“More than a woman’s issue”: Experts weigh in on challenges faced by S’pore’s female founders

Earlier in July, we did a deep dive into the startup scene in Singapore, where we interviewed four experts on whether the country lacks capable founders.

While we have determined this was not the case, one of our readers pointed out that only male voices were represented in the article. As such, we have reached out to two ladies active in the startup space in Singapore, either as venture capitalists or startup founders.

Well, it just so happened that our experts, Yuying Deng, CEO and founder of Esevel, and Anna Vanessa Haotanto, founder of Zora Health, have experience in both sectors; here are their insights.

“A capable founder is a generalist.”

Following the previous article, Yuying and Anna agree that beyond tangible metrics like revenue and user growth, being versatile in different areas and adapting to different approaches when needed are two key traits of “capable” founders.

Anna added that a capable founder must also create a strong company culture, build and lead a team, and sustain the company’s vision through difficult times. “To me, you need to always remember your values and vision and not waver when times get difficult.”

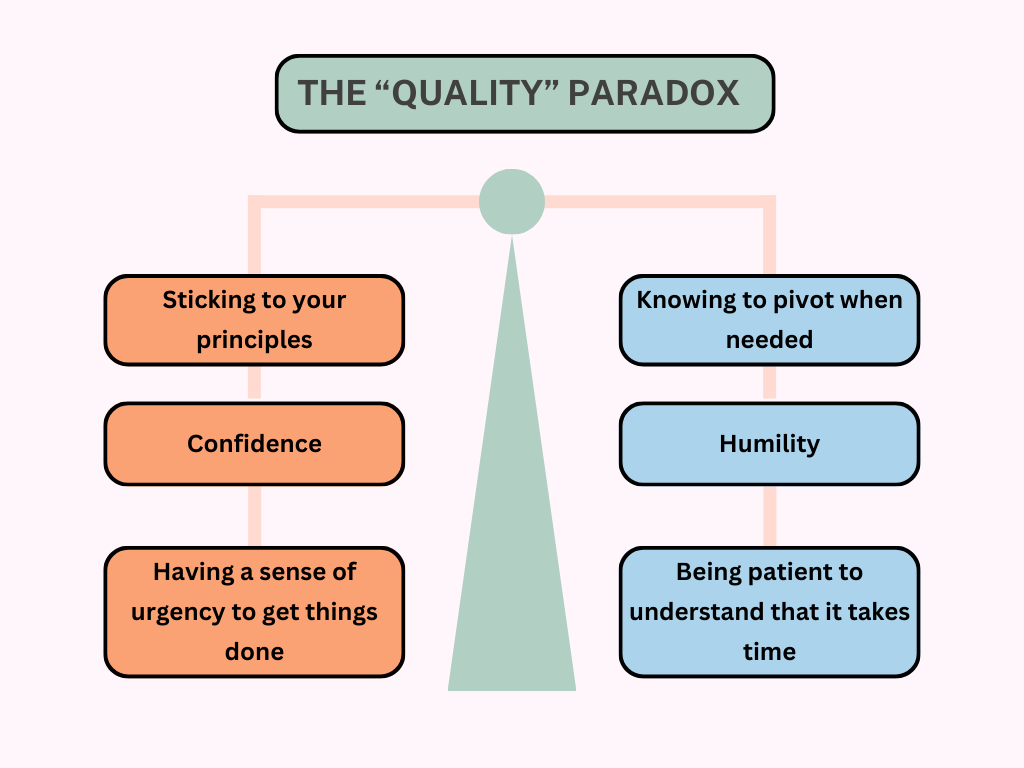

But one might wonder, what does it truly mean to be versatile? To Yuying, it is to master a paradox of qualities that “seem like opposites”.

She emphasised the need for entrepreneurs to listen, take feedback seriously, and take accountability for their mistakes. “The best entrepreneurs know they don’t have all the answers and are open to learning from others.”

Navigating the valley of death

Qualities aside, we need to acknowledge that the current economic environment has not made it easy for startups in Singapore to grow.

Due to inflation, many companies have become more conservative when managing their finances. Some choose to hire fewer employees, offshore operations to “less expensive” locations in the Southeast Asian region, or go fully remote.

Yuying highlighted that funding has “dried up” compared to the boom of 2021 and earlier years, inevitably increasing the pressure on startups to find their market fit in a shorter timeframe, which can be incredibly stressful.

