Piyush Gupta reflects on his 15 yr tenure as DBS CEO and his decision to step down

DBS CEO Piyush Gupta is a man of action—he’s all about hands-on execution when it comes to his leadership style.

“There’s a proverb that says, leadership is about doing the right things, and management is about doing things right—I don’t believe that.”

To Gupta, leadership is about constantly adapting to market changes, and “rolling up your sleeves and getting into the weeds” when necessary.

At the Singapore Fintech Festival yesterday (November 7), the CEO reflected on his 15-year journey at the helm of Singapore’s largest lender, and spoke to Sopnendu Mohanty, the Chief Fintech Officer of the Monetary Authority of Singapore (MAS), about some of the key takeaways from his time leading the bank.

Creating a “culture of entrepreneurship”

Gupta is widely credited for driving DBS’ digital transformation—during his time as CEO, the bank doubled down on developing tech systems that reshaped much of the bank’s operations.

When DBS set out on its digital journey in 2014, it tried to “embrace some of the main macrotrends” in the fintech landscape, said the 64-year-old back in a 2017 interview with McKinsey senior partner Joydeep Sengupta.

“The DBS board took the view that the future for us and for our industry would have to be digital. We felt that if we didn’t lead the charge, frankly, we might die.”

The same year DBS began digitalising its operations, it launched the PayLah! mobile wallet, followed by other milestones, including the launch of a digital exchange, and the elimination of physical tokens for corporate transactions.

At the root of it all, Gupta attributes the bank’s success to its culture. Quoting management consultant Peter Drucker (popularly known as the “father of management”), he said that “culture eats strategy for breakfast”.

Over the years, I have come to realise the truth of that. If you only use analytics, strategy, thinking, you can direct—you can run a command, control organisation. You can get people to operate in a particular way, but it is limited.

Piyush Gupta, CEO of DBS

Within DBS, the CEO has strived to create a “culture of entrepreneurship”. As he puts it, “if you can create a culture of entrepreneurship and risk-taking, then it’s like magic.”

Reflecting on his past decisions, Gupta recalled initially opposing the implementation of PayLah! as he thought that a mobile wallet was “superfluous” and that people could just debit funds directly from their bank accounts.

After being persuaded by his staff though, the platform has now grown to nearly three million users. “So we do have situations [like this], where people have the capacity to be able to push the dynamics,” he added.

Pushing past setbacks

Innovation is essential for growth, but that’s what makes it risky. In recent years, DBS has encountered digital disruptions, including a two-day outage in its banking services in November 2021.

Reflecting on the bank’s digital capabilities, Gupta admitted, “I did not actually think enough, and hard enough, about the operational complexity that comes with a distributed microservice architecture.”

This architecture is commonly used for banking applications to provide fast, and reliable online services to customers. “The challenge is to enhance resiliency while advancing innovation and speed. If I were to do it again, I’d take a different approach.”

Gupta’s faced his fair share of setbacks, even on a personal level—yet, it was these very moments that were essential to his professional growth.

Before joining DBS, he spent 27 years at Citi, with a brief one-year break in 2000 to try his hand as a tech entrepreneur. As the internet boom surged, he launched Go41.com, only to shut it down within months when the dot-com bubble burst.

I pulled the plug on that venture within seven or eight months. And in truth, when I went through the process, it was challenging. I left a very thriving, flourishing career, and you know, apart from the loss of face, it was also [a loss of] self confidence.

Piyush Gupta, CEO of DBS

He struggled with his mental health, battling acute anxiety for a year. “I was 40 years old, and it took me time to find myself”.

Despite this, he described the experience as a “defining moment” for him—it changed his appetite for risk. “Once you’ve seen the bottom of the barrel, you get to think, how much worse can it get? It can’t get much worse than you’ve seen already.”

The incident had also profoundly impacted his career trajectory. His aspirations, prior to setting up Go41.com, was more so about climbing the corporate ladder: How could he get promoted? How could he move on the “fast track” and become a managing director?

