Meet the first-ever M’sian community builder to win Facebook’s coveted accelerator

Out of a pool of 14K global applicants for the 2021 Facebook Community Accelerator, only 128 were selected. Out of those 128 participants, only 19 were from the Asian Pacific region.

And from Malaysia, there were four.

The four communities that were selected included the Doctorate Support Group, Entrepreneurs and Startups in Malaysia, Gabungan Anak-Anak Palsi Serebrum (GAPS), and KakiRepair by KakiDIY.

Eight months ago, Vulcan Post spoke to all four to learn more about their goals with the programme. On May 12, we found out that one Malaysian community builder had made it to the finals and will be the recipient of US$30K additional funding—Johnson Lam of KakiRepair by KakiDIY.

Eight months of grinding

Johnson started the Facebook group in 2017 as a passion project, wanting to encourage others to learn how to fix and repair things instead of immediately throwing them out into junkyards. He had a clear mission of what he wanted, but he wasn’t entirely sure of how to achieve it.

That’s where the community accelerator came in handy.

Given an initial budget of US$50K, Johnson and his team created a development plan for the eight-month programme. Through the accelerator, they were given access and insight into Facebook tools. Participants were also able to experience new, exclusive features.

For instance, KakiRepair now has an online store within its Facebook group. Typically, only business pages can start shops on Facebook. On top of that, they now have sub-membership groups.

Through a direct connection to the Facebook product team, he learnt more about Facebook’s algorithm and technology, such as the AI features, which autonomously moderate the KakiRepair page for the most part.

Besides building his own community, Johnson was able to connect to other communities in the Asian Pacific cohort as well, even considering the other 18 participants “family members” now.

“We are connected with these like-minded community builders, so we share best practices, we share pain points, and how we manage conflict and keyboard warriors,” Johnson said. “We learn from each other’s mistakes to grow our group and our community.”

Even though the programme is technically already officially over, he says the group chat with the other members is still active.

Facebook also curated an esteemed panel of mentors and coaches from across the globe to upskill the cohort. This included experts on sustainability, growth, scaling, and even psychologists.

“It steered KakiRepair into ways we never thought was possible,” Johnson expressed.

A well-oiled, self-sustaining community

For years now, Johnson has been funding KakiRepair from his own pocket. But with the help of the community accelerator, KakiRepair has grown to become financially sustainable.

Firstly, the team launched a knowledge management platform website. Here, all the DIY ideas and repair tips can be found in a centralised space. Given that it’s Johnson’s own website, he can easily monetise it as well. As such, the platform is now fully self-funded.

The accelerator also shortened his five-year plan of creating a decked-out motorhome with all the necessary tools that can move around Malaysia to help with repairs. It’s an upgraded version of the now-familiar MakerVan, and is currently pretty much completed and awaiting roll-out.

Another project KakiRepair is working on is a six-tiered tool kit. And it’s not just any normal tool kit—each item in the kit will come with a QR code that leads users to the knowledge management platform, which then teaches you how to use the tool.

And as the icing on the cake, the group had 19K members when we last spoke to it. Now, it has 47K members and counting.

According to Johnson, the final stage of the accelerator programme will last until July, with the goal of finishing more than 50% of what has been planned out.

But KakiRepair has actually already achieved more than 100% of their plans since March, said Johnson. “I’m a bit of an overachiever. I’m targeting 1,000%,” he chuckled.

Since the team has already completed the five-year plan of creating a motorhome, Johnson is taking a headstart on his plan of bringing KakiRepair abroad.

In fact, at the time of writing, he might already be in the Philippines, planning to teach others how to host repair events.

The pandemic & floods threw a wrench into their plans

Of course, the journey wasn’t all sunshine and rainbows. There were certainly a few bumps along the way, with the obvious one being the pandemic.

At the beginning of the pandemic, Johnson said he was in a “depressed mode” and nearly deleted the entire KakiRepair group. He felt like the group wasn’t creating much impact.

“We can’t go out and fix stuff, and there are so many haters and comments out there saying, ‘Who is this fella?’, ‘So stupid, go and fix things for free’,” Johnson shared. “So, I was quite discouraged.”

But eventually, Johnson started to change the way he did things. He ran 30-minute live events at first that ended up running for two hours. It was then that he realised there was demand for such a service, and steadily, the Facebook group grew.

Another challenge came when the entire team was down with COVID at one point. Johnson himself suffered from a case of long COVID, and even feels its effect until this day.

“When I was doing demo day [for the accelerator], I had brain fog, and I wasn’t even myself,” he said. Thankfully, he managed to get his points across despite the illness.

The flooding that occurred last year was also an issue for the team, and it seemed like there was nothing they could do about the situation.

Then Johnson realised he could mobilise the community by starting volunteer programmes to help those affected by the flood fix their items instead of dumping them.

“This wasn’t part of the development plan,” Johnson said. “But it showed so much impact that it became a significant result in the development plan.”

The crew ran six repair missions, repairing over US$50K worth of electronic stuff, Johnson estimated. Their efforts also helped with KakiRepair’s branding and reputation. With a simple pivot, Johnson had turned an unfortunate circumstance into a beneficial one.

Being community-driven VS profit-driven

As our interview with Johnson came to an end, we curiously asked him a burning question on our minds.

With KakiRepair now monetising and being financially self-sustaining, where does he draw the line between staying as a community organisation versus turning into a business?

