It’s 2022, SMEs need a transparent, quick, and cost-efficient international payment service

[This is a sponsored article with HSBC.]

Disclaimer: This article is for educational and informational purposes only. It is not intended to be a substitute for financial advice. Readers are encouraged to do their own research before arriving at any conclusions based solely on this content. Vulcan Post disclaims any reward or responsibility for any gains or losses arising from direct and indirect use and application of any contents of the written material.

While some Malaysian businesses have just caught up with local e-commerce trends, established SMEs may already be looking to expand into global markets.

If done right, international e-commerce brings lots of opportunities, including but not limited to: better brand visibility, the ability to take advantage of seasonal sales in different countries to avoid downtime, and to be the first-mover for your product/service in untapped markets.

But some of the biggest challenges involved in transacting across borders include the need to track multiple currencies, dealing with slow payment processing, being charged exorbitant transaction fees, and more.

In their 150+ years of serving Malaysians, HSBC has come up with relevant solutions for our banking needs. As Malaysia digitalised, so too have the bank’s products.

They include HSBC Receivables Financing, where SMEs get access to cash as soon as they invoice their customers, and HSBC Evolve that allows SMEs to lock foreign exchange (FX) rates today for a future transaction.

Now, with the rise of global e-commerce, they’ve launched HSBC Global Wallet (and HSBC Global Wallet-i) that’s geared to help entrepreneurs scale efficiently with proper management of international payments.

HSBC is a member of Perbadanan Insurans Deposit Malaysia (PIDM), allowing each depositor to be protected for up to RM250,000.

As of February 2022, HSBC Global Wallet is Malaysia’s only multi-currency digital wallet that will allow SMEs to hold, manage, send, and receive payments from multiple currencies, all of which can be done easily and securely from a single platform.

To break it down, here’s how HSBC Global Wallet simplifies international payments for growing SMEs.

1) Pay and receive* like a local

SMEs who are making international transactions might stress over exorbitant costs, and they’re not to blame. Not only are there fluctuating currency exchange rates to worry about, but there’s a chance that the third-party service might charge hidden or surprise fees.

By being able to transact in a range of up to 10 currencies currently, SMEs have better control and transparency over the costs of their international payments.

HBSC also states only flat fees are charged per transaction, and not based on the transaction value. To add, there are minimised correspondence bank fees for the “Pay Like a Local” feature.

Another worry is that cross-border payments may take up to few business days, but with HSBC Global Wallet, payments that SMEs make to overseas beneficiaries can be cleared within the same day or next day. HSBC Global Wallet payments use the respective countries local clearing rails, hence SMEs will be able to receive the funds fast and efficiently.

*Note: For now, users can receive CNY and HKD. Coming soon will be USD, GBP, SGD, AUD, EUR, JPY, CHF, and CAD.

2) Get more done in one place

Using HSBC Global Wallet, SMEs do not need third-party providers for international transactions.

Since the digital wallet is fully integrated within HSBC’s existing business banking platform, HSBCnet, entrepreneurs can benefit from having all of their banking solutions in one place.

This means that they can keep their focus on one platform and reduce the chance for errors to be made, saving SMEs time. And as we know it, time is money.

For those who prefer using their mobile phone, almost all the same services are available on the HSBCnet mobile app, barring the ability to create payments (viewing and authorising them is possible).

3) Exercise better visibility and control of overseas payments

By establishing just a single banking relationship with HSBC Malaysia, users are able to access a variety of financial relationships in other markets.

Not only does this quicken the entire transaction process, but it streamlines the payment flows an SME needs to keep track of.

Again, instead of having to track multiple payment channels, SMEs can save time while exercising better control and money management, which is critical for efficient cash flow forecasting.

4) Receive personalised FX rates

It’s a hassle for SMEs to keep up with currency conversion rates every time they need to make transactions at a high frequency, especially since the rates fluctuate and can be costly.

Thus, HSBC Global Wallet wants to empower SMEs to make faster decisions by providing them an immediate exchange rate before the payment is even executed.

Tailor-made for the ease of business

For companies that transact in large amounts, do note that if your incoming or outgoing transactions via your HSBC Global Wallet require an FX rate to be applied, there is a US$1 million limit applied per transaction. Otherwise, there would be no transaction limits.

HSBC’s suite of products is already trusted by more than 1.3 million commercial banking customers in 53 countries and territories, and their Global Wallet will further help SMEs go global.

HSBC Malaysia was recently awarded for the second year in a row the “Digital Bank of the Year” award by The Asset Triple A Digital Awards, a recognition of the bank’s continuous support to its clients during the pandemic using digital solutions, its commitment to help clients to transition to digital channels and the its efforts to digitise at scale to reimagine banking.

- Learn more about HSBC Global Wallet here.

Also Read: What a savvy home cook would want to know about this fridge tech called Prime Fresh

Businesses are fired up post pandemic, here’s some real talk from 2 big industry names

[This is a sponsored article with HSBC.]

Running a business on a normal day is no easy feat; trying to do so post-pandemic while the economy is still recovering is even tougher.

But if there’s anything that the many obstacles in the past two years (such as the pandemic and more recently, the floods) have proven to us, it’s that Malaysians are resilient.

We at Vulcan Post have heard first-hand stories of struggling SMEs with passionate founders putting in their all to make sure their businesses survive.

This new year, entrepreneurs will want to better balance their personal and professional lives, and though it won’t be an easy route, there’s a supportive community out there.

To understand the highs and lows SMEs have faced thus far, we spoke to 2 big industry names, Shockwave and Tiger Sugar, who also shared some real lessons that entrepreneurs can bring into 2022 for improved business acumen.

Always have a healthy runway for emergencies

Andrew Chu, Project Director at Shockwave, an event management and interior design company, told us that their daily operations pre-pandemic were largely centred around physical meetups, whether it was with clients, internally, to set up events, do renovations, or site visits.

Like many others, they were caught unprepared when the first lockdown came. “The first two weeks were spent on coordinating and organising resources to work from home, in order to continue our operations,” Andrew recalled.

Yet business remained halted for a long time. Thankfully, they had a 6-month runway to tide them by, but the team knew they had to pivot soon.

In the third to fourth week of the lockdown, Shockwave had a new plan. Do some online live interview programmes and events, then venture into online conferences, meetings, and more.

Business only truly began recovering in October 2021, but Andrew noted that clients and customers are still cautious with expenses.

Not to mention, materials, manpower, and suppliers’ costs have increased. However, to remain competitive, Shockwave is unable to increase their price proportionately. Therefore, the business is still running at a loss.

Yet Andrew and his team will continue to power through by focusing on their existing clients. He predicted it’ll continue to be tough for now, but believes that his team’s will to overcome this is equally as tough.

Though their main focus is still their core business in event management and interior design, they will be investing more time and money into digital sales and marketing.

No time to rest on one’s laurels

You would’ve thought F&B saw a slightly easier time during the pandemic, but KS Lu, franchisor of bubble tea brand Tiger Sugar revealed that was not the case.

In December 2019 and January 2020, they made over RM1.7 million in revenue (about 140K cups of drinks), but the moment the lockdowns happened, sales dropped to only 20% of that figure.

“MCO periods around October 2020 onwards were the most brutal. Directors had to inject fresh funds to keep the operations going,” KS recalled.

Currently though, sales are improving and edging past the 50% mark, and they’re starting to receive around 10 sub-franchising enquiries per month again.

KS knows that this is not the time for Tiger Sugar to let up on all its intensive efforts thus far though, so they’re still cutting costs where possible and trying to improve productivity all around.

Similar to Andrew, he’s anticipating that they’ll face a tougher business environment due to consumers’ spending uncertainties. But they won’t be deterred, as KS revealed Tiger Sugar will be launching new products soon.

Getting the right financial support

Despite the passion these business owners have, finances are still the key to seeing their ambitions through.

To that end, many business owners opt for specific banking solutions to take away the concern of finance management.

As HSBC is no stranger to supporting business owners who face challenges of managing a small business and personal finances, it came up with HSBC Fusion.