“Companies that raised funds at high valuations in 2021 or before are now struggling to generate the revenue needed to justify those valuations. This puts them in a tough spot as they try to scale and grow in a more cautious market,” added Yuying.

On the other hand, Anna believes that while funding is available, the real challenge lies in securing “the right type” of capital.

She explained that investors have become increasingly cautious, which results in more stringent due diligence processes and higher expectations for startups to demonstrate traction and scalability.

“Finding and retaining top talent is a persistent challenge, especially in a competitive market like Singapore. Entrepreneurs often struggle to attract skilled professionals who are both affordable and aligned with the startup’s vision,” Anna elaborated.

Gender equality in the entrepreneurship scene

Aside from defining the characteristics of a capable founder, we are also curious whether gender plays a part in growing their business (spoiler alert: it does).

Thanks to social media, more women have come forward to “dismantle gender inequality and the structures that uphold it”. While women have been able to access opportunities with their male counterparts, there is still much more to be done.

Both experts agreed that there is a funding gap for women-run enterprises. According to Yuying, female founders receive less than 3 per cent of venture capital funding that male entrepreneurs typically secure.

She added that on top of the societal pressure for women to be business leaders and primary caregivers, many women internalise the same burden, leading to feeling burnt out—an experience that men might not have in the same vein.

In her previous interview with Vulcan Post, Anna shared that it took her 158 pitches to reach her target fundraising goal, where she brought up the occurrence of gender issues.

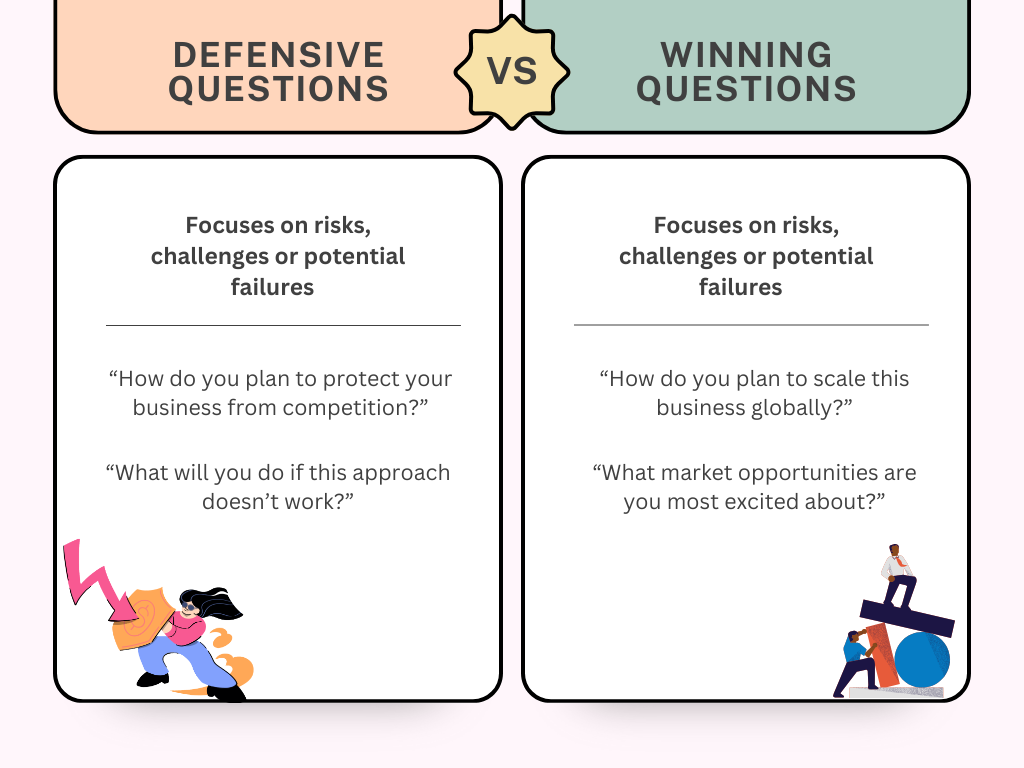

According to a study conducted by Harvard Business Review, women are more frequently asked defensive questions during pitches, interviews, and public forums, while men are asked more winning questions.

In essence, defensive questions implicitly assume their business is more vulnerable and require them to justify or defend their strategy and choices while winning questions assume the business will be successful and encourage the founder to highlight their vision and ambition.

The study also showed that the type of questions asked also has an impact on the amount of funding raised, with those being asked defensive questions only being able to raise an average of US$2.3 million in aggregate funds—seven times less than the US$16.8 million average raised by those asked winning questions.

