For decades, the startup narrative has been dominated by Silicon Valley’s mantra which is to raise capital, scale rapidly, and flip for profit.

Silicon Valley, a region in Northern California, is a renowned hub for high technology and innovation. It hosts numerous global tech giants and thousands of startups, making it a focal point for tech development. It also attracts a significant portion of venture capital investment in the United States.

However, this Silicon Valley narrative doesn’t hold true for many companies, especially in regions like Malaysia and Southeast Asia, according to Soonicorn Collective chairman Dr Sivapalan Vivekarajah, who spoke at KL20 Summit 2024.

It’s time to challenge this conventional wisdom and focus on building profitable and enduring businesses. Here’s why that’s important.

Limited acquisition opportunities

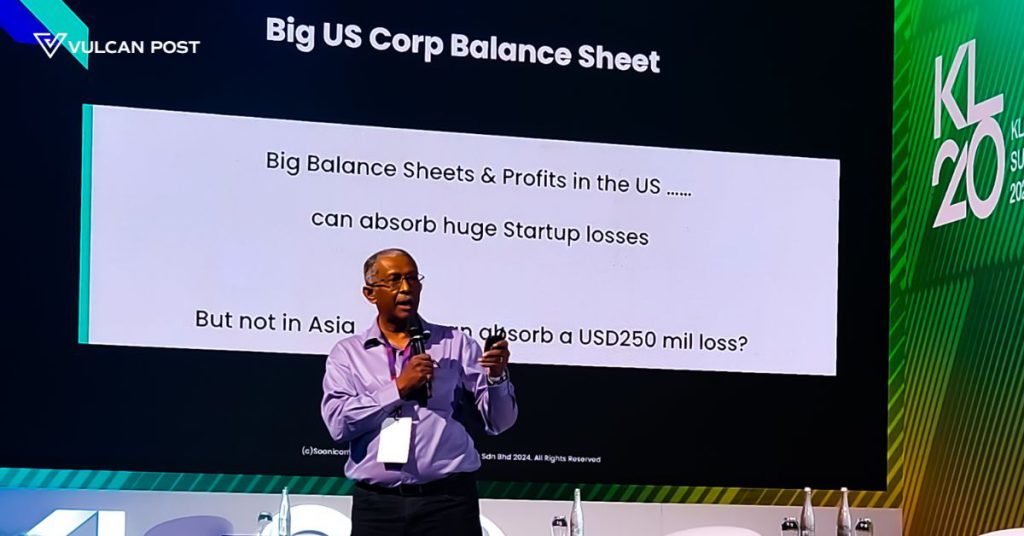

Firstly, the Silicon Valley startup narrative doesn’t always translate well outside of the United States.

Contrary to popular belief, the majority of mergers and acquisitions in the United States fail, with up to 90% of deals ending in disappointment, said Dr Sivapalan, citing a Harvard Business Review statistics.

“In Asia, very few acquisitions occur due to companies adhering to the traditional narrative of raising significant funds and prioritising rapid revenue growth despite substantial losses,” he said.

Hence, this situation is detrimental not only to investors and venture capitalists but also to the overall ecosystem.

Despite recognising these challenges, many companies continue to adhere to this narrative and often find themselves struggling to find buyers or sustain profitability.

This also makes the exit options for startups constrained, leading to stagnation and disillusionment.

Fundraising challenges

Even for companies that manage to raise significant funding, sustaining growth and profitability remains a challenge.

“It is challenging to raise funds, especially in recent years, which have been among the most difficult for fundraising.”

“Consequently, companies face tough decisions if they cannot raise capital. Many have struggled to retain staff, even those that successfully raised significant amounts, leading to layoffs of up to 30%, 40%, or even 50%,” said Dr Sivapalan.

He added that this trend stems from the prolonged difficulty in securing subsequent rounds of funding, forcing companies to downsize.

Additionally, in Asia, there is a scarcity of corporate buyers for startups. Despite aspirations to sell to Asian buyers, such acquisitions are rare exceptions rather than the norm.

“In Malaysia, for instance, the number of large corporates acquiring startups over the past decade is minimal, indicating the rarity of such occurrences in the region’s ecosystem,” he shared.

