When that paycheck hits your account at the end or start of the month, there’s a fleeting moment of joy for many working adults.

But in Malaysia, a portion of that happiness is reserved for the future because of the Employees Provident Fund (EPF).

Established in 1991 by the Malaysian government, the EPF is like a financial safety net, ensuring that a slice of your earnings goes towards your retirement fund.

But there’s been a recent restructuring in the EPF scheme, leaving many scratching their heads. Let’s break down what you need to know about EPF Account 3.

What’s changing?

So, what’s all the fuss about? Well, brace yourself for a three-account system. Say goodbye to the old two-account setup; it’s now three accounts for better financial planning. Here’s the breakdown:

- Akaun Persaraan (Account 1): Accumulates savings that will serve as income during retirement.

- Akaun Sejahtera (Account 2): Meets the various needs throughout life stages to enhance overall quality of life in retirement.

- Akaun Fleksibel (Account 3): Offers versatility for immediate financial requirements. Funds within this account can be withdrawn at any time according to members’ needs.

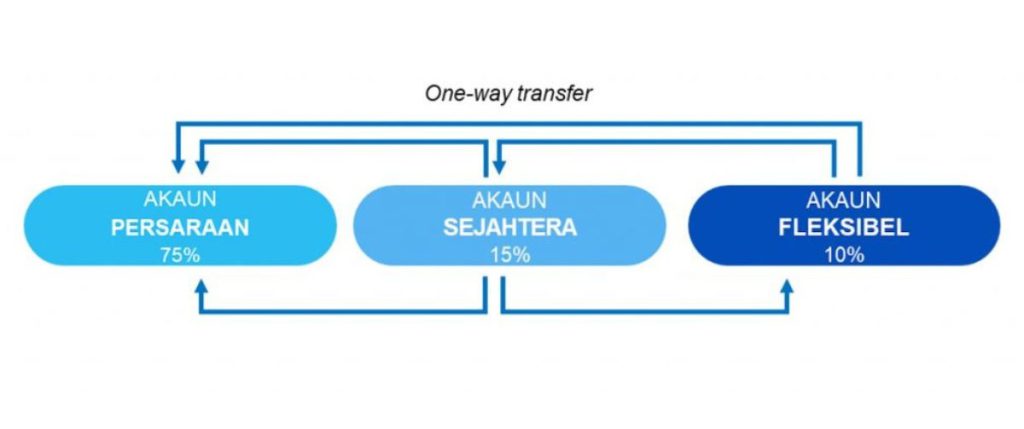

To maintain clarity, we’ll retain the original numerical labels for these accounts. Additionally, all EPF contributions will be divided into three portions based on these percentages:

- 75% will go into Account 1

- 15% will go into Account 2

- 10% will go into Account 3

Why the change?

EPF’s transformation serves not only to add heft to your retirement savings but also to align with the various stages of your life. Here’s what it aims to do:

- Increase the funds in your retirement account to provide greater security for life after work.

- Align short, medium, and long term requirements with members’ life cycle and lifespan.

- Develop EPF Schemes that factor in the evolving work trends shift, demographic shifts, and members’ present and future needs.

- Tackle short-term financial needs that may affect members’ well-being during retirement.

What will happen with the funds in my current EPF accounts?

Overall, there will be no changes to them. This means that all the current savings in your Account 1 and Account 2 will remain untouched, while the new Account 3 will begin with RM0.

Will the new EPF account impact the dividend rate?

According to KWSP, the dividend rate for EPF 2023 stands at 5.5% for conventional savings and 5.4% for Shariah-compliant savings.

Rest assured, the current policy governing dividend rates remains unchanged despite the restructuring. The dividends for Account 3 will be the same as for Account 1 and 2.

However, it’s worth noting that the more a contributor withdraws, the lower the dividend rate.

Conversely, keeping Account 3 untouched, even after opting for the one-time transfer, will ensure the contributor’s dividend rate remains unaffected.

When does it kick in?

Mark your calendars for May 11, 2024. That’s when EPF 3 steps into the ring. But, it’s not just for locals; non-Malaysians under 55 are in on the action too. The last day of the one-time transfer application is on August 31, 2024.

Got a lump sum? Here’s the deal.

EPF is permitting a one-time transfer from Account 2 to Account 3 between May 11 and August 31, 2024.

However, it’s important to note that you can’t withdraw any amount that you like. The withdrawal amount is contingent upon your current balance in Account 2.

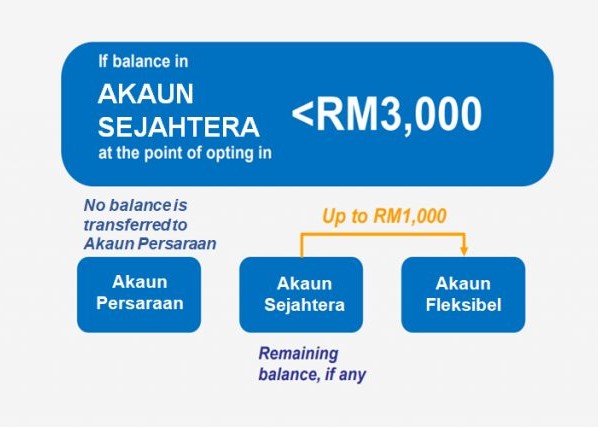

If the balance in Account 2 is RM3,000 or higher, one-third of the balance will be moved to Account 3, and another one-sixth will be allocated to Account 1. However, if the balance in Account 2 is less than RM3,000, the process varies slightly:

- For balances of RM1,000 and below in Account 2: All savings will be transferred to Account 3.

- For balances above RM1,000 but still below RM3,000 in Account 2: RM1,000 will be transferred to Account 3, while the remainder will stay in Account 2.

How to make transfers

You can apply for this one-time transfer through these options:

- Online: You can apply through the KWSP i-Akaun app.

- In person: You can also do it via Self-Service Terminals at all EPF branches nationwide.

Transfer options and rules

Got some funds you want to shuffle around? Here’s how you can do so.

- From Account 3 (Fleksibel): You can move funds to Account 2 or Account 1.

- From Account 2 (Sejahtera): Funds can hop to Account 1 or be used to kickstart your Account 3.

- From Account 1 (Persaraan): Transferring money out is not permitted.

However, once you’ve transferred money from Account 3 to Account 2 or Account 1, you can’t reverse the transfer. Additionally, you must personally visit an EPF branch to submit your transfer application.

Option to opt out

If you’re unhappy with the new three-account format and wish to stick with the current two-account setup, unfortunately, there’s no option to do so.

EPF will roll out the new account structure this May for all members under 55 years old without providing an opt-out choice.

In any case, if you have the privilege of leaving your EPF funds untouched until retirement, that would still be the most beneficial choice, and these structural changes shouldn’t affect you or your savings.

Featured Image Credit: Vulcan Post