Did it come down to being community-driven versus profit-driven? “Yes, actually, the answer is already there,” he pointed out.

At the end of the day, he clarified that there’s no right or wrong behind a community leader’s decision to transition their activities into being more business-focused. In fact, he said that Facebook encouraged that.

For him personally though, he’s opting to keep it community-driven. Of course, he’s aware that repair centres are a lucrative venture, but he has no plans to start one of his own now, or in the near future.

Instead, if anyone wants to start their own by utilising KakiRepair’s branding and influence, he welcomed them to get in touch for discussions.

Empowering other Malaysian leaders

2022’s Facebook Community Accelerator is likely to happen soon, and for those interested in joining, Johnson had some pointers.

He listed three criteria for community builders. First, you should be sure of what you want for your community. Secondly, you should be clear about the impact you’re providing.

The third is being able to sustain the community to scale and grow. This includes sustainability not just in terms of finances, but also content.

2021 was the first year that Malaysians were able to join the accelerator, making KakiRepair the first-ever Malaysian group to receive additional funding and essentially “win” in the programme.

With KakiRepair leading the way, Johnson hopes to see more Malaysians thriving through the Facebook Community Accelerator.

Also Read: Affiliate marketing differs from influencer marketing, but how, and who is it fit for?

Featured Image Credit: KakiRepair by KakiDIY

From ShopBack to Circles.Life: These 5 S’pore startups may join the billion-dollar “club” in 2022

It’s 2022 and things are looking rosier than a few months ago. Economies are reopening and travel is back in the picture.

Last year, many Singapore startups clinched the highly coveted “unicorn” ranking. The startups include Carousell, PatSnap, Ninja Van, and Carro.

Factors that drove the high valuations were due to robust funding from private equity markets in the Southeast Asia region over the past few years, supported by a rising middle class and an increase in smartphone and data usage.

The pandemic also boosted tech-related sectors due to an increase in tech and digital adoption.

With the pandemic abating, it seems companies are still not slowing down on digitisation, having realised the importance of that when some were caught unprepared by the impact of Covid-19. It’s likely that more Singapore startups will continue to reach the billion-dollar valuation status in the near term, as the country’s startup ecosystem matures.

So how many Singapore startups will likely hit “unicorn” status this year?

ShopBack

ShopBack, an online shopping rewards app backed by Temasek Holdings Pte, is said to be in talks with potential investors to raise US$150 million to help finance its expansion, according to a Bloomberg report.

The funding round is expected to value the company at about US$1 billion. The Singapore startup offers cashback and other rewards for users. It has expanded to 10 markets including Australia, Taiwan, and South Korea.

In 2020, it raised US$75 million in a funding round that included investors Temasek and Rakuten. In 2021, it raised US$40 million in an investment round participated by Temasek, EDBI, East Ventures, Indies Capital, and January Capital.

Not long after, it bought buy now, pay later (BNPL) startup Hoolah to accelerate BNPL offerings to merchants and shoppers.

The startup showed a 150 per cent growth in revenue in 2020, compared to a year ago. It is said to have 30 million users on its platform and has helped facilitate over US$7.3 billion in revenue for more than 5,000 merchant partners.

In an interview with Yahoo in 2020, the firm had not ruled out the idea of an IPO in the near term, but CEO Henry had said that it remains focused on creating value for users and merchants in this period.

To deal with the pandemic, ShopBack has been extra-focused on optimising the business and rationalising its cost structure to operate more effectively with limited resources.

Funding Societies

This Fintech claims it is the region’s largest SME digital financing platform. It uses alternative forms of credit scoring and has disbursed more than US$2 billion in financing to businesses since it launched in 2015.

In Feb this year, it announced it raised US$144 million in an oversubscribed Series C+ funding round led by SoftBank Vision Fund 2. New investors like VNG Corporation, Rapyd Ventures, EDBI, Indies Capital, K3 Ventures, and Ascend Vietnam participated in the round.

Institutional investors also provided US$150 million in debt lines. This adds up to a total funding of US$294 million (S$395.58 million) which the company will tap on to further its expansion plans in Southeast Asia.

The previous funding round was a US$45 million Series C raised between 2020 and 2021.

The startup’s clients range from neighbourhood stores and e-commerce vendors to medium-sized companies who seek alternative forms of financing than bank loans.

The business provides revenue-based financing and is said to be quicker to disburse than bank loans. Although the products’ interest rates are generally higher than banks but they are lower or equal to credit cards.

Based on data from VentureCap Insights, its last valuation prior to the latest fundraise was at US$326.4 million as of 2021. The startup is likely to now have a valuation that’s more than US$500 million.

Startup data insights portal Crunchbase notes Funding Societies’ total funding amount raised to be at US$400.50 million.

Circles.Life

The Singapore based digital telco has been boosting its Singapore headcount since October.

It had close to 250 people and wanted to increase more staff – by 25 to 35 per cent – in 12 months (from October last year) to scale up its Circles X software offering. Circles X operates on a software-as-a-service revenue model.

In December last year, Circles.Life offered to buy back US$5 million in employee stock options ahead of a planned initial public offering. The company said that employee stocks awarded in the early days of the business have grown over 13-fold in value.

The startup raised US$48.9 million in Series C funding in 2019, which valued the company at US$544 million, VentureCap Insights data showed.

In Feb 2020, the firm announced an undisclosed funding round from Warburg Pincus to further fund growth and for expansion in new markets. The startup did not divulge the investment sum, but data from Crunchbase show that growth investor Warburg Pincus tends to inject a few hundred million dollars when investing.

