Starting from January 2024, the Grab-powered digital bank GXBank started rolling out its very first physical card, the GX Card.

A debit card that’s linked to the GX Account, the GX Card can be used anywhere that takes Mastercard or MyDebit cards, and is also supported by the MEPS Shared ATM Network (SAN).

Like any usual credit or debit card, it is identified by a unique string of 16 numeric digits. The GX Card will have a five-year validity period upon card issuance, meaning if you get it this year, it’ll expire some time in 2029.

In terms of functionality, the GX Card looks pretty standard as far as cards go. So, what’s in it for people to sign up for it? Well, having been using it for a good week, here’s my review of the card, from applying for it to applying it in real-world use cases.

Easy application with nice perks

Applying for the GX Card is as easy as making a GXBank account and tapping on a little card icon once you set up your account. Given, it’s still being rolled out right now, so not everyone will get to enjoy this card just yet.

As for eligibility, applicants must:

- Be Malaysian citizens with a valid MyKad and residing in Malaysia

- Be aged 18 and above

- Have an active GX Account

If you fulfil those criteria, getting your card is seriously easy. I immediately was given access to the virtual card, though I only received the physical card about a week afterwards.

Ease of usage aside, some of the great perks of the GX Card include the fact that there’s no minimum account balance required to maintain the card. So if you forget to top up your GX Account, there’s absolutely no worry.

On top of that, GX Card is offering users 1% cashback on transactions with no cap from now until November 5, 2024. Some types of transactions are not eligible for the cashback, though, including:

- Cash withdrawals

- E-wallet top-up transactions

- Insurance or Takaful transactions

- Payments made to charity bodies

- Government transactions

- Gambling-related transactions

- Payments made to quasi-cash merchants (crypto, forex, etc.)

- Void transactions

Frequent Jaya Grocer shoppers will be happy to learn that GX Card offers 1.5x GrabRewards Points if you use the card at the grocery store. Just keep in mind that you have to flash the Jaya Grocer member barcode in Grab app at the cashier before you pay, or you won’t get any points.

Sadly, this perk is not inclusive of online Jaya Grocer orders.

Another great perk is that there are virtually no bank fees right now. That includes no new card (or even replacement) issuance fees or annual card fees.

Using it at any ATM via the MEPS SAN is also free. There will be a RM1 MEPS fee posted on the customer’s account, but it’ll be waived immediately. There are also no fees for overseas cash withdrawals using ATMs via Mastercard.

Just keep in mind that the waive is set to last until the end of this year (December 31, 2024).

No worries for customer service

So, after applying for my GX Card, I began waiting for my mail. No joke, I checked my mailbox every day. It was supposed to arrive on January 25, but considering that it was Thaipusam, I gave it a bit more time.

If you’re wondering why I couldn’t just start using the “virtual card”, well, it only works for online transactions. It doesn’t function as an NFC card like I wrongly assumed it would. Plus, GXBank hasn’t allowed users to add the card to their online wallets such as Samsung Pay, Google Pay, or Apple Wallet just yet.

When the card didn’t arrive by Friday night, I decided to shoot the customer service a message on the GXBank app. It was 10:30PM so I was pleasantly surprised when I got in touch with a human representative immediately.

Raaj, the customer service representative, informed me that there were some delays in sending out the card, and that I should receive it the following week. Lo and behold, come Monday, I got a special little delivery in my mailbox.

Putting it to the test

In terms of the build of the card, I would say it’s slightly thinner compared to my other cards. While this does mean it has a flimsier feel to it, it may be a plus for those who like to keep their wallets slim.

That aside, the card has a holographic sheen to it that makes me feel very cool when using it. It’s also vertical as opposed to horizontal, which I found unique. (Basically, every time I use it, I half-expect to get a compliment from the cashier. No luck so far.)

Once you receive the physical card, you simply have to activate it in the app.