This solution tackles both aspects in one place, allowing entrepreneurs to simply focus on turning their businesses around.

It offers features such as fee waivers, better rates, a dedicated relationship manager and contact centre, access to the HSBCnet digital banking portal, and more. Entrepreneurs who are interested in getting started with HSBC Fusion can learn more here.

But finance management is only one part of keeping a business running; putting lessons learnt to practice is another major factor as to why some businesses succeed while others fail.

Following their experience in the pandemic, Shockwave and Tiger Sugar had some important business lessons to share.

Andrew mainly lamented that Shockwave should have taken the situation more seriously back then to immediately look into cost-cutting measures.

Maintaining operations at full capacity during uncertain times was not their best decision, but is one that the team won’t be repeating anytime soon.

That aside, “Always look into adopting changes and diversifying your business to spread your risk,” he advised.

From a franchisor’s perspective, KS gave his two cents: “Do not expand too fast. Explore funding options before expanding using either self-generated funds or savings.”

-//-

It’s encouraging to see passionate business owners such as Andrew and KS fight on despite the challenges, and even more inspiring are the bold entrepreneurs taking leaps of faith to launch new businesses.

Every week or so, we’ll see a new business pop up in the market across various industries. For example, some pandemic and post-pandemic-born names in F&B include Mori Kohi, ONO, Bricks & Bread, The Rabbit Hole, and more.

These point to the fact that though still careful with spending, consumers are itching to browse and support local brands, old and new.

The nation is holding out hope that this trend will continue to rise, and by then, it will only be a matter of time before our economy is back in full swing.

- Learn more about HSBC Fusion’s offerings here.

Also Read: This M’sian rewards platform is rewarding its 1mil users with cash vouchers and a lucky draw

Featured Image Credit: Shockwave / Tiger Sugar

HSBC launches EZInvest in M’sia, allows users to invest in unit trusts via mobile app

[This is a sponsored article with HSBC Malaysia.]

As someone who’s entering their 30s with limited investment experience, it is both relieving and alarming to learn that I’m not alone. Turns out, roughly 43% of local millennials have not dabbled in investments at all, and have no plans to.

Taking a closer look at the financial habits of millennials, another recent report found that 40% of millennials actually spend beyond their means too. This means that a large number of the young workforce is not saving or investing.

The ongoing pandemic is likely their very first economic crisis where they are managing their own finances. It’s not all bad news though, experts believe that the Movement Control Order (MCO) is a good training period for the youngsters to reflect and adjust their spending and lifestyle.

Investing can be a good starting point to potentially grow your wealth. But that said, there are risks involved in investments, so make sure to do your own research and due diligence before making any financial decisions.

One investment option available to Malaysians are Unit Trusts.

What exactly are unit trusts?

Unit Trusts (UT) act just like normal investments, where we exchange funds for assets. However, there are a few key things to note about how UT works.

When first investing in UT, your money is pooled alongside other investors. The money is then managed by a financial professional who will invest the pooled money to fulfil the investment objective and approach agreed beforehand.

Example Scenario: Alan wants to invest RM1,000 into UT. He talks to a financial professional and they set a goal for how much Alan wants to profit. Alan wants to get out with a RM300 profit. The investment amount of RM1,000 is then channeled to the financial professional.

The financial professional also manages other investors like Alan. With a combined pool of money from different investors, they can invest more into different assets.

A year later, the market favoured Alan’s investments and reached his goal profit. He then decides to sell off the investment. Of course, other factors such as market volatility, risks and management fees are still at play even in UT. And depending on the UT, some might pay out yearly dividends.

Since the funds are managed by a financial professional, the unit holders (the investors) have limited control of the assets they’re investing into. In terms of profit, unit holders might also get less profit as they have to pay management fees to the financial professional.

Benefits-wise, unit owners will have a large portfolio list, as the financial professional will often diversify into different assets, in line with the age-old saying of “don’t put all your eggs in one basket”.

Dipping your toes into UT investment

HSBC’s investment platform on the HSBC Malaysia Mobile Banking App, EZInvest, is now available in Malaysia to give users convenient access to UT investing.

Compared to conventional UT investing where you need to talk to a financial professional, EZInvest provides you with the flexibility to invest in UT through a secured platform right on your mobile phone. To start, you’ll need a HSBC Unit Trust Investment account or a HSBC Amanah Unit Trust Investment Account.

With EZInvest, you can start investing from RM500.

Aside from the low entry point, HSBC allows investors to get access to different assets ranging from local, Asian and global markets. HSBC EZInvest is designed to be easy to use. Here are the steps to access its services:

1. Open up the HSBC Malaysia Mobile Banking App (download the app on Apple App Store or Google Play Store) and login via Biometrics or your account details.

2. Tap on EZInvest, which can be found under the “Products and Services” tab.

3. If you’re a first-time investor, you’ll be prompted with a welcome screen, showing the features of UT. If you’ve invested via the app, you can tap on “My Holdings” to view all your current assets, their market value, and the potential gain or loss of the asset. If you wish to buy more, you can do so in this section as well.

4. To begin investing, tap on “What Can I Invest” and you’ll be brought to a page where you can see all the details of a fund that you can invest in. It’ll show you detailed information about the fund’s price, performance, allocation, fees and charges. If you’re interested in investing in that specific fund, tap on “Invest Now”.

5. Fill in the necessary details as prompted, verify the details of the transaction, and you’re set. If you wish, you can save the transaction details by clicking on the share button.

With EZInvest, you won’t have to talk to any financial professionals or the likes to make an investment since you can buy, sell and manage your investment through the platform. And you will have access to your UT portfolios under HSBC and HSBC Amanah.

-//-

It is worth noting that gaining a profit from investing is not a sure thing. So make sure you study up what investment you are buying into to see if it suits your lifestyle, spending habits, and financial goals. Investments are usually tied to long-term profits, so it makes sense to start as early as you can.

The usage of EZInvest (app) is governed by the HSBC Bank Terms and Conditions for Online and Mobile Banking, End User License Agreement, and Important Notes available in the HSBC Malaysia Mobile Banking app. In order to perform transaction in this app, a sole Unit Trust investment account needs to firstly be opened. Please visit HSBC Bank or HSBC Amanah branch or contact us by phone to open a Unit Trust investment account to perform transaction on this app. The services provided through this app involve no recommendation of, or advice on, any product from us. All transactions that you enter into through this app are conducted on an execution-only basis and based on your own judgement. The value of investments, unit prices, income distribution and impact of exchange rate movement may go down or up, and the investor may not get back the original sum invested. Past performance of a unit trusts should not be taken as indicative of its future performance. Investors are advised to read carefully and understand the contents of the prospectus and consider the general risk factors associated with investing in unit trusts in addition to other specific risks uniquely associated with the unit trusts. All the relevant risk factors are set out in the relevant prospectus for the unit trusts. The list of Unit Trust funds provided through this app is not reflective of the full fund list offered by HSBC Bank and HSBC Amanah via the branch channel. If you’re looking for the full list of Unit Trust funds, you may visit our HSBC website or our branch for more information. The scope of available transactions are lump sum investment, Monthly Investment Plan (MIP) and redemption. To perform switching, transfer or exercise of cooling-off right in relation to unit trusts, please visit the nearest HSBC Bank or HSBC Amanah branches. If you would like to enquire of such procedure, please contact HSBC Bank Malaysia via the channels specified in https://www.hsbc.com.my/contact/. Unit trust schemes and units in such schemes are not protected by Perbadanan Insurans Deposit Malaysia (“PIDM”); and any money withdrawn from an insured deposit for the purpose of purchasing any units in a unit trust scheme is no longer protected by PIDM. This material has not been reviewed by the Securities Commission Malaysia (SC).

Also Read: A gap in the saturated sweet market led this hiker to make a sports candy

Featured Image Credit: HSBC

A gap in the saturated sweet market led this hiker to make a sports candy

[This is a sponsored article with HSBC.]

There are many reasons to start a business. For Mr Kenny Low, his journey into the candy industry was all about passion, continuing the family business, and fulfilling what the market lacked at that time.