The startup’s earlier investors include Sequoia Capital India, Singapore’s Economic Development Board investment arm EDBI, and Silicon Valley’s Founders Fund.

Circles.Life had said it would spend more than US$250 million to move into at least five markets by end-2020.

Kacific

Founded in 2013, this Singapore based startup is a next-generation broadband satellite operator that aims to provide fast high-quality broadband access at affordable prices to Asia Pacific.

It raised a total of US$307.30 million in funding over three rounds. The latest funding of US$160 million was in Dec 2019 from a debt financing round led by Asian Development Bank and GuarantCo.

This year, it said it has collaborated with ICT provider and network operator HGC Global Communications to boost critical connectivity across emerging markets in the Philippines. The providers offer infrastructure that will benefit the government and businesses in the country.

Kacific’s geostationary Ka-band satellite, Kacific1, was launched in Dec 2019 to provide connectivity to the underserved.

As the satellites are rolling out, the startup may have plans to raise more funds for expansion purposes.

If the satellites take off, the company may see a repricing of its valuation real soon, although it is likely to not disclose that piece of information even if it hits unicorn status for commercially competitive reasons.

Zilingo

The B2B retail platform co-founded by CEO Ankiti Bose and CTO Dhrub Kapoor in 2015 is reportedly raising US$150 million to US$200 million, in a report in February.

The deal could help it become the next unicorn with a valuation of over US$1 billion. In 2019, Zilingo had raised US$226 million in a fund raise led by Sequoia Capital, Temasek, and Burdal Principal Investments, giving it a US$970 million valuation.

The startup is just shy of US$30 million to hit that unicorn status. But that achievement might not be celebrated with Co-Founder and CEO Ankiti who has been suspended from her post.

The suspension is tied to Zilingo’s fund raising efforts. The process to raise funds meant that there would be a due diligence process required to check the company’s account books. This process turned into a probe into financial irregularities that involved Ankiti.

Ankiti was then suspended and the company’s various board of directors, which includes names like Shailendra Singh, the Managing Director of Sequoia India, quit.

This news came after the departures of Temasek Holdings’ Xu Wei Yang and Burda Principal Investments’ Albert Shyy.

Unless the funding round was scrapped after this high profile scandal, there might be a chance for Zilingo to make a comeback if it manages to resolve its management and board issues. But it will first have to do lots of fire fighting and get back the trust from investors and clients.

Deals continue to be active

Singapore continues to be a leader in funding and deals activity in Southeast Asia, thanks to the presence of high growth companies that has been years in the making.

Research from Google, Temasek, and Bain and Co show the region’s internet economy to double to US$363 billion by 2025. International investors are also hungry for ‘growth at scale’ investment opportunities, and Asia Pacific, especially Singapore, is an obvious market.

Observers are expecting more unicorns to emerge, following the momentum from last year. Time to catch a unicorn?

Featured Image Credit: ShopBack, Circles.Life, Kacific, Zilingo, Funding Societies

Also Read: Overcoming recessions and crises: How 65-year-old S’pore biz Metro diversified to stay alive

Going green: The rise of circular economy and how S’pore bizs are stepping up sustainability

Sustainability, recycling, carbon neutral, and eco-friendly have become such huge buzzwords in recent years.

In particular, a survey by YouGov revealed that 56 per cent of Singaporeans believe that businesses have a responsibility to prevent environmental damage.

This probably explains why more businesses in Singapore have begun to claim that they are sustainable and eco-friendly, and the public has in turn, increasingly scrutinised these businesses.

Awareness campaigns, questions about Environmental and Social Governance (ESG), and many other sustainability practices are increasingly gaining popularity and becoming commonplace.

All these efforts, in fact, are resulting in a change in the local economy — away from the pollutive models of the linear economy, and towards the sustainable model of the circular economy.

