This millennial is sharing her road to RM100K in 5 yrs and helping others on IG do the same

Most of us, especially when we’re still young, don’t prioritise saving and budgeting. But in the end, it’s an important lesson we all learn: you have to keep track of your spending, pre-plan your expenses, and manage your habits, one way or another. It’s a tough practice to cultivate yet a necessary one for financial stability.

So, how do you start?

For 36-year-old Anis, she chose to launch a financial-based Instagram page (@budgetwithanis).

Money talks

Known as finsta accounts, these pages typically share knowledge and tips on how to better manage your finances. This includes sharing their spending habits, income, and investment portfolios.

Inspired by local finsta account @myringgitbook, whom Vulcan Post previously interviewed alongside other financial bloggers on why they would willingly expose their finances online, Anis began documenting her journey online.

She likened her page to a journal with the purpose of recording her financial journey and keeping herself accountable. “At the time, I just started saving and I saw a lot of international accounts did this too. So I thought why not start a page for myself?” she quipped.

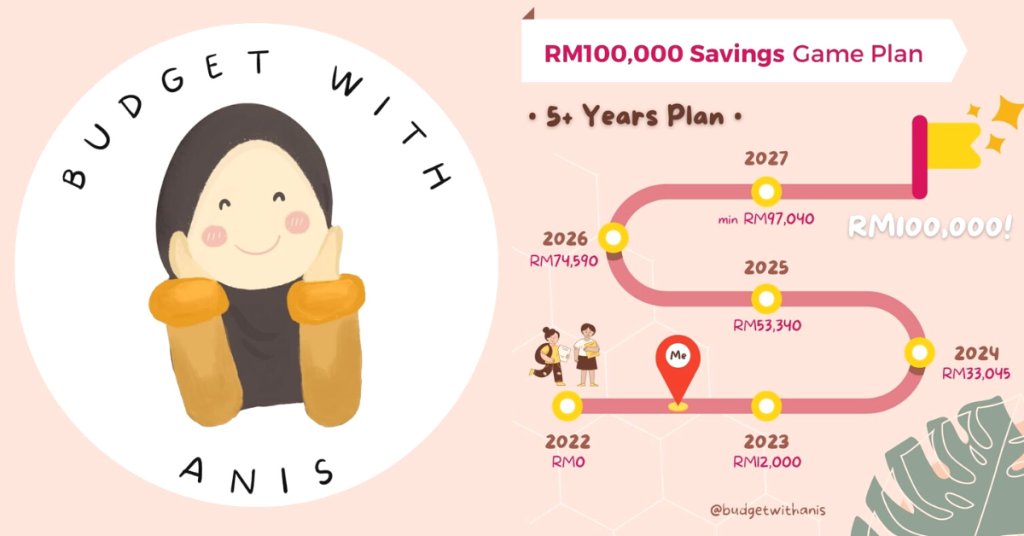

The goal she’d set out for herself was to save RM100,000 by 2027, a total of five years since first starting in May 2022. When asked why such a specific amount, Anis said, “I believe it is the minimum that everyone should at least have before they turn 40. From my calculations, it is achievable with some sacrifice.”

This theory is supported by other financial advisors and the maths quite literally adds up, according to The Simple Sum. By saving up about RM1,000 each month from your earnings, you should be able to hit the RM100K savings milestone in about seven years.

However, Anis takes this a step further by reducing the usual seven years needed to reach that amount. She came up with her own budgeting plan that focuses on her investment and saving efforts, as well as snowballing her debts away. Having a stable 9-to-5 job at a maintenance company makes it possible for Anis too.

Dictionary time: The debt snowball method is a debt-reduction strategy where you pay off debt in order of smallest to largest. When the smallest debt is paid in full, you roll the minimum payment you were making on that debt into the next-smallest debt payment.

Surprisingly, this wasn’t in her earlier life plans

Anis first entered the job force the moment she stepped out of high school. The thrill of earning and spending on items evoked a sense of happiness in her, something that others can surely relate to. When she settled down, this lifestyle continued as her husband took care of household expenses.

“I was only in charge of the cats and other small bills. I was living from paycheck to paycheck with no savings plan in mind,” she explained.

But then life came knocking on her door.

The pandemic and its effects on the economy caused her husband to be laid off. Money became tight and Anis started chipping in for larger payments. When the government allowed Malaysians to withdraw from their retirement funds (EPF), Anis ended up splurging out of habit, something that financial bloggers we interviewed on the topic definitely advised against.

“Instead of saving it, I ended up spending half of it on I-don’t-know-what and was scammed out of my money. I lost RM12,000 within a year because of my greediness,” she disclosed.

It was shortly after her husband was back on his feet that she discovered the minimalist movement. Moving away from the consumption mindset, Anis began practising mindfulness and reordering every aspect of her life.

“I started decluttering, throwing away unimportant items in my phone, and my room, and organising my digital files. Eventually, I came to tackle my finances too.”

Girls just wanna have funds

Cash stuffing was the first method she ventured into and has continued to stick with, specifically the viral RM100 challenge. She finds that practice has been so successful because it’s a channel to keep all the extra cash in one place. It’s also easier to track as you can physically see it, unlike money in the bank.

“The tracker keeps me on my toes. Once I have ticked the box, there is no coming back and I would never touch the money until it is completed,” she shared.

Anis also invests in unit trusts and gold funds, such as AHB (Amanah Hartanah Bumiputera) and Tabung Haji. As she’s still new to the game, she recommends others like her to look into lower risk investments first before making a big commitment.

If you’re still unsure where to start your savings journey, you could try the zero-based budgeting template that Anis created. It’s easy-to-follow and customisable, and the best part is that it’s completely free.

“I wanted to give something to my followers,” she explained. “I plan on monetising other downloadable templates in the future as a passive income funnel for @budgetwithanis. But those I created to be given away for free is my way of giving back to the community.”

Just by scrolling through her Instagram page, you’ll notice that Anis has been trying to have a child for awhile now. Curious, we asked her how she plans to stay on track with her RM100K goal if her family does expand within these five years.

“Having a baby at this time will affect my journey, though achieving RM100k is not the end goal. If we are blessed with a child during this period, I already had planned a few side incomes to back up the financing and keep my goal on track,” she shared.

A newfound “career”

What started out as a hobby to pour out her thoughts became a passion project. Although having a full-time career can be restricting, she’s amused by the blogging sphere.

“I love hearing from people and I am constantly motivated to keep updating when I hear their kind words and encouragement. It is my source of strength to keep updating. I hope that it will turn into something fruitful in the future.”

As for financial advice, Anis admitted that she’s not a licenced professional, but has a few recommendations for people wanting to start.

The basics is to start tracking by listing down all your incomes, expenses, and debts. Having them in a sheet helps to make sure you don’t miss out on anything important.