This disparity means that women must work harder to shift the narrative from a defensive stance and pivot the responses to emphasise strengths and opportunities.

I think many women reach a point where they realise they have to be five times as good to get the same recognition as their male counterparts. But the good news is that most women are ten times as good, if not better.

So rather than getting stuck on the inequalities, I’ve found it more empowering to keep pushing forward, staying focused on what I can change, and proving what I’m capable of.

Yuying Deng, CEO and co-founder of Essevel

That said, Anna quickly clarified that the challenges she encountered during the fundraising process were not gender-focused. Instead, there was a lack of understanding and education about the specific issues her company aimed to address: women’s health.

[Fertility and women’s health] are not easy or common topics, which sometimes led to misunderstandings or underestimations of the market opportunity. The key was to educate potential investors about the importance and impact of women’s health, particularly in areas like fertility, where the need is significant but often overlooked.

I believe that increasing awareness and understanding of these critical issues is essential for driving not only investment but also broader support and recognition of the value that companies like Zora Health bring to the market.

Anna Vanessa Haotanto, co-founder of Zora Health

Granting more access to resources

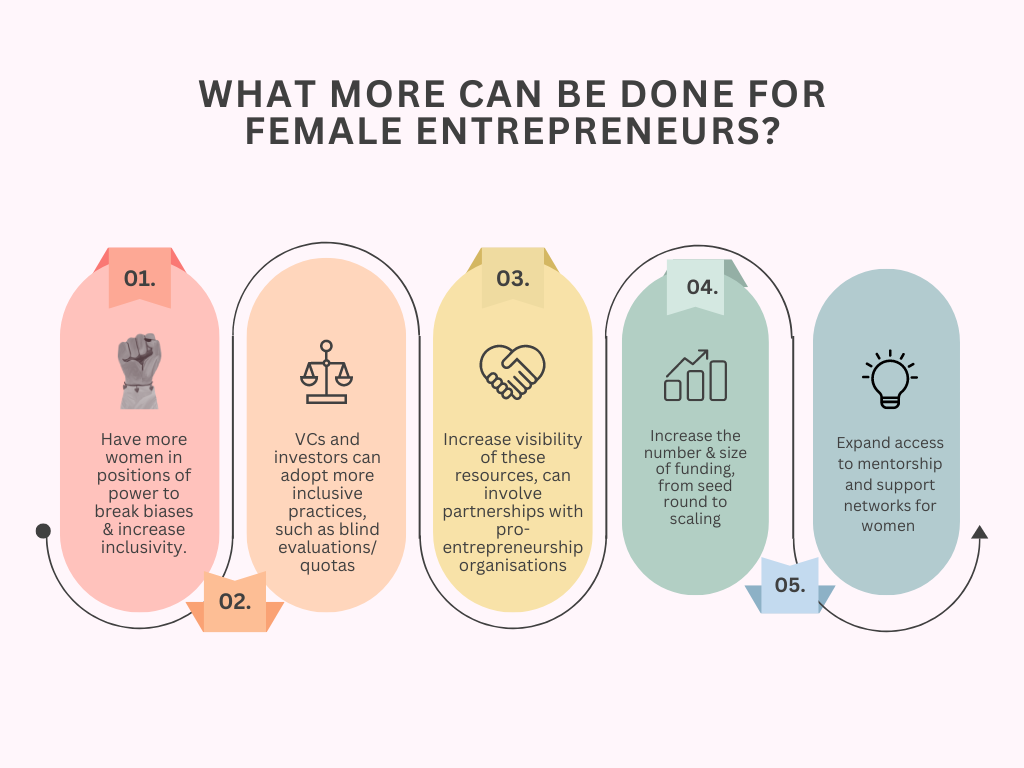

While there has been an increase in funding for female entrepreneurs, both Yuying and Anna believe that there’s room for improvement.

Yuying explained that while it is a great idea in practice, she has not seen many who have received these financial resources. “This suggests that while the intention is there, the accessibility of these funds might be lacking.”

It is also vital to create more funding opportunities and ensure that it can reach female entrepreneurs who could benefit from them. On top of that, giving them access to networks, mentorship, and training can help them leverage these funds effectively.

Yuying added that this is more than just a women’s issue—by overlooking female entrepreneurs’ contributions, we’re ignoring the potential of half of the world’s population.

“Imagine the innovations, businesses, and solutions we’re missing out on by not fully supporting women in their entrepreneurial journeys,” she added.

