ESG, SDG, CSR… As Philip Ling, the Head of Sustainability at CelcomDigi put it, it feels like all these corporate lingos have become an alphabet soup of sorts.

But there’s no doubt that ESG is more than just a buzzword these days. No, it has become a core component of corporate strategy, driven by increasing stakeholder demands for transparency and accountability.

And yet, distinguishing impactful narratives from the sea of misinformation, disinformation, and malinformation has become increasingly challenging.

Dictionary time: Disinformation is information that is false, and the person who is disseminating it knows it is false.

Misinformation is information that is false, but the person who is disseminating it believes that it is true.

Malinformation may refer to information which is based on fact, but removed from its original context in order to mislead, harm, or manipulate.

As corporates strive to communicate their ESG initiatives effectively, the need for authentic, compelling stories that resonate with stakeholders is more vital than ever.

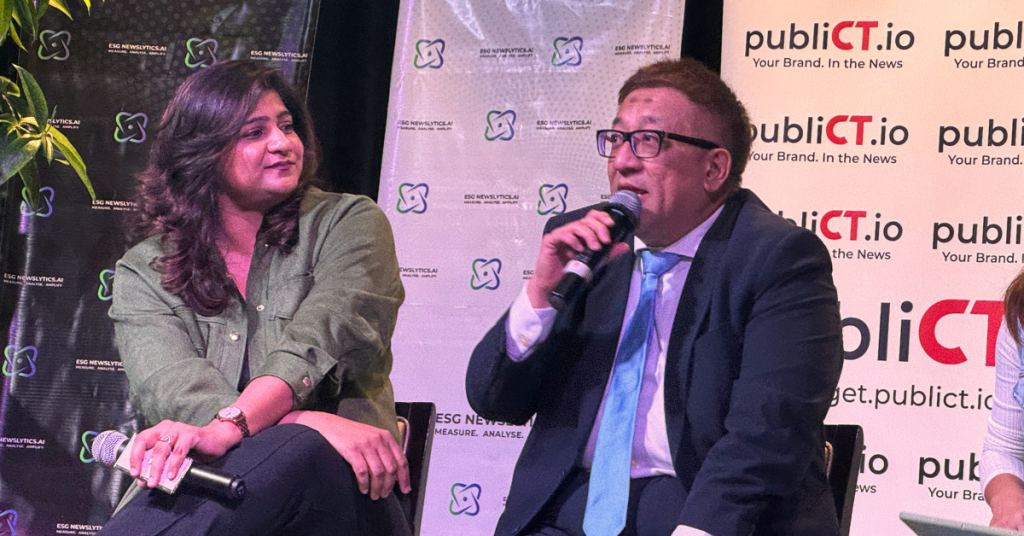

During the launch of ESGNewslytics.AI, there was panel titled “Storytelling for ESG: The Impact of Powerful Narratives”. For some context, ESGNewslytics.AI is an AI-powered tool by publiCT.io, a homegrown PR agency, for companies to easily measure, analyse, and amplify news coverage about their ESG efforts.

The panel comprised of Manminder Kaur Dhillon (founder and CEO of publiCT.io), Syed Mohammed Idid (general manager, strategic communications & stakeholder engagement at West Coast Expressway), Chia Ting Ting (CEO of FG Media), and the aforementioned Philip Ling (Head of Sustainability, CelcomDigi).

Here are the nuggets of wisdom shared by the panellists.

1. The medium is the message

Before you even consider the narrative you’re sharing, you must first interrogate: Where are you sharing it on?

Any social media marketer worth their salt will know that different platforms have different demographics and audiences. So, corporates need to first locate and identify their stakeholders, then determine which platform suits the correct stakeholder.

Stakeholders might include your shareholders, employees, customers, potential business partners, the mass audience, and more.

You wouldn’t want to just address one demographic either, but rather diversify your audience, too.

And of course, we need to look beyond just social media. There are also offline streams to consider.

To Ting Ting, long-form content is no longer the way to go when it comes to pushing ESG stories. Short-form and digestible information may be more effective.

The objective, she shared, is to start with engagement with the narrative, then get them to participate in the narrative, and finally, conquer or recruit them into sharing the narrative.

But just because the content is short, doesn’t mean it should be shallow.

2. Delve deeper

In an effort to highlight their ESG initiatives in digestible manners, many companies fall into the trap of delivering overly simplistic or surface-level narratives.

While these stories may temporarily boost a company’s image, they run the risk of being perceived as greenwashing—a deceptive practice where a company gives a false impression of its environmental efforts.

Corporates need to ensure that the narrative is actually providing value to the stakeholders.

That’s why platforms like ESGNewslytics.AI exist—so that corporations can use data to really showcase their ESG efforts.

Data-driven storytelling not only enhances the authenticity of ESG narratives but also serves as a guiding light for companies striving to make a real difference in the world.

3. Be a HIT

During the panel, Syed shared a handy mnemonic that can help corporates get their ESG messaging across, and that’s to be a HIT.

HIT stands for honesty, integrity, and transparency.

As cliched as might sound, Syed shared that good and impactful ESG stories should come from the heart. There should really be an honesty behind the message. This also helps combat any risks of greenwashing.

But, how do you convince people to believe that you’re being honest? Well, it comes down to trust.

And to earn that trust…

4. Consistency is key

Philip shared that the history of the messaging should be consistent. Instead of just doing something short-term, corporates must think of the bigger picture and develop proper roadmaps for their ESG efforts as well as ESG stories.

But of course, situations may change, and a company may change its approach. That’s why it’s important to…

5. Admit when you’re wrong

When mistakes happen, don’t just brush them under the rug. It’s important to recognise them so that you can move forward from them.

In that same vein, it’s important to remember that watchdogs are not your enemies. They’re a necessary part of the picture to ensure that all your blind spots are covered. Instead of reacting defensively, it’s important to actually take what they say into account.

Are we preaching to the choir?

During the panel, Philip pointed out that the people he needed to convince weren’t actually those in the room. Rather, it was those who weren’t there, the ones that don’t see the value of ESG, that needed to hear it the most.

Oftentimes, it does feel like articles and narratives on ESG are being consumed mainly by people who are already concerned with and aware of the topic.

That’s why it’s all the more important to craft relevant narratives so that you actually reach the people that matter—the people that need convincing.

So, corporates, don’t just focus on pushing your narrative out in an echo chamber. Be sure you’re actually providing value and impact so that you can reach the people who need to receive it the most.

- Learn more about ESGNewslytics.AI here.

- Read other articles we’ve written about Malaysian startups here.

Featured Image Credit: Vulcan Post