The next step is to budget and control your spending. It’s important to pay yourself first (by saving) before planning your other expenses, not the other way around.

Lastly, Anis echoes the philosophy of minimalism by advising to live moderately and “enjoy the process”.

- Learn more about Budget with Anis here.

- Read other articles we’ve written about personal finance here.

Also Read: Hopping into a festive Peranakan house, what does a DJ rabbit have to say about CNY?

Featured Image Credit: Budget with Anis

Where are they now? A look at 10 crypto companies that were actively hiring in S’pore in 2022

In the first half of 2022, crypto companies were flooding the job market in Singapore. The bull market was still well underway and there was no shortage of capital in the industry. At the time, we made a list of 10 companies that were among the most prolific in their hiring practices.

Needless to say, a lot has changed since then. First, it was the LUNA/USDT crash which triggered a domino effect, claiming companies including Three Arrows Capital and Hodlnaut.

More recently, the collapse of FTX sent shockwaves across the industry — further harming consumer trust and deepening the market crash.

As it stands, a recovery doesn’t seem to be in plain sight. However, it seems apt to revisit our list of 10 companies to see how well they’ve been weathering the storm.

1. Binance

Binance has been the world’s largest crypto exchange for over half a decade now. Following the collapse of FTX, its market dominance has expanded even further. The next competitor, Coinbase, only records around 10 per cent of Binance’s trading volume on a daily basis.

Amidst the crypto layoffs that started mid-2022, the company continued to hire. At the time, CEO Changpeng Zhao spoke about a “healthy war chest”, with the capacity to expand while competitors downsized. Going into 2023, this remains just as true.

At a crypto conference this January, Zhao announced plans to grow headcount by 15 to 30 percent this year. Currently, there are over 500 job openings listed on the Binance website, around 100 of which can be applied to by those based in Singapore.

As such, Binance is hiring more aggressively now than it was during the bull market, when the previous iteration of this article was written.

Although the company has faced allegations of poor fund management and misrepresented losses over the past few months, it doesn’t seem to have affected operations. In fact, Zhao has refuted some of these claims, claiming that the reported loss figures are off the mark by billions of dollars.

2. Crypto.com

Crypto.com hasn’t fared quite as well through the market crash. The company invested heavily in marketing through 2021 and 2022, committing almost a billion dollars to sponsorships alone.

US$700 million bought Crypto.com the naming rights to Los Angeles’ iconic Staples Center, and another US$100 million let the company decorate the promotional boards at Formula 1 events.

Since then, the company has quietly downsized its partnerships as per Ad Age. This has included backing out of deals with the UEFA Champions League and Twitch. Crypto.com has also been downsizing, with as much as 40 per cent of its workforce allegedly let go in the second half of 2022.

This January, CEO Kriz Marszalek announced a further 20 per cent reduction to headcount, stating that the company was unable to withstand the market impact brought about by the collapse of FTX.

Despite these cuts, Crypto.com is still hiring for a select few roles in Singapore. Included are positions such as Product Manager, Brand Designer, and Mobile Developer.

3. Okcoin

Okcoin has maintained its healthy standing through the market crash, as per a Twitter thread by CEO Hong Fang.

Fang states that the company has never lent out customer assets to others or tried to grow via leverage trading. This has helped them avoid much of the fallout from the collapse of firms like FTX and Three Arrows Capital.

Fang emphasises that Okcoin will continue to focus on technological developments rather than take on a banking role which many other crypto exchanges have opted for. “We will continue to refrain from taking on balance sheet risks,” she adds.

There have been no public reports of company-wide layoffs at Okcoin following the market crash. Although the company is not hiring in Singapore at this point of time, it has positions open in countries including Malta, South Korea, and USA.

4. Alchemy Pay

Unlike most of the companies on this list, which are crypto exchanges, Alchemy Pay’s primary business is to enable crypto payment solutions.

The firm works with a host of e-commerce and crypto partners — including Shopify, Paytend, Binance, and Huobi — to ease the conversion process between fiat money and cryptocurrency.

Going into 2023, Alchemy Pay has ambitious plans to continue expanding across the globe. It intends to add countries such as India, Korea, and Venezuela into the list of places where it’s on-and-off-ramp solutions are accessible. Along with this, Alchemy Pay has also become one of Visa’s official service providers and began supporting Apple Pay for fiat-to-crypto purchases.

It’s unclear whether Alchemy Pay had to lay off staff following the market crash. The company did not respond to Vulcan Post’s request for a comment. At this time, the company isn’t hiring in Singapore.

5. Coinbase

Coinbase found itself in the same boat as Crypto.com following the market crash, having to carry out multiple rounds of layoffs.

In June 2022, CEO Brian Armstrong admitted that the company had grown too quickly over the past year. The downturn exposed operational flaws and revealed a need to manage expenses better. This triggered a decision to downsize by 18 per cent.

Since then, Coinbase has continued its struggle to navigate the bear market. This January, the company made a decision to lay off another 20 per cent of its staff, amounting to almost 1,000 employees.

Armstrong admitted that the initial layoffs in June hadn’t been enough, and the subsequent collapse of FTX had further impacted the company’s standing.

Currently, Coinbase is only hiring for a HR & Recruiting position in Singapore. The job comes with perks including a gym and commuter allowance, and volunteer time off.

6. BTSE

BTSE seems to have fared well throughout the market crash, suffering no direct consequences from the LUNA/USDT crash or the collapse of FTX.

BTSE offers spot and futures trading with over 1,200 trading pairs for users to choose from. Last December, the company reclaimed its spot as one of the top 10 derivatives exchanges, as ranked by CoinGecko.

Much like the wider crypto market, BTSE’s native crypto token has lost significant value since 2022. It’s down over 60 per cent from its all-time-high last March. Despite this, CEO Henry Liu remains optimistic given recent signs of market stability and recovery.

BTSE is only recruiting for a marketing position in Singapore at the moment, and it is looking to expand its network of influencers and key opinion leaders to help grow the BTSE brand.

7. Kraken

Despite being among the longest standing exchanges — with a fair share of experience dealing with crypto winters — Kraken was forced to downsize by 30 per cent last December.

The company announced that it would lay off 1,100 employees in an effort to adapt to the prevailing market conditions. This decision came just six months after Kraken had started a process to expand its staff by 500.

Financial News reported on a “savage” redundancy process wherein employees were locked out of their computers with little to no warning. News about the layoffs had reached the media before the employees themselves were even informed.

Currently, Kraken remains the third largest crypto exchange by trading volume, behind only Binance and Coinbase. The company is currently not hiring in Singapore, however it has almost 100 positions open in other parts of the world including Europe and North America.

8. Coinhako

Singaporean crypto exchange Coinhako has weathered the storm without controversy. The company spent the first half of the year focusing on its institutional services — a segment which recorded a 300 per cent increase in trading volume during the time.

