Small and medium-sized enterprises (SMEs) in Singapore might not always make headlines, but they’ve certainly captured the attention of investors.

15 homegrown startups have earned spots on this year’s Forbes Asia 100 to Watch list, and they are anything but small in impact, offering a range of innovative solutions from space technology to advanced healthcare diagnostics.

Here are the businesses that made the list:

1. Aliena

Established in 2018 as a spinoff from NTU, Aliena harnesses cutting-edge space technology to deliver high-resolution data solutions to businesses.

The company specialises in creating electric propulsion engines that allow satellites to orbit closer to Earth, generating valuable and precise data that empowers industries including banking, maritime, and agriculture.

Aliena’s flagship engine, Music (which stands for Multi-Stage Ignition Compact), enables small satellites to operate in very low earth orbits—those at approximately 250 and 350 kilometres in altitude.

In March, Aliena raised US$5.6 million in a series A funding round led by Wavemaker Partners to expand its existing jet-propulsion test facilities in Singapore and accelerate the global deployment of its engines.

2. Bluesheets

Bluesheets develops Artificial Intelligence (AI)-powered data entry and management tools that enable companies to process financial data.

It builds AI-powered workflows and incorporates its proprietary file processing engine to clean, digitise, enrich, and structure data, automating data processing for companies from end to end with almost 100 per cent accuracy.

In January, Bluesheets raised US$6.5 million in a series A funding round, bringing the four-year-old startup’s total funding to over US$12 million.

Currently, the company serves clients across the accounting, insurance, banking, and logistics sectors, with a global presence spanning Asia, New Zealand, Europe, and the United States.

3. Botsync

Botsync is a prominent player in the field of industrial autonomous mobile robots, catering specifically to factories and warehouses.

Their robots move pallets, shelves, and trolleys in industrial settings, and have a user-friendly, no code management software that eliminates the need for extensive configuration or coding expertise. They can also be easily customised to fit with existing operations.

In addition to their industrial offerings, Botsync also develops cost-effective robot kits targeted to universities and students, fostering learning and exploration in the field of robotics.

Most recently, the company raised US$5.2 million in a series A round, bringing its total funding to over US$8 million.

4. ecoSPIRITS

Single-use glass is one of the biggest sources of waste and carbon emissions in the global wine and spirits industry. To tackle this, ecoSPIRITS has developed the “world’s first low carbon, low waste packaging system” for premium spirits and wine.

The company’s 4.5-litre ecoTOTE container—which is roughly equivalent to six bottles of spirits or wines—can be cleaned, sanitised, and refilled after use by restaurants, bars, hotels, and beverage brands.

According to the company, its patent-pending system can reduce the carbon footprint from the packaging and distribution process by 60 to 90 per cent, and eliminate more than 95 per cent of single-use packaging waste.

The startup shared that wine and spirit brands across 28 countries are using its containers, including Absolut Vodka, Havana Club, and Smirnoff. In 2023, the company raised US$10 million in series A funding led by New York-based Closed Loop Partners and Singapore-based Wavemaker Partners.

5. Fluid

Fluid is a Singapore-based fintech startup that offers flexible payment options for companies to pay their suppliers.

It focuses on streamlining B2B payments with a platform that allows suppliers to take on buyers with credit terms while enabling buyers’ access to purchase financing—essentially offering companies with a B2B “buy now, pay later” solution.

In February, Fluid raised US$5.2 million in a series A funding, bringing its total funding to US$7 million. With the funds, it aims to expand its product capabilities and onboard bigger suppliers across industries.

6. Graas

Homegrown startup Graas—the name is short for “growth as a service”—uses predictive AI to assist ecommerce businesses.

Through Graas’ online platform, users can track order volumes and access data-generated insights related to marketing and inventory management.

The AI engine also helps predict trends and deliver actionable recommendations across various verticals, including marketplace storefronts, warehousing, and last mile logistics.

Graas was founded in 2022, and raised US$40 million in a series A funding round that same year, which it used to acquire Indian data specialist Shoptimize, and SELLinALL, a Singapore-based ecommerce startup.

7. HitPay

Founded in 2016, HitPay offers easy payment solutions for both online and brick-and-mortar businesses.

Through HitPay’s software tools, companies can accept credit card and e-wallet payments, and offer “buy now, pay later” packages to customers.

Apart from Singapore, the Y Combinator alum has also expanded into other countries, including Malaysia and Thailand. According to the business, it currently helps over 15,000 businesses across the globe process to payments efficiently and securely.

