It’s a little surreal, planning out my death, especially just a few days after my 21st birthday.

(To be clear, when I say death preparation, I mean sorting out end-of-life stuff like wills and wishes, not actively participating in my demise.)

You might be thinking that I’m too young to be doing this, and I hope you’re right. I’m mostly healthy, but you never know what will happen next.

There will also be those superstitious few who think that this is “taboo” and pantang. I wouldn’t say I’m particularly sensitive when it comes to the topic of death. Sure, I don’t like ruminating over it for too long or I might get a bit weepy, but I won’t clam up when it comes to discussions surrounding it.

Still, there’s something a little bit daunting when it comes to imagining and preparing for a world without you in it. Not just for your own sake, but for your loved ones.

Just thinking about that—how my loved ones might and will outlive me—makes my heart twinge a little.

But death preparation isn’t meant to be a morbid topic; rather, its goal is to ensure that when you pass on, your loved ones can bury you the way you wished you would, your assets can be delegated as per your will, and more.

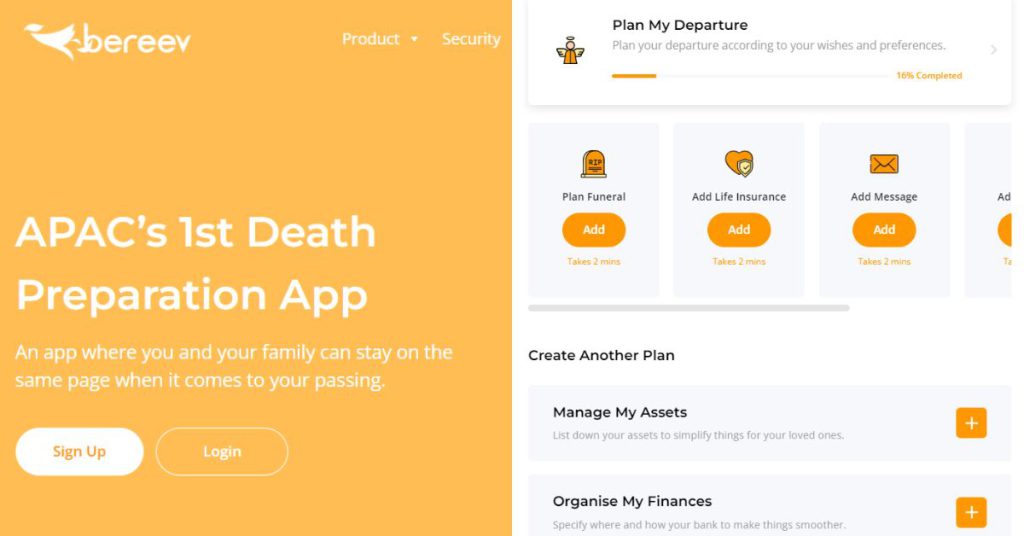

Done correctly, death preparation is meant to prevent family disharmony during a time of grieving. This is exactly what local deathtech startup Bereev wants to help with.

Let’s get prepping

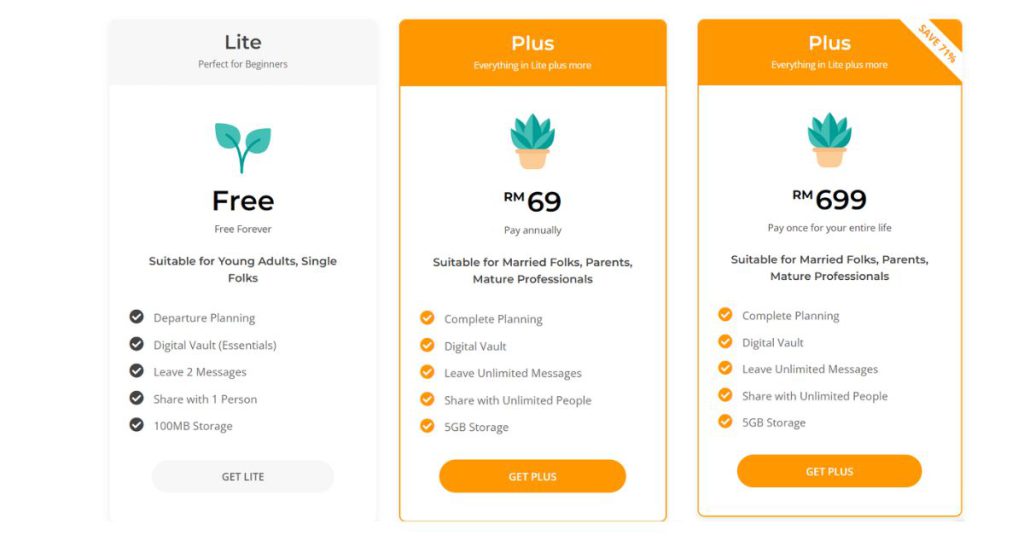

Bereev’s setup process is simple, unassuming. You go to the website and you choose a pricing plan—for the purposes of this review, Bereev’s founder, Izumi, graciously gave me access to a lifetime account, which would otherwise be RM699.

