Malaysia’s journey in the semiconductor industry began in 1972 when the state of Penang, facing economic challenges, successfully attracted global tech giants to its shores.

That’s when Intel launched its first production facility outside of the United States, a five-acre assembly site in Penang, Malaysia, according to the Malaysian Investment Development Authority. This strategic move transformed the region into a global hub for semiconductor assembly and testing.

Fast forward to today, Malaysia boasts a robust semiconductor ecosystem, contributing significantly to the nation’s economy.

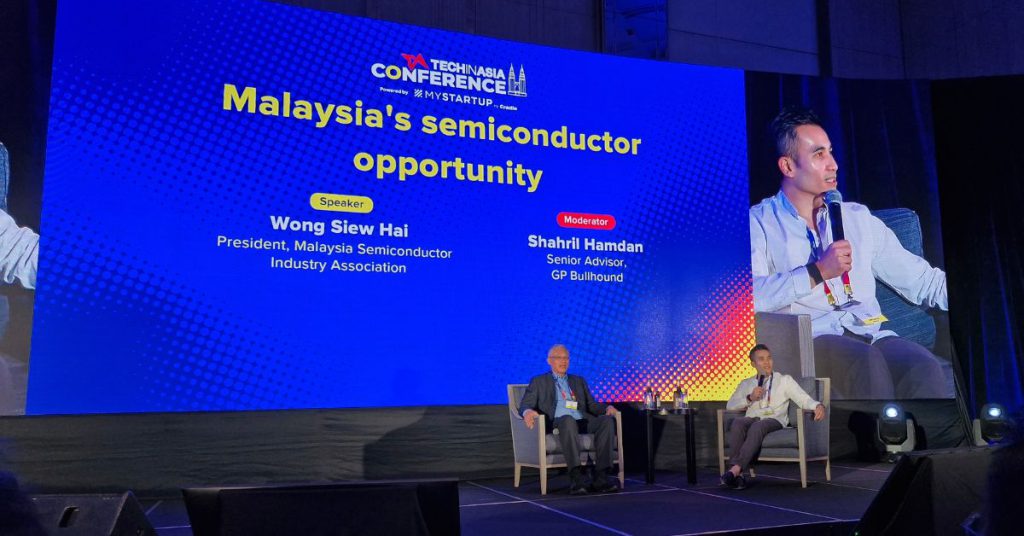

“The industry has grown at an impressive Compound Annual Growth Rate (CAGR) of 16% since 1972, and while the last seven years have seen a slightly moderated growth of 10%, the sector remains a cornerstone of Malaysia’s economic landscape,” said Malaysia Semiconductor Industry Association (MSIA) President Dato’ Seri Siew Hai Wong.

Despite remarkable growth over the decades, the industry now faces substantial challenges and opportunities as it aims to keep pace with global advancements and increasing market demands. Wong shared these relevant insights at the Tech in Asia conference 2024 in KL.

The talent conundrum

One of the most pressing issues facing Malaysia’s semiconductor industry is the significant shortage of skilled talent.

“The country needs approximately 300,000 workers to sustain and grow the industry, with around 60,000 required to be technical talents and engineers.”

“However, there has been a notable decline in the number of students pursuing science and engineering degrees, and many graduates opt for careers outside their field of study,” Wong noted.

To address this, Malaysia must adopt a dual strategy of developing local talent and attracting foreign expertise.

Initiatives such as the ‘Academy in Factory‘ programme can provide on-the-job training for high school graduates, equipping them with the skills needed to become manufacturing technicians.

Additionally, the government should implement policies that encourage foreign students, especially those in science and engineering, to remain in Malaysia and work post-graduation.

“This approach mirrors successful models in countries like Singapore, the US, and Australia.”

“You go and study over in the country, they let you work. So that’s why we’re trying to let all these people who study over here, especially in science and engineering, work in Malaysia,” Wong said.

Insufficient local industry ecosystem

Unlike Taiwan, Japan, South Korea, and China, Malaysia’s semiconductor industry heavily relies on foreign direct investments (FDIs) rather than fostering a robust local manufacturing ecosystem.

“However, our strength basically is in the automation part, that we are capable of designing either automation equipment, specific equipment, or the whole line of process automation to mechanise the whole automation,” he said.

“For example, in solar, we can build a whole system and reduce the headcount by half, or in EV batteries, we can design the whole thing. So we have capabilities like that.”