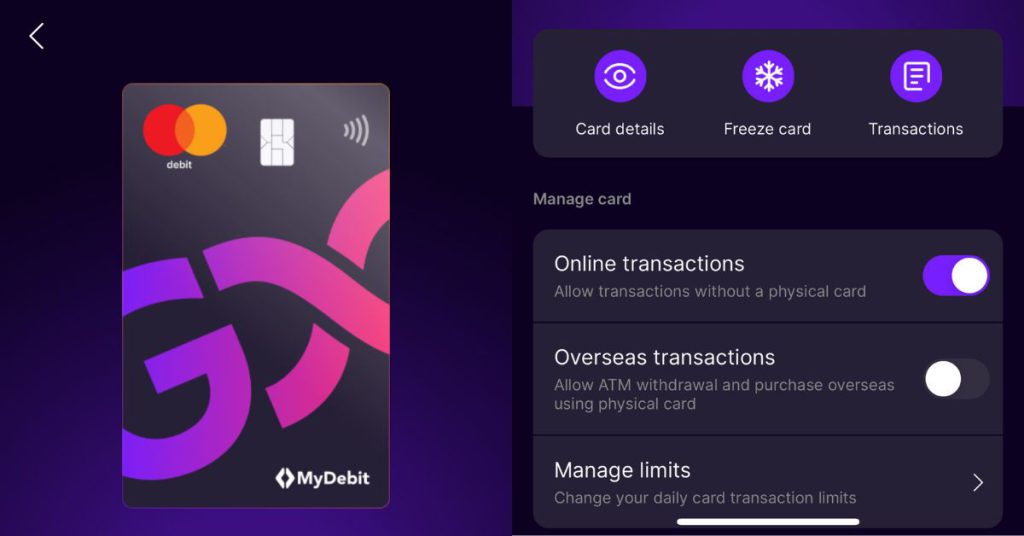

For card maintenance, the GXBank app has it all covered in a very intuitive manner. In the app’s card page, you can view card details, freeze or unfreeze your card, enable or disable online transactions, enable or disable overseas transactions, change your card PIN or limit, or fully cancel your card.

Using it for the first time, you will have to input your PIN, but subsequent transactions can be done via Paywave.

I’ve used it for quite the number of purchases thus far. For one, I like how it allows me to budget my spending since it’s tied to my GX Account, which doesn’t have that much money in there.

The cashback does seem to take a bit of time to be deposited. Checking the details again, I learnt that the cashback will be credited to your account by the end of the next day from the posting date of the transaction.

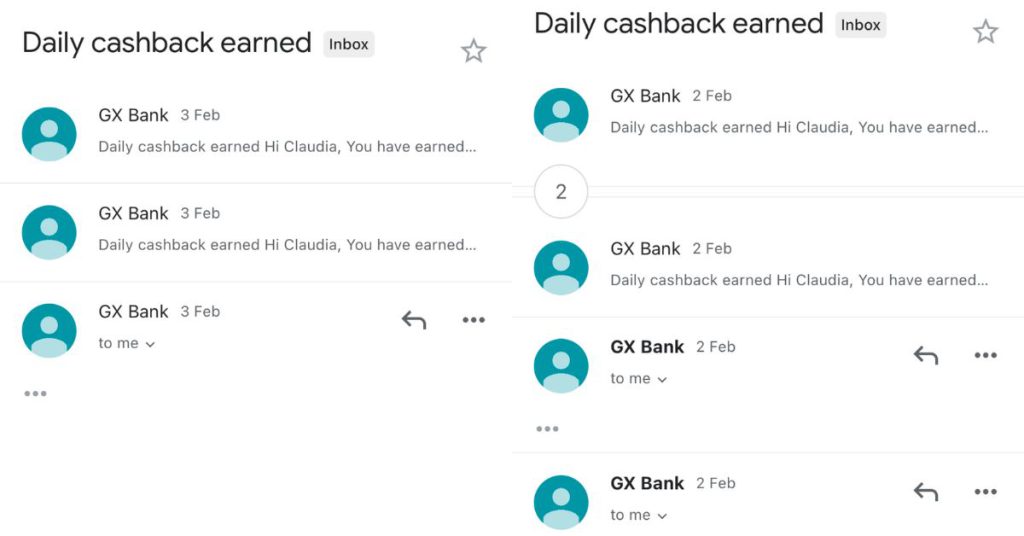

When my cashback was credited, the bank sent me not one, not two, not even three, but six whole notifications and emails (meaning I got 12 pings altogether on my phone) for a RM0.40 cashback. Not six RM0.40 cashbacks, but one.

For a moment I was genuinely worried it was stuck in a loop and I would be receiving notifications from GXBank forever.

This is really perplexing, and the only answer I have is that perhaps the cashback correlates to six total transactions. I’m really hoping this gets resolved soon.

In other news, I also found out that the 1% cashback value will be calculated and rounded down to the nearest two decimal points, so keep that in mind.

The cashback amount also needs to be at least RM0.01 to be eligible to be credited to your GX Account. All that means is the payment needs to be at least RM1.

Waiting for greater accessibility

Once upon a time, I was a person who swore by using cash only. But as the times changed, so have I. Not only am I usually cashless, I’m actually cardless too.

At times, all I have on me when I go out for lunch is just my phone. After all, many of the places I visit take QR payments. And if I need to use my card, I already have it on my Apple Wallet.

So, as much as I have enjoyed the GX Card and the novelty of having a new physical card to add to my wallet, I am very much looking forward to more developments with GXBank.

In any case, though, I do think it’s worth applying for the card, as there’s really nothing to lose. Plus, isn’t it a good idea to get the card while the perks last?