If you’re not ready or looking to commit to a full plan, Bereev also offers a lite option which is free. Here’s how it differs:

Like any other platform, it requires some basic information such as your name, phone number, birthday (the most recent year I can select is 2005, which means you have to be 18+ to use Bereev), and all that standard stuff.

You’re also prompted to select whether you’re Muslim or non-Muslim. On the non-Muslim mode, you have the option to add your will under the departure tab. This is hidden on the Muslim mode, where you’ll instead have the option to add your Wasiat and Hibah.

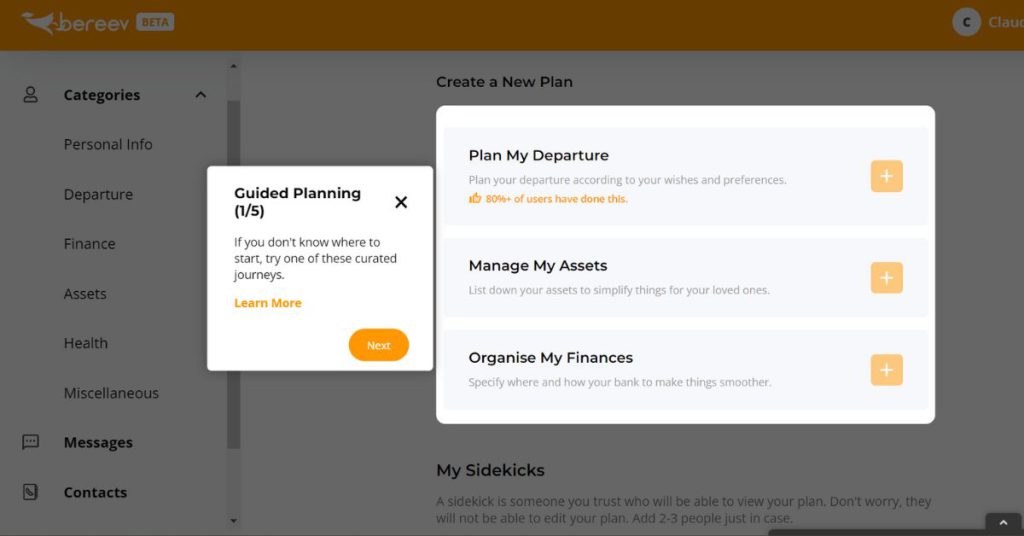

After verifying my email address, I was led straight into the app and given a few quick notes telling me where to start.

A nice thing about Bereev is that it seems to require you to log back in every single time, asking for your password as well as double authentication, so you can keep all your death-related secrets and plans uncompromised.