Kenny has always been fond of candy growing up, but unlike other sweet-loving kids, Kenny had a closer connection to toothsome treats—his family ran a candy wholesale business. He then decided to follow in his father’s footsteps and founded his own business called Nicko Jeep Manufacture Sdn Bhd.

Fun Fact: Nicko Jeep as a name does not have any meaning behind it. Kenny said that when he created the company, little jeep toys were popular and the name stuck.

Transitioning from distributor to manufacturer

When Nicko Jeep first started, they were just a distributor, selling candies in small stores next to schools. But Kenny was not satisfied with the status quo. He had big dreams of producing his own candy, but lacked the capabilities to do so earlier on.

To realise that dream, the company invested in equipment, facilities and hired staff with the right skills and experience to create Nicko Jeep’s own line of candies. The company also had to pour money into creating attractive packaging as they needed to stand out.

They succeeded in creating quite a few iconic treats. If you’re a candy-lover, you might have encountered Big Foot Lollipop and Big Foot Plum candies.

Kenny noted that the candy market is really competitive and the consumers are never short of options. He wanted the company to shine not just locally, but internationally. Thus, the business started to export their candies to other countries. They also started working on a truly unique product.

Creating a new candy category

When he’s not thinking about candy, Kenny fills his free time with hiking. As someone who hikes often and sweats a lot, he needed an easier way to keep his sodium levels in check. While sodium-containing sports drinks may help, they have more water than sodium.

This was when he realised he could marry both of his passions to create a solution for his fellow hikers and athletes. Thus, the Himalaya Salt Sports Candy was born. While Kenny thought he had a good idea in mind, the company encountered issues during production.

Firstly, Kenny knew the product had to be healthy, as consumers have the preconception of candies being unhealthy and contain a lot of sugar. The end product only contained two or three grams of sugar per serving.

In addition, Nicko Jeep needed to find a sweet spot, balancing sodium and sugar. After testing different types of salt, the team found that natural rock salt was the perfect ingredient for their candy. In 2018 when Himalaya Salt Sports Candy hit shelves, it was well-received across the Asia Pacific. The candy is now consumed by millions across 10 different countries.

Looking for the right treat

On top of the 10 countries where Himalaya Salt Sports Candy is distributed, Nicko Jeep also supplies candy to a total of 16 countries.

In the course of their international expansion, they ran into issues with customers paying using a letter of credit. This payment method could take a few days for banks to process, affecting the business’s cash flow.

This proved to be an issue until Nicko Jeep used HSBC as their bank of choice. Besides a quick processing time, Kenny recalled an instance when HSBC got back to him on the same day, prompting him to change the details on a letter of credit. If the letter had gone through, it would have taken him days to fix the potentially costly error.

Before using HSBC, Kenny and his team also used to go into the bank a few days a week to submit documents and perform transactions.

Through HSBCnet, HSBC’s online portal, Kenny no longer had to drop by or call the bank for submissions or transactions as he could perform it all on his desktop or on his phone.

He can view and control all his companies’ financials (local or international) through a single log-in too.

HSBCnet can act as a consolidated interface, providing business with a suite of flexible online financial solutions. It is designed to help businesses increase productivity and better manage their cash flow.

Handling hedging requirements all through HSBCnet

As a business that handles international exports, Nicko Jeep has to deal with different currencies and this is where HSBC Evolve comes in.

HSBC Evolve allows Kenny to lock in FX rates for his settlements too. For example, the current forex rate stands at RM1 = 7.55 Thai Baht. Kenny wishes to make his settlement on a later date but he likes the current rate offered. He can lock in the rate and won’t have to worry if the rates fluctuate on a later date and negatively affect his bottom line.

HSBC Evolve is designed to ensure that a user can better manage and execute their FX exposure effectively through real-time live pricing. The service can also provide SMEs with access to 460 currency pairs.

In the past, getting an updated FX rate would require Kenny to drop by or call a bank and look for a dealer to obtain special rates, which takes out a lot of his time. And if he didn’t like the rate he would then need to call the bank again to check and monitor the rates. But with HSBC Evolve, he can monitor the FX movement right in front of his computer and execute the trade within a minute, without even calling the bank.

Growing the business through digitalisation

“With the efficiency gained from these digital tools, it is easier to manage our business growth,” said Kenny, the Managing Director of Nicko Jeep.

Nicko Jeep got to where they are because they understood the importance of digitalisation to improve business processes. With 70% of the business focusing on exporting, they would be stuck in the deep end if they failed to digitalise their processes earlier on.

For companies who are still using traditional business models, Kenny said by adapting to trends and digitising processes, it can help your business keep up and stay relevant. With access to 16 countries and counting, he still has plans to develop new products and extend his reach further.

- Check out Nicko Jeep’s line of products here.

- For more info on HSBC solutions such as HSBCnet and HSBC Evolve, click here.

- Read up on what we’ve written about HSBC in the past here.

Also Read: 43% of this accelerator’s alumni received funding, sign ups are open now

Featured Image Credit: HSBC

SMEs can get their hands on transparent, real-time rates via HSBC’s digital forex solution

[This is a sponsored article with HSBC.]

SMEs make up 98.5% of the total 921K businesses in the nation. With SMEs in mind, HSBC Malaysia continues in their facilitation of local businesses, providing tools for pandemic recovery, growth, and international expansion.

Despite the projected difficulties in 2021, Malaysian businesses remain positive about international trade, with 74% of the local businesses planning to expand into Asia Pacific within the next 3 to 5 years, according to HSBC’s Navigator Survey 2020. For companies looking to expand internationally, one of the key aspects for consideration is foreign exchange (FX).

The Issues With Traditional FX Transactions

FX is the process of buying and selling one currency for another currency in a forex market. Whether it is to pay suppliers in another country or to receive sales proceeds from an international customer, each trade will involve FX dealings.

Usually, for an SME to conduct such a transaction, they will have to call their dealer in the bank to request for special rates, or to walk into the branch to execute the FX transaction over the counter. Because of the current work from home (WFH) arrangements, there might be limited resources in banks to assist you directly, and this might delay your transactions.

Imagine if an SME were to pay different suppliers worldwide on a single day, they will have to repeat the tedious process several times. There may even be a minimum value required for each FX transaction, which may restrict the flexibility needed by SMEs.

While there are other services that can enable FX transactions without going through Telegraphic Transfer (TT) from non-bank institutions, it comes with the additional costs for handling fees to transfer money from your bank to the service provider.

Bypassing Manual In-Person Processes

Instead of having to deal with the manual FX processes, HSBC introduces Get Rate, a tool for SMEs to get a real-time view on FX rates without the hassle of calling a dealer.

As a HSBC customer, you’ll gain price transparency when you book the rate via Get Rate, as the bank’s margin will be displayed prominently on your bank statement.

Through Get Rate, SMEs can complete transactions immediately at the current live special rate. However, there is a 10 to 20 second window for the final approval to lock in the rate for Get Rate.

Book Forex Rates In Advance

As the FX market can be volatile, it is vital for SMEs to reduce their FX risks through currency hedging. One way of doing this is through HSBC Evolve, which gives them the ability to lock FX rates today for a future transaction.

HSBC Evolve is designed specifically to ensure businesses have a full view and execute end-to-end FX transactions including hedging. HSBC Evolve provides SMEs access to 460 currency pairs for sophisticated hedging requirements.

Example Scenario: SH Trading, a local SME wants to pay their supplier in Europe for spare parts required for their manufacturing business.

There are 2 key HSBC services that can be used:

– Get Rate: SH Trading obtains the latest forex rates online, which is 1 Euro = RM4.92, and proceeds to pay its supplier by booking this rate when it executes the transaction .– Evolve: For its future payments to their supplier, SH Trading is worried about the possibility of Euro strengthening, so they proceed to lock in the current rate of 1 Euro = RM4.92, but only executing the transaction next month.

Even if the FX market next month changes to 1 Euro = RM5.10, the company will not be affected. Thus, they have successfully hedged any future currency risk by ensuring its profit margin remains the same without being affected by FX volatility.