In May 2022, HitPay raised US$15.8 million in a series A funding funding round led by Tiger Global.

8. Jenfi

Founded in 2019, Jenfi offers flexible financing for ecommerce operators and online businesses across Southeast Asia. To date, the company has raised a total of almost US$13 million.

Under its “growth capital as a service” model, the company disburses loans of up to US$1 million in exchange for a fixed percentage of monthly revenue.

Businesses can use the non-dilutive growth capital to manage cash flow gaps, whether for digital marketing, inventory management, or expanding into new markets.

9. k-ID

Built with help from co-founders with diverse backgrounds in privacy law, online trust, and safety, k-ID is a platform that helps game developers comply with privacy regulations and makes online gaming safer for children and teens.

Its technology can detect the age of a game user through various verification methods, after which the company automatically configures the game’s settings to age-appropriate content.

In June, k-ID announced a US$45 million series A funding round from investors including Lightspeed Venture Partners, bringing its total funding to US$51 million.

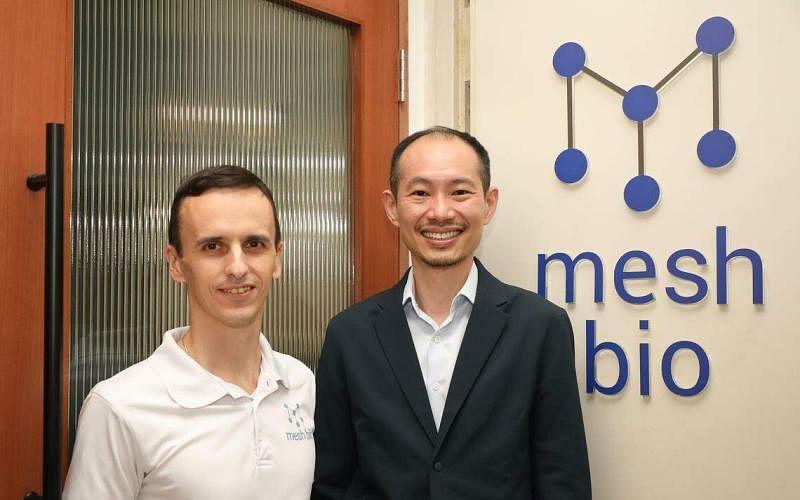

10. Mesh Bio

Mesh Bio is a digital health startup that develops clinical decision support analytics and automation solutions for the management of chronic diseases, enabling data-driven care that enhances patient engagement and health outcomes.

One of Mesh Bio’s innovations involve the creation of a digital replica—or a “twin”—of a patient’s body, allowing doctors to gain insight into their potential response to various treatments and therapies for chronic diseases.

That solution is currently being tested in several hospitals and polyclinics in Singapore to predict the risks of patients developing kidney damage from type 2 diabetes.

Most recently, the startup raised US$3.5 million in a series A funding round led by East Ventures to scale the deployment of its digital twin technologies across Hong Kong and Southeast Asia.

