I’ve been an avid user of GXBank since the first Malaysian digital banking platform got its start last November.

Some of my favourite features that I always highlight when recommending the platform is the unlimited cashback of 1% when using the GXBank debit card. Another thing is the 3.00% p.a. daily interest rate that they offer.

Well, some important updates will be implemented that will affect these features.

According to an email from GXBank today (September 6), there are two changes that they will be doing as the digital bank turns 2 years old:

- The daily interest rate will be adjusted to 2.00% p.a. for their Main Accounts and Saving Pockets effective October 1, 2024.

- They will be “revising” The GXCard’s unlimited 1% cashback programme effective November 6, 2024.

It’s not clear what they will be revising the cashback programme to, whether that be removing it entirely or lowering the percentage.

They also did not comment on whether there will be changes to the zero ATM withdrawal fees and zero markups on foreign transactions that GX Card users have been enjoying. However, based on what they have shared previously, the waive is set to last until the end of this year (December 31, 2024).

You can’t please them all

On their Facebook announcement detailing these changes, some netizens expressed dissatisfaction over the changes.

Some pointed out that the new 2% p.a. interest rate is lower than many other options in the market, including offerings by traditional banks and digital banks alike.

As a comparison, AEON Bank is offering 3.88% p.a. profit rates while Boost Bank is even offering up to 4.0% interest rates under special conditions.

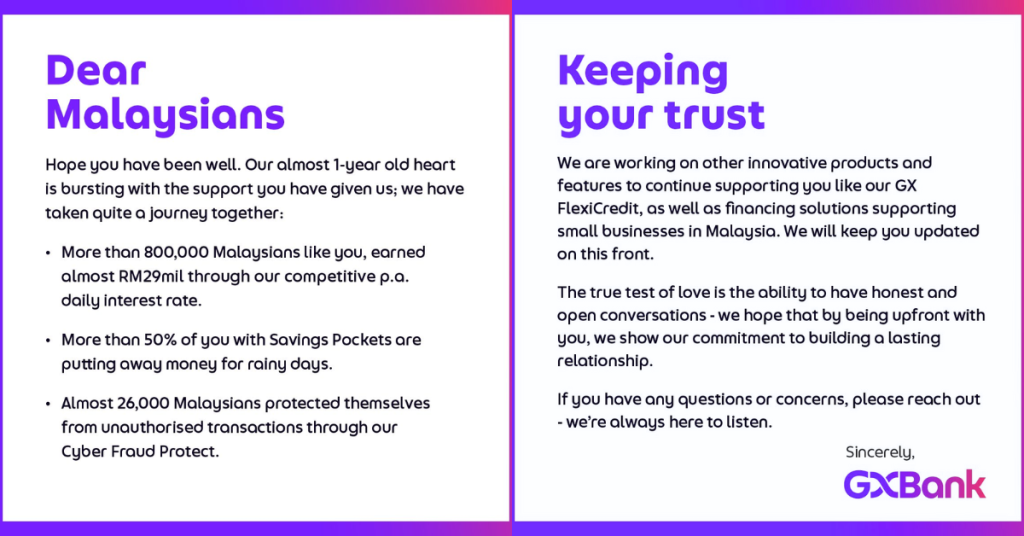

It is a shame that GXBank is lowering their interest rate, but that doesn’t diminish what they’ve achieved in the past year. GXBank shared that more than 800,000 Malaysians have earned almost RM29 million through their daily interest rates.

Plus, it’s important to note that GXBank has always been clear that the GX Card’s 1% cashback on transactions with no cap would only last until November 5, 2024.

Moving forward, GXBank will be working on new products such as its GX Flexi Credit, as well as financing solutions to support small businesses in Malaysia.

GX Flexi Credit, which was announced in August this year, is essentially a line of credit designed to offer financial flexibility to its customers.

The objective is to let users borrow with ease, paying interest only on the funds used. It’s also designed to be quick and hassle-free, with no need for paperwork and long waits for approval.

This product is not yet launched yet. Instead, GXBank is inviting Malaysians to join the waitlist on their website.

As a continual user of GXBank myself, I’m excited to see what’s next for the digital bank, even as these changes roll out. While the new 2.00% p.a. interest rate is less than ideal, I believe the new products in the pipeline are still worth keeping an eye on.

Featured Image Credit: Vulcan Post / GXBank