(Disclaimer: All opinions expressed in this article belong to the writer)

While Singapore is preparing to increase the local Goods and Services Tax (GST) from seven to nine per cent, a lot of attention in the city-state was given in recent years to the implementation of “wealth taxes”.

Ravi Menon, Managing Director of Monetary Authority of Singapore (MAS), floated the idea in July 2021, as one of the tools to tackle “wealth inequality”, suggesting property gains or inheritance tax.

Even Singapore’s Prime Minister, Lee Hsien Loong, weighed in on the issue:

You tax consumption, you tax income, you tax savings. And you should tax wealth, whether wealth in the form of property, ideally wealth in other forms. However, finding effective ways to tax other forms of wealth is “not so easy to implement”.

Lee Hsien Loong at Bloomberg New Economy Forum, November 17, 2021

Around the same time, in November 2021, Workers’ Party politician, Jamus Lim, suggested in the parliament the introduction of tax on net wealth – 0.5 per cent on net wealth in excess of S$10 million, rising to one per cent for wealth above S$50 million, and two per cent for wealth above S$1 billion.

Many ideas, but is any of them good – or even fair?

Should wealth be taxed at all?

I picked this moment of a widespread collapse in value of stocks (particularly in America) and cryptocurrencies, to illustrate just how difficult — and perhaps impossible to do fairly — it is to attempt taxing wealth.

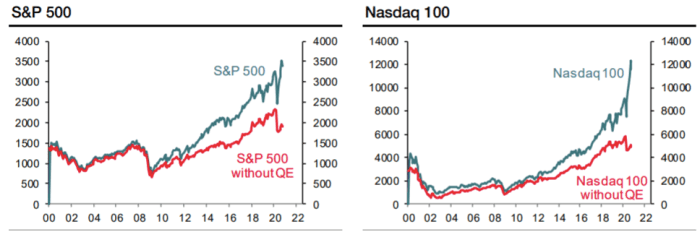

For the past two years, as markets rallied buoyed by excessively loose fiscal and monetary policies around the world, flooding economies with money, much of which flowed into stocks, we’ve heard many calls to tax the richest billionaires, whose wealth ballooned as a result.

At one point, Elon Musk’s net worth exceeded US$340 billion in 2021, making him the richest person in modern history and the first one to outrank John D. Rockefeller.

Left-wing activists and politicians around the world cried out at this growing “inequality” and began coming up with ideas on how to make governments trim this “excess wealth” for the public good, with some in America proposing a tax on unrealised capital gains, suggested by ex-Fed chief and current Secretary of the Treasury, Janet Yellen.

The proposal ultimately collapsed, but has certainly not made their desire to partake in the stock market (or other) riches disappear.

What people don’t seem to understand (and duplicitous politicians refuse to explain to their voters) is that wealth is not cash. Net worth is just a present — and constantly changing — representation of the market value of what a person owns. But that value did not come at anybody else’s expense, nor can it simply be “cashed out”.

Let’s look at Forrest Li, who is no longer the richest Singaporean. His personal wealth peaked at over US$22 billion (S$30 billion) in October last year. However, a little over three months later, it has melted to just US$8.5 billion (S$11.4 billion) today.

Would it have been fair to tax him two per cent, as some in Singapore propose, for the fact of owning a briefly inflated stock of his very own company?

And how would the wealth liable for taxation be estimated anyway? The peak value for the year? The bottom value? The average? Or maybe just the amount that it happened to have been on a particular day?

Why should anybody be forced to pay for little else than the ownership of something based on what someone else (i.e. the market) thinks it’s worth at a particular time?

Condition of Sea Ltd. hasn’t materially changed over these three to four months. The company is on track to achieving the results it projected in earlier quarters and the decline in stock valuation is not impacted by its performance (or lack thereof), but global market situation which saw about half of NASDAQ stocks plummet by 50 per cent or more from their last year’s highs.

Suggesting that anybody should pay any amount of money that is determined by the fluctuating market situation is absurd.

Other wealthy people around the world are facing similar fate. Elon Musk or Jeff Bezos have lost close to US$100 billion in half a year, while activists, NGOs and certain politicians called for taxing their entirely virtual, paper wealth, largely inflated by irresponsibility of the government and central banks.

Taxing net wealth would incentivise gaming the markets by both stockholders and the government.

It’s easy to see how any government would be interested in creating inflationary conditions in the equity markets to artificially increase their value to force owners to pay more of real, hard cash to the budget.

Conversely, stockholders and company owners would find it beneficial to underreport their company performance and paint a worse picture to depress the value of their holdings (particularly around the time of estimating taxable wealth).

Many would gladly take their companies private and make it far more difficult to price them, avoiding taxes altogether, minimising them or restricting to, at most, some government prescribed formula for estimating the value of private equity.

It would completely destroy free market mechanisms and force capital into hiding.

But taxing other forms of wealth is also grossly unfair, for the very same reasons. Why should anybody be forced to pay for owning something they already bought with taxable income?

Some basic form of taxing real estate is understandable, as it contributes to maintenance and improvements in the community. But why should inheritance be taxed? After all, whatever you inherit was bought with income that tax had already been paid for. It stays in the family, so why should the government want a cut when it merely moves from a parent to a child?

In Singapore, perhaps, it could be somewhat defended given the lack of capital gains taxation. In theory, after all, someone could live off occasional liquidation of his profitable stock holdings and not pay a penny on it. The same goes for property gains, which — at least when the money is not spent on another property purchase, could be deemed to be income.

Maybe this is the direction to look at: grudgingly consider taxing realised capital gains from stock trading and real estate, rather than mere ownership of something.

But an even better thing to tax is…

…consumption, not wealth

The moment you tax income or wealth, every person wants to minimise their tax bill, and the richest usually have the most tools to do so.

They can move money abroad, under-declare what they earn, hide property ownership, or simply live somewhere else, whether temporarily or for good.

One thing that cannot be escaped in the place you live is consumption. You have to eat, you have to live somewhere, drive a car, go to restaurants and so on.

And experience shows that the wealthy are more than willing to pay even highly inflated prices for things they desire in a place they chose as their residence.

That’s why exorbitantly expensive cars in Singapore do not faze them. Some of them own even a few, paying millions for something that would cost them a few hundred thousands in Europe.

And they do because consumption is controllable and reciprocal (you get something for what you pay), while blanket taxes on whatever they earn or own do not give them anything of equal value in return.

Higher GST on luxury items, designer clothing, vehicles, services or housing could help raise government revenues by billions, given that most 60 per cent of the tax is already paid by just 20 per cent of the top earning households and foreigners visiting the city-state, as I explained in my recent article:

They are a good target as they exhibit far smaller price elasticity, like all status-related goods and services. People are willing to spend more just to highlight their social position, and the tax component of the sale is less relevant to their purchasing decision.

Taxation should be tailored to human psychology and consumer propensities instead of serving ideological goals of punishing the rich for being too successful or redistributing wealth under questionable slogans of “fairness”.

Targeting wealth, in particular by trying to force people to pay by the value of things they own, is neither fair nor sound, and could lead to an economic disaster should the payers simply choose to leave to never return.

There is a reason, after all, why wealth taxation had a short-lived career even in the far more “progressive” West…

Penalising anybody for simply being successful is not the solution.

It also creates divisions in the society by portraying those who achieve the most, who employ the most people and who already pay most of the taxes as crooks, when in reality, they’re the ones pulling all of us ahead through innovative products and services that become globally successful.

Shop and support the best homegrown brands on VP Label now:

Featured Image Credit: Golden Capitalist