When I started my writing career at Vulcan Post circa 2020, digital banking in Malaysia was a mere concept.

Tech conferences featured fintech professionals discussing the potential threats digital banking—”neobanks” or “banking challengers” as they called it at the time—would pose to incumbent banks.

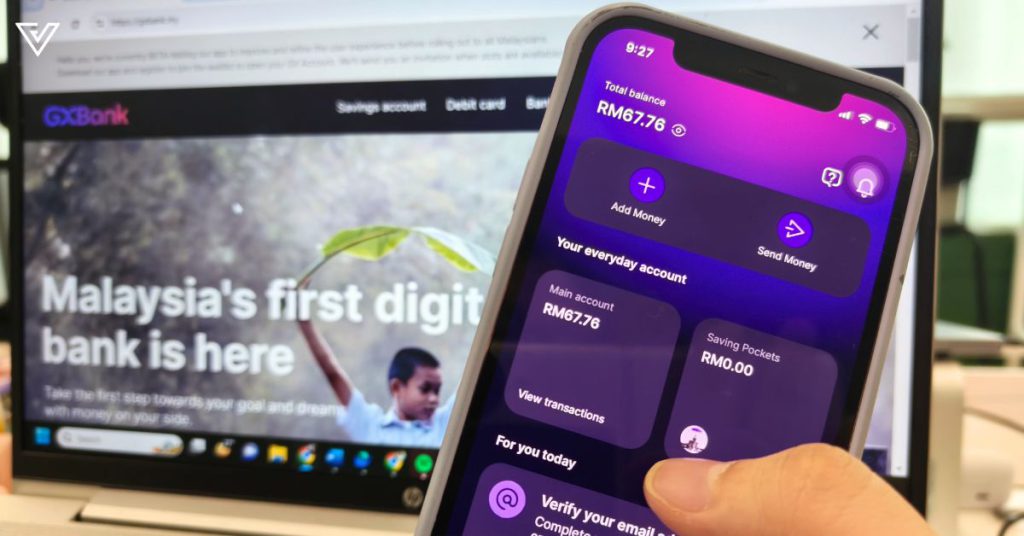

Several years have passed since then, and now three out of Malaysia’s five licensed digital banks are in operation.

The Tech in Asia Conference 2024 in Kuala Lumpur brought together a panel of experts in the digital banking scene around SEA:

- Aditya Saxena, Expert Associate Partner at McKinsey & Company (Moderator)

- Sheyantha Abeykoon, Group CEO of Boost

- Muthukrishnan Ramaswami, Group CEO of GXS Bank

- Sateesh Reddy, Deputy CEO of Tonik Bank in the Philippines

They shared their views on the progress made and the future of digital banking in Malaysia.

What we’ve achieved so far

1. Simplifying banking to narrow the financial inclusion gap

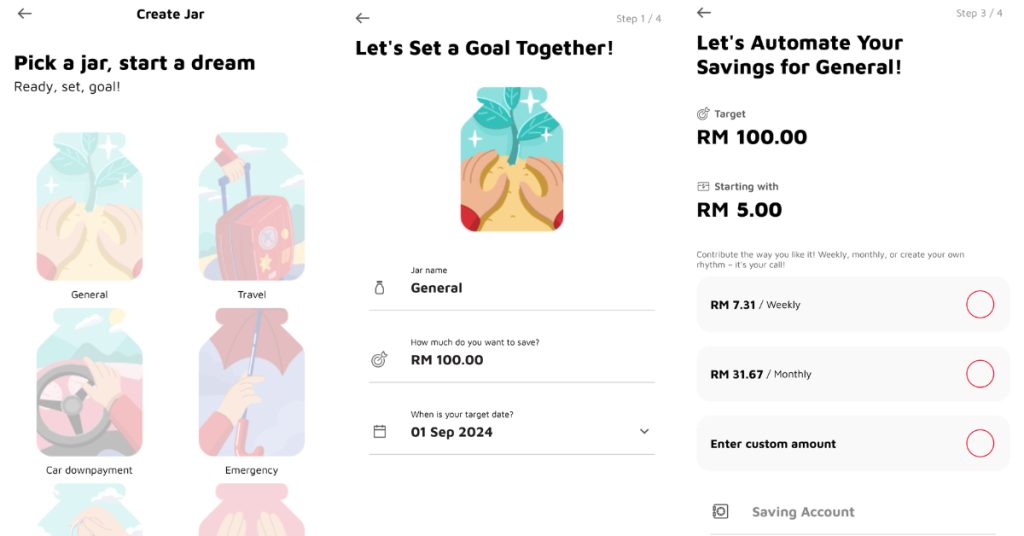

GXS Bank’s Group CEO stressed that simplicity is essential for serving underserved markets. Digital banking products are tailored to meet non-complex needs, as most people don’t require elaborate services early in their financial journey.

The whole idea of digital banking is to give underserved and unbanked communities better accessibility to financial services.

