We’ve long heard players in Malaysia’s startup ecosystem talk about the importance of private corporate participation in supporting local entrepreneurs. But the question is, why should corporates invest in startups, and how do they go about doing so?

At the Malaysia Venture Forum, hosted by the Malaysian Venture Capital & Private Equity Association (MVCA) as part of Startup Week Malaysia 2023, that was one of the topics discussed.

Specifically, it was addressed by a panel that was all about corporate venture capital (CVC). For those who haven’t heard of the term, CVC is the investment of corporate funds into external startup companies.

The panellists for this talk were:

- Datuk Thomas Leong, Group Chief Strategy Officer of Sime Darby Berhad

- Matt van Leeuwen, Chief Innovation Officer & CEO of Sunway iLabs

- Marien Kamal, CEO of Edgenta NXT

Sime Darby Berhad is the trading company dealing with logistics, particularly in automotives and heavy equipment.

Sunway iLabs was created as a partnership between Sunway Group and Sunway University with the goal of providing a collaborative space to foster entrepreneurship and stimulate market-driven innovations.

Edgenta NXT is a is a cloud technology solutions provider that was actually funded by a CVC, which was UEM Edgenta.

Each coming from different backgrounds, the panellists had different insights and perspectives to share about CVC in Malaysia.

Venturing into corporate venture capital

Some might think that there’s a simple reason for big corporations to invest into startups—profit.

While financial returns do play a part in corporates participating in startup investments, it’s actually not the sole or even the key motivator behind many CVC efforts, at least based on what we heard from the panel.

For instance, Matt explained that one of Sunway iLabs’s motivators is to serve as a testbed for students, offering entrepreneurship programmes such as accelerators, fellowships, and courses.

On top of that, the CVC efforts also serve the purpose of R&D for Sunway.

As we know, Sunway Group has presence in various different industries, and thus has many different problem statements and opportunities for innovation.

Sunway iLabs is able to connect these problems with apt solutions, especially as its programmes help identify the real trends in the market, as opposed to all the noise.

“We can filter that [noise] out by looking at early-stage startups through an accelerator as they come out with an MVP (minimum viable product),” Matt reasoned.

As for Marien, she was speaking from the perspective of a startup that was incubated and funded by Edgenta. In this case, Edgenta’s goal for its CVC activities is more for own use.

“Edgenta in the past was already developing software internally for own use,” Marien explained. “When (Managing Director and CEO) Syahrunizam Samsudin came in, he saw the gem within Edgenta itself.”

Seeing value in the inhouse solution, he believed other facility management companies would have a use for it, and that’s how NXT was created.

For Sime Darby, the reason for them to invest in startups is because of a very clear reason: survival.

As an automotive company with a rather traditional business model, Sime Darby realises that its industry will likely be disrupted (and in fact already is being disrupted) by more innovative and agile startups.

“We know that disruption is coming,” Thomas said. “We see a future where the role of the dealer or distributor is sidelined.”

He referenced companies such as Tesla which is now present in Malaysia selling direct to consumers, skipping car dealerships entirely.

“Therefore, we created a CVC to look at what’s out there,” he said. “How do we reinvent ourselves?”

The answer may just be investing in innovative startups.

Getting the leads

The next question is where these companies are getting their leads to begin with. As mentioned for Sunway iLabs, the organisation has plenty of programmes such as accelerators that help them find startups and entrepreneurs to invest in.

At Sime Darby, though, the leads are less direct. Thomas shared that a way they get leads is through referrals from ecosystem players like fund of funds and VC firms.

Sometimes, VCs are unable to invest in a startup for various reasons, but that doesn’t mean other organisations won’t want to invest.

By having connections with other players in the ecosystem, CVCs like Sime Darby will be able to swoop in when there’s something promising.

And of course, in the case of Edgenta, sometimes the lead is within the company itself. Marien added that NXT further influences how Edgenta invests, as the parent company will invest based on what can add value to NXT itself to form a more wholesome ecosystem.