A lot harder than anticipated

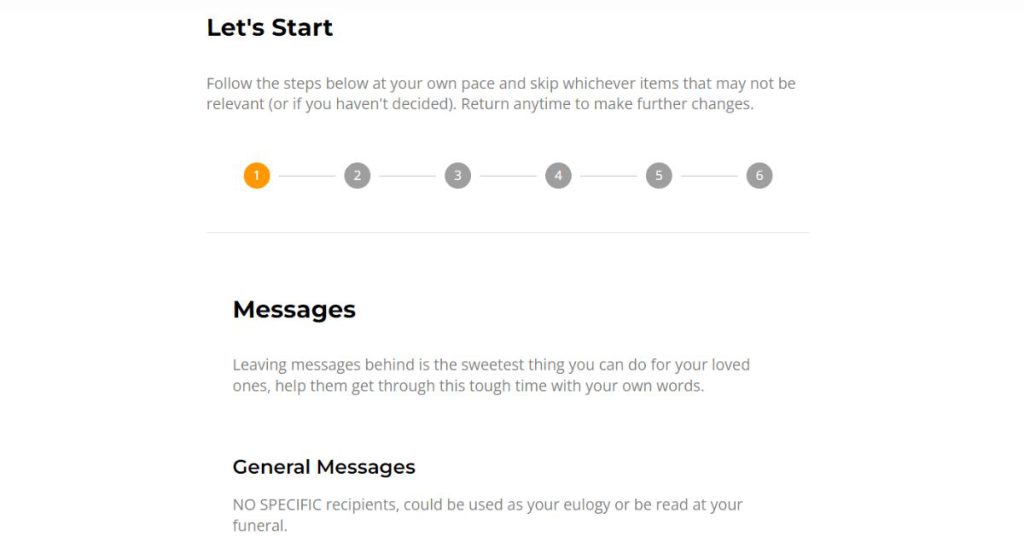

As a writer, words usually come easy to me, so I didn’t really think it would be difficult to write some heartfelt messages to leave for my loved ones.

But staring at Bereev’s page prompting me to write some words that might be read during my funeral, I found myself facing a bit of a writer’s block.

What can I say, I wondered, to comfort the people I love when I’m no longer there?

Can I really tell them I’ve lived a full life, at the ripe age of 21? Am I really ready to tell them not to worry and to chin up and to move on? Not to sound narcissistic, but can anything I say be enough to soothe the loss?

However, I guess the point isn’t so much to say what they need to hear but what I’ve never been able to say. If not now, then when, right?

Having to come up with a memorial photo is a little scary. And what to put on my tombstone, too. I think the main challenge with all this is just how final it feels, even though I can technically come back and change it.

But I suppose what’s worse is to make my loved ones make all these decisions for me. This comes back to the whole point of Bereev, which is to make our passing a little bit easier on our family and friends.

The bureaucracy of dying

Aside from helping you and your loved ones work through various emotions, a big part of Bereev is to sort out the actual technicalities of dying.

People who have experienced loss will know there’s actually quite a web of complex paperwork to go through when one passes. It was exactly this issue that inspired Izumi to start Bereev.

As mentioned, Bereev allows you add your will. But beyond that, it also lets you add a wealth (pun intended) of finance-related questions.

Between RM70 billion and RM90 billion in assets in Malaysia have been frozen as of 2020, Utusan Malaysia had reported. Their owners reportedly died without making wills or any proper inheritance plans, and family members of the deceased do not have sufficient information to do something about it.

With this in mind, Bereev will ask users to input how many bank accounts they have and who it’s with. It’ll also ask whether you have credit cards, loans or mortgages, and any other financial products such as life insurance, investments, retirement plans, or businesses.

Under the Assets tab, you can enter any properties, vehicles, devices, and digital assets you might own.

I don’t own any properties yet, so this part was mostly left blank.

Clicking into the Health portion, I came across something I never even thought about. Here, you can add your medical records, which to me seemed a little unimportant if I’ve already passed.

However, by providing access to your medical information, you’re allowing your descendants to have a better understanding of their health.

In the Miscellaneous tab, there is an additional portion where you can provide information on any pets you have, ensuring that they can be cared for when you move on.

Guiding your next of kin through a tough time

Once everything is done, it’s time for one of the hardest parts of this journey—sending your preparations to someone.

Bereev calls these people your “Sidekicks”, and it means someone you trust who’ll be able to view your plan.

I think this part is really tricky. Sending it to a very close loved one might just make them sad or worried, but it wouldn’t make sense to share it with some distant acquaintance.

It’s also a little sad when I think, what if the person I send this to passes first? In the Plus version, you can share your profile with an unlimited number of people, though, so there’s comfort in that.

All in all, I believe Bereev has done a good job of compiling and organising everything that might be handy after you pass. But is the app itself necessary? Wouldn’t it be sufficient to just write down all your thoughts and bank account details somewhere in a document?

That might be true, but I think Bereev’s interface helps to make the whole process less daunting and more approachable for both yourself as well as your loved ones, with less chance of any scattered documents getting lost over time.

With that said, the full version of Bereev can seem pricey to start with, but the Lite version gives users a good way to dip their toes into death preparation before they fully commit.

Especially for younger folks, it’s easy to look at this whole thing as very unnecessary. But it’s even more ridiculous to pretend that death isn’t literally a possible outcome every single day we live (knock on wood).

Using this death preparation app, I’ve been able to do a lot of introspection. While there were a few moments of sadness and grief for something that hasn’t even happened yet, I now feel a little more at ease and comforted by the topic of death and my dying.

More than just making sure your loved ones will be on the same page as you, Bereev is a way for you to reflect upon the kind of life you want to lead and the things you want to leave behind.

As I turn 21 and start a new chapter in my life, this has been the most valuable part out of this experience.