The velocity of money, or how quickly money moves through an economy, is a crucial indicator of economic health.

For startups, especially in emerging markets like Malaysia, this concept extends to the flow of investments, particularly across borders.

Despite a growing startup ecosystem, Malaysian entrepreneurs still face significant hurdles in attracting venture capital (VC) investments.

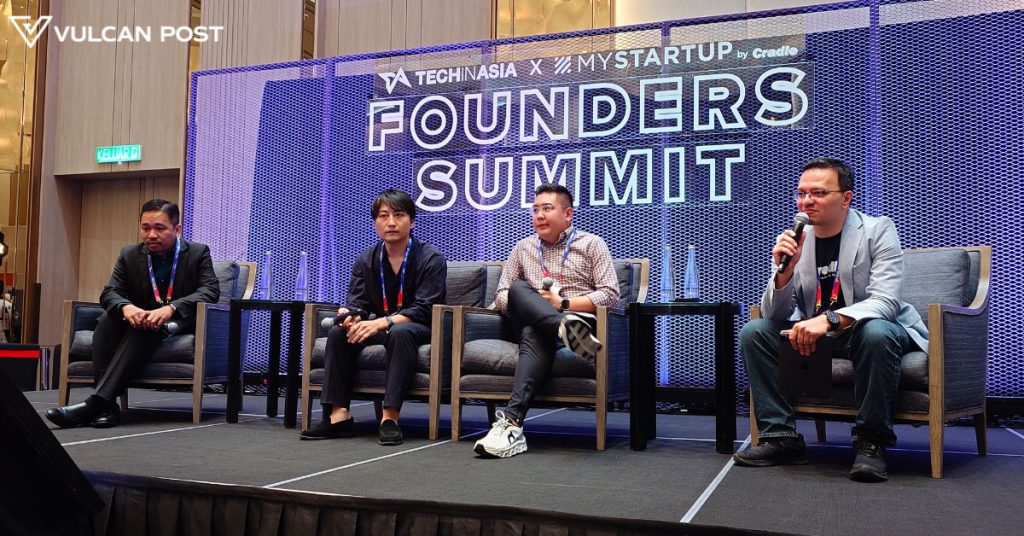

Insights from industry leaders like Melvin Chee, Koichi Saito, and Mohd Nazli Ghazali during the Tech in Asia Conference 2024 shed light on these challenges and the evolving landscape.

Make yourself visible

Melvin Chee, CEO of RPG Commerce, returned to Malaysia in 2018 after nearly a decade in Melbourne. Unfamiliar with the VC ecosystem, Melvin and his team built their business from the ground up, initially unaware of fundraising avenues.

Melvin recalled the initial struggle: “We didn’t know who to go to. I knew nobody in the ecosystem, nobody in the VC space.”

This changed through LinkedIn outreach, revealing a hidden network of seed and A-round investors in Malaysia. Melvin’s experience underscores the importance of visibility and networking in the local VC landscape.

Reflecting on the progress since 2018, Melvin noted a significant increase in capital and accelerators in the market.

Look for angel investors

Koichi Saito, founder of KK Fund, emphasised the importance of angel investors in Malaysia’s startup ecosystem.

Between 2013 and 2017, early-stage investments flourished, with many startups receiving crucial funding. Successful founders like Lee Ching Wei of iMoney, Joel Neoh of Fave, and Eric Cheng of Carsome have returned as angel investors, creating a positive cycle of reinvestment.

“This trend, common in the US and Japan, is a great ecosystem cycle,” Saito explained.

Angel investors play a critical role in nurturing early-stage startups, offering not just capital but mentorship and connections. This reinvestment by successful entrepreneurs is vital for sustaining and growing the ecosystem.

Develop products that address global needs

For Mohd Nazli Ghazali, Head of M&A and PETRONAS Ventures, attracting investors to Malaysia hinges on access to capital and markets.

He asserted that Malaysian startups can compete globally if they develop products that address global needs. However, the local ecosystem must be conducive for investors to feel comfortable deploying their capital in Malaysia.

This includes not just financial support but also regulatory frameworks, infrastructure, and a supportive business environment.

Think about making money outside Malaysia

Saito also highlighted Indonesia’s rapid growth as a significant influence on regional investment trends.

With projections to become the fourth-largest economy by 2050, Indonesia attracts substantial VC funds. This influx of capital drives up valuations, sometimes irrespective of a startup’s business model viability.

Malaysian founders, therefore, face a dichotomy: focus on regional expansion to attract global VCs, or build profitable, homegrown companies.

“To attract global VCs, Malaysian founders have to think about making money outside Malaysia,” Saito advised. This strategic decision impacts not only funding prospects but also long-term business sustainability.

The insights from these speakers paint a complex picture of Malaysia’s startup ecosystem. While progress is evident in the availability of capital and support structures, challenges remain in attracting and retaining VC investments.

For entrepreneurs, understanding the velocity of money and how to navigate cross-border investments can make the difference between stagnation and success. As Malaysia continues to evolve as a startup hub, fostering a conducive environment for both local and international investors will be key to sustaining growth and innovation.

- Learn more about the Tech in Asia Conference 2024 here.

Featured Image Credit: Vulcan Post