Following the onset of the crypto winter, Coinhako continued hiring with an intention to expand across Asia.

More recently, the crypto exchange has been easing the process for Singaporeans to purchase crypto. Users can now fund their accounts using PayNow, which only takes around a minute and doesn’t come with any fees.

Currently, Coinhako is hiring for over 20 jobs in Singapore. These include internships as well as full-time positions in fields including software engineering, product management, and data analysis.

9. Zilliqa

The crypto winter is often referred to as a time for building — when developers get to strap in and focus solely on the product. Zilliqa has continued growing its ecosystem over the past year, with major upgrades planned for 2023.

The network is pushing for the support and development of DeFi protocols, starting with Ionise — an app which facilitates short-term borrowing and lending. According to CEO Matt Dyer, this is an important step towards breaking the misconception that Zilliqa is solely meant for blockchain gaming.

As it stands, Zilliqa isn’t advertising any open positions exclusive to Singapore. However, the company does have roles in PR and Data Analysis for remote workers based anywhere in the world.

10. Cobo

Cobo was among the many crypto companies to move their operations from China to Singapore back in 2021. Since then, the firm has continued expanding its presence with the launch of a new regional headquarters last September.

As per co-founder Discus Fish, the next aim is to establish partnerships with other firms that make up Singapore’s financial sector. “Singapore has opened its borders to crypto and we hope to be able to provide infrastructure and develop the crypto ecosystem in Singapore,” Fish told Vulcan Post.

Cobo is actively hiring in Singapore, with open positions in Sales, Customer Service, and Website Development. The company is also seeking out local institutions to offer internships to students.

Featured Image Credit: Binance / Zilliqa / Crypto.com / Coinbase

Also Read: Crypto jobs in 2023: Is the industry too volatile for a stable career?

UOB ventures into the metaverse, continues to see potential in blockchain technology

Over the past two years, companies around the world have started taking interest in the metaverse.

The term dates back to a 90s sci-fi book, wherein it describes a three-dimensional virtual reality which mirrors the real world. In theory, it’s a place for people to live an alternate life with all the conveniences of digital technology.

As it stands, our metaverses aren’t fully inhabitable yet. However, there have been a number of developments to this end. From retailers setting up metaverse stores to musicians hosting virtual concerts, we’re steadily learning more about the online equivalent to real-world activities.

Last November, UOB launched SkyArtverse — a virtual art gallery built within Decentraland. Launched in 2020, Decentraland is one of the most popular metaverses today. It offers land parcels which can be bought using cryptocurrency and used to set up virtual environments.

Decentraland was selected for UOB’s first foray into this space as it has one of the largest user bases among the metaverses, aligning with our objective to broaden our engagement with audiences through a differentiated virtual experience.

– Lilian Chong, Head of Group Brand and Corporate Social Responsibility, UOB

UOB’s move followed two months after DBS became the first Singaporean bank to venture into the metaverse — doing so in partnership with The Sandbox, a close Decentraland competitor.

UBS and AXA are also among this list of financial companies pursuing metaverse strategies in Singapore. It’d appear as if the industry as a whole sees potential in this emerging technology.

Looking into SkyArtverse

SkyArtverse showcases the winning works from UOB’s Painting of the Year competition. Viewers may enter the gallery using their own customisable avatars, following which they can observe the artworks and learn more about the artists’ stories and inspirations.

“UOB has been a steadfast supporter of Southeast Asian art and artists for more than four decades,” explains Lilian Chong, UOB’s Head of Group Brand and Corporate Social Responsibility. For the banking institution, the metaverse offered a way to broaden engagement with both artists and audiences.

With the launch of SkyArtverse, UOB became the first bank in Asia to explore this intersection between art and technology.

In a 2022 survey, the company found eight in 10 respondents agree that art appreciation improved one’s quality of life. A similar proportion also vouched for art’s ability to bring people from different walks of life together.

“The reach of the metaverse beyond physical boundaries allows us to bring an international community of art lovers together,” Chong explains. Using this technology, UOB aimed to emphasise the benefits which many attribute to art. It was a way to improve accessibility and allow Southeast Asian works to reach a global audience.

So far, it’d seem the experiment has been a success. “We are encouraged by the public’s response to the platform, with visitors spending an average of 15 minutes in the virtual art theme park exploring the winning artworks,” says Chong.

Is decentralisation the way forward?

One of the key debates surrounding metaverse technology has been the need for decentralisation. Companies such as Meta and Microsoft have been pushing the case for centralised metaverses, while Decentraland and The Sandbox lead the charge on the other end.

As the next iteration of the internet takes form, it remains to be seen if both sides can coexist.

“Both centralised and decentralised metaverses have their pros and cons. We will continue to explore both types of platforms and assess their suitability for relevant projects,” says Chong. She cites governance and data privacy among the factors which are important to consider when making such decisions.

Centralised platforms collect user data for a variety of purposes.

For example, social media apps can recommend more relevant content as they learn more about the user. This adds an aspect of convenience and can improve the overall experience. On the other hand, the data might also be misused or sold to third parties without consent.

Decentralised platforms offer an alternative solution, where users can access such apps without having to give up any personal information. This guarantees privacy, but takes away the tailored experience.

As it stands, decentralised metaverses seem to have the upper edge over their counterparts. Meta’s Horizon World’s metaverse has been a notable source of the company’s financial woes, and the platform failed to reach its monthly active users target last year.

Meanwhile, Microsoft has been cutting down on its VR projects amid a major wave of tech layoffs.

Crypto and the metaverse

With their emergence coinciding, blockchain technology and the metaverse are often seen going hand-in-hand.

For example, Decentraland and The Sandbox both use their own crypto tokens to sustain an in-world economy. Users are identified solely by their crypto wallet addresses, which can be used to enter the platforms.

Such utilities are helping steer crypto away from its notoriety as a speculative investment. Chong acknowledges the inherent risks surrounding the asset class and the need for investors to have a thorough understanding of its complexities.

“That said, we continue to see the strong potential of underlying blockchain technology,” she says.

UOB is capitalising on the growing interest in digital assets by exploring utilities such as asset tokenisation, central bank digital currencies (CBDCs), and the metaverse.

“We believe that blockchain technology and the metaverse are here to stay, and UOB will continue to leverage [it] to offer suitable financial services and engage customers in a safe and secured manner.”

Featured Image Credit: UOB

Also Read: Crypto jobs in 2023: Is the industry too volatile for a stable career?

Believing passion trumps profit, these M’sian entrepreneurs went from law to personal care

Raise your hand if you’ve had a loved one tell you what profession you should go into, be it for the money, status, or whatnot.

On the flip side, how often is the idea of passion brought up by our elders?

