Tune Protect Life, the digital life insurance subsidiary that’s wholly owned by Tune Protect Group Berhad, introduced its FLEXIOne plan today. Targeting millennials and the Gen Z crowd, FLEXIOne is a flexible insurance solution covering life, medical, and critical illness.

As the name suggests, this new insurance solution provides customers with the flexibility to mix and match coverages based on personal preferences, as well as budgets.

Customers can either select one of its pre-packaged budget plans or build their own plan. To ease the purchase process, Tune Protect Life created Tracy, a virtual assistant to guide customers at every step.

Another feature of the brand’s new FLLEXIOne plan is its AI-powered Plan Recommender. Using some of the information shared by customers, such as age and gender, the artificial intelligence (AI) assistant will personalise and recommend customers the best-suited insurance package.

In other words, this AI Plan Recommender works similarly to an insurance agent. Tune Protect Life stated that the idea is to provide customers with convenience and to simplify the purchasing journey.

The press release also shared that the purchasing process is relatively straightforward, where only three simple health questions are asked. Hence, the time needed to buy insurance is also reduced to what the brand calls a “three-minute-to-buy discovery and purchase experience”.

Offering more flexible solutions

Aside from those, FLEXIOne provides customers with the ability to upgrade or downgrade their plan at any time. This would allow them to adapt it to their own needs and financial means across different life stages.

For example, if a customer is in a tight financial situation, they could reduce their premium by downgrading to a lower insurance plan. This way, customers won’t be forced to give up on their insurance plans entirely.

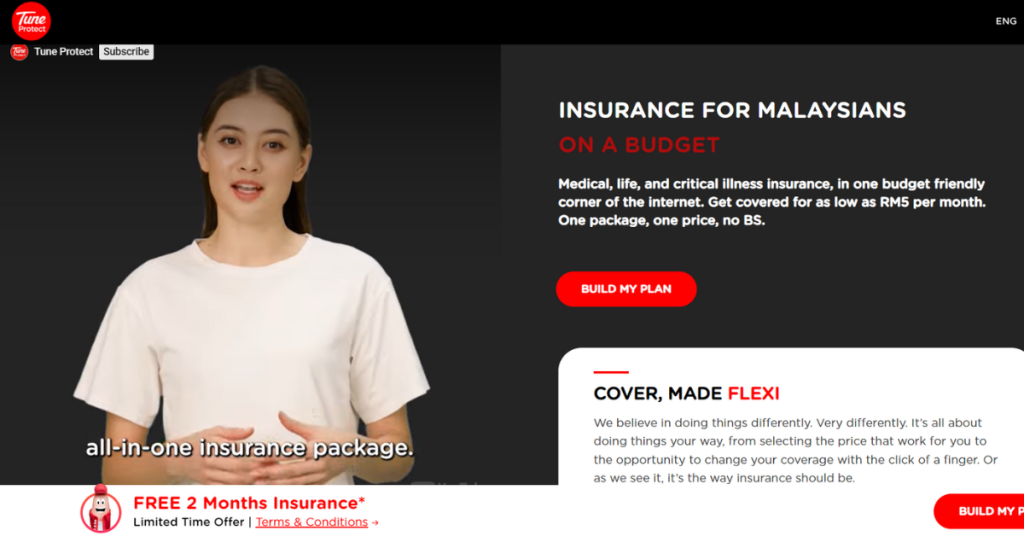

The main target market for FLEXIOne is the younger crowd, including first-time buyers and those on a shoestring budget. This is because its premiums start from RM5 a month.

Though, it’s not limited to just new insurance customers. The brand believes that it’s also ideal for those looking to top up their current insurance coverage.

Koot Chiew Ling, Principal Officer of Tune Protect Life said, “We are guided by our aspiration of bridging the protection gap in the country by providing affordable insurance solutions to consumers. With FLEXIOne, we are busting the myth that insurance is expensive and rigid.”

Currently, FLEXIOne is available for purchase on Tune Protect’s B2C online platform. As part of its introduction, the brand is offering two months of free FLEXIOne insurance of up to a total of RM300. This campaign will end on January 31, 2024.

“FLEXIOne checks all the boxes on insurance protection that is bite-sized, simple, innovative, and most importantly, value-for-money. If you are budget-conscious and want little commitment on your finances, this is the plan for you,” Chiew Ling concluded.

- Learn more about Tune Protect Life here.

- Read other articles we’ve written about Malaysian startups here.

Featured Image Credit: Tune Protect Group