In the digital age, small and medium-sized enterprises (SMEs) find themselves at the crossroads of abundant opportunities, propelled by the accessibility of diverse digital payments and online marketplaces.

While these avenues promise growth, the sheer volume of options can overwhelm businesses, leading to a growing need for streamlined processes. Amid this landscape, financial institutions have a unique opportunity to collaborate with platform providers to integrate payments seamlessly within their ecosystems.

This shift towards embedded finance (EmFi) not only facilitates frictionless transactions, but also paves the way for continued expansion and success for business.

Essentially, rather than traditional standalone offerings, EmFi seamlessly integrates financial tools and services into non-financial platforms. This integration enables businesses to access financial services directly within the platforms they use daily, ranging from e-commerce and payment gateways, to ride-hailing and social media apps.

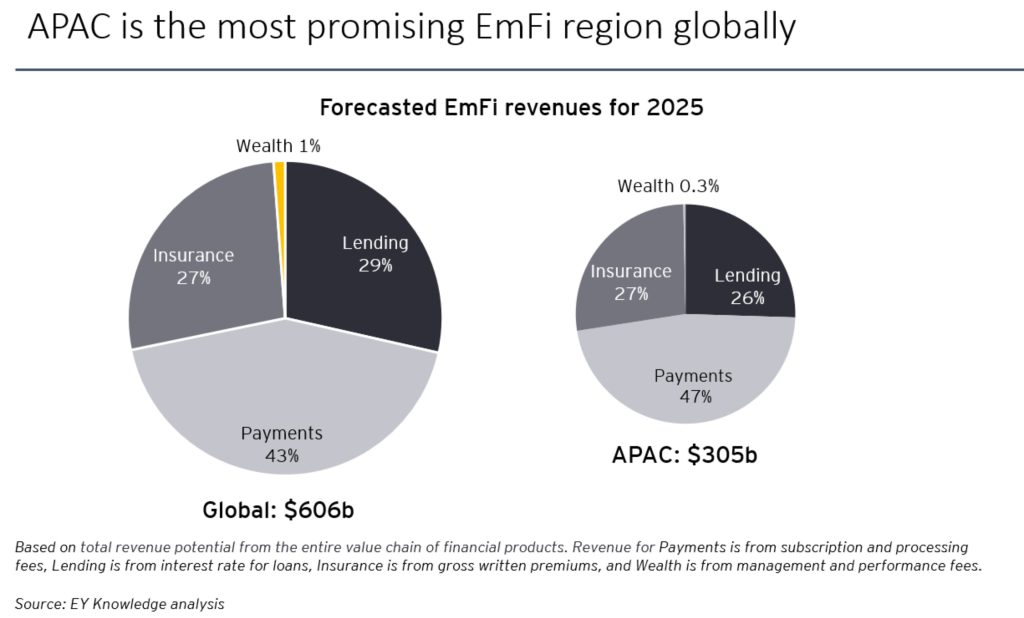

The enormity of this opportunity is underscored by Ernst & Young’s projection that the market size for global EmFi across the entire value chain will rise substantially from US$264 billion in 2021 to touch US$606 billion by 2025.

SEA’s digital landscape is bringing rise to EmFi

Asia, with its dynamic economies and rapid digital adoption, is a hotbed for EmFi.

Southeast Asia (SEA) in particular, is home to an estimated 400 million Internet users in 2023. The region’s adoption of mobile apps is among the most enthusiastic globally, with an increasing number of users leveraging digital platforms for various services.

Furthermore, big tech companies in SEA are expanding their influence by offering “super apps”, all-in-one mobile apps that offer a multitude of services.

Take Grab as an example — it was initially established as a ride-hailing service, but has expanded its offerings to include food delivery. The platform seamlessly integrates financial services like payments, insurance, investments, loans, and credit within its app structure. This integrated approach allows users to purchase and utilise various financial products without leaving the Grab ecosystem.

This shift towards comprehensive digital ecosystems naturally paves the way for the rise of EmFi, as users increasingly expect financial solutions to be an integral part of the broader digital services offered by these super apps.

