On August 1, we reported on FashionValet’s closure and aspects of the company that were being scrutinised online.

In particular, we based our research around a Facebook post by Aliff Ahmad, co-founder of Scrut.my, who has been making posts about Fashion Valet for a few years now.

We soon realised that there were some numbers that just weren’t adding up, so we bought Fashion Valet Sdn Bhd’s publicly available reports on MyData SSM ourselves to find out the truth.

1. Aliff’s screenshots about the RM4.2 million dividends corroborated what we found

In Aliff’s Facebook post, he made multiple mentions that the founders of 30 Maple Sdn Bhd (the initial parent company behind dUCk, but more on this later) took RM4.2 million in dividends.

Along with the written post, he uploaded a screenshot that supposedly showed how the company had given out RM4.2 million worth of dividends in 2017.

According to the annual reports of 30 Maple that we purchased, the figures reported corroborated Aliff’s claims.

Another thing that Aliff posted that we found proof of as well was the RM2.283 million web development write-off in FashionValet’s 2017 annual report.

Editor’s Update: We’ve updated this point and its following argument to be factually accurate, as we had mistakenly pointed out that Aliff’s claim about the RM4.2 million dividends did not line up with our own findings. However, he was referring to 30 Maple’s documents, and not FashionValet’s, which we had originally compared his claims to.

2. Multiple errors were made in FashionValet’s 2017 annual report

Interestingly, though, if we were to look at 2018’s annual report, it states that the 2017 numbers have been “restated”. A restatement refers to a revision of a company’s previous financial statements to correct an error.

Some of the restated information seems to include the loss for the year. While the 2017 report said the loss before taxation was (RM10,696,373), the 2018 report said 2017’s loss before tax was (RM15,027,196).

In the 2018 report, 2017’s web development write-off was not mentioned in the “loss for the year” section, which looks at both 2017 and 2018’s activities.

According to the 2018 report, there are a few prior year adjustments made. First, the company and group had “omitted the contract liabilities arising from the loyalty points granted to customers in the previous years’ financial statements”.

In the screenshot above, Company refers to FashionValet, while Group refers to FashionValet and its subsidiaries.

Because of this, the contract liabilities for FashionValet and its Group were understated by RM943,709 and RM1,687,041 respectively.

Corresponding to this, the Company and Group’s revenue was overstated by RM743,332.

Another error to note involves the measurement of the Redeemable Convertible Preference Shares (RCPS).

In 2017’s annual report, there was an incorrect classification of RCPS as equity, when such shares are actually compound financial instruments that contain components of debt and equity, and should be assessed, measured, and classified separately as financial liabilities and equity.

Because of this error, the liability component of RCPS of the group and the company were understated by RM21,283,806 and RM28,370,362 respectively.

Correspondingly, the share premium was overstated by RM23,444,459 and RM27,851,956 for the Group and Company respectively.

3. In the most recent annual report, directors’ remuneration actually went down, and there were no added bonuses

In Aliff’s post, he mentioned that the directors’ allowance was increasing. However, if we look at the latest financial statement ending December 31, 2020, the directors’ remuneration went down. In 2019, it had been RM2,152,416, while in 2020 it was RM1,453,866.

The 2020 annual report also states that no director of the company has received nor become entitled to receive any benefit other than the remuneration “by reason of a contract made by the company or a related corporation with the director or with a firm of which the director is a member, or with a company in which the director has a substantial financial interest”.

4. 30 Maple was bought in 2018 for RM95 million

Aliff had pointed out in his post that Vivy Yusof’s popular brand, dUCk was in fact separate from FashionValet itself despite being seen as an inhouse brand by some.

So, in a recent article by SAYS, why did Vivy share that FashionValet now fully owns dUCk? Well, it’s true now, but that wasn’t always the case.

With a bit of digging around, we found that dUCk was actually under 30 Maple Sdn Bhd. But in FashionValet’s 2018 annual report, it was shown that 30 Maple (and subsequently, dUCk), was purchased by Fashion Valet Sdn Bhd in December 2018 for RM95 million by issuance of 851,686 new ordinary shares.

This might explain why Vivy had also told SAYS that it has been a decision to focus the business on dUCK and LILIT. since 2019, because by then, FashionValet had just fully acquired 30 Maple.

5. Offline sales plummeted in 2020, though online sales only differed slightly

In the article with SAYS, Vivy said FashionValet has been able to survive the pandemic for the past two years thanks to its decision to focus on dUCk and LILIT.

Indeed, looking at FashionValet’s revenue in 2020, we noticed it had decreased mostly in offline sales.

