From law to street art: He quit his lawyer job to start S’pore’s first indoor graffiti studio

Victor Tong hasn’t always held a career in the realms of entrepreneurship. The 31-year-old founder of Heaven Spot, Singapore’s first indoor graffiti studio, initially started his professional journey as a lawyer.

He trained at a local law firm where he assisted their real estate division with transactions related to the sale and purchase of land.

After Victor was called to the Singapore bar, he decided to practice in the area of private mergers and acquisitions (M&As) at an international law firm based in Singapore — but little did he know that this one decision would significantly change his career trajectory by sparking his interest in entrepreneurship.

When I practiced in the area of private M&As, I became fascinated with companies and how people built them. And that inspired me to make the switch and explore the world of business.

– Victor Tong, founder of Heaven Spot

Armed with a “modest war chest”, Victor launched Heaven Spot back in April 2021 and has never looked back since.

Bringing the art form of graffiti to Singapore

When asked about the inspiration behind Heaven Spot, Victor said that he observed a growing interest in street art, yet, there were no accessible platforms for Singaporeans to experience and explore graffiti as an art form in the city-state.

“The idea for Heaven Spot was sparked from noticing a potential gap in the market and a desire to bring the dynamic art form of graffiti to a wider audience in Singapore,” he explained. Consequently, he envisioned creating a space where individuals could “engage with graffiti art in a fun and accessible way”.

According to Victor, the term “Heaven Spot” is deeply rooted in graffiti culture. Heaven Spot refers to hard-to-reach, and often risky areas that graffiti artists choose to create their work.

“We wanted our name to reflect the essence of the graffiti art form and its adventurous spirit,” said Victor. Through Heaven Spot, the former lawyer aims to provide a supportive environment for Singaporeans to “explore their creativity, learn the art form [of graffiti], and express themselves through it”.

Heaven Spot is more than just an art studio. It’s a vibrant space where people of all ages and backgrounds can come together to express themselves through graffiti art.

– Victor Tong, founder of Heaven Spot

Heaven Spot broke even in eight months

Although the initial response was slow, interest in the indoor graffiti studio gradually started to pick up as the brand gained exposure through various media platforms and social media.

Apart from this, Victor also attributes Heaven Spot’s initial growth to the fortuitous timing of its launch. “We launched during the peak of COVID-19 — everyone was stuck in Singapore and were looking for something new and interesting to do,” said Victor.

Heaven Spot managed to break even within seven to eight months of its inception. Despite its early success, establishing the indoor graffiti studio was not without its challenges.

Being fresh out of law practice, Victor admitted that he knew “next to nothing about running a business other than the aspects of a company and contract law”.

There were many gaps in what I knew I had to learn. This included basic accounting, marketing, advertising, managing people, sales, and customer service, amongst others.

I’ve learned the ropes and kickstarted my entrepreneurial journey with Heaven Spot, but a funny thing I’ve come to realise is that the more I learn, the more I have left to learn.

– Victor Tong, founder of Heaven Spot

At the same time, the business also faced significant pushback from the local graffiti scene as they were viewed as “outsiders who were capitalising on the art form”.

However, Victor emphasises that Heaven Spot stands firm on its inclusive stance. “We hope to let as many people in Singapore try out the medium of graffiti, and develop greater awareness and appreciation for the art form,” he added.

Over the years, Heaven Spot has seen significant growth, serving a diverse and impressive portfolio of clients. This includes teams from FAANG companies, the Big 4 accounting firms, government agencies and even public schools.

While its client base may be impressive, Victor humbly proclaims that the biggest milestone Heaven Spot has achieved so far was to have grown its team to three full-time employees.

“This may not seem like much of an accomplishment to some, but being able to provide jobs is something that I am personally proud to have been able to do at Heaven Spot.”

The former lawyer is now juggling three ventures

Earlier in September this year, Victor launched another business venture, Manual Focus, a studio that offers film photography workshops.

Recognising the growing interest in both the authentic and tangible aspects of analog photography, he launched the film studio to educate people not only on how to use older mechanical cameras, but to also develop film and create their own analog prints.

Film photography has been a long-time passion of mine and I was wondering if I could potentially replicate what I did with Heaven Spot with a different experience offering.

I view Manual Focus as a lateral expansion of Heaven Spot and a challenge to find out whether I would be able to replicate the model that was successfully executed at Heaven Spot.

– Victor Tong, founder of Heaven Spot

Aside from Manual Focus, the former lawyer also runs Unspokin, a bicycle shop that offers build-your-own bicycle workshops.