But when he returned to banking, his perspective had shifted. For the first time, he thought about how he could make a meaningful impact—and make an impact he did.

Why did Gupta choose to retire?

Just three months ago, Gupta announced that he would step down from his position at the bank’s next annual general meeting on Mar 28, 2025, but what drove this decision?

The CEO shared that he started thinking about leaving DBS in 2020, during the COVID-19 pandemic. “The pandemic really got me thinking about what I really wanted to do,” he said. In 2021, he told the board that he would be retiring at 65.

My board was keen [for me to continue my tenure], I could have worked for another five to seven years. But I chose to retire, because, much like planning for your career, you’ve got to also plan for your life.

I’ve done 40 to 45 years of banking and finance, and the big driver [for me], is that there other things I would like to do with my life.

Piyush Gupta, CEO of DBS

Gupta will be devoting his time in retirement to his passion for nature and wildlife, as well as education. Currently, he serves as the chairman of both the Singapore Management University and Mandai Park Holdings.

“When you get to my stage of life, the biggest premium is time. I want to make sure that I leave space to do the other things in my life, so I don’t look back with regret and say, ‘you know what? I should have done that’.”

- Read other articles we’ve written about DBS here.

Also Read: Ravi Menon shares leadership lessons from his tenure as MAS’ longest-serving chief

Featured Image Credit: DBS Bank

S’pore’s Tipsy Collective allegedly delayed paying October salaries amid legal dispute

Over 100 employees from Singaporean hospitality group Tipsy Collective allegedly did not receive their October salaries, hinting at the company’s potential financial mismanagement.

According to a report by The Straits Times, an internal memo was sent to employees on November 6, 2024, one day after payday, where they attributed the salary delay to “a temporary adjustment in financial scheduling.”

Tipsy Collective’s Human Resource Manager, Avril Lim, assured staff in the note that efforts are underway to resolve the issue and that payments should be made “over the next few days.”

Established in 2019, Tipsy Collective operates ten restaurants and bars in Singapore and one in Kuala Lumpur. Its recognisable brands include Tipsy Unicorn and Tipsy Flamingo.

The news of salary delays comes amid the company’s ongoing legal battle between its co-founder and shareholders, which began in August.

The company’s ongoing legal dispute

A September article published by The Straits Times reported that co-founder David Gan filed a lawsuit against eight parties, including shareholders and investors, accusing them of breaching a shareholders’ agreement and attempting to take control of the company.

According to the report, Gan sought a temporary injunction to retain control of the board, but the High Court denied the request on October 15, allowing the majority shareholders to appoint new directors.

The board eventually dismissed Gan as CEO on November 6, although he remains one of the three company directors. A representative of the new management also told the publication that the company’s corporate secretary at the time was terminated.

When asked about immediate actions to stabilise the company’s finances and operations, a representative cited limited access to company data, reportedly withheld by Gan, as an obstacle.

They have also added that the new board is made aware that employees have not received their salaries. However, they cannot verify financial information or the number of employees affected.

“Currently, there is no visibility over the company’s current state of affairs. We can only plan for the next steps after reviewing the current state of affairs after we are able to study through data,” the representative explained.

Gan, who told The Straits Times he no longer has an active role in management, stated that he had “directed the finance team to prioritise payroll” before his dismissal.

The team is working hard to ensure that everyone gets paid as soon as possible. I am saddened that I have been removed from the company that I founded. Nevertheless, I hope that the new management succeeds with their new ideas and the changes they intend to make. I wish the company continued success.

David Gan, co-founder of Tipsy Collective

The recent payroll delay follows other financial concerns raised by majority shareholders.

In court documents, the defendants claimed they were troubled by alleged financial mismanagement under Gan and the late co-founder Derek Ong, who passed away in August 2023.

The shareholders objected to developing projects such as Tipsy Unicorn, a 19,000-square-foot beach club at Sentosa’s Siloso Beach, whose budget reportedly doubled from S$3 million to S$6 million.