In 2019, the group’s offline sales were RM34,222,203, but that number went down to RM17,725,405 in 2020.

However, the group’s online sales remained mostly the same, with less than RM1 million difference between the two year’s online sales.

6. FashionValet has an accumulated loss of RM83 million as of the latest financial statements

According to the financial statements and reports for the financial year ending December 31, 2020, the company had made a loss of (RM12,371,305).

Furthermore, the company’s retained earnings were -RM83,442,646. A company with a negative retained earnings balance would signal “poor financial health”, according to Investopedia.

7. Khazanah and PNB’s involvement did improve the company’s profit margins

On August 5, 2022, Vivy Yusof made a statement to Malay Mail, saying: “Since Khazanah and PNB invested, the business has more than doubled in revenue, improved our profit margins and expanded to offline retail.”

We looked at FashionValet’s revenue over the years to ascertain whether this was true, keeping in mind that Khazanah and PNB were reported to have invested in the company around March 2018.

In 2017, before the two government-linked companies invested in FashionValet, the revenue was RM57,909,265. If Vivy is comparing that figure to the 2019 revenue of RM101,755,629, it would be slightly less than two times the profit.

However, it’s important to note that in 2020, the revenue went back down to RM84,495,919.

But we also have to consider the profit margin. We calculated the net profit by finding the profit as a percentage of the revenue, using FashionValet’s financial statements as the source.

In 2017, before PNB and Khazanah invested in the company, the profit margin we calculated was roughly -18.5%.

The next financial year (i.e. ending December 31, 2018) recorded a profit margin of -32.2%. PNB and Khazanah had invested earlier that year in March.

In 2019, though, the company improved its profit margin, which was around -15.7% at this point. In the financial year ending December 31, 2020, the company’s profit margin was around -14.6%.

If these are the figures Vivy was referring to in her statements to Malay Mail, then it seems that the figures align with what she said.

What’s next then?

As mentioned, FashionValet is invested by state investment funds such as Permodolan Nasional Berhad (PNB) and Khazanah Nasional.

According to Khazanah’s investment policy, its mandate is to grow Malaysia’s long-term wealth, i.e. to sustainably increase the value of investments while safeguarding financial capital injected into the fund.

With FashionValet’s negative retained earnings, it’s no wonder that members of the public are questioning Khazanah’s decision-making strategies behind its investments.

However, as pointed out by Vivy, FashionValet’s profit margin seems to be improving slowly, so perhaps Khazanah is truly focusing on the “long-term” aspect of its investment.

Whether the increased focus on growing dUCk and LILIT. will bear the results that Khazanah envisions, only time will tell.

- Read other articles we’ve written about FashionValet here.

- Read other articles we’ve written about Malaysian startups here.

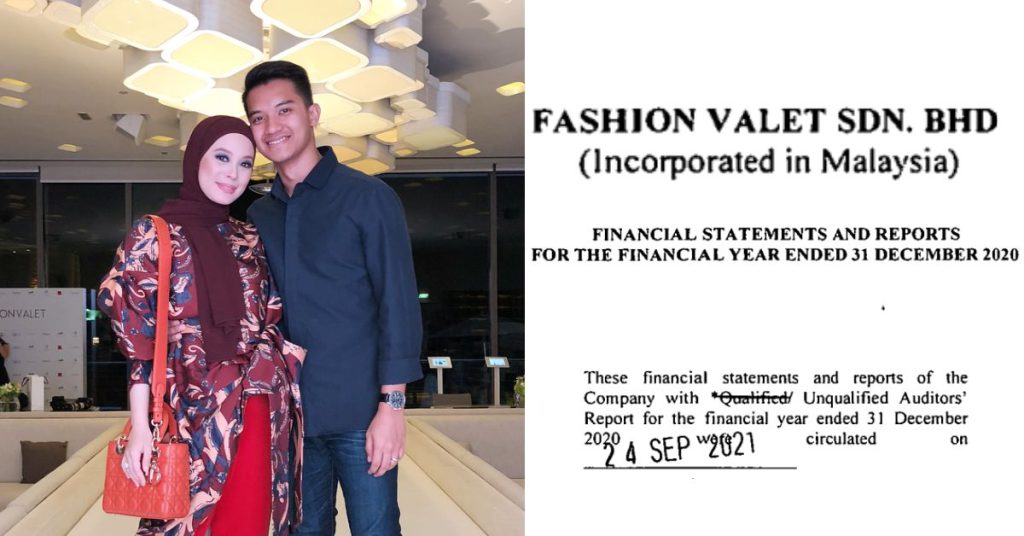

Featured Image Credit: FashionValet