It can sometimes be a struggle for new businesses and ventures to secure funding for their projects as it might be difficult to connect to and capture the attention of potential investors.

However, there are now more ways for budding entrepreneurs to get funds for their ventures through alternative fundraising methods such as equity crowdfunding (ECF).

For those of you who are perhaps unfamiliar with ECF, it is essentially a form of alternative fundraising that allows small businesses to raise capital from the public, using online platforms registered with the Securities Commission Malaysia (SC).

Through such platforms, entrepreneurs are able to present and promote their businesses by offering equity in their companies to prospective investors who in turn, will invest in the businesses they see potential in. In doing so, these investors become shareholders of the company.

The ABCs of equity crowdfunding

According to the Equity Crowdfunding Framework issued by the SC back in November 15, 2022, there are a few standardised practices that apply to ECF in general.

Meanwhile, an important guideline that potential investors need to know is that there are three types of investor categories which are:

- Sophisticated Investor: High Net Worth Individual, i.e. an individual with a total wealth or net personal assets exceeding RM3 million OR High Net Worth Entities (Companies/Corporations), i.e. corporation with total net assets exceeding RM 10 million or its equivalent in foreign currencies based on the last audited accounts)

- Angel Investor: An investor that is a tax resident in Malaysia whose total net personal assets exceed RM3 million or whose gross total annual income is not less than RM180,000

- Retail Investor: An individual who is not an angel investor or a sophisticated investor

The type of investor category you fall under will determine how much you are able to invest in a small business under ECF.

| Type of investor | Investment restrictions |

| Angel Investor | Limit of RM500,000 within a 12-month period |

| Retail Investor | Limit of RM5,000 with a total of not more than RM50,000 |

| Sophisticated Investor | No restrictions |

Getting to know the platforms

Currently, there are 10 ECF platforms that have been registered with the SC, but one of the platforms appears to be inactive.

Each platform has its own differences for both investors and entrepreneurs. For investors, the main difference between each platform is simply in regard to the registration process.

On the other hand, for businesses, the key differences between the platforms lie in the duration of days given to raise funds, the costs as well as the listing process.

For small businesses, here’s what you should know about the various ECF platforms:

1. Ata Plus

Ata Plus is a crowdfunding platform that connects entrepreneurs with potential investors and is one of the most well-known ECF platforms in Malaysia.

According to their website, they have had over 60 campaigns, raised RM83 million, and have had more than 10,000 investors.

Duration for businesses to raise funds: A maximum period of 90 days for any kind of business to get listed and reach their funding target.

Cost for issuers: RM4,888 including marketing and communication assistance throughout the whole campaign.

Listing process: To get your business listed, you’ll need to go through their online application and screening process known as ‘MyPitch’, which requires you to submit information and documents such as:

- The statutory standing of your business, past track record, and creditworthiness of your business and primary team members.

- Your business plan, financials, and funding requirements.