It’s usually a lesson left up to ourselves to figure out, one that sometimes takes months up to years.

Ivor and Meng of HYGR fall into the latter category. After spending five years studying law, they graduated around the time of the pandemic.

In an interview with Vulcan Post, Meng revealed that they had applied to around 20 to 30 companies, but had no luck.

So, left with no other choice but to take a break, they reflected on themselves. “Maybe we can do something else during this break to find our hobbies and passion,” Ivor recalled their thoughts.

From their own personal care issues, such as Ivor’s cracked lips and Meng’s body odour, they decided to start HYGR, a personal care brand.

Selling natural lip balms and deodorants, HYGR’s products are wrapped in eco-friendly packaging. It started small from home, but then a viral five-second TikTok video changed everything for the brand.

Sales shot up to about 2,000 to 3,000 units of lip balms and 500 to 700 deodorants a month, last we spoke to them a year ago. The couple also shared then that they were close to receiving six figures in monthly sales.

They were the picture of a small business that had made it. But it had taken a lot to get here.

Those closest to you can be your biggest critics

The couple’s families found it hard to accept the fact that they were branching out from law.

“For people [not in] law, they have respect for lawyers, and they think like, ‘Oh, lawyers earn a lot of money’, wearing suits and everything,” Ivor said.

Neither her nor Meng’s families have any connections to the legal industry other than through the couple, and their families were extremely proud of their profession.

So, when they broke the news that they were trying something non-law related, both their families were shocked. However, they chose not to go into detail about what they would do.

“When we first started HYGR, we didn’t tell them anything. We just did it,” Meng said.

Of course, they couldn’t stay silent about it for long. As they continued building their brand online, family members who were aware of it were, unfortunately, less supportive than Ivor and Meng had hoped for.

“They were like, can do meh? Huh, got people want to buy meh?” Meng’s family even commented that the paper packaging they used for their products was “not even nice”.

Meng’s father also grilled them on whether they had really thought through this idea of running a business, asking if they had factored in electricity, rental, and other costs.

“Wah, if like that, then don’t need to do anything. You have to get everything so perfect at the start. I think naysayers will always be your closest friends or family,” Meng said.

Ivor added, “I was actually hoping for them to understand that passion does not generate that much money in the beginning. But I also hope that [they realise] money is not the only thing that we should focus on in our life.”

After multiple tries of explaining to their family their passion and business, they realised it wasn’t working.

“We cannot use our words to persuade them,” Meng concluded.

Actions speak louder than words

“The more they are against our business, the more we want to prove them wrong,” Ivor said.

Since their families harboured so much doubt that HYGR could take off, Ivor told them, “Give me six months and I’ll try to sell.”

This made it more credible for them to believe in HYGR, though it still took lots of time.

For HYGR, it took the entire two to three years of the pandemic for their loved ones to acknowledge their business as a serious business, and not just a hobby.

Bit by bit, doubts turned into curiosity.

“[Our families] didn’t know, like, ‘Wait, you can sell online like this? You don’t need to meet the customers?’”

“‘Customers don’t need to try it? How would they know they want it?’” Meng recollected.

Then curiosity turned into acceptance.

When their families flew from their hometown Penang to KL to visit the couple, Ivor said that they commented, “Your home office looks legit now! There are a lot of things going on. You actually have staff! You need to pay them, whoa!”

They eventually expanded the business enough to work with a manufacturer, though both remain very hands-on with HYGR, even as Meng continues his full-time career at a law firm.

Learning to trust themselves

If Ivor and Meng could turn the clock back, they’d have ignored the peer pressure that came with everyone else going to college, university, graduating, or getting a job.

“I wish we could’ve just maybe taken a year break, or even a semester break. I value the gap year because it gives you more time to try things out and understand what your passion is,” Ivor said.

“I think pursuing your passion doesn’t just give an impact—it changes your whole life. The thought of the ‘result’ is different. [It’s no longer just] ‘I want this salary’,” Meng added.

Ivor feels that running HYGR and living out her passion each day has put her in a better mental state too, making her happier. “I can’t remember the last time I cried,” she commented, recalling that she was crying daily when working in a career she didn’t like.

For others who may be feeling lost or torn between what they want for themselves and what others want for them, Ivor and Meng had some advice from their lived experiences to impart.

“You might already know your passion but you’re just afraid to pursue it because your parents or friends are saying that it’s not financially rewarding. In the beginning obviously you need a full-time job to sustain yourself.”

Ivor continued, “But keep the fire burning. Trust yourself.”

- Learn more about HYGR here.

Also Read: For RM210/hr, international teachers can prep M’sian students for all major exams

Shopee’s parent company Sea to expand in M’sia as it seeks to achieve profitability in 2023

Singapore-based e-commerce giant Sea, the parent company of Shopee, has announced its commitment to expanding in Malaysia, which is expected to create over 2,000 jobs in the country.

Malaysia’s Minister of International Trade and Industry, Tengku Zafrul Aziz, made this announcement during his official visit to Sea’s headquarters in Singapore on Sunday (January 29).

During the minister’s visit, Sea shared its plans for expansion in Malaysia, which include the setting up of cloud computing services, data hosting and processing, as well as a new logistics e-commerce warehouse.

The cloud computing project will be located in a three-story green facility in Johor’s Kulai town and will include 24 data hall suites, mechanical and electrical rooms, office space, as well as storage and parking facilities. The target completion date for this project is set for the first quarter of 2024.

Shopee will also be expanding its footprint in Malaysia with a newly-constructed two-story mega warehouse in Bukit Raja, Klang. This warehouse will be an integrated hi-tech logistics park equipped with cloud infrastructure spanning 130,000 square metres.

“Their planned foreign direct investment in cloud computing and hi-tech warehousing is set to create more than 2,000 new jobs for our people, which will also help us upskill our human capital while enhancing national productivity and competitiveness in the long run,” said Tengku Zafrul Aziz.

He added that the company’s investment in Malaysia will also have positive spillover effects for small- and medium-sized enterprises, corporates, and local communities.

Sea’s primary objective is to be cashflow positive

Sea’s decision to expand its investment footprint in Malaysia reflects the company’s confidence in the country’s business landscape. Sea’s co-founder and group COO, Gang Ye, said that the company’s expansion plans in Malaysia are a significant development not only for the group, but also for the local digital ecosystem.

However, the company is reportedly facing some challenges. Sea’s founder, Forrest Li, announced last September in an internal memo that the company’s primary objective for the next 12 to 18 months is to achieve positive cashflow as soon as possible.

He had noted that Sea has been struggling in an era of rising interest rates, accelerating inflation, and a volatile market. He sees this as not a “passing storm”, adding that these will likely persist into the medium term.