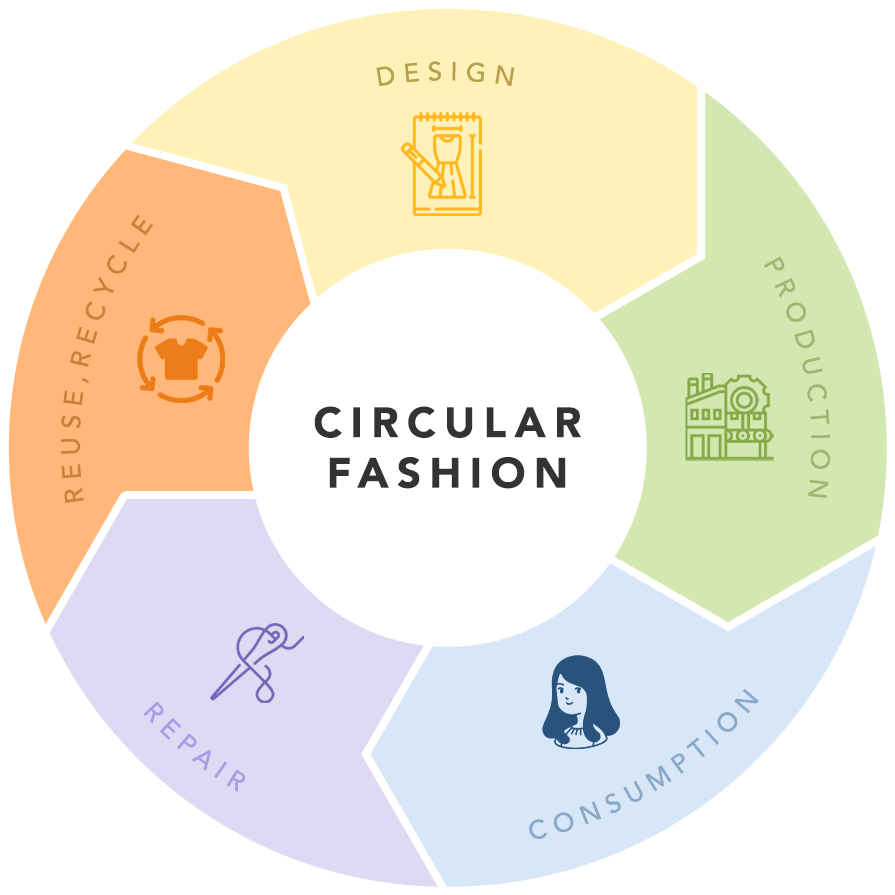

What exactly is the circular economy?

The circular economy is an ideal of how economies can, and should be run.

Instead of having waste from production and consumption discarded and to play no further use in the economy, production processes and products are instead designed so that waste and emissions are minimised, products are recycled and reused, and waste from one process is used to fuel another.

Waste is therefore minimised, and sustainability becomes common practice, baked into the design of the economy itself.

A model circular economy would have minimal waste and pollution, rely on renewable energy and materials, as well as the intensive use and reuse of products, to achieve these goals.

Circular economy in action: reusing products

Many businesses in Singapore can be said to be part of the circular economy. Carousell’s recent acquisition of REFASH is a prominent example that sees the merger of two such companies.

Carousell’s main focus is on having users sell their unwanted or unused goods online, encouraging them to make money off it instead of disposing these items.

REFASH has a similar business model. Rather than having individuals sell their clothes online, REFASH helps sellers to sell their unwanted clothes. Sellers are then paid a small fee after the sale has been made.

Essentially, clothes are reused by different consumers, prolonging the lifespan of individual pieces of clothing.

This is in contrast to fast fashion, which is part of the linear economy. The fashion industry worldwide produces 10 per cent of humanity’s carbon emissions, and many pieces of clothing are not reworn.

These business models focus on reusing products — after all, one man’s trash could very well be another man’s treasure.

Reducing emissions: cleaner inputs, intensifying use

The government is also moving Singapore towards a circular economy, with the Singapore Green Plan 2030. In response, the Land Transport Authority has begun to push for greater adoption of electric vehicles (EVs), and plans to phase out Internal Combustion Engine (ICE) vehicles by 2040.

There are also new initiatives to build “EV-ready towns” and install EV charging stations in HDB carparks to prepare for this transition towards EVs.

Businesses in Singapore are also helping the transition, with CRX Carbonbank launching a new carbon trading scheme for EVs.

SMRT has also begun transitioning its ICE vehicles to EVs, both for its taxi fleet and its bus fleet. These vehicles rely on electricity generated mostly from natural gas, rather than the more pollutive crude oil petroleum.

EV car sharing services such as TribeCar and BlueSG are also operating in Singapore, allowing multiple drivers to use the same car. These car sharing services have seen a spike in revenue and usership over the past few years, partly fuelled by the Covid-19 pandemic.

These activities and business models encourage more intensive use of the same vehicles, reducing the need for raw materials to produce vehicles.

Pushing businesses and governments to do more

Singapore has also seen a rise in social pressure for businesses to pay more attention to the environmental effects of their businesses as well. Civil society groups have sprung up to encourage awareness of the environmental impact of businesses and industrial production.

Activists are also getting younger, with even students taking it upon themselves to encourage eco-friendly practices.

Awareness pages like CASE Climate Change Mentoring also seek to raise awareness and provide climate education among youths.

In fact, the pressure for companies to have sustainable and eco-friendly practices has even spawned the term ‘green-washing’, which refers to when companies actively market their products and policies as environmentally friendly, even when they are nothing of the sort.

The government has taken notice of the practice, and aims to curb it via stress tests and technology.

While ‘greenwashed’ policies are not necessarily part of the circular economy, they are a testament to the strength of the eco-friendly sentiment in Singapore. Even when companies are unable to find ways to make their practices sustainable, they still hope to convince the public otherwise.

Awareness of the need for environmentally-friendly practices has also reached investors, who are increasingly demanding that companies exercise corporate social responsibility (CSR), with increasingly robust and detailed frameworks being set up for companies to declare the extent that their policies are environmentally friendly.

CSR, socially responsible investing and ESG have all become part of the national conversation, with the Taskforce on Nature Related Financial Disclosures taking the next step in demanding that sustainability should be more than just measuring and reducing carbon emissions.

Sustainability and eco-friendly practices are becoming the norm in Singapore, and the rise of the circular economy in Singapore has, almost without notice, slowly become the model on which we base future economic and social development.

These policies affect the lives of many Singaporeans — housing development regulations are changing, vehicle owners are increasingly incentivised to buy EVs, social enterprises are springing up, and the sustainability industry is growing. Businesses and consumers are increasingly driven towards choosing more eco-friendly options.

As these policies continue to be pushed out, the circular economy has slowly replaced the linear economy that many of us have grown accustomed to. Businesses and consumers who have yet to adapt, especially businesses that rely on greenwashing, would do well to adapt to this new reality.

