Here’s how OCBC Business is making it easy for M’sian SMEs to offer cross-border QR payments

[This is a sponsored article with OCBC Business Banking.]

Enabling cashless payment options to customers is essential for businesses in the digital landscape.

This way, you can provide customers with convenience and speed in making payments for your products or services.

Furthermore, if your business is looking to deal with customers from across the causeway, the importance of offering digital payments is heightened.

Understanding such needs, OCBC has a way for its business banking users to ease the process via OCBC OneCollect.

Seamless and efficient transactions

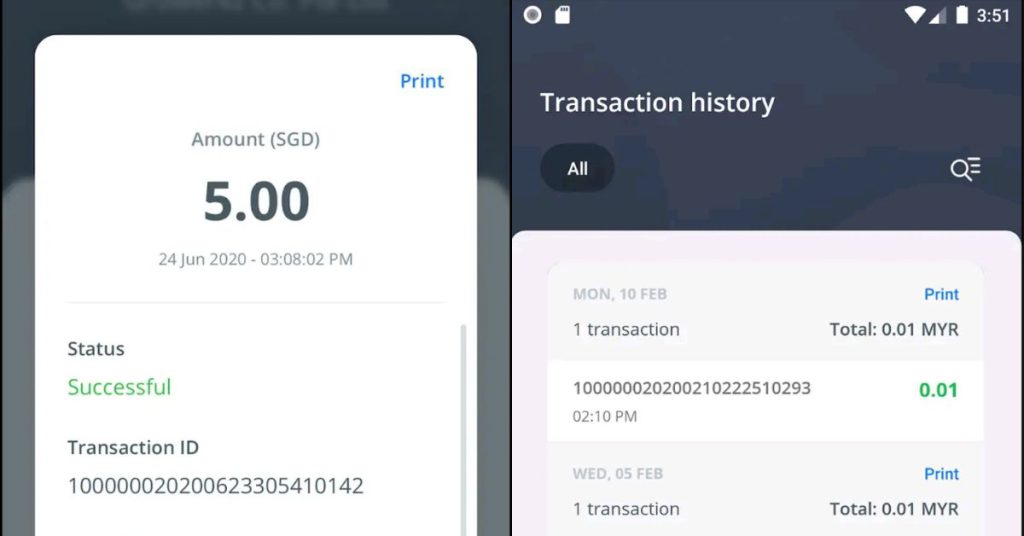

OCBC OneCollect enables businesses to collect payments seamlessly through QR codes by incorporating Malaysia’s national payments QR, DuitNow QR to support Ringgit (MYR) collection.

Using the OCBC OneCollect app, you can set up a dedicated DuitNow QR code for your business, and display it for buyers to scan and pay via any banking app or ewallet of their choice.

DuitNow QR runs on a real-time transfer basis, meaning upon a customer’s transaction, you’ll receive these payments instantly. There’s no need to rent a dedicated terminal for payments, reducing the operations cost for your business. You’ll also be notified when payments are received at the point of sale.

One local user of OCBC OneCollect is Redsea Esports Center, a cybercafe based in Wangsa Maju. Its business owners Tan Song Chun and Skeith Wong shared that they appreciate the speed, efficiency, and convenience of receiving payments via the QR payment solution.

They also reported that utilising OCBC OneCollect has been cost-effective for their business, as the bank does not charge transaction fees for the QR feature.

Receive payments from Singaporean customers

If your business deals with customers who are based in Singapore and transact with Singaporean Dollars (SGD), OCBC OneCollect has made it easy for you to transact with them as well.

OCBC OneCollect offers cross-border QR payments by integrating PayNow QR, which is Singapore’s version of DuitNow QR. To enable this function, you can generate a dynamic PayNow QR with a predefined transaction amount through the OCBC OneCollect app.

Upon scanning the PayNow QR, your customers will make payments in SGD while you receive the predefined amount in MYR.

For online businesses that don’t have a storefront, you can screenshot and share the dynamic PayNow QR code for your customers from Singapore to make payments. AM PM Pharmacy is a local user that uses this function from OCBC OneCollect to receive payments from their customers in Singapore.

Previously, their Singaporean customers would have to withdraw cash to make payments at the pharmacy, which sometimes led customers to abandon their purchases. For online transactions, AM PM Pharmacy would also experience delays in payment collection as overseas transactions from banks can be time-consuming.

“Since we adopted OCBC’s PayNow service, it has helped us address this issue, as my team are only required to send a QR code to the customer for payment, and it takes less than five minutes for the overall process,” said Ng Kee Wei, CEO of AM PM Pharmacy.

OCBC OneCollect is the first platform to offer cross-border payments between Malaysia and Singapore since 2020, with the app receiving the Recognition of Excellence Award by OpenGov Asia in 2023. This was for helping SMEs use the channel to ease their collections.