Additional concerns included the lack of financial transparency, audit delays, and debts amounting to S$5.2 million owed to suppliers, contractors, and creditors. The company also allegedly owes about S$1 million to Sentosa Development Corporation.

Further, the defendants alleged that Gan had committed the company to loans totalling S$8.7 million from January 2021 to November 2023, with S$6 million still outstanding.

In his statement of claim filed in August, Gan shared that the defendants had attempted to remove him as a company director.

He argued that the company’s affairs are regulated by a shareholders’ agreement that provides him with veto power over board decisions. This means no significant resolutions, including the removal of directors, can be approved without his consent.

In response, the defendants disputed that his veto rights over board decisions were void following Ong’s death, as the shareholders’ agreement was predicated on both founders’ presence, where both held a majority share in the company.

Following the court ruling on October 15, the board appointed investor Reino Barack as chairman on November 6, replacing former Chief Operating Officer Reuben Low.

Employees contacted by The Straits Times declined to comment but confirmed the missed salaries and memo details.

Also Read: A toast to Tipsy Collective: 14 brands in 5 years, continuing strong after co-founder’s passing

Featured Image Credit: Tipsy Collective

SFF 2024: What’s next for S’pore’s fintech industry? Experts hash it out.

As part of this year’s Singapore Fintech Festival, Singaporean bank UOB took to the stage to present the main findings for its annual FinTech in ASEAN report on Thursday (November 6) afternoon.

Janet Young, the managing director and group head of channels and digitalisation at UOB, presented the report’s key takeaways, which outlined pivotal events that shaped the fintech industry in the past decade and explored potential catalysts that could accelerate the sector’s growth in the future.

A panel discussion was also held after the presentation, and here’s what was said.

Highlights of the report

In her presentation, Young first acknowledged the definitive events that have greatly impacted the world, namely the COVID-19 pandemic, Brexit and the introduction of OpenAI and ChatGPT.