Currently, Victor is personally overseeing operations at Manual Focus while simultaneously managing his team at Heaven Spot, who are responsible for running the daily operations at the indoor graffiti studio.

Meanwhile, Victor’s business partner oversees the operations at Unspokin for the most part as Victor has taken a “backseat” on the business ever since launching Manual Focus.

With his hands busy managing the film photography studio, Victor shares that he does not have any immediate plans for expansion, especially in Singapore, given the city-state’s relative small market size. Nevertheless, he is in early stages of exploring the feasibility for overseas expansion to serve nearby markets that may be similar to Singapore.

Through these ventures, Victor hopes to drive empowerment through art and to champion positivity and creativity. Ultimately, he aspires to “inspire and support individuals from all walks of life in discovering their creative potential and expressing themselves freely”.

Embark on your startup journey with MAS-regulated ANEXT Bank, one of Singapore’s first digital banks for SMEs.

Featured Image Credit: Heaven Spot/ Victor Tong

Also Read: From EV chargers to powering Pulau Ubin: How this S’pore startup is redefining energy storage

S’pore telehealth startup Doctor Anywhere secures US$40.8M funding to fuel healthcare innovation

In a resilient move amid a global funding downturn, Doctor Anywhere (DA), a tech-led healthcare company headquartered in Singapore, has successfully closed a US$40.8 million Series C1 extension round. The funding round saw participation from prominent investors such as Square Peg and Novo Holdings.

The additional capital injection is slated to accelerate next-generation healthcare innovation within the company and strengthen its presence in secondary care.

Doctor Anywhere aims to intensify efforts in product innovation, building a vertically integrated digital healthcare ecosystem to meet the growing demand for comprehensive and connected healthcare solutions that prioritise patient experiences and outcomes.

Despite challenging market conditions, the company’s robust performance and business model have attracted significant investment. Doctor Anywhere’s impressive growth has been fuelled by rapid customer acquisition, continuous product innovation, regional expansion initiatives, and the recent acquisition of specialist healthcare group Asian Healthcare Specialists.

These milestones have firmly positioned DA as a key player in the healthcare sector, poised to shape the future of healthcare in the region.

Tushar Roy, Partner at Square Peg, emphasised the firm’s confidence in Doctor Anywhere’s growth trajectory, stating, “Our continued investment underscores our strong conviction in DA’s growth trajectory and its emergence as the dominant digital health platform across South East Asia.”

Empowering users to take charge of their health

Founder and CEO of Doctor Anywhere, Lim Wai Mun, expressed excitement about the possibilities that generative artificial intelligence (AI) offers to advance their goal of empowering individuals to take charge of their health and well-being.

He noted, “In the next phase of Southeast Asia’s healthcare evolution, our goal is to empower individuals to take charge of their health and well-being with early detection and preventive measures against chronic illnesses.”

Dr. Amit Kakar, Senior Partner and Head of Novo Holdings Asia, highlighted their commitment to fostering personalised and intuitive healthcare experiences that lead to better health outcomes. He stated, “Our investment in Doctor Anywhere reflects our commitment to fostering personalised and intuitive healthcare experiences that result in better health outcomes. We firmly support the company’s vision to deliver patient-centric care through innovative technology.”

Doctor Anywhere has set itself apart with a tech-driven approach, leading to innovations like the industry’s first online supervised tele-antigen rapid testing (ART) service.

Building on this foundation, the company aims to introduce new service offerings, strengthen strategic partnerships, and explore acquisition opportunities to comprehensively fulfil and empower individuals’ healthcare needs throughout their health journey.

Featured Image Credit: Doctor Anywhere

Also Read: Borderless healthcare: Doctor Anywhere founder on building one of the largest “hospitals” in SEA

8 years into their online cake biz, this couple has opened their own dessert café in KL

Established in 2020, Kuké might be a business you mistakenly believe is the result of the pandemic.

However, even though the Kuké brand name only came to be in 2020, it actually has a much longer history.

Husband-and-wife duo Inn and Corina actually started their baking business in 2015, though the both the business model and its name was quite different.

Called Whipped Cakes at the time, the business was focused on being a cake supplier to cafes and restaurants.

But five years later, the two decided to shift their attention to serving customers directly. Given the pivot, Inn and Corina also decided to change the brand name to something more unique.

Pronounced “koo-kay” (think how a Brit would say cookie), Kuké has grown to open its very own dessert café just last month in November. To better understand the couple’s journey with the “desserterie”, let’s first go back to how they got into baking in the first place.