As of December last year, it is reported that Sea has laid off more than 7,000 employees, or around 10 per cent of its global workforce. Its latest round of layoffs — its third one within 2022 — was conducted last November.

Earlier that year, Shopee had also let go of its regional workers in its ShopeeFood and ShopeePay teams. Then in September 2022, Shopee also trimmed staff in its gaming arm Garena and research and development unit Sea Labs.

Separately, Shopee also made headlines recently for withdrawing multiple job offers based in Singapore. The e-commerce firm reasoned that due to adjustments in hiring plans, a number of roles at Shopee are no longer available.

Featured Image Credit: Tengku Zafrul via Facebook

Also Read: AirAsia CEO announces plans to expand its ride-hailing service in S’pore by June 2023

5 health success stories from M’sians to inspire your physical & mental goals for 2023

[This is a sponsored article with Tune Protect.]

Taking control of our health and wellness can be a challenging task, especially when progress isn’t tracked. I’ve tried to improve my diet, workout, and sleep year after year, with little success because I wasn’t staying consistent, or tracking my progress.

Recently, Tune Protect Group (Tune Protect) has made it easier for individuals to improve their overall well-being by launching PUMP, a free health and wellness feature in its app.

PUMP allows users to track their fitness, overall lifestyle, mental health, fibre intake, and sleep, making it a holistic platform, regardless of age and fitness levels.

A key aspect of PUMP is that it rewards users who keep up with its recommended habits for a healthy lifestyle. Therefore, increasing your PUMP Score will earn you e-vouchers from popular brands like Decathlon, Adidas, and HealthLand.

And to inspire Malaysians to stick to their health goals in 2023, Tune Protect has challenged us to look for individuals who have successfully achieved theirs in 2022.

Conquered Mount Kinabalu after getting back in shape

To start off, we spoke to Mike Chu, an active outdoor adventurer who lost a grip on his fitness over the two-year lockdowns. After nearly fainting from his first hike post-pandemic, he realised it was time to get back in shape.

In May 2022, Mike signed up for a Mount Kinabalu hike, so he couldn’t easily back out from the challenge. The goal was simple: to reach Mount Kinabalu’s peak like it was a leisurely hike, instead of a “suffer-fest,” as Mike put it, referring to the first time he attempted to reach the summit.

His weekly training routine alternated between gym sessions, hikes, and 30-minute walks.

“Aside from consistency, I made sure I had fun and varied things up along the way, so I mixed it up with things like Muay Thai class and rock climbing with my friends as well,” he detailed.

In the end, Mike managed to hit his goal of climbing Mount Kinabalu in November 2022 with little to no struggle.

Keeping up the momentum in 2023, Mike intends to conquer bigger mountains like Mount Raung in Indonesia, and Island Peak in Nepal, along with international running events.

Rebuilt physical strength and regained self-esteem

Sarah Enxhi shared her goal to build up not just her strength, but also her self-esteem.

This was coupled with her worsening endometriosis condition causing hormonal issues, fatigue, bloating, and lower abdomen cramps. In February 2022, Sarah decided that she was going to take back control of her health.

“I went back to weightlifting, something that I used to do many years back, and hired a personal trainer to train me properly and keep me accountable,” Sarah said.

On top of two to three weekly training sessions, she even bought her own dumbbells, barbells, and plates to set up a mini personal gym at home. She also got a walking pad to help her reach 10,000 steps a day.

By the way: Even if you don’t plan to scale mountains like Mike, or invest in home workout equipment like Sarah, you can always start small. Try brisk walking around your neighbourhood or moving around in the office to increase your daily step count.

The PUMP app tracks this, resulting in higher PUMP Scores, and higher chances of earning rewards.

Sarah realised her physical and mental goals were achieved when she gained significant confidence in her body.

“I learnt to appreciate my strength and muscles, instead of nitpicking and self-loathing over flabby or fatty body parts of mine,” Sarah reflected.

Of course, there come days when work gets tiring, and her endometriosis cramps would demotivate her from working out.

In such moments, Sarah shared, “I will always remind myself that ‘done is better than perfect’. I also listen to my body, if I really am unable to do it for that day, then I just don’t, and I rest.”

Prioritised mental health with the help of professionals

On the subject of mental health, Ain Nasir shared her story of healing after losing her late father in March 2022. Ain’s grief left her feeling lost, and in a state where she no longer enjoyed the activities she once loved.

Consulting professionals, Ain was diagnosed with ADHD and BPD by psychiatrists, which pushed her to work on her mental health.

Did you know: Attention-deficit and hyperactivity disorder (ADHD) in adults can lead to anxiety and depression due to difficulties in focusing, concentration, and impulsivity.

Meanwhile, borderline personality disorder (BPD) is a mental illness that severely impacts a person’s ability to regulate their emotions.

When these problems aren’t managed effectively, they can lead to feelings of frustration, irritability, and low self-esteem.

Aside from medication, Ain saw a therapist at least twice a week, and found comfort in religion. She also convinced herself to find joy in her hobbies again, including music, swimming, and weightlifting.

“I’m only human, and I can’t force myself to always be strong,” Ain recognised.

Over time, Ain began seeing things in a new light. Though she wouldn’t claim to be 100% where she hopes to be mentally, she’s confident that she’s in a better state of mind, and intends to keep trying, no matter what it takes.

By the way: More than working on your fitness, PUMP has features to stay on top of your mental health. You can set mind goals, note down entries in the in-app thought journal, practise guided meditation, and more.

Mind goals achieved add up to your overall PUMP Scores to earn rewards as well.

Overcame insomnia through consistent sleep training

Although Fadhilah Amaani has struggled with sleep for seven years, her insomnia worsened during the MCO, where she’d only get around five hours of sleep per night.

Did you know: Sleeping between seven and nine hours is essential for your health and can have beneficial effects on your heart, metabolism, and productivity.

Getting a good night’s sleep can increase your PUMP Score.

“Believe me, I’ve tried sleeping early, but my body was just used to living with a night owl’s schedule,” she recalled. “Sometimes at night, I’d get anxious that I won’t wake up on time for the next working day, and I’d end up not sleeping to avoid that altogether.”

In January 2022, Fadhilah decided enough was enough and was determined to reset her body clock.

Each night, she’d start her sleep routine at 10PM, tucking herself in with a weighted blanket. Then, she’ll scroll social media on her phone for an hour or so, which calms her mind enough to fall asleep.

Though this conflicts with commonly known advice, what’s important is that Fadhilah has found a solution that works for her sleep routine, and is sticking to it.

After months of staying disciplined, Fadhilah proudly stated that her body naturally feels tired by 11PM each night, even without going through the routine that once helped her.

“I have to avoid thinking about things that’ll worry me at night. I tell myself to think about it the next day. To me, it’s not running away from problems. It’s more like dealing with it at the right time,” Fadhilah reflected.