In the same year, OCBC Malaysia also won the ‘Malaysia Customer Experience of the Year – Banking” by Asian Experience Awards 2023 and the “Malaysia’s Bank of the Year 2023” by The Banker of London, awards achieved by providing exemplary customer service.

Track your transactions in real-time

As highlighted above, DuitNow transfers happen in real-time, so you’ll receive your customers’ payments instantly and be notified via the OCBC OneCollect app.

The OCBC OneCollect app’s reporting function can also give you a clear view of your daily sales report to ease the reconciliation process, saving you the time which could be allocated to planning for your business.

Furthermore, when consolidating your daily or monthly sales reports, OCBC OneCollect’s app seamlessly tracks your transactions and gives you an overview of them.

Redsea Esports Center praised this function in the app too, and shared, “OCBC OneCollect has notably improved our cash flow management and reduced transaction costs, contributing to an increase in overall revenue over approximately 3,500 transactions per month.”

AM PM Pharmacy shared the same sentiment, and expressed, “The user-friendly online banking interface and mobile app have provided quick access to the team on essential financial information and tools, contributing to efficient financial management.”

If you’re a serial entrepreneur managing multiple outlets, you can create different “Shops” in the OneCollect app.

These Shops can help you identify the transactions received by each of your businesses, keeping your business finances orderly.

Moreover, you can easily add your business partners or employees as users through the OCBC OneCollect app, and set up customised functions to meet your daily operational needs.

If you’re already an OCBC Business user and would like to start your digitalisation journey for your business by collecting payments through QR codes, you can download the OCBC OneCollect Malaysia app from the App Store and Google Play Store.

Meanwhile, if you’re newly starting your business and are keen to sign up for an OCBC eBiz Account, you’ll enjoy a 100% online application that comes with complimentary digital tools. They include OCBC OneCollect and OCBC Velocity, which are OCBC’s business banking portals containing useful business tools for you to run your business seamlessly.

- Learn more about OCBC OneCollect here, the OCBC eBiz account here, and OCBC Velocity here.

- Read more finance-related topics we’ve written here.

Also Read: The Tokyo govt wants to grow MY & SG startups in Japan, here’s how entrepreneurs can benefit

Featured Image Credit: OCBC

3 M’sian founders share their biggest business mistakes that made them better entrepreneurs

[This is a sponsored article with OCBC.]

You might think that the phrase “what doesn’t kill you makes you stronger” is overused. But there’s a good reason for that.

It’s a catchy reminder that going through tough times makes one more resilient, something that entrepreneurs probably know very well.

Common issues they may face include tight financial situations, and poor company performance. Oftentimes, this can be due to their own oversight, which can cause them to lose significant amounts of money.

In collaboration with OCBC Bank (Malaysia) Berhad, we interviewed three Malaysian SME founders to learn about their costly business mistakes, and how they course-corrected them.

Not properly assessing the market before expanding overseas

Stan Chooi co-founded Sometime, a brand that paved the way for women to own exclusive designer handbags at a fraction of the cost. Starting out as an online-only business in 2012, the company now runs several physical outlets at The Gardens Mall, One Utama, and IOI City Mall.

Seeing the brand’s success in the local market, Stan wanted to grow Sometime beyond Malaysia’s borders.

“Pre-COVID-19, we planned to invest and expand to another country in Southeast Asia,” he recounted.

Then the pandemic struck. Stan belittled the severity of the situation and decided to double down on the initiative.

But, as he soon realised, “The entire logistics and ecommerce operations weren’t feasible with all the lockdowns everywhere.”

By this point, there was nothing much he could do to fix things, so Stan aborted the plan in Q3 2020, incurring around RM500,000 in losses for Sometime.

At the end of the exercise, expanding to another country at the wrong time became his business’s costliest mistake.

Having experienced this, Stan now approaches similar situations more carefully, such as being more vigilant in observing the market before expanding.

Hiring staff too quickly with no time to train them

Shah Farid Rashid is the founder of Fasih Mandarin, a language centre started in 2018.

Accepting students ranging from 4-year-olds to seniors aged 70 and over, the brand went viral after several celebrities joined their online courses.

“We ended up having quadruple revenue,” he said. “The cost [of running the business] was no longer an issue as our finances could sustain our company for at least three years.”

Demand for the tutoring service was high. So, the founder decided to expand his sales team to grow their client base. With more students enrolling, they hired more tutors too.

At one point, every trainer’s schedule was packed. Since they had no time to train new hires, it resulted in incompetency.

Many new members drifted from the company’s objectives, and this wasted the time and motivation of other employees.

“The mistake was simply because no proper financial planning was done,” he confessed, adding that this “luxurious spending” lost the company over RM200,000.

This crisis took a turn after Shah began looking into the company’s spending and tightened his belt on resource allocation.

On the hiring front, Shah ensured that Fasih Mandarin’s HR team focused on recruiting competent people, and that they received adequate training too.