From banker to baker

Before she was the chief baker at Kuké, Corina was actually a banker. Meanwhile, Inn was in marketing in the education sector.

However, she decided to leave her job to care for her children around 2010. That was when she embarked on her own baking journey, which eventually blossomed into a home business.

Before Whipped Cakes, she was actually selling cakes to friends and family, but the couple saw an opportunity in the market to sell to cafes.

At the time, Inn recalled that coffee shops were booming, so the couple believed there was a demand to serve this clientele quality cakes.

“Over time, the economy became more challenging and we discovered that there was greater pressure to reduce the price of the cakes,” he revealed. “We tested several cheaper alternatives using cheaper ingredients but we didn’t like those creations and decided against this direction.”

The decision not to compromise their quality ended up being the catalyst for Corina and Inn to go direct to customers, whom they believed would better appreciate great-tasting cakes.

To mark the start of a new chapter for the couple, they also changed their name to Kuké.

“Whipped Cakes was created when we were supplying cakes and we thought a generic name would suit the business,” Inn explained. “Now that we were going to brand our business to the general public, we realised we have changed over the years.”

For one, Corina had found a niche in Asian flavours, inspired by mixed roots of Chinese, Filipino, Indian, and Western tastes.

So, the name Kuké was adopted, taken from the words “kuih” and “cake”.

Opening a desserterie

Running their dessert business, Inn and Corina always had an ambition to open up a bakery where customers could drop by to dine on their cakes.

Furthermore, during the pandemic, Corina had further experimented with various desserts, creating items such as tarts, choux puffs, and babkas. These were delicious (at least, according to Inn), but required batch orders.

“Opening up a cafe makes a lot of sense with these new offerings,” Inn pointed out.

With that, the couple began work on creating their dessert café. They moved from their old central kitchen, which was very spacious but not the most space efficient.

Remaining in the Sri Hartamas area, the café now features a smaller kitchen and a tiny admin office, but houses more bakers, a large dessert display, and a dining area that can seat up to 30 patrons.

“It’s much, much better now,” Inn shared proudly.

Other than bakes, the café menu also includes a range of coffee, teas, matcha, chocolate and some of their own specially created drinks. As a dessert café, though, they have no intention to start offering savoury foods—at least not in the near term.

Going forward, the team is focused on ensuring the physical cafe is a success.

“For us that means to have repeat customers and make it a place that the neighbourhood will think of when they want to have desserts,” Inn explained.

“In the medium term, we would love to be part of the established dessert dining scene in Klang Valley—a destination to try out and treat yourself. And perhaps eventually be regarded as one of the top must-eat cafes in the city.”

Not a cake walk, but a sweet journey

Much has changed for the husband-and-wife team over the years. Starting with eight cake flavours in 2015, Kuké now offers over 45 flavours of cakes, 20 types of pastries, and eight types of sweet breads.

This diversification certainly helps with staying competitive. From a consumer’s perspective, it feels like there have been more and more options of bakeries to choose from.

To that, Inn said, “I think competition has remained fierce and it has always been this way. There are always new players and they bring something fresh to the dessert landscape, while established players are also constantly evolving.”

Aware of the need to continuously grow, Kuké takes care to stay abreast of trends and won’t shy away from playing around with them.

If a new flavour arises from those trends that meets the team’s standards and expectations, it may very well become a new menu item for customers to try. That said, it’ll always have a Kuké spin to it.

“We are unique when it comes to our creations, following our own path and way of doing things,” Inn explained. “There is no need to make something just for the sake of it. If we just want a regular chocolate or cheesecake there are so many other bakers to go to. It’s not our goal to be just like everyone else.”

Aside from being unique, one of Kuké’s ethos is to make desserts that must taste good, because they must be worth the calories.

“We are a guilty pleasure,” Inn said. “We have the privilege to give customers joy and solace.”

Thinking back, Inn believes they should’ve started as a direct-to-customer business instead of going the supply business route from the get-go.

“The times were good but it required too much manpower and sacrifices for us,” Inn admitted.

“We are too much of an artisanal business, not willing to just accept customer requirements. We were not confident enough—especially as we didn’t have much industry experience—and thought that our cakes were not aesthetically attractive enough to compete with other bakers that make much prettier cakes.”

However, their eight-year journey, with all the lessons along the way, has brought them where they are now—a dessert brand with its own café, and much more to come.

Also Read: Earn RM2.4k/mo as an intern in the capital markets via the investED leadership programme

Featured Image Credit: Kuké

Don’t worry about higher GST – most Singaporeans are not going to really pay it

Disclaimer: Any opinions expressed below belong solely to the author.

