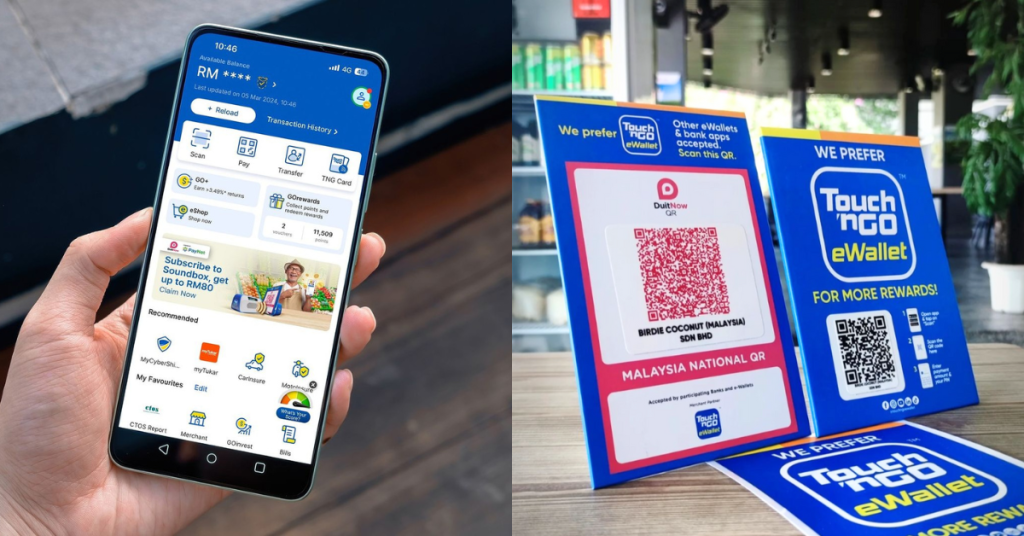

TNG Digital, one of Malaysia’s leading integrated fintech players and operator of TNG eWallet, just announced the introduction of a new service to users—recurring payments.

Directly integrated with the TNG eWallet, this latest offering aims to empower underserved markets and improve financial accessibility for merchants and consumers across Malaysia.

Traditionally, recurring payments for gym memberships or streaming services require details from a debit or credit card. These are payment options that not everyone may have, especially amongst the younger crowds like teenagers and unbanked individuals in rural areas.

Through a partnership with Curlec by Razorpay (Curlec), a business whose core focus is on recurring payments, consumers can now use their TNG eWallet to make these monthly subscription payments.

Curlec serves a vast range of clientele with over 2,000 merchants locally and over 10 million businesses globally.

In lieu of card details, users can key in their TNG eWallet information and subscribe to recurring payments seamlessly and safely.

“This partnership will truly benefit many Malaysian businesses and consumers [as] up to 88% of Malaysians prefer TNG eWallet as a payment method (when it comes to ewallets),” remarked Zac Liew, the co-founder and CEO of Curlec.

From a merchant’s standpoint, this payment gateway allows SMEs to collect dues regularly, which would help with overall financial cash flow. So small businesses including tuition centres, subscription-based services like rent-to-own items, and self-storage facilities will also benefit from this new addition.

Fostering financial inclusion nationwide

According to the press release, TNG eWallet currently has over 60% market share in the ewallet industry and has reached over two million merchants. This partnership with Curlec intends to extend its scope even more.

The goal is to empower micro and small businesses to flourish in the digital economy by enhancing their operational efficiency and financial management.

“This also applies to merchants or businesses located in rural areas, where card penetration is not as high. Payment choices are more inclined towards TNG eWallet. This is a game-changer for any small [and] medium businesses looking for financial stability,” said Liew.

Alan Ni, Chief Executive Officer of TNG Digital stated that the collaboration with Curlec aligns perfectly TNG Digital’s commitment to democratising financial access in Malaysia and fostering a financially empowered society.

“Through this partnership, more people including consumers, businesses, and organisations, will enjoy the advantages of recurring eWallet payments,” he said.

“As Malaysia’s largest ewallet, we’re poised to bridge gaps, foster financial inclusion, and empower over 21 million verified eWallet users nationwide with seamless transactions and tailored financial solutions.”

This partnership is in line with Bank Negara Malaysia’s Financial Sector Blueprint 2022-2026 which aims to advance the digitalisation of the financial sector through the support of a vibrant digital financial services landscape.

- Learn more about TNG Digital here.

- Learn more about Curlec by Razorpay here.

- Read other articles we’ve written about Malaysian startups here.

Featured Image Credit: Touch ‘n Go