With investors increasingly focused on profitability and cash flow, startups must demonstrate a clear path to sustainable growth to attract funding.

And on that note, the way forward includes…

Embracing profitability

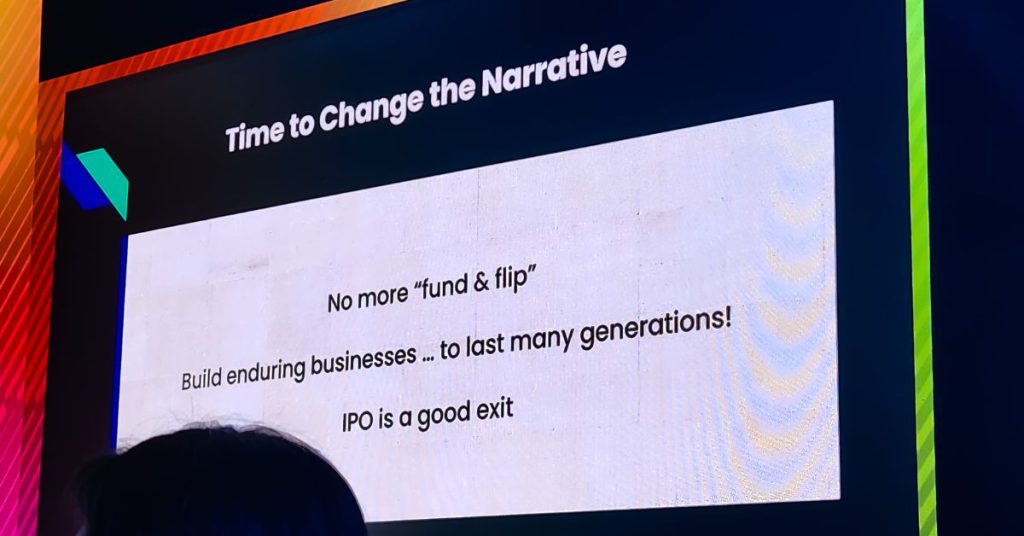

Startups must shift their focus from rapid growth at any cost to building profitable and sustainable businesses.

By prioritising profitability and capital efficiency, companies can weather market fluctuations and attract long-term investors. Thankfully, our local startups already have one foot in the door when it comes to this.

“Many companies, especially those unable to raise funds, naturally become more capital efficient. This efficiency is appealing to investors, particularly those from Singapore, who appreciate Malaysian companies’ ability to operate efficiently without relying on large fundraising rounds like their counterparts in Singapore and Indonesia.”

“Instead of chasing short-term gains through quick exits, aim to build enduring businesses that can last for generations,” he said.

The most successful companies, such as Facebook, Google, and Microsoft, are not built on the promise of a quick flip but on the foundation of enduring, multi-generational businesses.

He reiterated that startups should emulate their focus on long-term sustainability and value creation rather than seeking quick returns through premature exits.

Exploring IPOs

Going public through an Initial Public Offering (IPO) is a viable option for startups looking to build enduring businesses.

“To establish enduring legacies, these companies opted to IPO, listing their shares on global stock exchanges, thus solidifying their position as long-lasting enterprises.”

“Contrary to common belief, achieving an IPO isn’t as challenging as perceived. While there’s a prevailing stereotype surrounding IPOs, astute businesses recognise the feasibility of this path.”

“I encourage you to reconsider the notion that IPOs are inaccessible,” noted Dr Sivapalan.

This is because, by IPO, companies gain access to public markets, investor capital, and increased visibility, paving the way for long-term growth and success.

Long story short, it’s time for startups in Malaysia and Southeast Asia to rethink the traditional startup narrative and focus on building profitable, enduring businesses.

This is a discussion that we know is already taking place in the Malaysian startup scene, and as more established brands set an example for it, here’s to hoping Malaysia can grow to be a nation of prosperous, profitable businesses.

- Learn more about the KL20 Summit 2024 here.

- Read other articles we’ve written about Malaysian startups here.

Featured Image Credit: Vulcan Post