2. iPivot

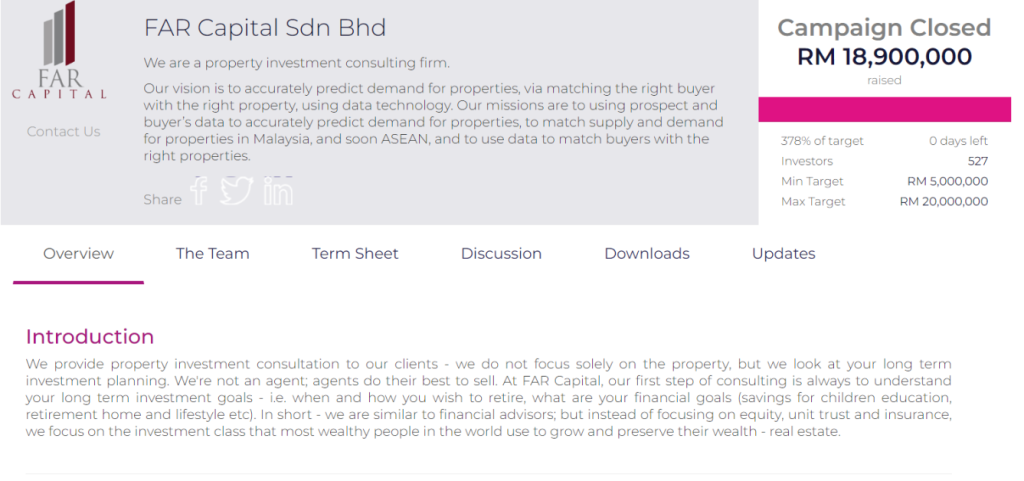

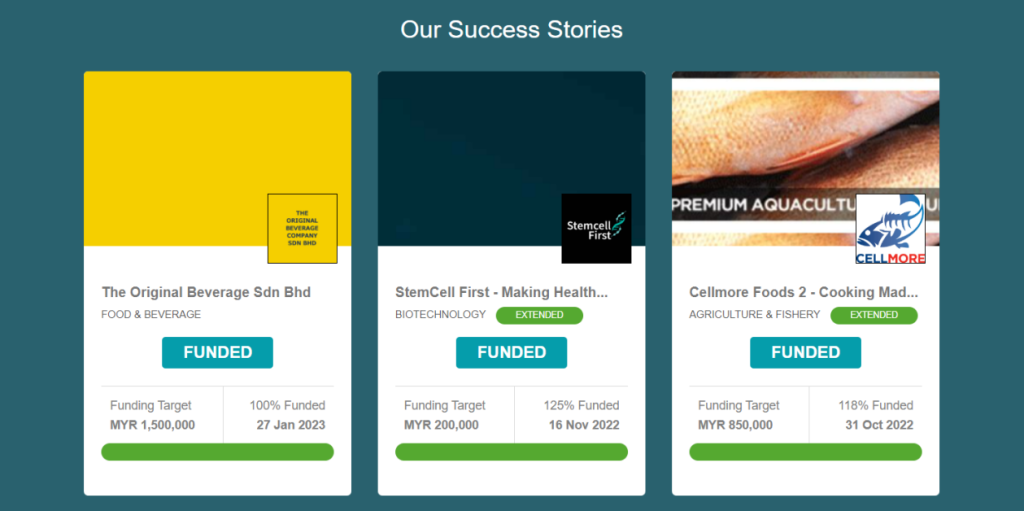

Founded in 2015, iPivot is ASEAN’s first equity crowdfunding platform, and was previously known as CrowdPlus.asia.

One of their past campaigns was the equity crowdfunding effort for The Original Beverage Sdn Bhd which reached its target of RM1.5 million from investors. According to the iPivot team, approximately 70% of their campaigns manage to reach their fundraising goals.

Duration for businesses to raise funds: The offer period is usually 30 days from the launch date but an extension period of up to 30 days might be given on a case-by-case basis.

Cost for issuers:

- An application fee of RM 4,888 will be charged once they grant you initial approval,

- A fee of 7% is charged on the total amount raised in a successful fundraising.

Listing process: Once you have joined iPivot as a user, you will be guided through their setup process where you are required to input business and financial information about your company.

Once completed, your information is reviewed to ensure it meets the criteria and if the information provided is satisfactory, you will be notified.

3. Crowdo

Crowdo is a regional fintech platform offering a full portfolio of alternative financing solutions including ECF.

With operations in Singapore, Malaysia and Indonesia, they boast a global community of over 30,000 members and have successfully financed more than 3,500 projects to date.

Duration for businesses to raise funds: You can set your funding period to any time between 10 to 45 days. This duration is decided before the launch of your fundraising loan.

Cost for issuers: Full details not available. Basic fees charged to an issuer are processing fees, onboarding fees, and an administrative fee which is charged as a % of the funds raised.

Listing process: To get your business listed, you’ll need to go through their online application and screening process via their website.

4. Ethis

Ethis is a fintech, impact investment, and Islamic crowdfunding leader based in Malaysia with a growing global community of funders from more than 80 countries.

Duration for businesses to raise funds: Campaigns can run for a maximum of three months.

Cost for issuers: A pre-campaign fee of RM3,500, 8%-10% of the amount raised from investors payable on a success basis, and post-campaign fee of RM3,600 per annum.

Listing process:

- Fill up the Issuer Onboarding Form and NDA (Non-Disclosure Agreement).

- Ethis’ investment team will vet the application and reach out to the company for further information.

- The company has to go through a due diligence process.

- If accepted for equity crowdfunding, the company will work alongside Ethis’ team to provide the necessary materials for the campaign launch.

- Once ready, Ethis will launch the campaign on their platform.

5. Eureeca

Eureeca matches companies ranging from growth businesses to pre-IPO ventures with institutional and individual investors that add value to the companies’ strategic expansion plans.

Duration for businesses to raise funds: There will be a 90-day period to raise capital from the crowd.

Cost for issuers: No need to pay any fees to apply, and there are no upfront fees. Once your business has been approved, and the Terms of Business have been signed, there is an application fee of US$750. If a campaign is successful, Eureeca takes a success fee of 7.25% of the amount raised.

Listing process: Upload your funding proposal here to start the campaign process.