Featured Image Credit: Centre for Liveable Cities

Also Read: A look at S’pore’s carbon-credit scheme for EVs and how it stands out from global efforts

With 350+ cryptocurrencies available on Poloniex, here are 3 features it brings to the scene

[This is a sponsored article with Poloniex.]

Disclaimer: Poloniex is not a registered recognised market operator under the digital asset exchange category by the Securities Commission Malaysia, therefore they have no license to operate in Malaysia. This content is for information purposes only, do not take this article as financial advice. Before making any key financial decisions, please ensure that you perform the necessary due diligence.

When dipping your toes into cryptocurrency trading for the first time, many crypto veterans recommend picking the right crypto exchange platform.

There are a number of things to consider, such as the number of tradeable cryptocurrencies available, the transactional fees, how secure it is, and how user-friendly the platform is.

The age of the crypto exchange platform plays an important role too, as older platforms are perceived to be more trustworthy compared to existing platforms that were launched not too long ago.

One example is crypto exchange Poloniex. Here are 3 features the platform has that might benefit the crypto trading community.

1. An ever-growing number of supported currencies

A platform that supports many trading options provides more investing freedom to the users as they can convert them to other up-and-coming currencies quickly.

Having a mix of different cryptocurrencies in your portfolio is never a bad thing, as these currencies were developed with varying functionalities in mind.

For example, while Bitcoin (BTC) is mainly used for transferring money, the Ethereum blockchain uses Ether (ETH) to pay for gas fees, which are used to pay for any processes done on the blockchain. These include minting non-fungible tokens (NFT), creating smart contracts, and more.

Another example is the MATIC token used to access Web3 applications built on the Polygon network with much lower fees and faster than the conventional decentralised applications (dApps).

So, if you own BTC but would like to mint NFTs or use the Polygon network, you can trade your BTC for ETH or MATIC to use those services.

2. Low trading fees across its pricing tiers

Another thing to consider is trading fees, which are taken from each transaction you make on the crypto exchange platform.

In 2021, the average trading fee on 30+ crypto exchanges was around 0.18% of the total transaction, which can be lowered if you have a much higher transaction amount.

However, even with the most expensive tier, Poloniex charges 0.155% of the total transaction, and the fee can be lowered further with a higher-value transaction or by using TRX, the token of the TRON ecosystem.

With lower transaction fees, you can make more frequent trades without incurring a higher cost.

3. The option to forgo KYC requirements for new users

To start trading on some crypto exchange platforms, they usually employ the know-your-customer (KYC) policy, which generally requires the users to be verified via their National Registration Identity Card (NRIC).

Some platforms like Poloniex are now starting to offer non-KYC accounts called Level 1 accounts that do not require any form of identification other than a registered email address and password.

Users can also start their investment journey immediately, instead of waiting for their identities to be verified before being able to trade.

The account has access to several services such as Spot trading, Staking, Futures trading, and buying Bitcoin with cards, with some limitations.

Note that these Level 1 accounts also come with limited functionality though, such as only allowing users to withdraw only up to US$10,000 a day, or up to US$50,000 a day if you enable 2 factor-authentication (2FA).

To upgrade your account to Level 2, you must complete all the KYC checks. Your account will have the previous restrictions lifted, and your maximum withdrawal per day will be increased to US$1 million per day.

-//-

Using eight years of experience thus far, Poloniex has plans to improve the crypto exchange platform further. These improvements include a new trading system to enhance trading speed, price-matching, improved API latency, and security for a better investment experience.

They have also just launched Poloniex Global Tour which aims to share more latest news and trends in the blockchain industry.

They want to run more campaigns with attractive prizes to reward existing and new users in the future too.

Poloniex is available on Google Play Store or the Apple App Store.

Also Read: Affiliate marketing differs from influencer marketing, but how, and who is it fit for?

NFTs in M’sia this week: Our local KFC is bringing the food chain to the blockchain

Last week, we saw a local artist who came up with an NFT Raya song, and MyEG promoting responsible car ownership and NFTs at a go.

This week, we’ve got fast food and the Illuminati to talk about.

From food chain to blockchain

We’ve previously covered the story of MyeongDong Topokki setting up an NFT restaurant in Genting Highlands. Now, another fast food chain in Malaysia is jumping on the bandwagon.

KFC Malaysia released 11 NFTs, a nod to the brand’s 11 herbs and spices secret blend. Named Original KFC Moments, the collection is made up of artworks by local artists including Wilson Ng, Book of Lai, and Arif Rafhan Othman.

The NFT reveal was part of its latest “Finger Lickin’ Good” campaign. It aims to reignite the shared love for Finger Lickin’ Good KFC moments, which the brand believes resonates with all Malaysians.

Eight of the artworks were made available on OpenSea on May 10, while three of the remaining artworks were up for grabs via a contest on KFC Malaysia’s Instagram page.

In line with the marketing campaign, to win a KFC NFT, users could write in a comment about their personal heartfelt moments featuring KFC.

Looking at the OpenSea page, it appears that some of the NFTs, particularly the ones reserved for the giveaway, have already been transacted multiple times. The lowest bid is now going for 0.1 WETH (about RM841 at the time of writing), while the highest is currently 0.9 WETH (about RM7,575).

Did you know: WETH is essentially a “wrapped” ETH token. For cryptocurrencies, a “wrapped” token is nothing but an empty vessel that contains the original asset. The process of wrapping helps use a non-native asset on any blockchain.