Justifying the investment

So, we know that money is not the sole motivator behind CVC’s investments. However, make no mistake, an important metric is still financial returns.

“It’s not just the synergies,” Matt said. “At the end of the day, we are sitting in front of our CFO, our exco, and they’re asking the tough questions. You need to have an answer to that.”

Therefore, they must work to ensure the startup is profitable, and eventually have upsides (appreciation in valuation) and exits.

Of course, not every startup is going to be a unicorn, and that’s fine. What matters is making sure leaders in the company understand that some investments aren’t just justified quantitatively through dollars or deals, but through other intangible factors such as for future-proofing purposes.

Providing startups value beyond financial

Matching a corporation to a startup is a two-way street. Why should a startup go the route of CVCs instead of just working with a venture capital firm?

Matt pointed out that a key advantage that Sunway provides is its vast network of arms in various industries.

They also have plenty of assets, such as great access to both B2B and B2C distribution channels.

“How can we use that to our advantage, and also provide value to startups that need that kind of access?” Matt asked rhetorically.

As an example, for healthtech startups working with Sunway iLabs, they have the opportunity to actually get insights from medical professionals and work alongside them.

For Sime Darby, Thomas shared that the company is essentially a springboard for startups, especially when it comes to overseas expansions, given Sime Darby’s global connections.

Driving Malaysia’s ecosystem forward

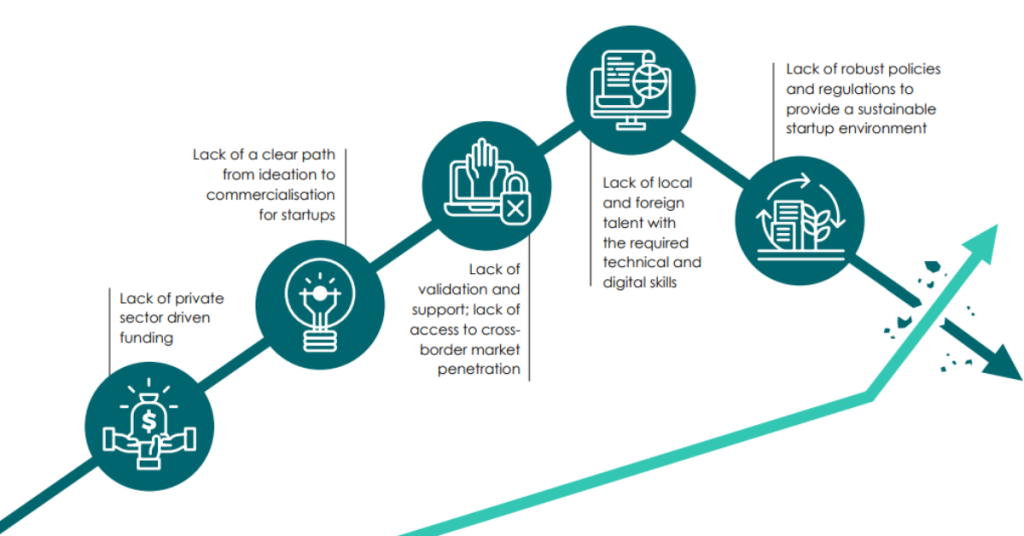

In MOSTI’s Malaysia Startup Ecosystem Roadmap 2021-2030, also known as SUPER, the first challenge in the ecosystem was lack of private sector funding.

“While the government plays a big role as a shareholder, providing direct funding to startups, more needs to be done to draw in private investors,” it stated.

Last year, we heard from ecosystem players that private sector investment and investment from corporations in particular matter because they can act as a safe harbour and path to exit for startups.

And if more exit scenarios exist in Malaysia due to the involvement of private organisations, the region will attract more investments overall while motivating founders to stay in the country, too.

As such, we hope to see more CVCs in Malaysia in the coming years, taking the local startup ecosystem a step further.

- Read other articles we’ve written about Startup Week Malaysia 2023 here.

Featured Image Credit: Vulcan Post