In the example scenarios above, SMEs gain convenience with Get Rate as transactions can be done anywhere via laptop or mobile. Whereas for SMEs with hedging needs, they can gain more control over their FX exposure with Evolve as almost all major currencies are covered.

As an added value service, HSBC provides access to FX research and reports for SMEs to gain further insights into the FX market.

Track Payments And Have Full View Of Your Financial Position

When making payments internationally or domestically, the ability to track the transactions are essential. However, transactions made through Telegraphic Transfers (TT) usually do not come with tracking tools.

The payees are usually left in the dark and they do not know if the payment goes through.

HSBCnet’s answer to this is the HSBCnet Track Payment feature, where SMEs can obtain real-time status of their collections, credit and payments through desktop or mobile devices.

The tool also informs you if there are any actions you need to take, whether a transaction is rejected, pending, or requires additional documentation to be processed.

Through HSBC, SMEs can elevate their digital banking experience by viewing the financial position of their business across different markets and currencies in one place through the Liquidity Management Dashboard.

The dashboard allows businesses to see what was transferred and when, with a transparent audit trail. Not only that, it also has a tool to help SMEs to forecast cash flow for better working capital management.

If you’re interested in getting access to any of the HSBC FX or payment solutions, you can submit an enquiry form on this page.

- Find out more about HSBC Business Banking Solutions here.

- Read on what we’ve written about HSBC in the past here.

Also Read: This Chair Has A Smart Fitness Band For Real-Time Health Updates To Plan My Massages

Featured Image Credit: HSBC

4 Key Steps To Prepare M’sian Businesses For 2021, Based On A HSBC Survey

[This is a sponsored article with HSBC.]

2020 brought about a wave of unpredictability in the business environment, and 2021 seems to be starting on the same foot as well. But, it’s not all doom and gloom. Some managed to seek out new opportunities, while others had to close up shop due to the lack of demand.

In HSBC’s annual Navigator survey, they found that 55% of Malaysian businesses managed to adapt to the new challenges. And 30% of them thrived due to these changes too—compared to the global percentage of just 24%.

Note: HSBC’s 2020 Navigator survey was conducted by Kantar (a market research company) on behalf of HSBC. They interviewed over 10,000 businesses globally. The report specific to Malaysia is based on a survey of 200 Malaysian businesses from various industries.

Here are some of the findings from the survey that will help you prepare your business for the upcoming economic rebound.

1. Demand Alone Is Not Enough, Changes Are Needed

Businesses in Malaysia didn’t have a great start in 2020 due to the early Movement Control Order (MCO) back in March. However, consumer spending is slowly recovering with various government stimulus and support programs.

The survey points out that 76% of businesses believe they can return to pre-COVID-19 profitability levels by the end of 2022 too.

Many local businesses have enjoyed the increase in local demand for their goods and services, and demand is poised to increase in 2021. However, just catering to local demand alone is not enough.

Ultimately, businesses need to learn to make changes and adapt to evolving market needs. Some transformed to offer their services digitally, for example, businesses are creating their own online platform to make their products more accessible to consumers instead of relying on their retail footprint.

74% of the surveyed businesses said that they’ve made changes in their business in the last 12 months in order to adapt to the new reality. Looking ahead, Malaysian companies view innovation and collaboration as the top two key success factors in their business.

Utilise HSBC Omni Collect: This enables your business to accept a wide range of payment methods such as cards, e-wallets, FPX Bank Transfers, QR Scan & Pay, all from a single terminal.

These payments will then be transferred to your account on the very next business day which helps with cash flow. You will also have access to a consolidated report to keep track of payments. This solution is available for your E-commerce or M-commerce business too.

2. Increase Investment Into The Business

Even with the intention to up the company’s digital capability, a company can’t optimise their revenue if they don’t reinvest into the company for the right tools and resources.

The survey reported that 78% of businesses will look into more opportunities to invest in their company in 2021. In fact, 25% of them plan to increase their investment spending by 20%. They are prioritising their investments to improve cash flow, marketing and product innovation.

Maintaining a healthy cash flow is vital, especially for SMEs. Thus, having a robust tool to manage cash flow can simplify a lot of banking tasks for SMEs.

Utilise HSBCnet: HSBCnet is HSBC’s digital banking platform which comes in 20 global languages. It stands to be a one-stop platform for all business banking needs.

You can even access different company accounts from a single profile. You’ll get an overview of your company’s cash position, and be able to manage everyday banking such as making payments with the ability to track local and overseas transfers too.

Once you’re equipped with the capabilities to accept overseas payment, you’ll be ready for international expansion.

3. Prepare To Expand The Business Into APAC

And in terms of expansion, 74% of respondents have plans to expand into APAC in 2 years too. Since 86% of the surveyed companies are already trading within APAC, they believe the expansion will help make their business more competitive.

However, before businesses can think of expansion, they’ll have to consider making changes to their supply chain. This is why 99% of the surveyed businesses have made adjustments accordingly, such as utilising digital tech and diversifying their suppliers.

These changes can result in cost reduction, an increase in supply chain visibility and being closer to the end buyer.

Utilise HSBC’s Trade and FX Solutions: HSBCnet Internet Trade Service (ITS) supports your global business trades through your laptop or mobile phone. You can initiate trades, view transaction status and track whether bills are received, processed, authorised, sent or accepted, wherever you are.

You can manage FX exposure via HSBC Evolve too, which gives you a real-time view of two-way pricing for SPOT and Forward trading and provides access to 460 currency pairs.

4. Streamline Process Of Receivables For Better Cash Flow

Managing a global business can be challenging if you don’t have a healthy cash flow. You may face a situation whereby your customers aren’t paying you quick enough and you need to make payments to your suppliers at the same time.

This can be risky to your business if not managed carefully.

Utilise HSBC’s Receivables Financing (RF): RF Express is a simplified receivables financing solution designed with streamlined approval. As an alternative financing source, it gives you access to cash from your receivables as soon as you invoice your customers, so you don’t have to wait weeks or months for your payments to arrive.

-//-

As you can see from the survey, businesses that thrived and have good prospects moving forward were able to do so thanks to a combination of smart choices.

Despite the current MCO 2.0, economic recovery is looming on everyone’s minds. But, being equipped with the right digital tools can be the turning point that businesses are looking for to be competitive in a post-COVID world.

- For more info on HSBC’s offerings, click here.

- Read up on what we’ve written about HSBC in the past here.

Also Read: This Cyberjaya Accelerator Equipped 75 Startups To Go Commercial In 7 Years And They’re Not Done Yet

Featured Image Credit: HSBC

How They Went From A Struggling Company To A Manufacturing Partner Of Global Corporations

[This is a paid article with HSBC.]

Despite Malaysia being one of the top 5 countries in terms of cost competitiveness for manufacturing, Malaysia was hit hard by the COVID pandemic. Supply chains were disrupted because of the lockdowns implemented all over the world in various ways.

Some manufacturers even had to shut their doors for good because they couldn’t get their hands on the supplies they needed. However, for the more seasoned veterans, this is not the first crisis they’ve encountered.

Cape EMS, a local provider of electronic manufacturing and precision machining services based in Johor Bahru struggled to stay afloat during its early years.