Despite this, Wong said Malaysia can still be considered a hub for advanced technology due to Intel’s announcement in 2021 of a US$7 billion investment in advanced packaging.

He stated that the new advanced packaging facility in Malaysia is expected to begin production by the end of this year or next year.

Wong also said that Malaysia needs to incentivise local entrepreneurship and innovation within the semiconductor sector.

Government-backed funding and venture capital should be directed towards promising Malaysian startups in advanced packaging and IC design.

Did you know: Integrated circuit (IC) design is a process of interconnecting circuit elements to perform a specific function. Nearly every electronic device you use is made of ICs. Advanced semiconductor packaging is a collection of manufacturing processes combining multiple semiconductor chips into a single electronics package.

Synopsys / Semiconductor Engineering

Learning from China’s model, where substantial government support reduces entry barriers for local companies, Malaysia could adopt similar measures.

“Then you have China which started sometime in the 1990s. They attracted many multinationals and FDIs, but they also focused on their local companies. So they have a very strong local ecosystem as well,” Wong shared.

One of the ways is to establish a target to cultivate a certain number of homegrown semiconductor companies by a specific year, which would provide clear goals and foster a supportive environment for local businesses.

High costs and investment barriers

The semiconductor industry is capital-intensive, with initial investments for advanced packaging and IC design startups reaching tens of millions of US dollars.

This high financial barrier deters many potential local entrepreneurs and investors from entering the market.

“In the semiconductor environment, the startup fund, the seed fund is high. For example, in advanced packaging, if you want to start a company, it will be about US$60 million. Just to start, we are not even talking about the second round and so on.”

“If you talk about the IC design, you probably need something like RM50 million to maybe RM80 million to start,” he shared.

According to Wong, Malaysia should establish a comprehensive funding ecosystem that includes seed funding, venture capital, and government grants to support semiconductor startups.

Collaborative funding models, where central, provincial, and local governments share investment risks, can significantly lower barriers for local entrepreneurs.

Additionally, public-private partnerships could be promoted to pool resources and expertise, further driving innovation and growth in the sector.

Need for advanced technology adoption

To remain competitive, Malaysia must transition from traditional assembly and test operations to more advanced technologies such as industrial automation and Industry 4.0 practices.

This transition is crucial to enhance productivity and reduce dependency on labour-intensive processes.

Investment in research and development (R&D) and the adoption of advanced technologies are essential.

Government policies should encourage both multinational and local companies to invest in automation and advanced manufacturing technologies.

“And I think all the GLCs are actually now looking at how to help this industry and move it. Because most of the companies, when they want to grow or invest and move up the value chain, or you want to help them to lower the barrier to the investment of design development, they need help,” Wong added.

Not only that, he said that training programmes focusing on upskilling the current workforce in these new technologies will also be vital. Partnerships with leading global technology firms can facilitate knowledge transfer and expedite the adoption of advanced technologies within Malaysia’s semiconductor industry.

Global competition and market dynamics

Malaysia faces stiff competition from other semiconductor powerhouses like Taiwan, South Korea, Japan, and China.

These countries have established strong local ecosystems and have significant government support, making it challenging for Malaysia to attract and retain major semiconductor projects.

“On one hand, the ongoing US-China trade tensions have driven many semiconductor companies to diversify their supply chains, benefiting countries like Malaysia.”

“On the other hand, China’s aggressive investments and government support pose stiff competition,” he said.

He added that Malaysia must capitalise on this window of opportunity by attracting foreign investments and developing its local capabilities. We must have a strategic approach that balances short-term gains with long-term sustainability.

Building stronger ties with key international players and positioning Malaysia as a neutral and reliable partner can enhance its attractiveness.

Plus, focusing on niche areas where Malaysia can offer unique value propositions, such as specific types of advanced packaging or speciality semiconductor products, can differentiate the country in the global market.

The semiconductor industry is poised for tremendous growth globally, and Malaysia has the potential to significantly benefit from this trend.

“In the semiconductor world, as you know, it is extremely competitive. Very competitive. If you just sleep on it for one day, you have already lost,” he said.

So, seizing the opportunities presented by global market dynamics and geopolitical shifts will further bolster Malaysia’s position as a leading semiconductor hub, driving sustainable growth and economic prosperity for the nation.

- Learn more about Tech in Asia Conference 2024 here.

Featured Image Credit: Vulcan Post