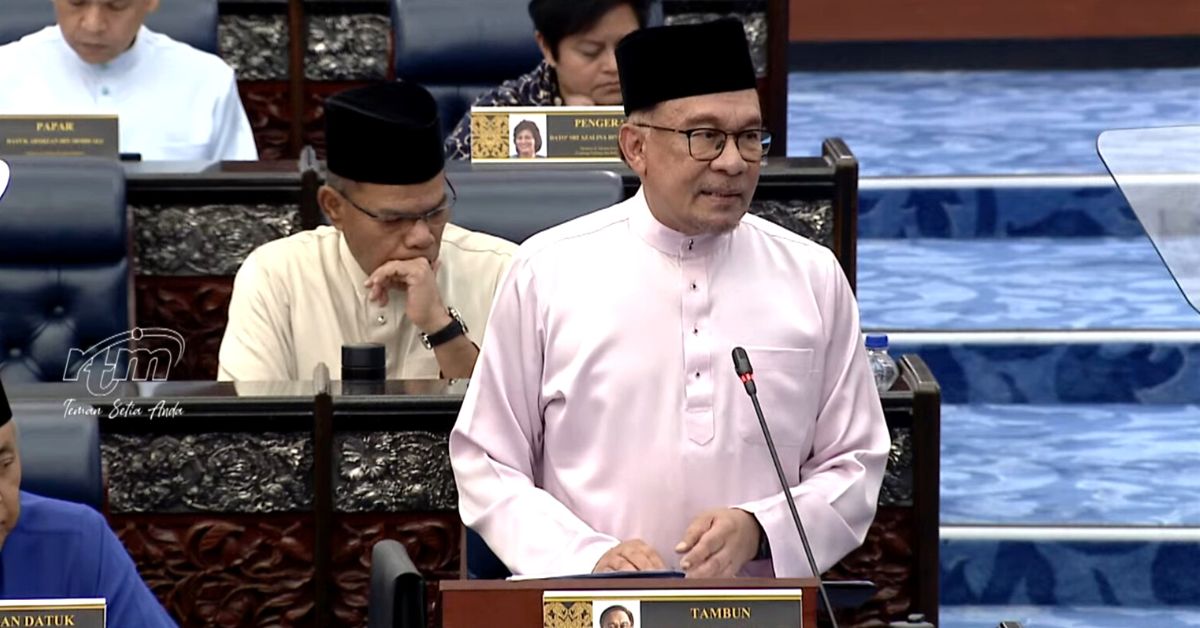

Prime Minister Datuk Seri Anwar Ibrahim, who is also Malaysia’s Finance Minister, has tabled the 2024 Budget in parliament today (October 13, 2023).

Here are key things to note when it comes to taxes.

E-invoicing has become mandatory for taxpayers with income or annual sales exceeding RM100 million, starting from August 2024. The implementation of this e-invoicing mandate in other income categories will be happening in phases by July 1, 2025.

Capital gains tax on disposal of non-listed shares by local companies will be enforced at a rate of 10% of net profit from March 1, 2024.

The government will consider the exemption of capital gains tax on the disposal of shares related to certain activities such as approved Initial Public Offering (IPO), internal structuring, and venture capital companies. This will be subject to set conditions.

A global minimum tax will also be implemented in 2025 on companies with a global income of at least EUR750 million.

Service tax will go up to from the current 6% to 8%, but this doesn’t include services such as F&B and telecommunications.

However, the government will be expanding the scope of taxable services. This will now include things such as logistics, brokerage, underwriting, and karaoke services.

High Value Goods Tax will be implemented at 5% to 10% on high-value items such as jewellery and watches. This appears to be the Luxury Goods Tax mentioned last year during the tabling of the revised Budget 2023.

Tax incentives for angel investors have been extended until December 31, 2026, to encourage capital funding in tech startups.

The government is also proposing to exempt income tax on income arising from Islamic Securities Selling and Buying (ISSB) from assessment year 2024.

Entertainment tax will be reduced from 25% in the Federal Territories, including a full tax exemption for local artistes and performers, an entertainment tax reduction to 10% for international arts events and foreign performers.

A reduction to 5% for theme parks and family recreational centres will be implemented too.

Applications period for income tax exemption for social enterprises extended until 2025.

Featured Image Credit: RTM