The dreaded second step up in Singapore’s GST increase is upon us, with the tax increasing to 9 per cent from 1 January 2024. Many citizens and politicians have been opposing or protesting the hike from 7 per cent, which was still the rate last year.

But, upon closer look, most people have nothing to complain about, really.

Like most taxes in Singapore, GST is designed in a way that burdens wealthy consumers most — while the broader society, comprising millions of regular Singaporeans, stands to benefit.

To accurately understand the impact of taxation, we first have to consider what it buys us. And, in Singapore, it’s not only infrastructure, education or healthcare, but considerably more.

So much more, in fact, that on average, all Singapore residents receive more in government benefits than they pay in all personal taxes combined.

More than what you paid for

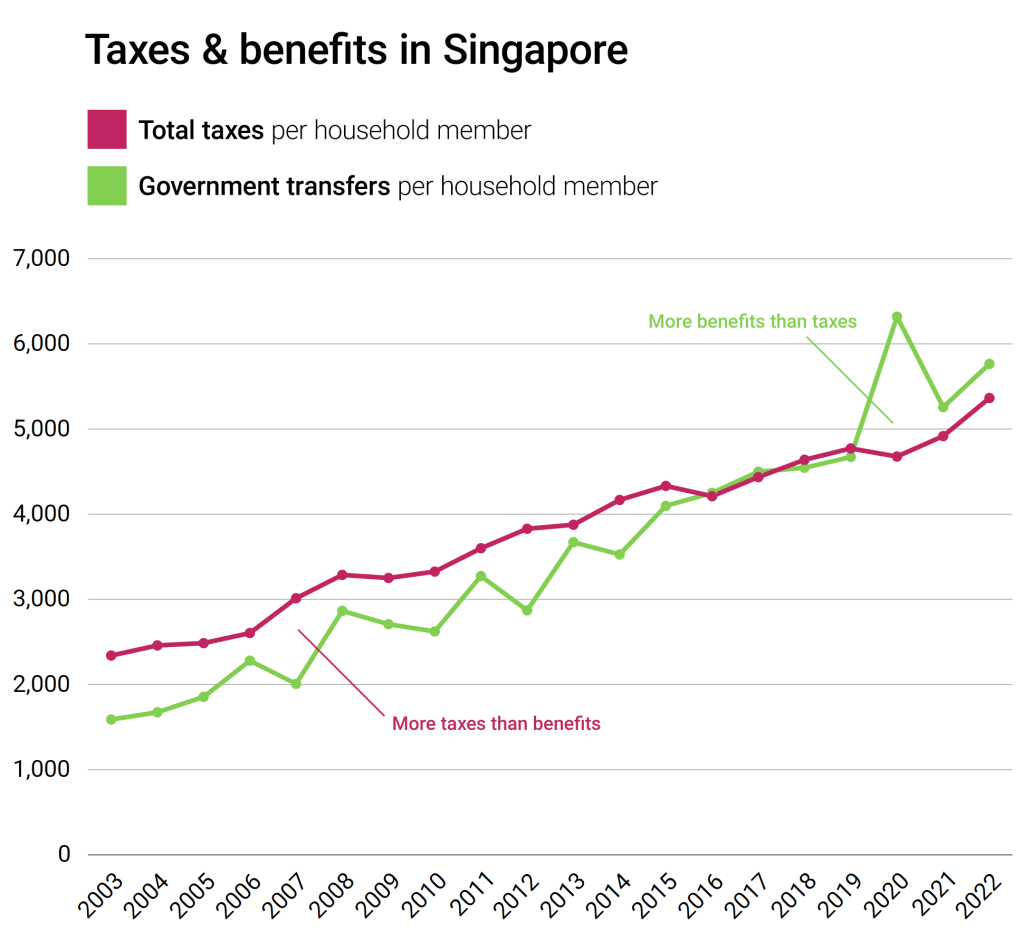

In 2022, the Singapore government collected an average of S$5,364 per household member across all households in the country, but paid out S$5,765 in various support schemes.

This figure is even more impressive considering that the Top 10% of the wealthiest households pay approximately 80 per cent of all income taxes, and the Top 20% contribute to about half in GST receipts.

In other words, since the above figures are only averages, it means that the vast majority of Singaporeans pay even less in taxes per household member, while receiving considerably more in return.

Please bear in mind that taxes refer to all taxes that resident households pay, including GST.

In other words, on balance, most Singaporean households not only already do not pay any taxes, but actually receive a net positive return from the government.