Beyond closing the gender gap, Anna believes that all entrepreneurs, regardless of gender, are assessed on the strength of their ideas, execution, and the impact they can create.

Ultimately, the definition of capability remains the same across both genders. However, the number of hurdles they face is different.

We’re not saying that one has it worse than the other—instead, we need to acknowledge that granting accessibility to resources to those in need can help boost the growth of our local startups.

ANEXT Bank, a Singapore-based digital bank regulated by MAS, empowers startups with easy and accessible financing to fuel their business growth and expansion.

- Read more stories about Singaporean startups here.

Also Read: Is Singapore lacking capable founders? Experts weigh in on S’pore’s startup scene

Featured Image Credits: Yuying Deng via LinkedIn, Zora Health

S’pore’s Supermom raises S$18M in Series B funding to expand its AI-driven platform in SEA

Singapore-based Supermom, a leading AI-powered consumer data platform, recently raised S$18 million in a Series B funding round.

Led by Granite Asia with participation from Hearst Ventures, Qualgro, and AC Ventures, this funding follows their S$8 million Series A round last December.

Supermom plans to channel this fresh capital into expanding its AI tools, international reach, and team across Southeast Asia to further support consumer engagement and brand activations, it said in a press release.

AI vision for brand-consumer connections

Founded by Joan Ong, Luke Lim, and Rebecca Koh, Supermom serves a growing ecosystem of over 10 million parents across Southeast Asia, along with 6,000 online communities.

With major clients including global names like AIA, Kimberly Clark, and Unilever, as well as regional giants like Mandiri and Indofood, Supermom’s platform creates data-driven insights that enhance brands’ connections with family-centred consumers.

Supermom’s AI tools are designed to analyse data and provide actionable insights that benefit both brands and platform users. By creating accurate user profiles, Supermom can tailor brand activations, helping families discover relevant products while allowing users to earn rewards.

This data-driven approach also aids in content generation by users, making the platform more engaging and meaningful for families seeking relatable brand experiences.

One standout feature of Supermom’s latest AI application is its Knowledge of Moms (KOM) graph, which uses predictive algorithms to refine how brands reach and engage with key consumer segments.

By identifying and analysing influential parent figures within its network, Supermom offers brands a powerful, predictive way to deliver more personalised, effective campaigns to the right audiences.

According to Supermom’s CEO, Luke Lim, this technology is a vital piece of the puzzle in their mission to build SEA’s largest AI-driven data platform focused on families and brands.

“We are grateful to our investors—both new and returning—for believing in our vision and extending their support,” said Lim.

“With Granite Asia’s leadership, we’re confident in our growth potential and the impact we can make by connecting brands and consumers on a more meaningful level.”

Aiming for regional expansion

Already operational in Singapore, Malaysia, Indonesia, and newly in Vietnam, Supermom is primed to continue its regional expansion.

The company’s strategic plan includes growing its workforce from over 100 to around 150 employees across Southeast Asia, positioning itself to capture even more of the region’s growing parent market, reported The Business Times.

“We plan to triple our engagements and grow our user base, deepening our tech and making it more robust and efficient, and realise this in the next 12 months,” Lim was quoted as saying by the new portal.

The latest investment signals strong confidence in Supermom’s vision to harness AI in building predictive consumer profiles, ultimately transforming how brands interact with family-focused consumers.

With its newest funding, the company is well-positioned to deliver on its mission and capitalise on the opportunities of Southeast Asia’s vibrant young demographic.

Also Read: How this Malaysian SME overcame financial hurdles to grow their business with this 1 solution

Featured Image Credit: AC Ventures

Khazanah & PNB lost around RM43.9mil in “fire sale” of FashionValet, MOF reveals

On Monday evening, the Ministry of Finance (MOF) revealed that Khazanah Nasional Bhd and Permodalan Nasional Bhd (PNB) had sold their RM47 million stakes in FashionValet for just RM3.1 million in late 2023, in what some called a “fire sale”.

This came from a written reply on the Parliament’s website to a query from Puchong MP Yeo Bee Yin, who had asked for details of the transaction, and whether other government-linked companies or government-linked investment companies had also invested in FashionValet.

In 2018, Khazanah had invested RM27 million into FashionValet while PNB invested RM20 million, both for minority stakes in the company, according to MOF’s published reply.

At the end of 2023, Khazanah and PNB had then sold their stakes to NXBT Partners Sdn Bhd, an investment holding company owned by Afzal Bin Abdul Rahim, who is also the CEO of TIME dotCom Berhad.