The Story Behind Cape EMS

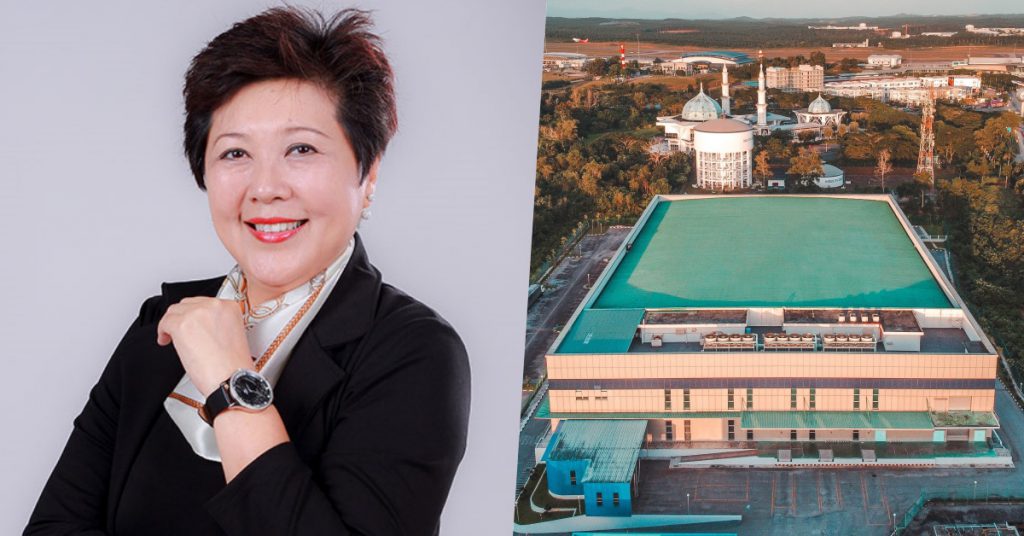

Christina Tee, the founder and CEO of Cape EMS shared her company’s journey in an interview with HSBC.

With more than 30 years of experience, Christina is already a veteran in this industry with her last role as a Group CEO in a group of plastic manufacturing companies.

In the early years of running the business, there were times that Christina had to keep the company going by investing all of her personal savings into the company as a lot of upfront costs was needed to kick-start the operations.

Finding clients proved to be an issue too because Cape EMS operates in a sector that is extremely competitive and being a new and unknown entrant makes it more difficult.

Along the way, she recognised that there was a space that Cape EMS could fill. She observed that clients in the Wireless and Technology modules in the manufacturing sector constantly had issues that other providers couldn’t or wouldn’t solve internally.

Determined To Prove Their Capabilities

With the gusto to prove that they were the real deal, Cape EMS decided to form a complete manufacturing ecosystem to help their clients as quickly as they could.

The company worked diligently to solve the clients’ problems, even if it’s out of their usual job scope. They helped their clients with getting certification and even debugging R&D products.

Instead of looking at these tasks as a hassle, the company took it as an opportunity to learn and grow.

Because of this genuine interest in solving problems for customers, Cape EMS managed to build a good rapport with their clients, some of which had been with them since the very beginning.

Getting Help With Managing Finances

As orders started coming in and more industry players began to take notice of their quality of work, Cape EMS realised that they needed help with financial restructuring. This is when they approached HSBC to look for a solution.

Because of a general industry practice, Cape EMS usually don’t get paid by their clients upfront. They even have to wait for roughly 2 to 3 months after shipment before getting paid.

And this meant that they had to fork out their own money to pay their suppliers for raw materials and any spare parts.

But with the HSBC Receivables Financing, one of HSBC Business Banking solutions, Cape EMS could get access to cash as soon as they invoice their customers.

This meant that they no longer have to wait long for payments to arrive.

With immediate cash in hand, Cape EMS was able to sustain large amounts of orders without having to strain their day-to-day business cash flow.

Growing Past Their Original Targets

In 2017, Christina decided that it was time for Cape EMS to pursue bigger goals. So, they sold their most profitable line of business (the product line of modem and wireless products) to generate cash for further expansion.

With that sale, Cape EMS was able to divide the business into four areas:

- Wireless Infrastructure

- Smart Home Appliances

- E-cigarette / E-vape

- Smart Industrial Products

Despite diversifying and spreading out their resources at that time, Cape EMS still had a leg up over the competition. Their original motto of servicing clients remained unchanged.

Most of their clients come to them with designs in mind, but they do not know the ins-and-outs of manufacturing. So, this is where Cape EMS comes in to provide advice on how the designs can be improved for manufacturing.

Their clientele now extends to e-cigarette, robotic vacuum cleaners, and sensor manufacturers too.

When the company went through restructuring, HSBC came in to provide Cape EMS with the additional financing needed for their expansion into new business lines and new markets.

Aside from financing, credibility plays a huge role too when doing business, especially when it comes to the global arena. For a relatively young company such as Cape EMS, they leverage the brand strength of HSBC when they enter the global business scene and it has been extremely valuable to them.

“Our customers are worldwide and HSBC has a strong global footprint so it really helps when doing business with global customers. It gives us a lot of credibility and we are proud to tell our customers that HSBC is our main banker” said Christina.

Getting The Right Help That They Needed

Coming into 2020, there were interruptions to Cape EMS’ operations due to COVID-19. The situation was also worsened by the suppliers too. Most suppliers accepted cash only without extended loan terms.

To cope with that, Cape EMS approached HSBC and was provided with the Prihatin SJPP financing scheme within a month’s time. This gave Cape EMS a breakthrough in a rather challenging situation.

The restructuring back in 2017 proves to be fruitful and HSBC stepped in to help at the right time. The growing demand from the work-from-home trend such as wireless products and home appliances is driving new growth for Cape EMS today.

As for future plans, they are working on distributing new products such as Data Gathering System utility meters in new markets, and even coming out with their own line of products.

With such plans in place, Christina aims to grow Cape EMS into a company that’s 5 times bigger than what they are today.

“Through a dedicated Relationship Manager, HSBC offers more than financing by offering advice on how to navigate the industry that Cape EMS operates in. This proves to be valuable as Cape EMS was able to leverage the expertise that we have. By bringing to customers our wealth of experience, we can help our customers unlock growth and connect them to opportunities through our global network. The collaboration with Cape EMS exemplifies the benefits of our business banking solutions and how we can support the growth ambitions of our customers.”

Ranil Perrera, Country Head of Business Banking, HSBC Malaysia

- To find out more about HSBC Business Banking solutions, click here.

- Read up on what we’ve written about HSBC in the past here.

Also Read: This M’sian-Based Company Works Behind The Scenes To Customise The Food We Regularly Consume

Featured Image Credit: MICCI / Cape EMS

This M’sian-Based Company Works Behind The Scenes To Customise The Food We Regularly Consume

[This is a paid article by HSBC.]

If you’ve ever stopped by a Shell station’s convenience store, deli2go, you may have noticed the fresh ready-to-eat sandwiches by a brand called Foodcraft.

Foodcraft is a Malaysian homegrown in-house brand under the leading food specialist and distribution company, DPO International, with its HQ in KL, and offices all over Southeast Asia and China.

Even though the company has been in the food industry for over 20 years, not many Malaysians are aware that the food they’re consuming daily is customised by DPO International.

The company actually has a laboratory to develop and adjust ingredients according to required specifications and local consumer tastes.

As an expert in handling a comprehensive range of specialised services for the food industry, they’re involved in nearly all parts of the food supply chain in Southeast Asia and China, operating in 7 countries namely China, Indonesia, Malaysia, Philippines, Sri Lanka, Thailand and Vietnam.

Whether it’s for a big supermarket chain, a small retailer, a start-up café business or a hotel, DPO International caters to the consumers’ requests in supplying and distributing the food products they favour, through the company’s 25 offices and warehouses in the region.

Fun Fact: DPO is an abbreviation of Daniel Pans’ Office. Daniel Pans founded DPO back in 1993 in Japan and later relocated its headquarters to KL. They added ‘International’ to the name as they’ve extended their service to international clients.

However, the food supply chain management is not as straightforward as just delivering food to the consumers.

Food specialists like DPO International need to undergo a complex web of interactions involving producers, processors, multiple vendors, suppliers and clients in multiple areas.

This complexity extends to its financial management too.

Although the global economy has made it easier for companies to operate and sell their services almost anywhere in the world, managing cash collection, trade deals, international transactions and supplier payments are no easy tasks to tackle, especially when it involves 7 different countries.

Access To All Their Banking Accounts At A Glance

Daniel Pans, the founder and Group CEO of DPO International said that digitalisation has largely helped them improve the existing supply chain management and allowing the system to be more connected than ever.

The company now can fast track certain operations and have optimal inventory control even at multiple different locations.