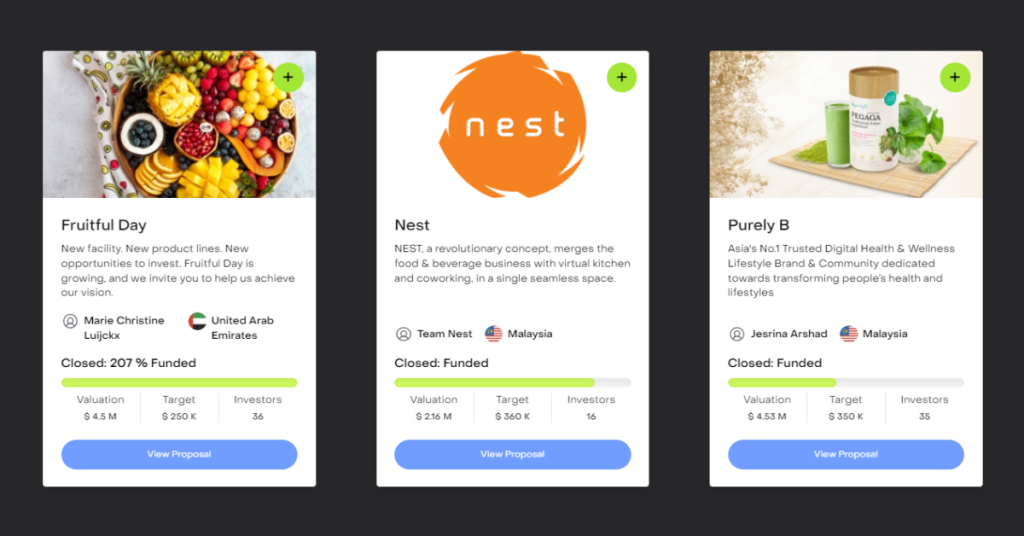

6. Alta

Alta (formerly known as Fundnel) is headquartered in Singapore and is Southeast Asia’s largest digital marketplace for alternative investments and gives investors direct access to invest and trade.

Since 2016, Alta has completed over 1,000 transactions valued in excess of US$600 million and has created access for investors to invest in over US$22 billion worth of mandated opportunities globally.

Duration for businesses to raise funds: The period of the deal (campaign) publication is entirely up to your company and its deal structure.

Cost for issuers: They charge a 3-5% success-based fee on the total funds raised from your deal.

Listing process: You may submit your fundraising application here. Upon submission, your fundraising application goes through a vetting process.

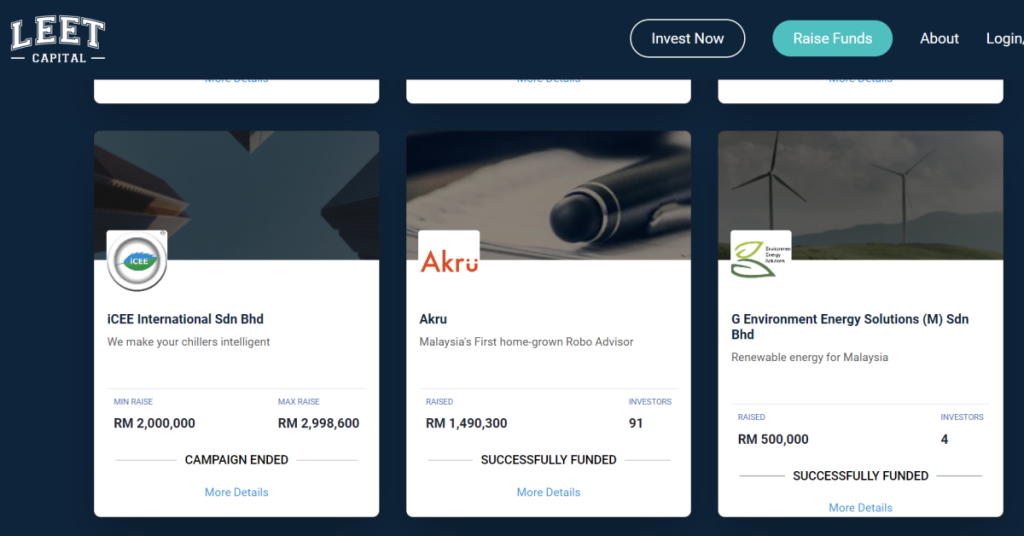

7. Leet Capital

Leet Capital is an innovative and premier equity crowdfunding platform that was awarded their license by the Securities Commission in May 2019.

Duration for businesses to raise funds: Around 30-60 days.

Cost for issuers: Once you agree to host on the platform, they will charge a one-time administrative fee of RM2,000 and a fundraising fee of between 5% to 7% for funds successfully raised.

Listing process:

- Register as a user and fill in the account profile with your company name, description, website, etc.

- Fill out a campaign request, including details such as funding goal, company valuation, and equity offering.

- On their side, they will review all requests submitted and perform due diligence to ensure that the requests meet all their criteria.