Afzal is also a founding board member of Endeavor Malaysia and a senior independent director at CIMB.

The nature of NXBT Partners is “Activities of holding companies”. A holding company typically exists for the sole purpose of controlling other companies.

NXBT now owns 51.25% (2,513,467) of the company’s total shares (4,904,325), with other shareholders being Vivy Yusof and her husband Fadzarudin, along with a number of corporate bodies.

MyEG Capital is also a shareholder with 283,246 ordinary shares. MyEG Capital had actually given FashionValet its seed funding of RM1 million in 2012.

Back in September, we looked into FashionValet’s financial documents to verify various facts and numbers, and you can read about our findings here.

For now, it’s unclear where FashionValet is headed, but perhaps with Afzal at the helm now, we’ll see some changes being made to turn business around, as its reported earnings for the financial year ended December 31, 2023, stood at -RM127,576,371.

Also Read: How this Malaysian SME overcame financial hurdles to grow their business with this 1 solution

Featured Image Credit: Khazanah Nasional / PNB

These M’sians quit being auditors to start KGB, now the burger chain has grown to 7 stores

If you’re from the Klang Valley, chances are you’ve come across this popular Malaysian burger chain at least once—or maybe even indulged in one of their mouthwatering American-style burgers. For me, they’re undoubtedly in my top three go-to burger spots.

In case you’re still wondering which burger joint I’m talking about, it’s none other than KGB (Killer Gourmet Burgers). Though I’ve seen them around for a few years, I was surprised to learn that they’ve been in the F&B scene for over a decade.

Here’s how this beloved spot for burger lovers got its start.

The dream that started it all

In 2013, Steven and his business partner Joey, who were both working at one of Malaysia’s largest accounting firms, decided to trade their auditor suits for aprons and frying pans, embarking on a culinary adventure that would bring American-style burgers to the heart of Malaysia.

Why that? A similarity they both shared was a passion for food, especially American comfort cuisine.

But their journey wasn’t just about burgers—it was about taking control of quality, crafting a unique brand, and providing top-notch, freshly made meals at reasonable prices.

Their initial plan was to franchise an international burger chain, but after realising that the high costs of licensing and shipping processed meat from abroad would make their burgers unaffordable for most, the duo had a lightbulb moment: Why not grind their own meat fresh daily?

This decision set the foundation for KGB’s success, allowing them to offer premium burgers without compromising quality or price.

Eventually, another partner joined them. “Nazrie joined us in 2017 as a junior store manager, and his determination and keen business sense quickly earned our respect, leading to his promotion as a business partner,” Steven told Vulcan Post.

From humble beginnings to local favourites

KGB’s first outlet was a modest half-shop lot in the Bangsar Telawi area. With Steven helming the kitchen and Joey managing the front of house, they started with a small team of four and opened only for dinner.

The response was overwhelming. Within a few months, the founders said that KGB made its way onto several “top burger joints” lists, quickly building a loyal customer base.

They also shared that at the time, Malaysia’s burger scene lacked the variety seen in Western countries. “At the time we started, America was experiencing a ‘better burgers’ movement, which was reshaping the landscape of traditional fast food and upscale gourmet restaurants.”

“This fast-casual burger trend stood out for its use of premium ingredients, affordable prices, and laid-back settings, making high-quality burgers more accessible,” they said.

Inspired by this, KGB brought two iconic cooking styles to their menu: the ‘smash technique’, where patties are smashed onto a searing griddle for a crispy exterior, and ‘flame grilling’, which locks in juices while imparting a smoky flavour.

These techniques, paired with regional United States influences like the West Coast’s emphasis on fresh ingredients and the East Coast’s premium beef blends, filled a gap in Malaysia’s burger market. The result was a mouthwatering range of burgers that pushed the boundaries of what Malaysians expected from this classic dish.

Perfecting the burger formula

Steven and Joey didn’t rush into the burger game; they took time to perfect every aspect of their menu. From experimenting with different cuts of beef to tweaking the meat-to-fat ratios, creating KGB’s signature patties was no small feat.

The buns took even longer to get right. They needed to be soft but sturdy enough to support the juicy patties and rich toppings without falling apart.

Once they nailed the buns and patties, crafting toppings became the fun part, allowing them to experiment with flavours and textures that brought their creations to life.

Among KGB’s bestsellers are the Animal Style burger, a classic for minimalist burger lovers, and the Truffle’d Swiss Mushroom burger, an indulgent gourmet option for mushroom fans.