Managed the effects of a disease by cooking a nutritious diet

Timothy Wong has suffered from atopic dermatitis (eczema) for over 20 years, where he’s dealt with constant itching, inflamed skin, and open wounds that have led to infections. “I also had nights where I couldn’t sleep because of how itchy it was,” he shared.

He recently learnt about how diet affects his condition, and began keeping a food diary to observe the reactions his body had to certain foods.

A physician advised Timothy to cut out canned, frozen, and processed foods, and introduce more fruits and vegetables, cooked fresh every day.

“I didn’t have any experience cooking in the kitchen, but knowing my health was on the line, I had to try and just learn from experience,” Timothy decided.

Although sticking to clean eating habits isn’t easy whenever socialising comes into the picture, Timothy would still try to pack his pre-cooked meals and join loved ones at restaurants.

When it comes to cheat days, Timothy gets creative and cooks himself a dessert of sorts using ingredients he knows are safe for his body.

“For example, I made myself baked potatoes or pumpkin purée. That helped my weekly sweet cravings,” he shared.

“I just had to change the idea of what a ‘cheat day’ meant for me.”

By the way: Using PUMP, you can check your daily fibre intake and try cooking high-fibre recipes listed on the app as a guide to a balanced lifestyle.

“[By the end of 2022], although my skin is still inflamed and itchy, there are fewer open wounds, and I can at least have a good night’s rest,” Timothy observed.

-//-

A word from our sponsor: Tune Protect’s PUMP can complement your fitness and wellness journeys, you’ll have a tracking tool to look back at how far you’ve come in your goals, be they for your diet, mental health, sleep, or fitness.

Ultimately, a common theme shared by our interviewees is that improving your health and wellness is a continuous process.

Success comes not just from consistency, but from making the right choice for yourself in the moment too.

As demonstrated by our interviewees, it’s alright to take a break for a day or two if that means bouncing back stronger.

Also Read: Hopping into a festive Peranakan house, what does a DJ rabbit have to say about CNY?

Featured Image Credit: Fadhilah Amaani / Sarah Enxhi / Timothy Wong

Keeping the tradition of paper-cut art alive for 10 yrs got this M’sian featured by Netflix

Have you ever tried to create paper-cut art? You know, like folding up a piece of paper and then cutting little designs into it? It doesn’t seem that hard, right?

That’s probably because you’re not doing what professional Malaysian artist Eten Teo is doing.

“I first came into contact with paper-cutting when I was in middle school,” Eten recalled. “When my family wanted to decorate the house during the New Year, they suggested cutting some patterns with red paper for decoration.”

With that simple activity, Eten’s interest was piqued. He started learning the craft by himself and would take pictures of his handiwork and share them on social media. From there, he began to receive orders from relatives and friends, and continued honing his skills.

One day, a friend of Eten’s suggested that it would be better to open a dedicated paper-cut account to reach a wider audience. Accepting the idea, the brand Redcut Paper Cutting (Redcut) was born.

That fateful decision was made in 2013. Now, 10 years later, Eten is still going strong with the brand.

Showcasing Malaysian talent to the world

Paper-cutting is a traditional craft that might seem simple at a glance, but actually requires great patience.

However, it’s also an art form that’s dwindling in practice.

As such, Eten has often been featured in the media, from ASTRO to CNN, as someone who’s keeping the art alive and active. Since then, he has also worked with many well-known names for various events, from Parkson to Burberry.

For the Year of the Rabbit, one of the brands Eten has collaborated with is Netflix.

According to a press release, Eten’s paper-cut piece marks the first time a physical artwork is digitised to be featured on a local moment on Netflix.

“At the beginning, I was a little puzzled why Netflix wanted to create a serious paper-cut piece, because we can say that what we do is completely irrelevant,” Eten admitted.

Netflix could have engaged with illustrators and graphic designers for a completely digital project, rather than work with Eten to digitalise a physical piece of artwork. After all, the latter still required the Netflix team to have Eten cut the paper on-site for them to film and shoot.

“But after many discussions, I realised that Netflix is just that sincere and wants to use the most original traditional art to bring out the whole New Year atmosphere,” Eten shared.

Eten’s no stranger to working with big brands, but those were mostly limited to the Malaysian crowd.

This collaboration with Netflix will further Eten’s reach, as the art will be spotlighted on the Netflix platform in Singapore, Taiwan, Hong Kong, and Vietnam.

However, Eten shared that this feature might not have a great impact on the art of paper-cutting.

“After all, people may not pay much attention to the art of paper-cutting after the New Year,” he explained. “But I am still very happy that Netflix chose paper-cut art as this visual concept this year. It gave this traditional art a chance to be exposed and made everyone feel that this art is still very beautiful.”

Receiving the spotlight once a year

Eten graduated from the department of graphic design and multimedia at UTAR. However, his current full-time job is actually in the logistics industry.

“Redcut has always been operated as a hobby, but of course, it’s a side hustle that I’m quite serious about,” he told Vulcan Post.

This makes sense because Eten typically only gets busy during the festive periods, namely Chinese New Year.

He usually starts receiving requests from clients as early as three months before Lunar New Year. However, once the festive season is over, Eten’s schedule clears out.

“This is an obvious issue, and most people will not notice paper-cutting until New Year’s Eve or some specific festivals,” Eten shared.

The seasonal nature of this job explains why Redcut must remain as a side hustle for Eten.

On the bright side, this setup makes it easier for Eten to balance his full-time commitment as well as his interest in paper-cutting.

Still, Eten also pointed out that the root of this issue lies in the fact that Malaysia is very underappreciative of the arts industry.

“Many people often think that art is very cheap,” he explained. “The price of a piece of paper may only be RM1, but the time cost of a paper-cut work far exceeds this value. How much do you think you would be willing to pay for a paper-cut piece? RM10? Maybe it took me five hours to cut this work. How much do you think is reasonable?”

“Of course, there is no standard answer,” he concluded. “But what I think I want is just respect for art.”

Preserving the tradition of paper-cutting

With the bulk of his preparation for Chinese New Year 2023 mostly done or underway, Eten is already looking to new upcoming projects.

He shared that he might be holding an exhibition with another artist this year, though nothing is set in stone yet. He’ll also be preparing a dragon papercut for the upcoming year, which might end up being his largest papercut yet.

It’s been 10 years since Eten started Redcut, and throughout the years, he’s remained passionate about preserving and highlighting paper-cutting.

“I think I myself might not have made a big impact, but I think the Redcut brand is able to grow the papercutting industry in Malaysia. There aren’t many papercut artists in Malaysia, and fewer yet are the artists who provide customised services.”

“So, I hope my work is one that makes people feel amazed and shows how Malaysia too is home to art like this.”

Also Read: Hopping into a festive Peranakan house, what does a DJ rabbit have to say about CNY?