With optimal inventory control and cash management, deliveries can be made on time so their customers can get the best and the freshest ingredients or products that DPO International has to offer.

HSBC plays a pivotal role in making all these processes run smoothly. Through HSBC’s banking platform, HSBCnet, DPO International has full access to their cash management.

From authorising payments in multiple currencies to importing food supplies, HSBC enables DPO International to run their business in a more efficient and methodical way.

COVID-19 has truly rocked the food industry, with a huge reduction of food services to airlines, hotels and even schools during MCO.

Through HSBCnet, they were able to quickly check on their cash positions in each country to see how they can overcome the impact of the pandemic.

HSBCnet is equipped with an array of tools for businesses to handle cash management and business trades too, all on one platform. It also allows DPO International to have an instant view of all cash positions on all of their bank accounts in the region.

By having that level of transparency on a global scale, the productivity of DPO International in their day to day operations has increased significantly, from fulfilling the food supply’s demand faster to making payments seamlessly.

“Our ambition is to “Glocalise”, this means “globalise” where there are economies of scale and “localise” where local reach is vital. HSBC’s digital banking platform, HSBCnet, allows us to centralize our credit control capabilities as it provides us with a full view of all of our cash positions across our 7 markets in the region. Because it is real-time, we can respond quicker and make more informed decisions.”

Daniel Pans, Founder and Group CEO of DPO International™ and BIGbox Asia™

Tackling The E-Commerce Market

In their mission to bring a wide range of groceries from local and around the world, DPO International launched their very own e-commerce platform called BIGbox Asia.

BIGbox Asia provides their customers with a dazzling variety of options for their grocery shopping.

Through their dedicated Chilled and Frozen delivery services, it provides customers with a convenient way to buy fresh products every day of the week, online.

This has empowered the company to provide to not just the B2B customers, but to reach out to the B2C market as well. BIGbox Asia currently carries notable brands such as Aik Cheong, OldTown, Nong Shim, Walkers and many more.

Protecting Their Employees

As the team of delivery truck drivers from DPO International continued to work during the COVID-19 period, they needed a way to ensure that their drivers are as safe as possible.

With HSBC’s Omni Channel solution, the company can now equip all of its team members with contactless payment solutions.

This solution will help them to operate more efficiently, not only by eliminating the hassle of cash collection but to help them streamline various collection methods of credit cards, e-wallets and QR codes.

The payments can be transferred in real-time, along with a single consolidated report sent to DPO International.

The food industry is complex and it requires great digital tools to lead to a more efficient food supply chain which is critical for DPO International. This is made possible through HSBC’s digital solutions, which evidently play an important role in DPO International’s operations.

“Digital solutions such as HSBCnet and Omni Collect have become key enablers for businesses like DPO International to navigate in the new normal. With full transparency and real-time oversight on cash management, trade solutions and access to contactless payment options, DPO International is able to centralise their credit control capabilities and manage suppliers more effectively while ensuring the safety and wellbeing of their employees. Our collaboration with DPO International exemplifies the benefits of leveraging on technology to increase scalability and resilience, and we are confident our digital solutions will empower more businesses to be more agile and emerge stronger during these challenging times.”

Karel Doshi, Managing Director & Country Head of Corporate, HSBC Malaysia

- For more info on HSBCnet, click here.

- To learn more on HSBC Omni Channel, click here.

- Read what we’ve written about HSBC in the past here.

Also Read: HP Just Launched An Affordable Plan For SMEs To Help With Digital Transformation

Featured Image Credit: (Left to Right) Harry Chong, Group Chief Financial Officer and Daniel Pans, Group Chief Executive Officer of DPO International™ and BIGbox Asia™

This 15-Year-Old M’sian Company Thrived During MCO, And Here’s The Solution That Helped

[This is a paid article with HSBC.]

It’s disheartening to see companies folding from the effects of COVID-19. But, essential companies have been thriving because their services are still needed more than ever.

Saluran Pasifik, one of the leading oil and gas equipment suppliers in Malaysia, had their own fights to tackle. The company was incorporated in Malaysia since 2005, and their clients also consist of companies within the oil and gas, shipbuilding, power plants and petrochemical sectors.

But COVID-19 brought to light issues in their older processes and these were what interrupted their operations throughout the lockdown period.

Impact Of COVID-19 On Business Operations

For one, because of the export restrictions added when COVID-19 struck, they couldn’t get important parts from their suppliers in Europe and it forced the company to relocate its supply chain to Asia.

Since their clients are companies offering essential services, the clients expected them to work and to provide their services without any hiccups. So, the expectations for them were high. Not to mention, some of their business processes were still done manually.

To make things worse, their suppliers also required them to transfer payments first before they can start work on producing.

With seemingly endless walls closing in on them, they realised that they were growing fast, but their digital capabilities did not. The looming COVID-19 related restrictions were being piled on as well, so they decided to step up their game.

Going Digital From Operations To Banking

Internally, Saluran Pasifik embarked on a digital journey in parts of their company procedures from operations to finance. All meetings were switched to virtual meetings and staffs were provided with work-from-home essentials during the MCO period.

As for dealing with suppliers and managing their finance operations, they reached out to HSBC to look for ways to transform digitally. And that’s when they were introduced to HSBCnet, HSBC’s digital banking platform.

With most of their supplies coming from overseas, it’s not surprising that they need to deal with a lot of trade documentation which can get complex and time-consuming.

By using HSBCnet Internet Trade Services, all processes such as making payments to suppliers, issuance of bank guarantees and letter of credit can be done digitally anytime and anywhere.

This improved their financial efficiency and provided them with the right financial tools in negotiating with their suppliers.

With the lockdown taking place throughout the world, they certainly made the right choice to go digital, as they’re now capable of making payments to their suppliers and conducting international trades without visiting any bank branches.

Gordon Lu, the Managing Director of Saluran Pasifik said that the partnership with HSBC and the move to digital helped them surpass their previous market share, marking the biggest increase within 15 years of operations.

This happened within the MCO period too.

“Our market share increased the most during the MCO period and digital is the key driver. Our banking tasks can now be done anytime and anywhere with HSBCnet. Through HSBC’s trade facilities, we have shortened our sales cycle and made our import trade much faster.

Gordon Lu, the Managing Director of Saluran Pasifik

Be Prepared For Currency Fluctuations

Like every company involved in international trade, Saluran Pasifik is exposed to the unpredictable foreign exchange risks. It is not a new phenomenon, but what they can do is be better prepared for fluctuations.

With the help of HSBC Evolve, Saluran Pasifik can hedge their foreign exchange risks carefully yet conveniently in just a few clicks.

They were also kept up to date with foreign exchange rates and the risks involved so they’ll never be in the blind when it comes to checking how the Ringgit is performing against other currencies.

Going digital has helped Saluran Pasifik to be more agile and allowed them to gain new market share and it was a crucial turning point for the company too.

“This is a great example of how digitalisation can unlock new growth for SMEs. As companies focus on their effort in creating the right products for customers, managing cash flow and operations is equally important. That’s where HSBC can help in improving both financial and operational efficiency of a business through innovative digital solutions. A smooth-running business ensures you can make and deliver your products optimally.”

Ranil Perera, Country Head of Business Banking, HSBC Malaysia

• To find out more on how HSBCnet can help your business, click here.

Also Read: Rentokil Initial Malaysia Takes Digitalisation A Step Further With This Payment Solution

Featured Image Credit: Saluran Pasifik

Rentokil Initial Malaysia Takes Digitalisation A Step Further With This Payment Solution

[This is a paid article with HSBC.]

You probably have seen Rentokil Initial Malaysia’s vans around the city centre before and would easily recognise it as a pest control business and hygiene service provider.

But what you probably don’t know is that Rentokil Initial Malaysia is the same pest control company that treated the soil around Petronas Twin Towers back in 1994. At the time, the landmark was still the tallest building in the world and Rentokil’s services kept it termite-free.

Rentokil Initial was founded in 1925 by Harold Maxwell-Lefroy, a professor of entomology (a study of insects) in the UK. It started operating in Malaysia since 1967 and grew into a regional hub for the Asia Pacific with a workforce of 1,400 employees.