NFT holders will receive a monthly RM20 KFC e-voucher for delivery orders made on the brand’s app or website.

Chief Marketing Officer Chan May Ling told Advertising + Marketing Malaysia that KFC Malaysia strives to be at forefront of the latest in technology and innovation.

According to her, the brand is original, unique, distinct, and irreplaceable, like NFTs. Thus, venturing into the world of non-replicable digital assets is one way to further express KFC’s brand identity.

NFT art meets streetwear… and the Illuminati?

Recently, a local NFT project had Instagram users speculating it was working with the Illuminati. Though the release of this project happened a few months ago, we found it worth featuring after chancing upon the story of its shortcomings and successes, posted by the NFT project’s creator on Twitter.

Stoned, State of Mind (SSOM) was a collaborative NFT project between Stoned & Co, a streetwear brand located in Subang Jaya’s SS15, and Frame of Mind, an NFT artist on Pentas.io.

The collab released 11 NFTs in its SSOM Genesis collection, each on sale for 25 BNB (RM27,224.40 at the time of writing), which were sold out a month later.

To create attention for its launch event, SSOM was featured on a Lot 10 billboard around mid-February 2022. It featured motifs of weed, psychedelic patterns and colours, and a single eyeball that, of course, people pointed out as being the symbol of the Illuminati.

In spite of the accusations, SSOM drew enough attention at its launch event that Frame of Mind claimed attendance was full. It even saw event participants including members from the Pentas.io community, and 8sian (a known name in the world where NFTs meet fashion).

Frame of Mind described this project as a personal milestone for being their first NFT project to collaborate with a Malaysian fashion brand.

Moving forward, we’re definitely anticipating more collaborations of this kind as local brands increasingly catch on to how NFTs can be their new marketing strategy, as well as a potential revenue stream.

- If you’ve got something NFT-related to share that’s both exciting and locally-relevant, hit us up with your story at malaysia.team@vulcanpost.com.

- Read more of our NFT content here.

Also Read: 5 ways this crypto platform simplifies the investment process for beginners & pros

Our newest teammates are dependable, hardworking, and non-human. They’re Dyson devices.

Dyson is known for being one of the most technologically advanced, innovative companies in the household appliances industry. I dream of the day I can furnish my own place with their appliances, but using them in our office is the closest I’ve gotten to this so far.

At the office, we were using Dyson’s Pure Cool air purifier TP04 for a year before the MCO pushed us into WFH. We’ve also had the privilege of keeping our office clean with the powerful Dyson Cyclone V10 Absolute+ vacuum cleaner, and still depend on it today.

Now, our team has moved back into our newly renovated office, and Dyson has generously sponsored us with more high-tech appliances to add to our space.

They include a Dyson Lightcycle Morph floor light, Dyson Purifier Cool Formaldehyde air purifier TP09, and a Dyson Pure Cool air purifier TP00. Here’s how we have been utilising them around the office.

Dyson Lightcycle Morph

When you think of standing lamps, I’m willing to bet that it looks nothing like the Dyson Lightcycle Morph worth RM3,999. The brand has a way of making regular household appliances look rather innovative, and it’s no different for its standing floor lamp.

The black unit we got was tubular and futuristic-looking, and at first glance, you might not even realise it’s a lamp. It’s 125cm tall over a round base, with a long, jointed arm that can swing 360 degrees on a horizontal plane.

It can also be turned 360 degrees on a vertical axis, so you can point it at whatever you want without moving the 6.1kg lamp around too much.

Depending on the mood you’re trying to achieve, you can adjust the brightness and whiteness of the light too, making the Lightcycle Morph multifunctional.

It can be a reading light. It can be a task lamp. It can be a spotlight, or part of your three-point lighting setup for photo or videography.

Or, if you don’t feel like turning on a full set of lights, shining the lamp against the wall can create soft indirect light to reduce eye strain.

If you swing the bulb back over the metal central column dock, it locks in with a magnet and illuminates it, transforming it into a muted, ambient light. Though it looks like a heating unit you’d find in colder climates, rest assured that the device itself doesn’t heat up your space even after being on for hours.

This is likely due to the Lightcycle Morph’s Heat Pipe cooling technology. With it, Dyson claims that the lamp’s LED bulb can last up to 60 years without burning out even with eight hours of use a day.

If you’re in a dimmer house or office with limited natural daylight, the Lightcycle Morph lets you simulate the lighting situation outside. This can be controlled through the Dyson Link app that allows you to choose your location to mimic the natural lighting outside.

Using this feature, I’ve also heard of use cases where the lamp can be used as a light alarm of sorts. It supposedly triggers your circadian rhythm by waking you up as the sun rises, since the lamp mimics natural daylight.

While I personally haven’t tested this myself since I don’t sleep in the office where our Lightcycle Morph unit resides, it can be helpful to those whose space lacks a window facing the outside world.

The auto-brightness takes the ambient light of the room into account and will adjust the intensity of the lamp to compensate.

If you aren’t too meticulous about your lighting controls, you can just use the tangible controls found on the Lightcycle Morph itself. This allows anyone to control the light’s settings too without having to download the app.

On the top of the lamp, you’ll find a large on/off touch-enabled button, and two slide controls next to it that allow you to choose the intensity of the light and its whiteness.

Along the side of the lamp are keys to toggle the daylight setting, auto-brightness, and motion sensors.

