[This is a sponsored article with OCBC Business Banking.]

Enabling cashless payment options to customers is essential for businesses in the digital landscape.

This way, you can provide customers with convenience and speed in making payments for your products or services.

Furthermore, if your business is looking to deal with customers from across the causeway, the importance of offering digital payments is heightened.

Understanding such needs, OCBC has a way for its business banking users to ease the process via OCBC OneCollect.

Seamless and efficient transactions

OCBC OneCollect enables businesses to collect payments seamlessly through QR codes by incorporating Malaysia’s national payments QR, DuitNow QR to support Ringgit (MYR) collection.

Using the OCBC OneCollect app, you can set up a dedicated DuitNow QR code for your business, and display it for buyers to scan and pay via any banking app or ewallet of their choice.

DuitNow QR runs on a real-time transfer basis, meaning upon a customer’s transaction, you’ll receive these payments instantly. There’s no need to rent a dedicated terminal for payments, reducing the operations cost for your business. You’ll also be notified when payments are received at the point of sale.

One local user of OCBC OneCollect is Redsea Esports Center, a cybercafe based in Wangsa Maju. Its business owners Tan Song Chun and Skeith Wong shared that they appreciate the speed, efficiency, and convenience of receiving payments via the QR payment solution.

They also reported that utilising OCBC OneCollect has been cost-effective for their business, as the bank does not charge transaction fees for the QR feature.

Receive payments from Singaporean customers

If your business deals with customers who are based in Singapore and transact with Singaporean Dollars (SGD), OCBC OneCollect has made it easy for you to transact with them as well.

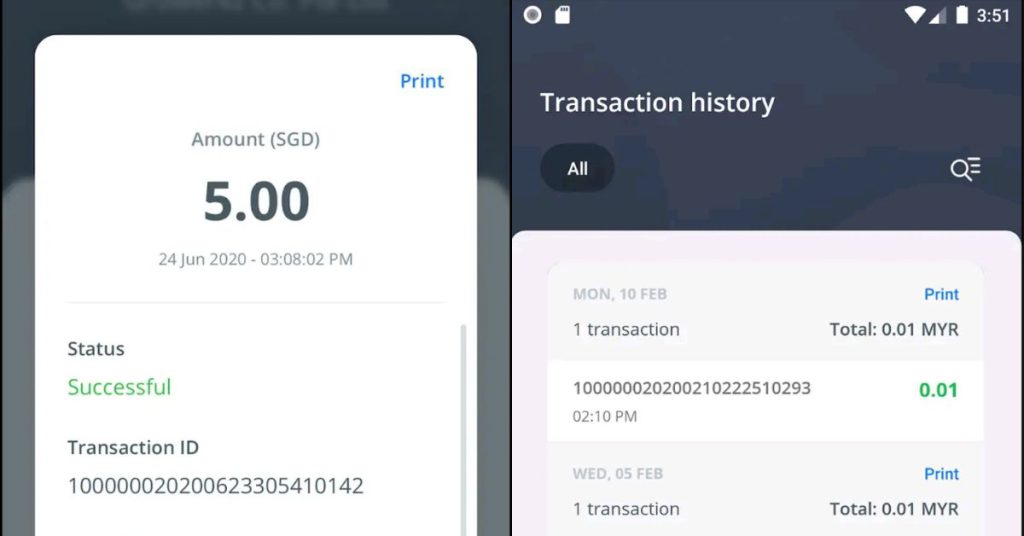

OCBC OneCollect offers cross-border QR payments by integrating PayNow QR, which is Singapore’s version of DuitNow QR. To enable this function, you can generate a dynamic PayNow QR with a predefined transaction amount through the OCBC OneCollect app.

Upon scanning the PayNow QR, your customers will make payments in SGD while you receive the predefined amount in MYR.

For online businesses that don’t have a storefront, you can screenshot and share the dynamic PayNow QR code for your customers from Singapore to make payments. AM PM Pharmacy is a local user that uses this function from OCBC OneCollect to receive payments from their customers in Singapore.

Previously, their Singaporean customers would have to withdraw cash to make payments at the pharmacy, which sometimes led customers to abandon their purchases. For online transactions, AM PM Pharmacy would also experience delays in payment collection as overseas transactions from banks can be time-consuming.

“Since we adopted OCBC’s PayNow service, it has helped us address this issue, as my team are only required to send a QR code to the customer for payment, and it takes less than five minutes for the overall process,” said Ng Kee Wei, CEO of AM PM Pharmacy.

OCBC OneCollect is the first platform to offer cross-border payments between Malaysia and Singapore since 2020, with the app receiving the Recognition of Excellence Award by OpenGov Asia in 2023. This was for helping SMEs use the channel to ease their collections.

In the same year, OCBC Malaysia also won the ‘Malaysia Customer Experience of the Year – Banking” by Asian Experience Awards 2023 and the “Malaysia’s Bank of the Year 2023” by The Banker of London, awards achieved by providing exemplary customer service.

Track your transactions in real-time

As highlighted above, DuitNow transfers happen in real-time, so you’ll receive your customers’ payments instantly and be notified via the OCBC OneCollect app.

The OCBC OneCollect app’s reporting function can also give you a clear view of your daily sales report to ease the reconciliation process, saving you the time which could be allocated to planning for your business.

Furthermore, when consolidating your daily or monthly sales reports, OCBC OneCollect’s app seamlessly tracks your transactions and gives you an overview of them.

Redsea Esports Center praised this function in the app too, and shared, “OCBC OneCollect has notably improved our cash flow management and reduced transaction costs, contributing to an increase in overall revenue over approximately 3,500 transactions per month.”

AM PM Pharmacy shared the same sentiment, and expressed, “The user-friendly online banking interface and mobile app have provided quick access to the team on essential financial information and tools, contributing to efficient financial management.”

If you’re a serial entrepreneur managing multiple outlets, you can create different “Shops” in the OneCollect app.

These Shops can help you identify the transactions received by each of your businesses, keeping your business finances orderly.

Moreover, you can easily add your business partners or employees as users through the OCBC OneCollect app, and set up customised functions to meet your daily operational needs.

If you’re already an OCBC Business user and would like to start your digitalisation journey for your business by collecting payments through QR codes, you can download the OCBC OneCollect Malaysia app from the App Store and Google Play Store.

Meanwhile, if you’re newly starting your business and are keen to sign up for an OCBC eBiz Account, you’ll enjoy a 100% online application that comes with complimentary digital tools. They include OCBC OneCollect and OCBC Velocity, which are OCBC’s business banking portals containing useful business tools for you to run your business seamlessly.

- Learn more about OCBC OneCollect here, the OCBC eBiz account here, and OCBC Velocity here.

- Read more finance-related topics we’ve written here.

Featured Image Credit: OCBC