The Money Challenges That Come With Growth

Traditionally, Rentokil Initial Malaysia had customers pay for its services via cash or cheque.

Because of this antique and manual payment process, the company struggled with collecting payments from the customers. Even after collecting payment, there are risks involved with cash fraud and basic human error.

Did You Know: Fraud can happen when malicious employees pocket the money themselves or when a customer files for a false refund, citing job not done or provide the business with a cheque that bounces.

As the business continued to grow exponentially, the issue of cash collection became more apparent as they tried to keep up with the increasing amount of payers from their different services.

To solve its problems, Rentokil Initial Malaysia created a new digital financial ecosystem with HSBC in 2017 to improve the company’s processes.

Banking Solutions To Keep Up And Avoid Mess Ups

With the help of HSBC’s Virtual Account, Rentokil Initial Malaysia was able to identify all their payers accurately without the hassle of matching them manually. This finance solution allowed the company to track all their business collections from different payment channels so there are minimal leakages.

HSBC’s Virtual Account has significantly reduced the turnaround time for their collection cycle too, and provided greater visibility of its overall cash position. With that, Rentokil Initial Malaysia has successfully streamlined its entire cash collection process across the different markets in the Asia Pacific.

“Speed is key. With digitalisation, we have converted a large part of our collections from cheque to virtual account solution by HSBC. Through this, it saves us a lot of time on closing. With that, our business collection is reduced from 4 days to only 1 day today.”

Soon Mei Fong, Finance Director of Rentokil Initial Malaysia

With most of its finance operations centralised in Malaysia, Rentokil Initial Malaysia can utilise HSBCnet, HSBC’s digital banking platform to approve payments to their suppliers within the Asia markets easily.

This is a simpler, effective and cost-saving solution for the company, as compared to having different approvals in multiple countries using different banks.

Going Contactless In The New Normal

With COVID-19 still present, many companies are looking to keep their buildings as safe as possible for employees and customers. So, Rentokil Initial Malaysia stepped up to the challenge and diversified to offer disinfection and surface cleaning services to both commercial and residential customers.

Given how contagious COVID-19 is, many people have started to opt for cashless payment, which is safer compared to physical cash.

Thus, the partnership between the company and HSBC continues in the realm of digital payments.

Utilising HSBC’s Mobile Collection, Rentokil Initial Malaysia’s customers can now make contactless payments via e-wallets or DuitNow QR. This is to ensure safety first for their customers as we embrace the new normal that practices good hygiene.

Rentokil Initial Malaysia’s story highlights the many benefits that digitalisation can bring to any regional or global hubs. HSBC’s digital solutions can also help your company improve business productivity and provide you with new ways to grow your business.

“We are proud to be Rentokil’s regional partner in its digital journey. With HSBC’s Receivable Management solution available across multiple locations, Rentokil can identify their payers accurately thereby improving operational efficiency for its regional hub in Malaysia. It also provides greater visibility of its overall cash position across the region. This partnership highlights how HSBC’s digital solutions can support in the digital transformation of regional and international companies.”

Vishal Karanwal, Country Head, International Subsidiary Banking, HSBC Malaysia

- Equip your business the right tools for expansion via HSBC here.

Also Read: This M’sian E-Commerce Platform Promised A 1-Day Delivery, We Put That To The Test

Featured Image Credit: Rentokil Initial Malaysia

How A Bank Was Pivotal In Chek Hup’s Expansion To 15 Countries

[This article is a paid feature with HSBC.]

If you’re a fan of instant coffee or tea, you would’ve heard of a brand called Chek Hup. Their products are available on the shelves of markets nationwide, from small stores like 7-Eleven to large-scale supermarkets like Aeon. But the brand didn’t grow in popularity overnight.

Founded in Ipoh in 1965 by the late Tan Soo Hor, Chek Hup originally started its business by selling rock sugar to the Malaysian and Singaporean markets. Then in 2000, the company ventured into the instant beverage market with the Chek Hup 3-in-1 Ipoh White Coffee.

Since then, they’ve added new products such as teh tarik, chocolate drinks and gourmet coffee (with rock sugar on a stick) under their belt.

One ever-present ingredient? Rock sugar. It is known as a healthier alternative to processed sugar. While processed sugar might be cheaper in terms of cost, they believe in sticking to their roots and prioritise taste first instead of going for the profit-focused route.

Bringing Rock Sugar Coffee To International Markets

For an ambitious company looking to grow and expand, it is not enough to just rely on the domestic market. And this is why in 2003, Chek Hup decided to revamp its business model and began its expansion in the Asia Pacific.

To scale up its export business effectively, Chek Hup sources its coffee beans from neighbouring countries while maintaining its production and assembly operations in Malaysia.

Furthermore, Chek Hup also relies on HSBCnet (HSBC’s digital banking platform), which conveniently authorises payments across 15 markets in the Asia Pacific, to manage the company’s coffee trade in Southeast Asia efficiently.

Did You Know: Malaysia is the world’s fourth largest exporter of coffee extract. In 2017, Malaysia exported around RM2 billion worth of coffee extracts to China, Thailand and Indonesia.

Managing Foreign Exchange Smarter

With such a robust export business, it is of great importance for Chek Hup to be able to minimise its foreign exchange risks and have complete visibility of its foreign exchange exposure.

This is made possible with the use of HSBC Evolve, an interactive platform that provides Chek Hup with access to HSBC’s depth of liquidity with over 460 currency pairs for their hedging requirements.

With HSBC Evolve, transparent live pricing is available from SPOT to forward, and rates can be booked easily with just a few clicks.

Dictionary Time: Spot pricing is the price of a commodity that is bought and paid for at that time, instead of predicted or future pricing. Example: Gold is worth RM300, but could be worth RM500 in the future. But since you’re buying it now, you just pay RM300.

Looking to the future, Chek Hup has set its sights for further growth within China as the nation embraces the coffee-drinking culture. And thanks to their partnership with HSBC, Chek Hup can tap into HSBC’s wealth of knowledge and an understanding of the market dynamics in China.

And they’ve already made their first step. In 2019 on Single’s Day (11/11), Alibaba Group revealed that Chek Hup was one of the top three Malaysian brands exporting to China.

As a leading international bank with a presence in 64 countries and territories, HSBC has always been supporting its clients at every stage of their journey with its well-established global network and expertise in international trade.

It is very useful to have HSBC when we want to understand the market. They are our first partner whom we go to find out more actual information for us to make good decisions.

Joseph Tan, Managing Director, Chek Hup

- For more information on HSBC’s banking solutions, click here.

Also Read: This M’sian Telco Startup Is Available In 200 Countries, Here’s How They Did It

Featured Image Credit: Chek Hup

With Too Many Cashless Payment Options, This Major Retailer Uses A Simple Solution

In the transition to Recovery Movement Control Order (RMCO), social distancing will be the main focus and one trend that’s on the up-and-coming is contactless payment in the retail industry.

The adoption rate for e-wallets skyrocketed during the COVID-19 outbreak and they have been one of the main choices for consumers when it comes to making contactless payments. But in this new normal, the situation is different for retailers. With the rising options for contactless payments, they must learn and adapt to different ways of receiving payments.

For the front end of the business, the cashier is required to know how to accept the different types of payment, and the back-end employees might have to struggle with reconciling the payments from various channels at the end of the day.

Clearly, there needs to be a better way for retailers to simplify their payment and collection process.

And there’s a major retailer that has recently made changes to their operations as they adopt the contactless payment trend. Sports Direct is UK’s largest sporting goods retailer and they have over 30 retail stores in Malaysia alone, offering more than 70 brands in their stores.

With its key priority to elevate customer experience throughout their shopping journey, Sports Direct now uses HSBC Omni Channel, a one-stop platform with a single interface for multiple payment types and easy reconciliation. With this addition, Sports Direct can provide a better retail experience for its customers and streamline their collection process.