The motion sensor is a power-saving feature that’ll switch the light off when it’s not in use. It’s less ideal for scenarios where you won’t be moving much (like when reading or working at your desk), but comes in handy for temporary lighting in specific areas.

Dyson Purifier Cool Formaldehyde air purifier TP09

The Dyson Purifier Cool Formaldehyde (DPCF) is built with all of the features of preceding Dyson purifiers and costs RM3,299.

Not only does the purifier capture pollen and allergens through HEPA H13 and activated carbon filters, but it is so far the brand’s only purifier that eradicates toxic formaldehyde gas continuously in an 81 cubic-metre room.

Briefly, formaldehyde is a pungent-smelling colourless gas that naturally surfaces from organic compounds. In layman terms, it’s those strong fumes you’d get from fresh paint and varnish, or musty carpets.

We were lucky to receive our white/gold purifier unit shortly before we moved back into the office. The space was newly painted, with plenty of new furniture as well as dusty old decor we brought back in.

With the Purifier Cool Formaldehyde turned on as we settled in, the fumes from the freshly painted walls were not much of a bother, and neither was the dust. If you’re someone who gets headaches from chemical fumes and is extremely allergy-prone like me, you’d appreciate this feature.

We were so excited to see the air purifier in action, we forgot to take pictures of the initial air quality level. If you’ll take our word for it, it started at 12 and dropped to three within a few hours.

The numbers essentially point out the air quality (AQ) levels in the room. The higher the number, the poorer the AQ, and vice versa. The ideal number you’d wanna reach is two, for the AQ to be considered safe.

To simulate how well the air purifier is able to rid of fumes in the air, we lit a match next to the device and watched as the AQ levels shot up. I was impressed by how quickly it went back down to a healthy AQ level again in under five minutes.

There is also a Diffused mode on the purifier which diverts airflow through the back of the machine. It’s meant to purify the air around you, which can be helpful in the event of strong cooking fumes or smoke in the air.

Other than the AQ levels displayed on the LCD screen, you’ll also find information on the temperature, humidity, pollen, and CO2 concentration in the air.

This purifier works by catching pollutants from the purifier section that makes up the base of the fan. The bladeless fan will then project clean air back out across the room with 350-degree oscillation. It is best to prop the purifier unit against a wall corner so that the whole room will be able to feel the breeze from the fan.

My colleagues placed the Purifier Cool Formaldehyde in the middle of their seating area, and even on a low setting of four (out of 10), they could stay cool enough without the aircond throughout most of the day.

As the Dyson Purifier Cool Formaldehyde is another smart home device, it connects to the Dyson Link app too for remote control and air quality monitoring.

Of course, all controls can also be accessed without the app, via the purifier’s remote control that can be magnetically attached at the top of the device.

Dyson Pure Cool air purifier

Sometimes, you might be on a tighter budget and are looking for a simpler fan/air purifier unit that gets the job done.

The Dyson Pure Cool air purifier might just fit this bill, but note that it doesn’t come with the Dyson Link app support.

For RM1,499, the Dyson Pure Cool air purifier is equipped with basic purification features via its HEPA filtration that captures pollen, bacteria, and pet dander particles from all angles.

Similar to the flagship model above, particles sucked in by the filter are projected out to provide cooling air by oscillating 350 degrees through Dyson’s signature bladeless fan.

My colleague, Rikco was the main user of this purifier unit, and using it on a higher setting of six, he was able to remain cool in his private office that doesn’t have air conditioning.

While we didn’t measure how purified the air was in his room with the Dyson Pure Cool turned on, Rikco did report that the surrounding air felt less “stuffy” whenever the unit was running.

-//-

Overall, the air purifiers from Dyson have been a welcome addition to our space, helping us save on energy usage by keeping us cool without relying too heavily on air conditioning.

To add, with their air purification abilities, I’ve been hearing fewer sniffles around the office from me and a few of my colleagues who were usually triggered by minuscule allergens in the air pre-MCO.

As for the Lightcycle Morph, there’s much more to be explored. Our video team has yet to fully play around with its creative possibilities, but I can already imagine the various lighting effects we could create with it.

Also Read: Affiliate marketing differs from influencer marketing, but how, and who is it fit for?

End of a fad or sign of maturity? NFT sales collapse by 75.1% since September 2021

Disclaimer: Opinions expressed below belong solely to the author.

It’s not the best of periods for the crypto world with the wipeout of Terra Luna and a market-wide drop in cryptocurrencies, with BTC falling below US$30,000 for the first time since December 2020.

All of it is rather overshadowed, however, by the collapse of the NFT market since its autumn peaks.

Wall Street Journal reported drops of up to 92 per cent in the average number of sales between extreme days (i.e. the peak in September and the lowest days in April) and, on the whole, the market is down by 75.1 per cent in monthly averages in May — after a brief recovery from around -82 per cent last month.

The drop in active market wallets is a tad smaller, with 60 per cent gone from a maximum of little over a million last year — but still substantial, particularly for a novel industry that was expecting (and briefly experiencing) explosive growth.

Is this just a transitional decrease, or is the interest in NFTs waning across the board?

The “Bitcoinisation” of NFT

Careful observers will point out that while the number of transactions has gone down, the actual value saw a surge this month, not far from the figures it registered last year.