For those who prefer chicken, KGB’s menu doesn’t disappoint, with the Hot Mess burger (my personal favourite), a Southern fried chicken delight topped with onion rings and hot sauce aioli, being a fan favourite, said Steven.

But KGB’s appeal doesn’t end with beef and chicken. The restaurant also caters to vegetarians and vegans, with plant-based options crafted from scratch in-house.

Despite their American-inspired roots, KGB hasn’t shied away from experimenting with local flavours. From nasi lemak and spicy salted egg yolk burgers to more adventurous offerings like the blue cheese durian tempoyak burger, KGB has become known for its creative, limited-edition menu items that tap into Malaysian tastes.

KGB draws inspiration from global cuisines, too. Specials like the Korean Ramdon burger and the Beef Wellington-inspired Christmas burger demonstrate their ability to merge Western burger techniques with international flavours, keeping the menu fresh and innovative.

The rise of American-style burgers

As Malaysia’s food scene evolves, so does the demand for gourmet American-style burgers. Gone are the days when fast food and street-side Ramly burgers dominated the market.

Nowadays, Malaysian palates are becoming more refined, and many are seeking premium burgers made with freshly ground meat, handmade buns, and high-quality toppings. This shift has created space for local brands like KGB to thrive.

Steven noted that international burger chains such as Shake Shack and Five Guys have entered the Malaysian market too, but he remains confident in KGB’s local advantage.

“We don’t have the high costs of franchise fees or branding, which allows us to offer great quality at more affordable prices,” he explained. While these international chains bring a lot of buzz, KGB’s consistent quality and attention to detail continue to win over customers, he said.

A burger for everyone

KGB’s expansion from its original Bangsar location to malls like Pavilion and Gardens, as well as suburban spots like TTDI and SS15 Subang, has been fuelled by customer demand.

With more people calling for KGB to open in other states, such as Johor and Penang, Steven and Joey are now strategising to make this dream a reality.

A new development for the brand is the KGB Diner, a concept launched at Tropicana Gardens Mall. This elevated version offers a refined dining experience with plated dishes, espresso-based drinks, and even milkshakes.

According to the founder, the diner concept is in direct response to customer feedback, catering to those who want a more elevated sit-down meal while still enjoying KGB’s gourmet burgers.

Some of their diner specials include Spiked Pastrami, Chile Cheeseskirt, Harlem Waffles and Philly Cheesesteak.

As KGB looks to the future, Steven and Joey are exploring the possibility of expanding beyond Malaysia. With its creative menu, loyal following, and dedication to quality, KGB has not only solidified itself as one of Malaysia’s go-to burger spots but also helped shape the nation’s growing appetite for premium American-style burgers.

As Steven says, “We’re proud to be one of the OGs in Malaysia’s gourmet burger scene. And we’re just getting started.”

Also Read: SDEC 2024 will explore the latest trends in semicon, AI & ecommerce, here’s how to join

Featured Image Credit: KGB and Alvin Leow

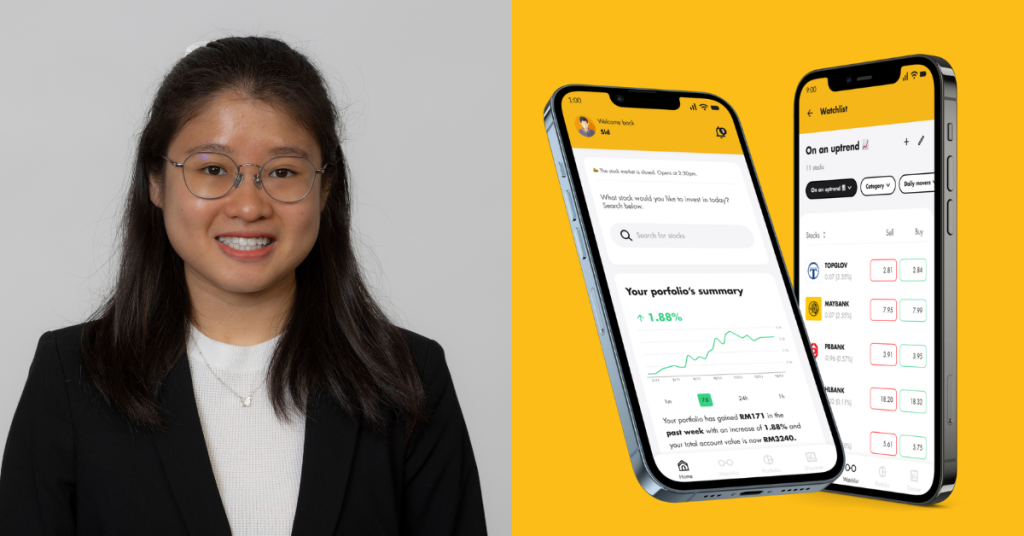

Most M’sians don’t know how to invest, so she created an app that aims to change that

Majoring in Economics with a minor in Statistics, Kuching-born Edrea Lee had graduated from the University of Michigan, Ann Arbor during pandemic times in 2020. Despite the uncertain job market, she landed a role in Deloitte in the US.