Eagle-eyed readers will point out that it’s obviously a result of the COVID-19 outbreak in 2020, when the government boosted support for the public and implemented additional measures to address rising living costs due to global inflation over the past year or so.

And that is true, of course — the pandemic has clearly led to higher spending. But the average between taxes paid and transfers received already reached parity in 2016, and had been quite near it in the previous few years.

In other words, since the richest have always paid disproportionately more, most Singaporeans had already been in a net positive position for a decade before the virus locked us all down for two years, with the money steadily redistributed from the wealthiest residents down.

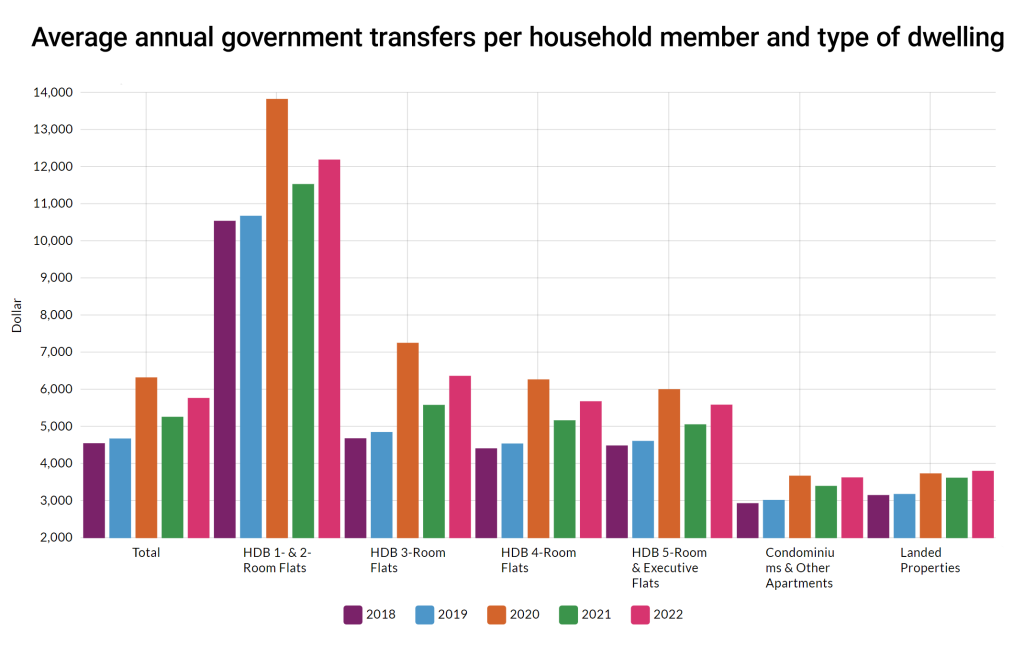

This is confirmed by another set of figures, which averages government transfers by the type of dwelling occupied by recipients.

Occupants of the smallest HDB flats tend to be the least well-off (and may frequently be elderly), so it’s not a surprise that they receive by far the most money — whether for education, health, old age, utilities, or any other category.

But, as you can also notice, the benefits received are at least around the average for the entire nation for almost everybody living up to a 5R HDB.

This means that condominium and landed property owners are the ones paying significantly more (as there are considerably fewer of them too), so that pretty much everybody living in public housing has their own taxes offset by the transfers received from the state.

Of course, it’s not unexpected since those who live in private housing in Singapore are usually quite a bit wealthier than the rest.

But what it also shows us is that they effectively fund public benefits for everybody else — as much as 70 to 80 per cent of the society, considering that this is how many Singaporeans live in HDB apartments.

GST? What GST?

The tax/benefit situation in Singapore is such that the government could, technically, abolish all personal and consumption taxes (and corresponding benefits, of course) and, on average, everybody would still receive a few hundred dollars per year extra.

Mind you, please note that it doesn’t even include expenses on infrastructure or defence — these do not even require your taxes to be paid for.

Of course, in this scenario, the individual situation would change greatly since the richest would end up receiving massive tax relief while most Singaporeans would lose enormous state support in healthcare, education or housing grants and subsidies, along with countless other benefits.

But this is why there are personal taxes — and why GST is going up — to get a few billion dollars more out of the richest spenders in Singapore, while most of the society continues to enjoy having their tax bills offset by handouts financing some of their most crucial needs.

Unless you’re a Top 20% taxpayer living in a condo or bungalow, the coming GST hike won’t really affect you. For every dollar you pay in taxes, you receive more than a dollar back. Not a bad deal.

Also Read: Between Oxford and Yale: NUS graduates ranked 9th most sought-after by global employers