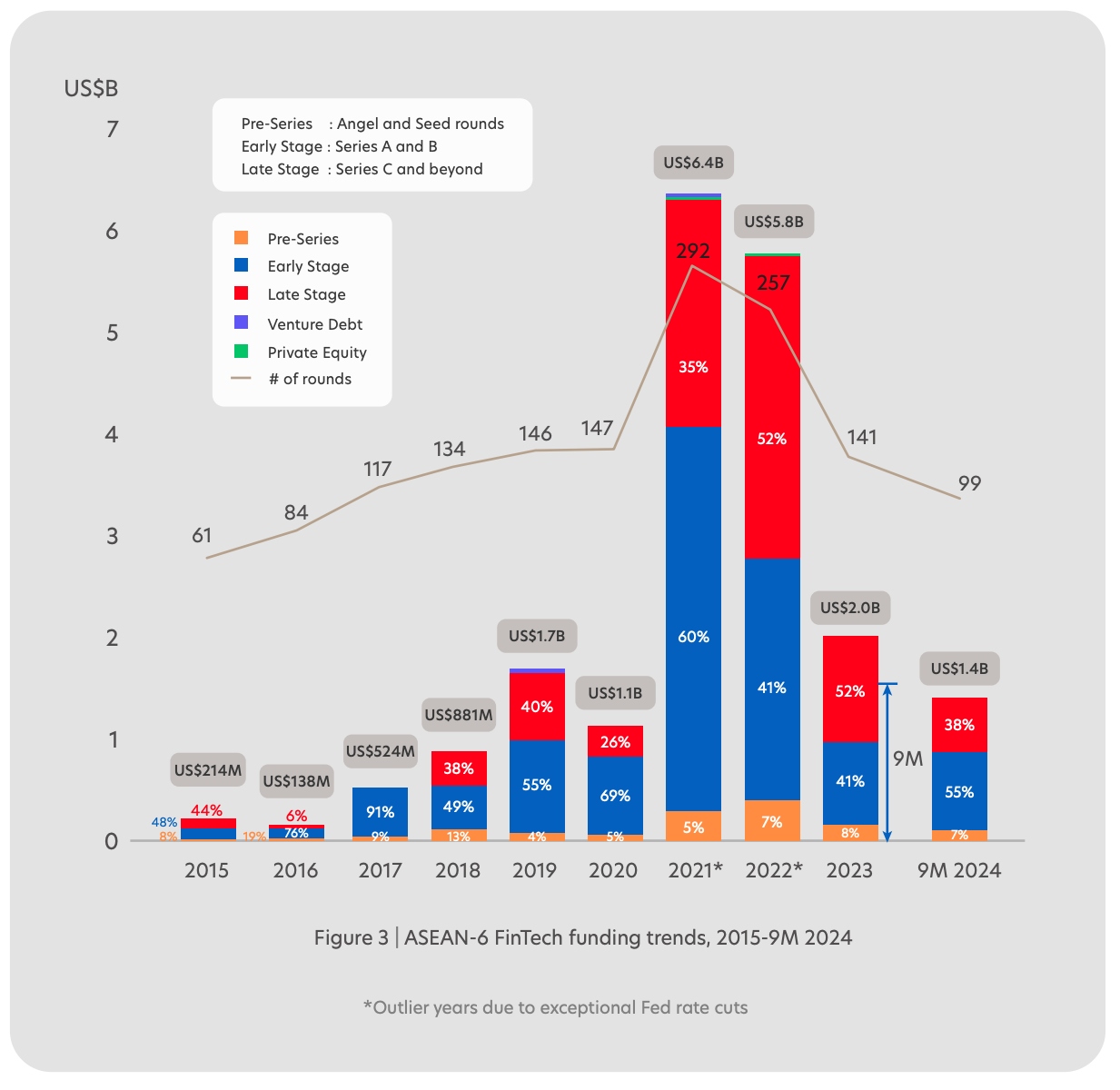

However, despite these events’ disruptions, the report found that ASEAN’s fintech funding has surged more than 10 times since 2015 and reached a peak of almost US$6.4 billion in 2021.

In total, fintech businesses in the region have raised over US$20 billion in funding from 1500 fundraising deals over the past decade. Young added that global fintech funding has also grown by 10%, with the projected funding for the year at US$39 billion.

She also pointed out that early-stage funding has continued to grow despite the challenging environment and encouraged young startups to move forward with their innovations.

Addressing the sharp spike in 2021, Young explains that due to the Fed cuts in 2020, interest rates were at a “historical low,” making the funding environment more conducive.

Looking forward, she shared that generative artificial intelligence (Gen AI), blockchain and quantum computing will spur “the next era” of fintech funding and growth.

Singapore as a global fintech hub

Following the presentation, a panel discussion amongst leaders in the fintech industry focused on the future of Singapore’s fintech industry.

Wanyi Wong, fintech leader at PwC Singapore, kicked off the discussion by highlighting that Singapore accounts for more than half of funding in the ASEAN region, which signifies the city-state’s attractiveness to the industry.

So the main question is: Why Singapore?

Wong Joo Seng, co-founder and CEO of Spark Systems, stated that the country “ticks all the boxes” for fintech businesses. “It has been a place where money looks for good ideas, and good ideas seek funding,” he added.

He went on to explain that while Singapore has a small population compared to its foreign counterparts, it is still a good test bed and springboard for successful businesses that have gained traction and are looking to expand outwards.

On the regulatory front, Wong added that intellectual property (IP), vital to tech startups, is safeguarded by Singaporean law. Walter De Oude, founder of Singlife and Chocolate Finance, jumped in, stating that the city-state is “probably the gold standard” as a regulated environment.

He elaborated that the country’s legislation recognises the required standards for operating governance and structure in the financial services sector.

“People might argue that Singapore’s system is very stringent and difficult, but if you can demonstrate credibility and capability and success in the Singapore context, you can do it pretty much anywhere,” De Oude added.

Shadab Taiyabi, president of the Singapore Fintech Association (SFA), shared his thoughts from a regulator’s perspective. Collaborative regulators and clear guidelines are needed to engage with policymakers, who actively listen and implement suggestions from the community, allowing trust to be built.