Featured Image Credit: Eten Teo, founder of Redcut Paper Cutting / Netflix

Elon Musk silences critics as Tesla’s profits beat expectations, more than double in 2022

Disclaimer: Any opinions expressed below belong solely to the author.

To be honest, this article could just contain this chart (and a mic drop somewhere in the background):

Tesla beat expectations posting US$3.7 billion in profit in the fourth quarter of 2022, for a total of US$12.6 billion in 2022 — or more than twice the US$5.5 billion it recorded in 2021.

Revenue posted a jump of over 50 per cent to US$81.5 billion, very nearly four times of what it was before the pandemic.

And yet, a month ago, we heard complaints coming from some corners that “a Tesla investor slammed Elon Musk and said he is ‘killing the company with his antics’ at Twitter” and that he “abandoned it”.

Well, it looks like it was nothing more than a PR slap done for partisan, political purposes by someone who dislikes Elon’s approach to managing Twitter and his stance on American politics, rather than an honest opinion about how the world’s most coveted electric vehicle maker is being run.

And, as the stock market comprises a bit more than a few sour grapes, the response of the money couldn’t be any clearer, as Tesla’s shares have rallied 63 per cent in a month:

And while they are still down from their peaks of the cheap cash infused bonanza of 2021 and parts of 2022, they are still worth five times what they were on the eve of the global pandemic.

That’s 500 per cent up during a time of freeze on travel and even basic commute, supply chain issues, shortages of semiconductors, Russian invasion of Ukraine, raging global inflation and tightening competition which has forced Tesla to slash prices of its cars.

I have to say, I used to be a major Tesla skeptic myself. The company struggled to make money and when it did register its first profit three years ago, it was on the back of carbon credits.

As recently as in the first quarter of 2021, it made more money trading CO2 and crypto than selling cars.

But it’s growing — and rapidly, at that. It delivered 1.4 million cars in 2022 and is expecting to hit 1.8 million this year, if not two million, which would mean it has quadrupled its output in just three years.

From a niche startup making premium cars for early adopters willing to accept the growing pains of a new industry, it is becoming a proper car company, rapidly catching up on the big guys.

The leaders at Toyota and Volkswagen are feeling the pinch. Toyota’s annual sales in 2022 fell, reportedly under 10 million units, or down by about five per cent from the year before (see chart). Meanwhile, Volkswagen is continuing its downward trend, delivered the fewest cars in a decade, at just 8.3 million.

It’s clear that Tesla is eating into the market share quite rapidly, taking around half a million cars from everybody else year on year.

Reaching two million would put it at a quarter of Volkswagen’s production — and we have to remember that the Volkswagen Group sells a whole range of cars under multiple brands (like Audi, Skoda or Seat) in markets all over the world.

In contrast, Tesla offers just four models.

Its good year-end performance and positive outlook for 2023 should give Musk some respite from the attacks he’s enduring for his handling of Twitter, as he tries to turn it into a profitable social media platform which doesn’t bend to the whims of certain political and ideological influencers.

It also goes to show that, for all the controversy associated with it, Tesla’s customers are not abandoning it in droves over the ruckus.

As one of the company’s fleet partners, Optimus EV reported that only two “out of thousands” of its customers decided to switch in recent months — surely not something that is going to keep Musk awake at night.

Also Read: Twitter Paradox: Musk badly overpaid, but it was still a bargain that will make him billions

Tharman warns that regulating “crazy” crypto may backfire, but a simple solution is at hand

Disclaimer: Any opinions expressed below belong solely to the author.

I’ve long believed that the greatest talent of one of Singapore’s most liked and respected politicians, senior minister and chairman of the Monetary Authority of Singapore (MAS), Tharman Shanmugaratnam, is his ability to get to the essence of any issue at hand and present it in just a few words.

Or, simply put: hit the nail on the head.

And he’s done it again during the panel discussion during World Economic Forum summit at Davos on January 18, this time speaking about regulating crypto space — in a way that I think hasn’t been given quite enough credit.

To regulate or not to regulate?

In my own coverage of the industry here on Vulcan Post, I’ve frequently remarked that the entire cryptoverse — and any currencies it produces — simply make no sense without regulation or outright government backing.

And the need to impose some form of legal boundaries on the space found common support among the panel members, including the CEO of Citigroup, Jane Fraser, Chairman of UBS group, Colm Kelleher and the Governor of the Bank of France, François Villeroy de Galhau.

However, what Tharman pointed out really flipped the common idea of regulating crypto on its head.

It’s typical for politicians to want to impose control on things that carry huge risks to the public. However, what if the sheer act of regulation ends up helping to legitimise the risky activity, making it inherently more dangerous to people betting their savings on things they shouldn’t be?

I think whether it’s crypto or traditional finance, you have to regulate for things like money laundering — that’s very clear.

But beyond that, if we’re thinking about regulating crypto the same way we regulate banks or insurance companies, I think we have to take a step back and ask a basic philosophical question: does that legitimise something that is inherently, purely speculative, and in fact slightly crazy?

– Minister Tharman Shanmugaratnam

In other words, what if the cure is worse than the disease? It’s a real risk that isn’t spoken about.

And as the chairman of MAS, Tharman knows the complexity of the issue first-hand.

Despite the fact that MAS has imposed strict licensing requirements for businesses offering crypto-related services in the city-state, it was not enough to protect everyone from the risks of the highly volatile industry operating in largely borderless internet — as the bankruptcy of Three Arrows Capital or the collapse of FTX have shown.

There’s only so much that regulators can do and it’s made even harder by the fundamental unpredictability that comes with a new technology that does not conform to standard ways of doing things.

Lawmakers face an unenviable task of balancing the risk and rewards from innovation, trying to protect millions of people while encouraging productive technological progress.

Too many rules may discourage investment, but too few may lead to the ruin of people already targeted by unscrupulous scammers in many other ways.

What would Tharman do?

Are we better off just providing ultra-clarity that it’s an unregulated market and if you go in you go in at your own risk?

… We have to regulate a segment of the business (like regulated stable coins with full backing et cetera), but trying to regulate everything is going to be a never-ending game, and I’m not sure it’s the right way to go.

– Minister Tharman Shanmugaratnam

In other words, what Tharman proposes is freedom with disclaimers, warnings and education for individual customers.

However, this liberty would extend only to the borders of traditional finance.

In essence, as long as crypto businesses do not want to offer services typical of traditional banks, they and their customers operate at their own risk (perhaps with some exceptions applicable to backed assets, stable coins et cetera, such as companies making certain claims about what they offer).

But the moment they want to cross the boundary into traditional financial services, they would simply fall under existing rules that apply to banks and other financial institutions — no special treatment.