The solution that HSBC offers to Sports Direct is a comprehensive one, which enables our business to adopt a single point of interface for payment acceptance covering both traditional and digital payments (cards, e-wallets) through a single platform, reducing the number of touchpoints in this ecosystem.

Paul Gibbons, Managing Director of Sports Direct MST Sdn Bhd

The Benefits Of HSBC Omni Channel For Sports Direct

1) A Single Terminal For All Payments

A cluttered counter-top is a common sight for businesses that accept multiple payment types. They have multiple payment terminals and multiple QR code stands on the register.

By utilising HSBC Omni Channel, payments via e-wallets such as Touch ‘n Go, Boost, Grab and conventional payments such as debit and credit cards can be accepted via a single smart terminal.

This not only simplifies the payment process for Sports Direct’s customers, but it also reduces the complexity for the cashier in handling various payment terminals.

At the same time, HSBC Omni Channel is fully integrated into Sports Direct’s Point-of-Sale (POS) system. That helps to reduce the need in training employees to handle different payment methods and minimises the chance of potentially keying in wrong amounts or other human errors.

2) Never Lose Track Of Payments

With the multiple types of payment channels, retailers often face difficulties in reconciling their reports.

By using HSBC Omni Channel, Sports Direct receives a daily report that captures transactions from all of their payment channels. This simplifies the reconciliation process for Sports Direct, and it helps them to keep track of all payments made in their stores.

It doesn’t just stop there! Sports Direct also receive payments made by their customers from all payment channels within the very next business day. This certainly helps Sports Direct to manage their cash flow better.

3) Keeping Up With Countless E-Wallets

With over 45 approved e-wallet providers in Malaysia, it will take a considerable amount of time and resources for Sports Direct to evaluate and implement each e-wallet into their business.

Imagine going through the hassle of negotiating and technical enablement with an e-wallet provider, let alone 45 of them.

By consolidating and enabling all major e-wallet providers onto their platform, HSBC Omni Channel was able to simplify the e-wallet implementation process for Sports Direct.

As a market leader in digital banking, we are committed to innovate and always prioritise end-user experience when it comes to designing solutions for them. Omni Channel is one of HSBC’s many new digital innovations to have been launched for our Malaysian customers this year.

– Shayan Hazir, Country Head of Global Liquidity and Cash Management, HSBC Malaysia.

With this solution, Sports Direct was not only able to adopt the contactless payment trend easily, but also to deliver an unrivalled customer experience.

- For more info on HSBC Omni Channel, click here.

Also Read: 5 Benefits Local Entrepreneurs Can Get From Alibaba Cloud

Image Credit: HSBC

3 Ways On How HSBC Is Helping SMEs To Get Through These Tough Times

SMEs employ over 66% of the total working population in Malaysia. They help to drive our economy, and if they suffer, the effects will be heavy and far-ranging.

The government acknowledged the importance of SMEs and announced assistance to SMEs in Malaysia to help tide them over this period.

Besides the government, there is a clear need for financial institutions and banking services to play their role to support these businesses.

HSBC, a bank with more than 150 years of history in Malaysia is also stepping up to help SMEs that are struggling, in 3 ways.

The goal is to be a helping hand and provide the support SMEs need from financing to day-to-day banking.

1. Get a Loan/Financing Deferment

Announced by the Bank Negara Malaysia on Feb 27th 2020 and Prime Minister Muhyiddin Yassin in the PRIHATIN Economic Stimulus Package announcement on March 27th 2020, banking institutions in Malaysia are to offer deferment for all loan/financing repayments for 6 months, starting from April 1, 2020.

Fact to note: A loan deferment basically means that there is a temporary suspension of loan/financing repayment obligation for a limited period of time, and there will be no late payment charges.

Taking this a step further, HSBC will not be compounding interest/profit during the deferment period because the bank understands that every cent matters to the SMEs.

This means that they won’t be charging interest on top of the accrued interest during the deferment period.

According to HSBC, all eligible SME customers are automatically opted into the deferment.

“We empathise with everyone who is currently going through a challenging time here in Malaysia due to the COVID-19 outbreak and therefore we have taken the decision for retail and SME customers—both the interest for conventional loans as well as profit on Islamic financing will not be compounded during the moratorium period, we hope this proactive effort will help ease the financial burden of our retail and SME customers.”

Stuart Milne, CEO of HSBC Bank Malaysia

If you’re a larger company and have experienced stress during this period, you can also reach out to HSBC to be included in this deferment. They have an extensive FAQ for the businesses who want to find out more.

2. Apply For Some Quick Financing Solutions

In its efforts to help alleviate the financial burden of SMEs due to COVID-19 outbreak, HSBC has made available the financing solutions offered by Bank Negara Malaysia.

With an allocation of RM13.1 billion1, these are the 5 financing facilities offered:

1) Special Relief Facility

RM5 billion allocated to assist with short-term cash flow issues. SMEs can obtain financing of up to RM1 million for up to 5.5 years, with a 6-month grace period and capped at 3.5% per annum. Available from 6 March 2020 to 31 December 2020.

2) Agrofood Facility

RM1 billion allocated to increase local food production for export purposes. SMEs can get financing of up to RM5 million for a period of up to 8 years. Capped at 3.75% per annum. Available from 6 March 2020 onwards.

3) SME Automation and Digitalisation Facility

RM300 million allocated to incentivise SMEs to improve efficiency and productivity. SMEs can obtain financing of up to RM3 million for a tenure of up to 10 years. Capped at 4% per annum. Available from 6 March 2020 to 31 December 2020.

4) All Economic Sector Facility

Enhanced financing access provided to SMEs with an allocation of RM6.8 billion. Eligible SMEs can obtain financing of up to RM5 million for a tenure of up to 5 years, with a capped rate of 7% per annum. Available from 6 March 2020 onwards.

5) Micro-Enterprise Facility

RM300 million allocated to increase access for collateral-free financing for micro-enterprises. SMEs eligible for this can get up to RM50,000 for a period of 5 years. Financing rate to be determined by HSBC. Available from 6 March 2020 onwards.

HSBC acknowledges the challenging situation of SMEs in these trying times.

They have recently introduced the Simplified SME Financing solution, so SMEs can get quicker access to capital used for day-to-day operations or in setting up new ventures.

These are the 5 main benefits of HSBC’s Simplified SME Financing:

- High Financing Limit: Get access of up to RM2 million for your business needs

- Expedited Approval: Quicker approval process to get ahead during these uncertain times

- Attractive Rates: Get cash flow with competitive profit rates

- Tangible-collateral free: Focus on what matters without tangible collateral*

- Flexible Repayment: Get a flexible repayment schedule for up to 5 years with no penalty for early repayment

*A guarantee from Syarikat Jaminan Pembiayaan Perniagaan (SJPP) is required.

3. Manage Your Business Finances Online

With the MCO in place, people aren’t allowed to go about just like they previously could. Even after the MCO lifts, many might still be reluctant to move around too much outside.

HSBCnet, the Bank’s digital banking platform can help SMEs to manage their business finances remotely and keep your business running under any circumstances.

It can be used anytime and anywhere, and was designed to simplify banking processes for SMEs.

The platform allows SMEs to handle operations ranging from payment to staff, providing real-time access to manage trade transactions, bulk payments to customised payment reports.

For example, if you’re still relying on banking cheques to pay your employees, HSBCnet allows businesses to transition to making online payments to staff.

On the platform, customers can also view live foreign exchange rates when making international payments and transfers. GetRate, HSBC’s foreign currency platform, can also help SMEs with features that’ll reduce currency costs and mitigate foreign exchange risk.

-//-

HSBC has stood shoulder-to-shoulder with Malaysians through ups and downs. The current situation is no different. HSBC understands that many business owners find themselves in a very challenging situation and is ready to help.

With these solutions, HSBC wants businesses owners to know that they are here to provide the support you need through this journey.

With the loan deferments as well as other financing services, that takes the pressure off the business owners who are now going through a very challenging period and trying to maintain business survival.

Source

1. Bank Negara Malaysia Press Release 27th March 2020

Featured Image Credit: HSBC