- Once approved, they may request further information and documentation to help them better understand the project.

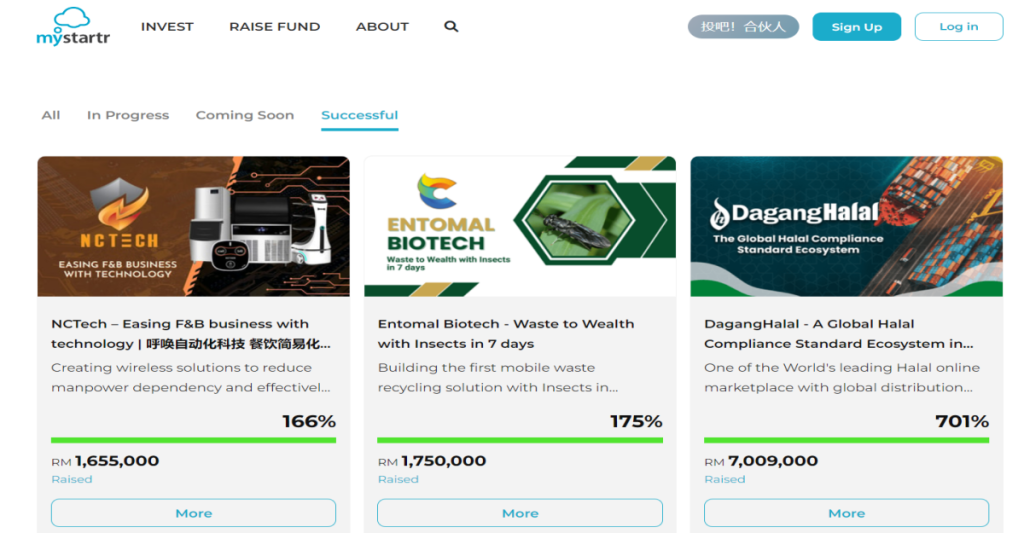

8. MyStartr

MyStartr is one of the fastest-growing equity crowdfunding platforms in Malaysia and has so far, helped companies raise more than RM64 million. It caters largely to Mandarin-speaking entrepreneurs in the creative industry.

Duration for businesses to raise funds: Each campaign shall run for a period of 60 calendar days or any other period as may be notified by them to you in writing.

Cost for issuers: A success fee equivalent to 8% of the total funds raised through MyStartr’s ECF Platform will be charged to you. On top of that, MyStartr will also charge a non-refundable processing fee and LLP set-up fee of RM3,000.

Listing process: You may submit your fundraising application on their website. Upon submission, your fundraising application goes through a vetting process.

9. pitchIN

pitchIN is a digital platform for investing and fundraising that connects entrepreneurs with potential investors.

Some of its well-known campaigns include TheLorry and Speedhome, which managed to raise RM4.1 million and RM2 million respectively on pitchIN.

Duration for businesses to raise funds: Campaigns will generally be set to run for between 30 to 60 days.

Cost for issuers:

- An RM1,688 administrative charge;

- An amount to be paid annually subsequent to the end of the campaign period based on the number of investors managed. It’s free for the first year while they will charge RM2,888 per year for campaigns under 35 investors, and RM3,888 for 36 and more investors in subsequent years;

- Success fees below RM5 million raised means a 6% charge, RM5 million to RM10 million raised: 5%, RM10 million to RM15 million raised: 4.5%, and more than RM15 million raised: 4%.

Listing process: You may submit your fundraising application on their website. Upon submission, your fundraising application goes through a vetting process.

| ECF Platform | Cost for entrepreneurs | Duration of campaign |

| Ata Plus | RM4,888 upfront fee | 90 days |

| iPivot | – RM4,888 application fee – 7% success-based fee | 30 days but a 30-day extension is available |

| Crowdo | Undisclosed | Between 10 to 45 days |

| Ethis | – Pre-campaign fee of RM3,500 – 8%-10% success-based fee – Post-campaign fee of RM3,600 per year | 90 days |

| Eureeca | – Application fee of US$750 – Success fee of 7.25% of the amount raised | 90 days |

| Alta | 3-5% success-based fee | Up to you |

| Leet Capital | – Administrative fee of RM2,000 – Fundraising fee of between 5% to 7% for funds successfully raised | Between 30 to 60 days |

| MyStartr | – Non-refundable processing fee and LLP set up fee of RM3,000 – A success fee equivalent to 8% | 60 days |

| pitchIN | – RM1,688 admin charge – Annual payment based on the number of investors – Success fees that differ based on the funds raised | Between 30 to 60 days |

Featured Image Credit: pitchIN/Leet Capital/Ethis/iPivot/Ata Plus/MyStartr