If crypto companies would like to do things that traditional finance is doing, you apply exactly the same regulations to them (regarding liquidity, reserves et cetera), under one regulatory system.

– Minister Tharman Shanmugaratnam

This, frankly speaking, is a beautifully simple cut to the Gordian knot that the topic of regulating crypto has become in the past two years.

Essentially, then, few new rules are really needed.

Aside from preventing criminal activity and ensuring that businesses don’t make unfounded claims, regulatory environment for any service that aims to compete with TradFi is already here.

It just has to be extended to these digital businesses when they want to offer deposits, loans, trading et cetera.

Meanwhile, everything else is just a gamble you have to bear the risks of. If you want to dump a million bucks on an image of a drunken ape, it’s on you.

Featured Image Credit: World Economic Forum

Also Read: Vitalik Buterin warns Singapore about separating cryptocurrencies and blockchain – but why?

A look at the Assurance Package and how it’s helping to cushion the impact of GST hike

As we usher in the new year, 2023 also brings along an increased Goods and Services Tax (GST) rate of 8 per cent.

By 2030, one in four Singaporeans will be over 65 years old. This will cause healthcare expenditure to increase.

In addition, social spending will be increasing as Singapore strives to do more for our communities, and care for the young, vulnerable, and the needy among us. To support such expenses, the government has to increase revenue base accordingly, and raising the GST rate is one way to do so.

To help Singaporeans cope with the impact of the GST hike, the government has introduced a S$6.6 billion Assurance Package (AP) for GST, which was further enhanced to S$8 billion as announced in November 2022.

However, how many of us actually know what the AP actually consists of, and how much support we can receive from it?

What is the purpose of the Assurance Package?

To help Singaporeans cushion the impact of the GST hike, the government has introduced the AP, which is designed to help Singaporeans in areas of daily essentials such as food, groceries, utilities and healthcare.

This AP support is provided on top of the permanent GST Voucher (GSTV) scheme that was introduced by the government in Budget 2012 in order to help lower- and middle-income Singaporean households defray their GST expenses.

First introduced in 2020, the AP has been topped up twice so far – the first top-up of S$640 million was announced during Budget 2022, and the second top-up of S$1.4 billion was announced in November 2022.

These top-ups, which now bring the AP to S$8 billion, are aimed at ensuring that the support for Singaporeans remains adequate amid inflationary pressures.

The AP will help offset additional GST expenses for the majority of Singaporean households for at least five years, with around 10 years offset for lower-income households.

While Singaporeans will definitely feel the pinch of higher prices and have to adjust to them, the government remains committed to helping Singaporeans through this.

However, it’s worth noting that the average Singaporeans are not the ones who contribute the most to GST revenue.

As a matter of fact, around half of net GST revenue is contributed by tourists and foreigners residing in Singapore, while the top 20 per cent of resident households account for close to 20 per cent of net GST revenue. Therefore, the GST hike can be expected to mainly affect these groups rather than the average Singaporeans.

How will Singaporeans benefit from the Assurance Package?

The AP comprises cash payouts, Community Development Council (CDC) Vouchers, additional GSTV – U-Save, and MediSave top-ups.

These will be disbursed over five years, and the first tranche of AP benefits will be disbursed from December 2022 to February 2023.

The good news is that all Singaporeans will stand to benefit from the AP. Here’s a breakdown of the support that you will receive:

- AP Cash for all adults

As part of the AP, all adult Singaporeans will be receiving cash support.

For starters, all Singaporeans aged 21 and above will receive between S$700 and S$1,600 over five years. The amount received will depend on factors such as assessable income and number of properties owned.

The first round of AP cash has already been disbursed, in which about 2.9 million adult Singaporeans received up to S$200 of AP cash in December 2022, ahead of the GST hike.

- GSTV – Cash (Seniors’ Bonus) for lower-income seniors

In February 2023, lower-income senior Singaporeans aged 55 and above will receive up to S$300 cash under the GSTV – Cash (Seniors’ Bonus). Eligible seniors cannot own more than one property, and must have an assessable income of S$34,000 and below a year.

These payouts will be disbursed over three years until 2025, and will benefit a total of about 85,000 seniors.

- Rebates and CDC Vouchers for Singapore households

Apart from the cash payouts, eligible HDB households will also receive additional GST Voucher (GSTV) – U-Save rebates to offset utility bills from 2023 to 2026.

This is on top of the regular GSTV – U-Save rebates under the permanent GSTV scheme of up to S$95 for eligible households.

This year, up to S$95 of additional GSTV – U-Save rebates will be credited in January 2023. This amount will be bumped up to S$190 in 2024 and 2025.

The amount of additional rebates received will depend on the type of HDB flat that the household owns. Households staying in one-room and two-room HDB flats will receive S$570, while those living in executive or multi-generation flats will receive S$330 in total over the next three years.

From 3 January 2023, every Singaporean household will receive a total of S$300 in CDC Vouchers. This comprises S$200 CDC Vouchers under the AP announced at Budget 2022, and S$100 CDC Vouchers from the S$1.5 billion Support Package announced in October 2022.

The CDC Vouchers can be spent at participating hawkers, heartland merchants and supermarkets until 31 December 2023.

- MediSave top-ups for children and seniors

In February 2023, the government will also be providing MediSave top-ups to children aged 20 and below, as well as eligible seniors aged 55 and above.

S$150 will be credited annually into their CPF MediSave Account under the AP MediSave, which will be disbursed until 2025.

These top-ups will benefit about two million Singaporean children and seniors.

The government is doing what it can to support Singaporeans

The Singapore government recognises the recent inflation, which is why it has pushed out support packages to help with the increased cost of living.

While AP is meant to cushion the impact of the increase in GST expenses, the government has provided additional support for Singaporeans over the course of 2022 via three support packages – the Household Support Package (HSP), the S$1.5 billion support package announced in June, and the additional S$1.5 billion support package announced in October.

Last year, the government doubled the amount of GSTV – U-Save that households received in April, July, and October under the HSP. There have also been additional top-ups to Child Development Accounts, Edusave Accounts, and Post-Secondary Education Accounts.

2.5 million adult Singaporeans also received a one-off Cost of Living Special Payment of up to S$500, which has been progressively disbursed in December 2022, together with the AP Cash.

All of these efforts have been made in order to provide relief for Singaporeans to better cope with higher costs of living, and to ultimately ensure that no one gets left behind.

This also means that every Singaporean and every Singaporean household have received something, be it CDC Vouchers, the Household Utilities Credit, or more support for the lower-income.

At the end of the day, these efforts by the government are by no means exhaustive, so do stay tuned to the details of the enhanced S$8 billion AP in Budget 2023, when further updates will be announced.

Featured Image Credit: YouTrip

Also Read: S’pore households get S$300 in CDC vouchers from Jan 3 – here’s how to claim and use them