One of the most significant impacts of EmFi in SEA is its role in promoting financial inclusion, particularly in emerging markets where individuals and small businesses face multiple barriers to accessing basic financial services.

According to the World Bank, nearly 49 per cent of adults in Indonesia and the Philippines do not have formal bank accounts, double the global average of 24 per cent. This unbanked population presents a crucial target market for financial institutions, especially as their wealth and education levels improve.

In Indonesia, a staggering 44 per cent of SMEs lacked access to financing in 2011, primarily due to insufficient availability of funds. Meanwhile, in 2013, 40 per cent of SMEs in Singapore avoided bank loans due to delayed payments and cash flow challenges.

Then in 2014, 58 per cent of SMEs in Malaysia did not apply for financing due to inaccessibility and an information gap. That same year in the Philippines, 60 per cent of SMEs sought alternative funding sources.

Additionally, 58 per cent of SMEs in Thailand had no access to financing due to ineligibility to borrow from financial institutions.

Given SEA’s young and aspiring population, rapid digital maturity, and new ways of consuming financial services, the region holds much promise for EmFi development.

Players leading EmFi in the region

Several companies in the region are already capitalising on the potential of EmFi.

For example, Cake by VPBank, a digital bank in Vietnam, offers its customers the ability to link their Cake account to other digital wallets and e-commerce platforms, as well as ride-hailing service Be.

This seamless integration allows users to access a spectrum of financial and non-financial services effortlessly.

Similarly, UNOBank in the Philippines offers a range of digital banking and lending services to customers. Through a partnership with AI-led fintech Trusting Social, UNOBank which leverages access to telco data to provide credit assessments for consumers who would otherwise struggle to access formal credit.

UNOBank’s integration of financial services into its platform not only enhances accessibility, but also demonstrates the transformative impact of EmFi on financial inclusion.

Bank INA, a digital bank in Indonesia, is another example of a company that has successfully utilised EmFi by establishing partnerships with various non-financial platforms.

Collaborations with ride-hailing and e-commerce platforms enable it to offer customers a suite of financial services, including loans, savings accounts, and insurance products. This approach capitalises on the vast user base of non-financial platforms, bringing financial services directly to those who may not have engaged with traditional banking channels.

ANEXT Bank — a wholly-owned subsidiary of Ant International — is another significant player in the EmFi landscape, standing out for its collaborative model.

Unlike some providers that build standalone solutions, ANEXT Bank focuses on enabling existing platforms to deliver EmFi through its ANEXT Programme for Industry Specialists (APIs). This enables platforms to develop new business and revenue opportunities, while enabling financing solutions to be delivered to SMEs where they are currently doing business at.

This difference allows for a more expansive network of partners which enables the bank to anticipate and deliver financial services to SMEs, especially micro and growing businesses, in an intuitive and timely manner.

The future of financial services in Asia

EmFi is ushering a new era of financial services in Asia, challenging traditional models and empowering businesses of all sizes.

The implications of EmFi for businesses in Asia are profound. With the collaborative model championed by ANEXT Bank and others, barriers to accessing financial services are significantly reduced.

Startups can now leverage the EmFi framework to streamline their operations, access financing more readily, and unlock new revenue opportunities. For small businesses, the integration of financial services into daily operations translates into increased efficiency and a smoother financial management process.

Looking ahead, the future of financial services in Asia is intricately tied to the growth of EmFi. As tech continues to advance, the integration of financial tools into non-financial platforms is expected to become even more seamless.

This evolution not only provides a lifeline for startups and small businesses, but also contributes to the democratisation of financial services, promoting inclusivity and accessibility across diverse sectors of the economy.

As the region continues to embrace this transformative trend, the future holds promising prospects for startups, small businesses, and the broader financial landscape in Asia.

ANEXT Bank, a Singapore-based digital bank regulated by MAS, empowers startups with easy and accessible financing to fuel their business growth and expansion.

Featured Image Credit: ETBFSI Research

Also Read: Why S’pore makes an ideal launchpad for startups to launch a business before going global