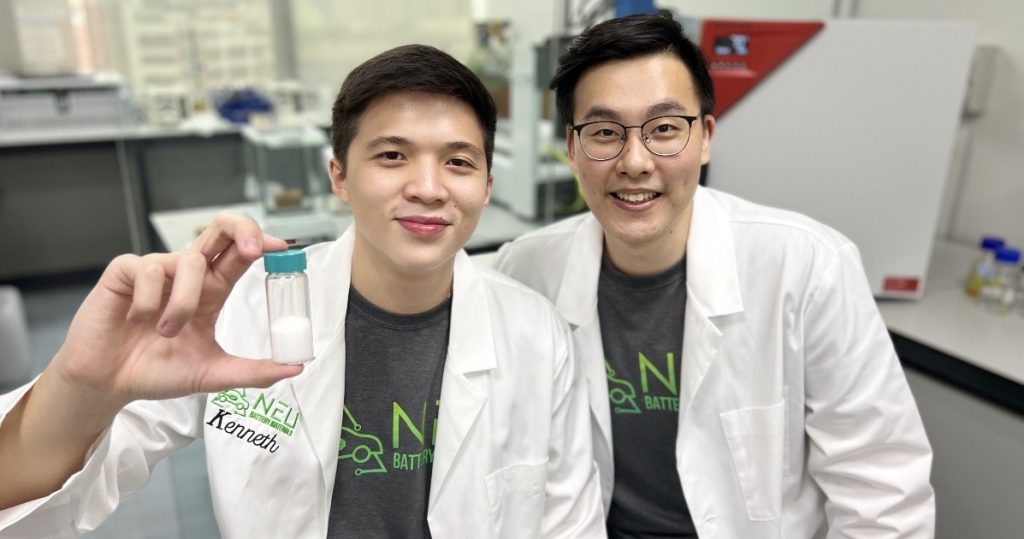

11. NEU Battery Materials

Lithium battery recycling is costly, inflexible, and inefficient. To provide a greener, scalable, and commercially viable alternative to conventional processes, NEU Battery Materials has developed the world’s first electrochemical lithium-ion battery recycling technology.

According to the company, its patented technology enables a near-zero waste recycling process of lithium batteries.

Additionally, NEU Battery Material’s recycling units only consume water and electricity to extract lithium from end-of-life lithium batteries, eliminating the need for costly and wasteful methods like acid leaching or smelting, which are common in conventional processes.

Last year, the company raised US$3.7 million in seed funding from SGInnovate, and the corporate venture arm of taxi operator ComfortDelGro, among others.

12. Neurowyzr

Founded in 2019, Neurowyzr develops tests to help adults spot and potentially mitigate early cognitive decline. Through a series of online mini games, Neurowyzr’s Digital Brain Function Screen (DBFS) test measures short-term memory, attention, and thought flexibility.

For example, one puzzle has dots with a number on each scattered across the screen, and asks the users to connect them in order. Another shows a series of numbers that users need to memorise and then write in order.

DBFS can be completed in 15 to 20 minutes and is hosted online, so patients can access it conveniently through a web browser link at home, though it was originally designed for primary care settings.

Last August, the startup closed its seed funding round led by Jungle Ventures and Peak XV’s Surge, bringing its total funding to US$3.3 million.

13. SaladStop! Group

Founded in 2009 by father and son Daniel and Adrien Desbaillets, and co-headed by daughter Katherine and son-in-law Frantz Braha, SaladStop! Group has sought to disrupt the traditional fast food model, and has pioneered delivering healthy, nutritious menus to customers across Asia.

From grain bowls to sushi takeout, the company sells meals that appeal to the health-conscious through its four brands: SaladStop!, Heybo, Wooshi, and catering service FreshKitchen.

The family business was first founded in Singapore and currently operates 75 outlets across six markets—Singapore, Hong Kong, Indonesia, Vietnam, the Philippines, and South Korea—with over 800 employees. In 2021, the company raised US$9 million in a series B investment round led by Temasek.

14. SquareX

Cybersecurity startup SquareX offers web browser products that help organisations detect and prevent online attacks against their users.

SquareX’s browser extension, which the startup says has been downloaded over 100,000 times from the Google Chrome web store, can alert users to potentially malicious files and websites, avoiding compromised networks.

The startup also offers companies web-based VPN and file isolation tools. In 2023, the company successfully raised US$6 million in funding from Sequoia Capital India & SEA (now known as Peak XV Partners).

15. Tazapay

Tazapay is a fintech startup that enables businesses to seamlessly carry out cross-border payments.

Targeting gaming, ecommerce, and travel companies, the company provides checkout, payment link, and escrow solutions, simplifying international transactions in over 170 markets globally.

The company is a member of the Singapore FinTech Association, and its founders bring over 50 years of experience from prominent, high-growth fintech and service companies around the world.

In 2023, Tazapay raised US$16.9 million in a series A funding round led by Sequoia Capital India & SEA (now called Peak XV Partners).

-//-

The Forbes Asia 100 to Watch list spotlights 100 small companies and startups on the rise across the Asia-Pacific region.

The 100 firms in the list’s fourth iteration this year have drawn over US$2 billion in total investments to date. 83 of them have raised money since the start of 2023, even as venture capital funding in the region hit a seven-year low last year.

This influx of investment was driven by their innovations, spanning some of the world’s hottest industries such as spacetech, biotech, and robotics. Their ambition and achievements thus far paint a positive picture for the future of Asia-Pacific’s startup ecosystem.

– Rana Wehbe Watson, Editorial Director/Special Projects at Forbes Asia

- Learn more about Forbes Asia’s 100 to Watch list here.

- Read other articles we’ve written about Singaporean startups here.

Featured Image Credit: SaladStop! Group/ Mesh Bio/ NEU Battery Materials/ Aliena