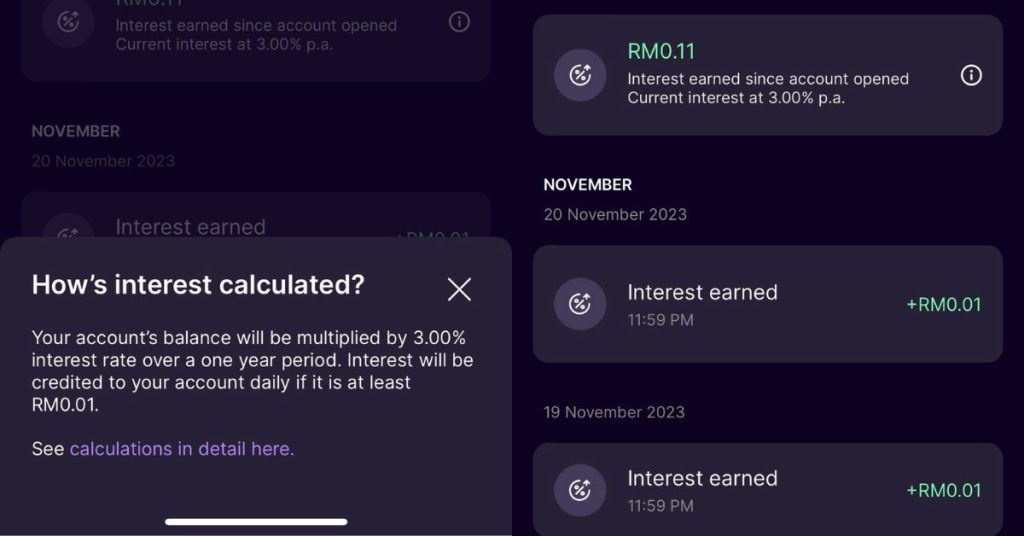

These groups consist of individuals who may not have access to services offered by traditional banks, such as having a minimum of RM20,000 deposited in their savings accounts to earn interest.

“If you go to the big banks, there are a lot of complex terms and conditions to earn interest and most people don’t understand them, and why,” said Muthukrishnan.

“The more of the underserved segment you go, the less financially literate they are. So what we’re trying to do as a digital bank is keep ourselves extremely simple.”

Digital banks offered in Malaysia today have been shown to simplify this process by allowing customers to earn interest regardless of their account balance. This therefore bridges the gap for the underserved in accessing banking services.

Malaysia’s digital banks tend to offer more competitive interest rates than traditional banks as well, thanks to lower customer acquisition costs, reduced service fees, and the absence of physical branches or salespeople.

2. Widespread QR payments adoption from businesses and consumers

The payment landscape has changed drastically over the past decade.

In 2017-2018, most transactions were cash-based, observed Boost CEO Shayentha, but the pandemic spurred a nationwide shift to QR payments.

In fact, the convenience of QR payments has expanded across SEA countries, allowing Malaysian tourists in Indonesia, Singapore, Thailand, China, and Korea to use their preferred mobile banking or e-wallet apps with participating merchants, and vice versa.

“Now across markets, even when you look at small shops, they all use it too. So in terms of digitalisation and market adoption, this has helped bring inclusion to smaller businesses and consumers alike,” Shayentha shared.

What we’ve got going for us

Regulators are encouraging innovation

Regarding innovating under a regulated environment by the central bank, Shayentha stressed the importance of proactively working with regulators.

He explained that Malaysia has a principle-based approach when it comes to launching new banking products. “If we’re doing something outside the norm, we need to define our compensatory controls, our risk appetite, and roll out a period of exposure for our new innovation,” he elaborated.

Digital banks in Malaysia can test the benefits and risks of their innovations through government sandboxes, and further develop their solutions from there.

“I would say that regulators in this region and in Malaysia have been all-encompassing of product innovation. So I don’t really think innovation will be a major issue moving forward,” Shayentha said.

What’s next?

Expanding into lending

All the panellists agreed that market penetration in Malaysia’s digital banking landscape so far is strong, particularly in deposits and payments.

So what’s next, in terms of providing greater financial inclusion to underserved communities?

Over in the Philippines, Tonik Bank’s Sateesh noted that his digital bank primarily serves users by offering loans, seeing roughly a threefold increase in user uptake in the last year.

“It’s what the underserved needs. Big banks involve a lot of paperwork the underserved may not have and a lot of time before they can decide to offer someone a loan,” he commented.

With Malaysian digital banks now holding deposits from their users, both GXS Bank and Boost believe that offering loans to underserved markets will be the next step for their digital banks too.

After all, it is the standard evolution most digital banks have taken, to offer deposits and then go into lending. “Once they get into the fray, they can help bridge the financial inclusion gap,” Shayentha said.

“I can conclusively say that there was a gap before digital banking came about, and fintech has helped close the gap. Digital banking has helped provide a commodity that is under the regulatory umbrella, and they can provide it at scale, which can definitely help bridge the inclusion gap,” Muthukrishnan expressed.

Building financial literacy in underserved individuals

Sateesh addressed that while these financial services are offered to the underserved, building financial literacy in users still needs work.

“Many people with smartphones don’t know what they have access to,” Sateesh highlighted, to which the rest of the panel echoed.

Muthukrishnan believes that building the underserved markets’ financial literacy will be something digital banks will have to work on in the next two to three years.

Ultimately, the growth of digital banks is driven by a singular goal, which GXS Bank’s CEO articulated with a single prompt:

“How do you offer financial services to the underserved based on their current circumstances that the big banks won’t? That’s our positioning as digital banks.”

- Read other digital banking-related articles we’ve written here.

Featured Image Credit: Vulcan Post