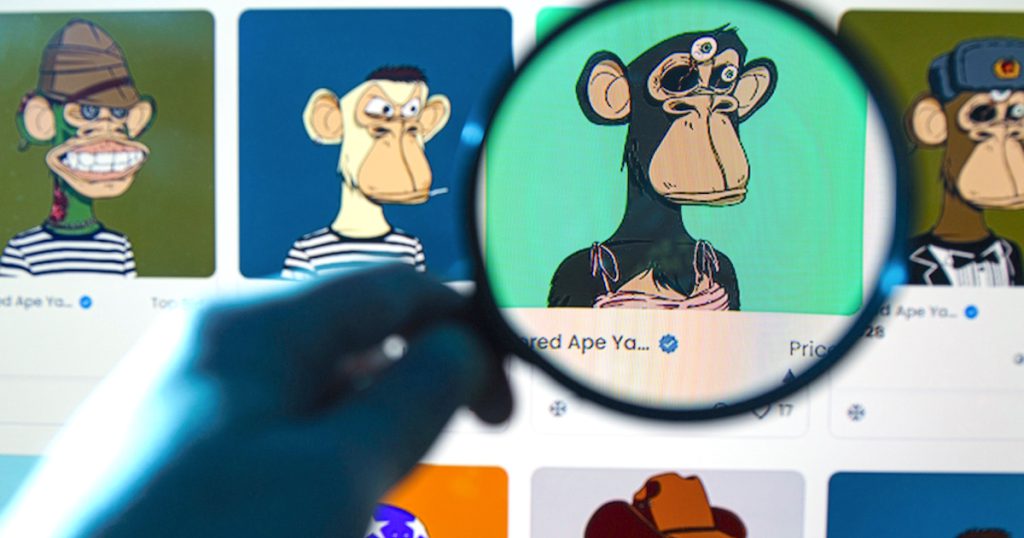

These observations are entirely accurate as the market received a boost earlier this May with the launch of metaverse NFTs by the company behind Bored Ape Yacht Club (BAYC), Yuga Labs.

The Otherside, as it is called, is promised to be a 3D MMORPG in the BAYC universe and the Otherdeed NFTs that the company launched are effectively unique properties that participants can buy in it.

The launch that broke Ethereum

When Otherdeed dropped on May 1, the interest was so high that it effectively broke the entire Ethereum blockchain, leading not only to a slowdown in transaction processing across the entire network, but also skyrocketing gas fees, which reached as high as US$44,000 just for the right to mint the NFT purchased.

Many were even more unlucky, with thousands of dollars lost to failed transactions that Yuga took on itself to refund later.

The collection sold out nearly instantly, netting Yuga over US$300 million. In total, close to US$900 million has been transacted for Otherdeed in the past two weeks, contributing to a spike in total sales figures, with one virtual plot fetching over US$1.6 million.

But, while some may consider it a positive sign that interest in NFTs is still high, I would rather suggest it’s a process similar to the one that is visible among cryptocurrencies — centralisation of activity around a single, or a few, top performer(s). Among currencies, it’s BTC and in the NFT market, it’s BAYC.

Therefore, as you can observe in the chart above, while the sales report occasional surges whenever popular collections make their debut, the overall number of sellers has gone down by 60 per cent — from over 500,000 in the autumn, to a little over 200,000 today.

The promise that NFTs could liberate the creatives, enabling them to make money off their work through its sale to supporters and subsequent trade appears to be in retreat.

The truth is, as ever, that most projects are destined to fail and the handful of top performers will rake in most of the money. Yes, there are examples of smaller contributors also achieving a degree of success, but they are rather an exception than the rule.

The NFT paradox

They say that “there’s no such thing as bad publicity”, but it seems to me that this old adage is being proven wrong in the NFT world (and a few other places).

While publicity generated by the most successful projects is getting eyeballs and contributes to the surge in interest among some, it is actually discouraging everybody else.

Despite the fact that the idea behind NFTs is sound and practical, giving digital creators almost infinite ways of cultivating communities and monetising benefits from participation in them, most people are likely unaware of these promises.

What they are aware of, however, is the incessant bombardment of headlines reporting on yet another collection of thousands of JPG avatars of monkeys, birds or some pixelated cartoons which sell for obscene amounts of money.

Some hail it as the next big thing and another way of getting rich quickly on the internet, but regular users smell a scam and stay away because it’s too outrageous and too unbelievable.

As a result, the market turns inward. Instead of attracting more people with simple, useful services, it becomes cult-like, while everybody else is trying to keep their distance.

It’s a shame, of course, because the technology itself could — when deployed properly — transform the ways we interact online and how entire communities become self-sustainable economically (without the need for third-party middlemen), rewarding their owners and participants alike.

Alas, it has become a victim of its own success, or at least success of the few who attract most of the attention (not always for the best reasons).

So, answering the question from the title: is this collapse in activity by both buyers and creators a sign that NFTs are just a fading fad or is the industry growing more mature? In my view, it’s the former but hopefully preceding the latter.

The interest is clearly waning among both the users and creators, but it may actually help the industry in the long run. The hype never lasts, so what matters is what is left after the dust settles.

It’s not BAYC that we should look at, but smaller communities of people who know what they’re doing and support work done by people they admire. NFTs will hit the mainstream when they’re no longer seen as a get-rich-quick scheme. The question is, however, whether they are able to shake off this label with time.

Featured Image Credit: Stewarts Law

Also Read: Forget about decentralisation: Singapore wants to become a hub for centralised crypto