On March 11, Malaysian mini mart chain 99 Speedmart filed an IPO prospectus draft on the Securities Commission (SC) Malaysia.

A prospectus is a document that provides details about an investment offering that’s for sale to the public. In Malaysia, the SC is the sole regulatory authority for approving and registering prospectuses.

According to the filing, the company aims to have an initial public offering (IPO) of up to 1.428 billion ordinary shares in 99 Holdings, the mini mart’s investment holdings company.

This first-time share sale will comprise an offer for sale of up to 1.028 billion existing shares and a public issue of 400 million new shares.

Of these numbers, the institutional offering makes up 1.218 billion shares, representing 14.5% of the group’s enlarged issued share capital. It will comprise 1.028 billion existing shares and 190 million new shares.

Meanwhile, the retail offering involves the leftover 210 million new shares (2.5% of the group’s enlarged share capital). 42 million shares are reserved for eligible staff while 168 million shares will be offered to the Malaysian public.

Through this IPO on Bursa Malaysia’s main market, founder Lee Thiam Wah and his family will be letting go of a 17% stake.

A bit about 99 Speedmart

For those who don’t know, 99 Speedmart is a popular mini mart chain that retails daily necessities, mainly comprising fast-moving consumer goods (FMCG).

The mini mart is operated through two of 99 Holdings’ wholly owned subsidiaries. The holdings company also owns two other wholly owned subsidiaries—Yiwu J-Jade Trading, and Yiwu SM Import and Export.

These two subsidiaries were recently incorporated in the People’s Republic of China for the purpose of investment holding and procuring merchandise for sale in the company’s outlets.

According to the prospectus, the company considers itself the “largest Malaysian homegrown mini market chain retailer to capitalise on the strong growth potential of the grocery retail segment”.

The prospectus elaborates, “With a history spanning 36 years since the inception of ‘Pasar Raya Hiap Hoe’ by our founder, Lee Thiam Wah, and having operated ‘99 Speedmart’ outlets for over 20 years, we have established our presence as a leading retailer of daily necessities comprising mainly FMCG across Malaysia.”

Pasar Raya Hiap Hoe was founded by Lee at 23 years old, with a capital of RM17,000, which he later sold to pursue the 99 Speedmart chain.

Lee is known as an inspiring figure in Malaysia’s entrepreneurial scene, having persisted and succeeded in the field despite his disability, which forced him to leave school after his primary education.

He’s known for his advice to “strive for perfection (99 marks), knowing there is always room for improvement”.

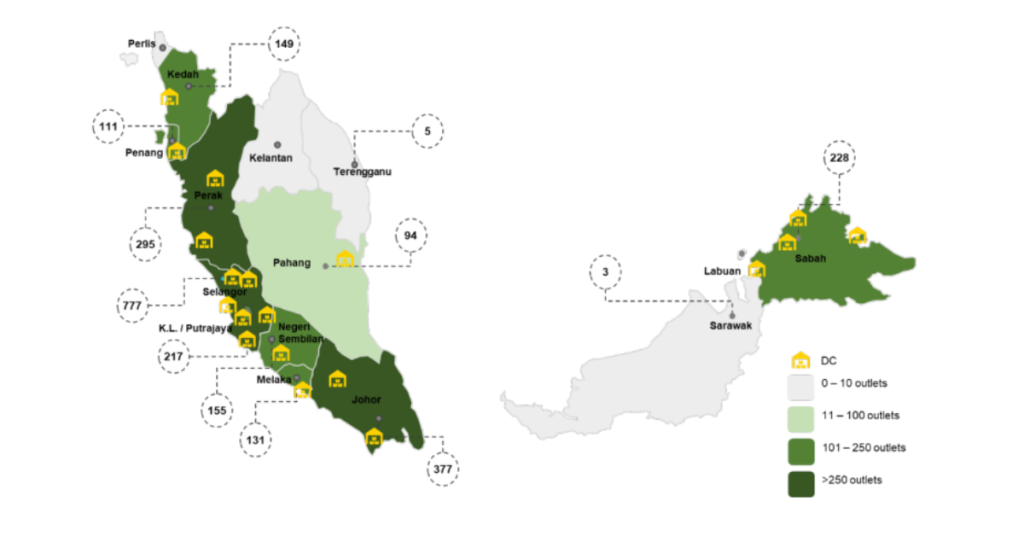

Other strengths the company highlighted include its competitive price points and curated offerings, as well as an efficient nationwide network of distribution centres (DCs). The prospectus also emphasises on the fact that it is a scalable business platform and has a highly experienced team.

As for the company’s past performance, for the financial year ending in 2023, 99 Holdings had a revenue of RM8,075,262,000, with a profit after tax of RM326,665,000.

Speeding towards 3,000 outlets nationwide

As for future plans, the prospectus claims that the company intends to reach a target total of about 3,000 outlets operating nationwide by the end of 2025. Currently, it has 2,542 outlets.

Beyond this, it aims to continue opening an average of 250 outlets annually.

Their primary objective is to further expand their footprint in regions with lower outlet penetration rates such as the northern and east coast regions of Peninsular Malaysia, as well as the whole of East Malaysia.

On top of that, the company also aims to expand its network of DCs and logistical capabilities across Malaysia, while also looking at opportunities for expansion into international markets to enhance the company’s sourcing capabilities or outlet network.

Lastly, the company wants to enhance their bulk sales capabilities through an ecommerce-driven business model, facilitating bulk sales across Malaysia.

According to the prospectus, the use of proceeds from the public issue will be used for:

- Outlet and DC expenditure (including opening of new outlets, establishment of new DCs, upgrading of existing outlets, and purchase of delivery trucks)

- Repayment of existing bank borrowings

- Defray fees and expenses for their public issues

For now, the draft prospectus has not provided an IPO price or timeline.

More information on the prospectus can be found online, but for now, it’s solely for the purpose of seeking comments from the public, as it has not been registered with the SC under Section 232 of the Capital Markets and Services Act 2007.

That means the prospectus should not be used for making any investment decisions.

- Learn more about 99 Speedmart here.

- Read other articles we’ve written about Malaysian startups here.

Also Read: 5 townships in Greater KL & Seremban worth considering for families eyeing a landed home

Featured Image Credit: 99 Speedmart