However, a year later, she was informed that she was not selected in the H1B permanent work visa’s lottery selection process.

Returning to Malaysia, Edrea joined Accenture Malaysia as a strategy analyst. Yet, two years in, she decided to pursue a Master of Science in Business Analytics at Imperial College London in the UK, which she’s still completing now.

“My goal for pursuing a Master’s was to gain a hard skill—namely data analytics—and also to take a break from the corporate world to reflect on my career choices and explore how to ramp up the process of building Vespid,” she said.

That’s right—all this while, throughout her professional career, Edrea has been running a startup on the side by the name of Vespid.

Venturing into Vespid

It started when a university friend introduced her to a platform called Robinhood, which features simple zero-commission stock trading to masses in the US.

Edrea and her friend had wondered, why isn’t there a Robinhood-like platform in Malaysia?

Vespid was established to answer that question. Aside from stock trading features, it would also educate Malaysians about stock investing, demystifying the perception that stock investing was like gambling.

“We chose the name Vespid, which is the scientific name for hornets or wasps that can live solitarily,” they said. “We wanted to empower Malaysians to be financially literate and be able to stand on their own two feet to make their own investing choices.”

Together with her initial co-founder, Edrea joined the University of Michigan Optimize Social Innovation Challenge, pitching Vespid as a simplistic and user-friendly stock investing platform for Malaysians.

They ended up winning some funding from this, giving them the confidence to start their entrepreneurial journey.

“I took a calculated risk where I didn’t throw everything into just Vespid,” Edrea said. “I still made sure I had a steady income in the day while I worked on Vespid.”

That’s why, even today, she balances her day job with building a startup.

“Of course this means I work extra hard, because I work on Vespid after work. But entrepreneurship was, and is, always tough and rough,” she reasoned.

Commitment aside, there were other challenges, such as the finance and investment industry in Malaysia being highly regulated and very expensive. There was a high fee and capital required to even qualify for a licence to run a stock trading platform certified by the Securities Commission (SC).

At the time, the founding team comprised just fresh grads who were 22 and 23. They were unfamiliar with the landscape, but they were also ambitious, and would cold-message connections on LinkedIn and Facebook to understand the landscape.

Eventually, they managed to launch a beta simulation stock trading platform with 80 to 100 testers. The feedback was quite positive, especially with the UI/UX and educational content.

Yet, that’s not what Vespid is doing today.

Pivoting to greener pastures

The decision to pivot came after the InvestSmart event at Mid Valley Exhibition Centre in 2022.

“During this event, I came across MooMoo who was marketing their plans to enter Malaysia and the region by 2023,” Edrea said.

A global simplistic, user-friendly, and low commission trading platform, MooMoo was obtaining the certification to be a licensed stock trading platform from SC.

This is exactly what Vespid was trying to achieve in the past two years.

Quickly, she understood that MooMoo would likely become a major player in the stock trading platform scene in Malaysia with its lucrative offerings.

Paired with all the other obstacles, the founder was no longer confident that Vespid’s concept would still hold water.

“Like all young adults and working professionals going through quarter life crisis, we as Vespid also went through an identity crisis of what we should become and be at this point,” she said.

But Vespid still had an element that users enjoyed—the bite-sized educational content on stock investing.

Gamifying personal finance literacy

Reportedly, only 36% of Malaysians understand basic financial concepts such as interest rates, inflation, and risk diversification. This financial illiteracy has made Malaysians vulnerable to scams, losing almost RM1.3 billion to scams in 2023.

Vespid wants to change this by creating a gamified platform for Malaysians to learn about financial concepts.

“Considering how Malaysians love playing games online and spinning Shopee coin wheels, we hypothesised that the best ways to engage Malaysians was through games that came with rewards,” Edrea said.