Beyond policies, several government initiatives and education institutions have played positive roles in the industry. Notably, co-working spaces set by Enterprise SG provide platforms for founders, and local universities have evolved their curriculums to cover emerging technologies.

Where is Singapore’s fintech industry at now?

A decade has passed, and Singapore’s fintech industry has evolved. Wong shared that, at the beginning, the community was “filled with new ideas.”

But the industry has grown beyond simply having new ideas. Having been in the sector for 20 years, some companies who have identified their audience’s pain points and developed their solutions are on the path towards success.

In addition, artificial intelligence (AI) will “behave” like tech and permeate our everyday lives and operations. “AI will become something that it will be second nature to all of us, and that will drive probably the second sort of wave of fintech development,” Wong added.

De Oude, however, has an opposing opinion. He stated that there has been an “overexuberance” of fintech startups in the past decades, especially between 2020 and early 2022, and many fintech startups will die in the next three to five years.

He explained that many payment companies operate on similar business models and questioned how they could effectively compete with one another. “Yes, payment flow has gone up to trillions. But the consolidation, or the death of fintechs, is going to come soon.”

If I’m a new guy and I want to start my own business, what should I do? Don’t do something that everybody else is doing, because the competition is high, not only for customers, but competition is high for capital, for resources, and actually just for diversified being different from everybody else.

Walter de oude, founder of Singlife and Chocolate Finance

Adding to the topic of AI in the industry, De Oude predicted that the world of agency in AI would become “a phenomenal section of growth”—beyond replacing talent with agents, the orchestration of how to make agents efficient could potentially be an entirely new industry.

While he added that the “new industry” will be where a large amount of funding will go, procuring funds will not be “easy to come by” from early stages to scaling, leading to “tough times ahead.”

Taiyabi chimed in, adding that more than half of companies holding SFA membership have evolved from startups to scale-ups. However, despite the potential decrease in the number of companies, maturity will increase.

Due to the cooling of funding from the sharp spike in 2021 and 2022, he also stated that many founders shared that the industry is “normalising”.

Advice to founders and people looking for fintech jobs

At this point, we have seen the tech industry go through its highs and lows, and it seems that it’s at a point of stagnation and, in Wong’s words, exhaustion.

However, he not only believes that positive change is happening in the fintech industry—it’s accelerating.

It’s difficult for the human mind to think of acceleration by our natural instinct. We kind of want to know where is the leopard jumps and where the leopard in three seconds time, and that’s linear, exponential growth is difficult to conceptualise, but I think that we will see that.

I think we will see changes in the industry in the next 10 years that will rival the last 50 years, right? So that’s the definition of accelerated change.

If you can find a pain point that you think needs to be solved, and you think you know how to do it. Do it.

Wong Joo Seng, co-founder and CEO of Spark Systems

De Oude offered four pieces of advice, which Taiyabi deemed to be “hard truths” for those in the fintech space. Taiyabi addressed his advice to people who are looking to get hired into the industry,

According to him, 60% of fintech companies are B2B, and one of the key challenges they face is that they cannot clearly articulate the challenges of the potential client or prospect they are selling to, which leads to a significant mismatch between both parties.

Try and put yourself in the shoes of the person you’re selling to clearly identify the challenges that person has, because your product can be the best product in the world, and you can have the most flashy marketing slides. But if you’re not able to capture the other person’s pain points in your first five minutes, you’re out of the door in his mind.

Shadab Taiyabi, president of the Singapore Fintech Association (SFA)

De Oude chimed in, proclaiming that he values the hunger to solve problems over credentials. “I don’t care what university you went to. I don’t care at all. I don’t care if you went to university.”

Wong took a milder yet more encouraging approach as he concluded the panel, stating that passion is irreplaceable. “What you want is someone who can come up on top at the very edge of where things are in as short a time as possible.”

Also Read: MAS’ new MD makes 1st appearance at SFF, shares overall vision for S’pore’s fintech sector

Featured image credit: Vulcan Post