[This is a sponsored article with Syarikat Jaminan Pembiayaan Perniagaan (SJPP).]

Disclaimer: This article is for educational and informational purposes only. It is not intended to be a substitute for financial advice. Readers are encouraged to do their own research before arriving at any conclusions based solely on this content. Vulcan Post disclaims any reward or responsibility for any gains or losses arising from the direct and indirect use and application of any contents of the written material.

The topic of business loans is a polarising one.

Ask different business owners and each may give you varying answers, from “It’s necessary for growth,” to “Avoid them like the plague.”

As a business owner, though, you should know your company best and be able to make the right financial calls for its growth and sustainability.

Here are some perks and drawbacks of getting a business loan from a bank, so you can decide if taking one up will be the right fit for your business.

The perks

1. Generous loan amounts with attractive interest rates

Bank loans typically offer a larger amount compared to other financing alternatives such as online lenders approved by the Ministry of Housing and Local Government (KPKT).

And as opposed to crowdfunding where there is a chance that you might not hit your fundraising targets, the money that you can get from a bank loan is as stated on the agreement.

The better your credit score, the higher you may be able to negotiate the borrowed amount.

Not only that, the interest rate for bank loans tends to be lower than other financing alternatives such as venture capitals or private loans.

Dictionary time: Private loans are loans given to an individual or company by a private entity. This could be a private organisation, a wealthy individual, or even friends and family.

Interest rates are also typically fixed upon application. The bank will not, for instance, take a percentage of your profits or ask for shares in your company.

2. Longer terms

Bank loans can also be paid back over an extended period of time.

These are usually in monthly instalments, as opposed to online lenders who may request weekly or even daily payments over the course of one to two years.

Banks on the other hand offer the choice of either a short or long-term loan payment plan.

For instance, Alliance Bank’s microfinance targeted at MSMEs has a repayment range of one month to up to seven years.

Long-term loans usually enjoy lower interest rates as opposed to short-term ones, on top of also having lower monthly payment costs.

This also lends itself to being able to borrow larger amounts as required.

3. Flexible usage

Bank loans are also flexible in the sense that borrowers are granted the freedom to allocate their newly-acquired funds as they see fit.

This is in contrast to venture capitals or angel investors who may impose restrictions on what the funds can and cannot be spent on.

Dictionary time: Angel investors are individuals who finance startups in the early stage of the business, typically in exchange for equity or convertible debt.

This flexibility in usage could very well serve as a safety net for SMEs in the event of an emergency, or to quickly seize a business opportunity with quick turnaround times.

The drawbacks

1. Lengthy waiting periods

It is important to note that there can be lengthy wait times for bank loan applications to go through.

Dr Sabariah, founder of Berkat OSH Services (BOSH), for instance, noted that some banks can take over three to six months just for the application itself to be approved.

It may then take another two months on top of that for the funds to be disbursed.

In BOSH’s case, this delay in receiving funds put a damper on growth plans, preventing them from investing in more equipment, staff, and operational clinics.

The high deposit required additionally strained their cash flow.

2. Stringent eligibility guidelines

Banks also tend to be strict on who can qualify for a loan in the first place.

The criteria for a business to qualify naturally differ from bank to bank as well as package to package, but some examples of what might crop up here in Malaysia include:

- Being owned and/or registered in Malaysia

- The business is of a certain size and/or classification (SME, sole proprietorship, etc.)

- A minimum sales revenue of a certain amount

- Being in operation for a certain amount of time

- Being within a specified age range

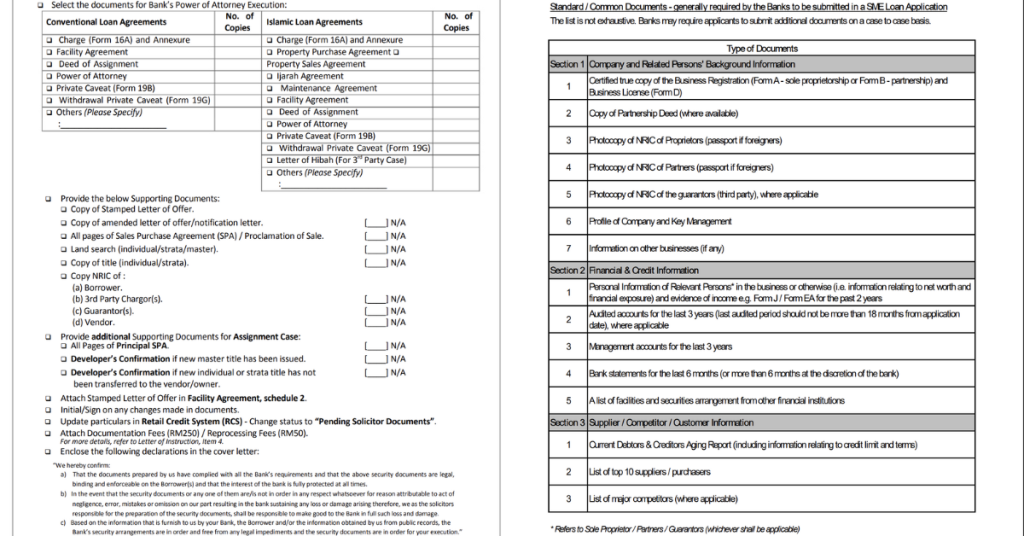

3. Extensive documentation requirements

The list of documents that need to be submitted to apply for a bank loan usually also tends to be quite extensive.

As an example, here are CIMB and Hong Leong Islamic Bank’s document checklists.

CIMB notes that poor documentation of their required business documents can ultimately lead to the loan application being rejected.

A damaged credit score, cash flow limitations, a weak business plan, or too much existing debt were also listed to be potential failure points in this regard.

Quite understandably, banks are wary of who they’re lending money to. And that’s where a guarantor comes in.

Easing the process

A guarantor is an individual or organisation that promises to pay the debts of the borrower that they’ve signed with in the event that the borrower is unable to pay back their loan.

One such example of this is SJPP, a Minister of Finance Incorporated company that administers and manages government guarantee schemes designed to assist SMEs in securing financing from banks.

Since its inception in 2009, SJPP has facilitated total financing to SMEs amounting to RM102 billion, benefiting 75,000 business owners, noted Finance Minister II Dato’ Seri Amir Hamzah Azizan in an Instagram post.

They reduce the risks for banks handing out loans to SMEs by guaranteeing a set percentage of the loan in question.

This added layer of security not only reduces qualification barriers for SMEs, but also improves the loan terms, SJPP told Vulcan Post.

One of the schemes that the SJPP has under its belt is the Government Guarantee Scheme MADANI 2 (GGSM2).

This is meant to provide financial assistance to SMEs in the green economy, high technology, halal, and healthcare sectors.

Another would be their Working Capital Guarantee Scheme – Bumiputera (WCGS-B), which boasts a claimed 80% guarantee rate for financial institutions that they’re partnered with.

More government guarantee schemes are of course available, and the full list can be viewed on their website here.

Startups and small businesses have always been an integral part of the Malaysian economy, with MSMEs accounting for nearly 97% of local establishments.

As such, government guarantee schemes administered and managed by SJPP not only keep the Malaysian economy alive, but are also conducive to the dreams of aspiring entrepreneurs, especially in the face of global economic uncertainties.

Also Read: Why Brisbane & Gold Coast should be M’sian travellers’ top Aussie destinations in 2025

Featured Image Credit: SJPP