Thus, Vespid exists today as a one-stop gamified personal finance learning platform for Malaysians, targeting youths aged from 12 to 34. Think Duolingo but for financial literacy.

“We have lots of influencers and websites that teach about personal finance but these platforms lack personalisation and engagement,” Edrea said.

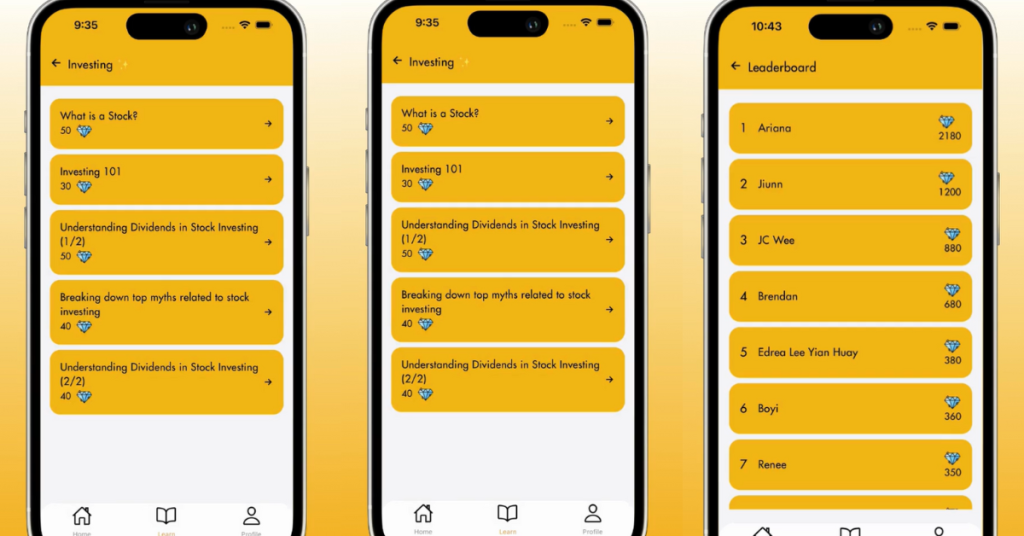

The current beta app features flashcards, quizzes, and a leaderboard as well as a referral system. There’s around 27 sets of flashcards and quizzes cutting across investing, budgeting, insurance, and identifying scams.

Launched in March 2024, the beta app has gotten around 70+ downloads. However, the number of active and returning users has been very low. To increase active users, Vespid is working on new gamification features such as a streaks system.

Editor’s Update [10/4/2025]: Edrea shared with Vulcan Post that their app is no longer in beta, and the full version is downloaded on Android here. It boasts a new feature, where you can earn rewards while learning and use those to redeem vouchers from brands like ZUS Coffee, Grab, and Shopee.

Monetising the business

Thus far, the startup has not monetised its beta app yet.

“This is one of the struggles we face, which is to convert users engaging with the content for free to subscribe and pay for the content,” she said.

As such, the team is focusing on a B2B business model, aiming to engage with organisations who might be willing to pay a monthly subscription to digitise and make engaging personal finance content for their customers or employees.

“In the future, we foresee that Vespid can also be used as a marketing and user acquisition tool by organisations to educate future and new users on their products,” Edrea added.

For now, the startup has been surviving on the RM40,000 funds obtained from the Optimize Social Innovation Challenge.

That said, the team is hoping to raise around RM60K to ramp up operations and development to secure their first B2B customer in the next one to two years.

Looking to the future

Currently, Vespid comprises two co-founders, Edrea and Riza. Based in the US, Riza is their technology lead. They’re currently enrolled in the MyHeart Innovate Accelerator run by Beyond4tech in partnership with Talentcorp and Cradle.

Through this, Edrea aims to shape Vespid into a more sustainable business model and build connections in hopes of securing the first B2B customer.

“The biggest challenge for us as an early-stage startup is to maintain the discipline and time commitment to building Vespid, given we all still have a day job,” Edrea said.

The founder shared that she’s proud of her team for taking risks to build Vespid despite family and personal commitments.

“Over the past four years, I have learnt that to overcome the challenge of maintaining discipline and commitment is to find purpose in the work we do, and surround ourselves with those who believe in our purpose as well and can motivate us to go through this journey together,” the 26-year-old founder said.

“The goal is to achieve a point where Vespid is up and running, making its first dollar and more, before we can work on it full time.”

Also Read: How this Malaysian SME overcame financial hurdles to grow their business with this 1 solution

Featured Image Credit: Vespid