Not setting up proper finance systems in a family business

After the pandemic caused Chris Chin to shut down his 13-year-old neighbourhood restaurant, CintaRia@DJ, he started a new brand with his wife, Nichole.

Nicholes Cakery Cafe launched as a home bakery selling cakes online, and the duo disregarded tracking the business’s finances.

“Being husband and wife, we thought that we shouldn’t be too particular in terms of money and all, and so we started using both our personal accounts for all our business purchases,” Chris explained.

At the time, they were overwhelmed with fulfilling customers’ orders, from shopping for ingredients and baking, to packaging and logistics.

Chris and Nichole were also in the midst of renovating their café space that would take up the lot which CintaRia@DJ left behind.

Not knowing what their personal or business finances were spent on, and losing track of which customers have paid, made them realise that they had no idea where they were bleeding money from.

Realising they needed to get a grip on their business’s finances, they started creating simple spreadsheets to better understand their revenue and expenses.

Since they had minimal financial experience, they also attended business network meetings to learn from mentors and other entrepreneurs.

Eventually, Chris and Nichole signed on for a business banking account, which made things more systematic and professional.

Get the right tools to streamline your financial management

Aware of the kinds of struggles entrepreneurs like Chris and Nichole face, banks in Malaysia are providing easy and convenient ways for small business owners to manage their business finances.

OCBC eBiz Account is one of them, and it allows you to open an account 100% online, and with a low initial deposit of RM500.

With an OCBC eBiz Account, you’ll get complimentary banking tools too. They include internet and mobile banking capabilities via the OCBC Velocity and Business Mobile Banking app to stay on top of your business anytime, anywhere.

Contained in OCBC’s internet banking access is OCBC Business Financial Management (BFM). It acts as your financial assistant of sorts, helping you get an overview of your business by viewing your past, present, and forecasted cash flow through simple and intuitive visuals.

Additionally, BFM lets you examine data from multiple accounts in real-time, or dive into a single account to act on a plan immediately.

Being able to project your business’s cash flow and make decisions based on real-time data is advantageous when planning your next steps.

In the cases of Stan and Shah, this could help in projecting a business’s financial health when expanding overseas, or in financial planning for resource allocation when hiring more staff.

By signing up for an OCBC eBiz Account, you can also give your customers the option to make contactless payments, via debit or credit cards, and QR codes.

To register, your business must be wholly owned by Malaysians, and registered with Suruhanjaya Syarikat Malaysia (SSM).

-//-

As these entrepreneurs have shown, losing a grip on things can lead to some costly mistakes.

Passion alone can’t run a business, as money is still a powerful tool that allows founders to carry out their mission.

It’s true that taking risks is part of entrepreneurship, but it’s equally important that those risks are calculated and approached carefully.

As Sometime’s co-founder Stan summed up, “Don’t rush, don’t FOMO, do your detailed due diligence regardless of the time required.”

Also Read: Singledom, rivalry, and fortune: Here’s how June 18 became a global ecommerce festival

Featured Image Credit: Shah Farid Rashid, founder of Fasih Mandarin / Chris Chin and Nichole, co-founders of Nicholes Cakery Cafe / Stan Chooi, co-founder of Sometime

Starting a career in tech? Here’s why you should consider joining the banking industry

The latest turmoil in the tech industry has seen tech giants axing employees worldwide. Reasons for these layoffs include the current economic conditions, global events such as the war in Ukraine, and market turmoil.

Despite the global tech retrenchments, Singapore is seeing a digital shift and tech is becoming a bigger focus of both multinational and local companies. Companies remain eager to not only retain top tech talent, but continue hiring to build their tech teams to ramp up digital capabilities.

Singapore’s shift towards digitalisation also has the support of the government, with S$200 million to be set aside over the next few years to enhance schemes that build the digital capabilities in businesses and workers in Singapore, as announced during Budget 2022.

The rise of deep tech in Singapore

With the government’s support bolstering the tech landscape, deep tech such as artificial intelligence (AI), robotics, blockchain and biotech, has seen exponential growth in Singapore.

The integration of deep tech into different sectors has accelerated the adoption of Web3, augmented reality/virtual reality, and the metaverse – simplifying previously tedious processes such as money transfers, real estate transactions and logistics.

For example, to simplify the distribution of government payouts and vouchers, the Singapore government is experimenting with the issuance of programmable money through blockchain tech.

The possibilities of tech are endless and it’s a good industry to enter, considering the vast potential it holds. The global Information and Communications Technology (ICT) market in Singapore was valued at US$41.76 billion in 2021, and it’s expected to grow to US$61.06 billion by 2026.

As more companies delve into the tech space, NTUC Secretary-General Ng Chee Meng said that “there is a lot of aggregate demand for tech talent”. Hence, if you’re looking for a new job or a career switch, the tech industry could be the perfect choice.

OCBC is looking to ramp up its digital capabilities with new tech hires

As tech skills are highly transferable across industries, the use of tech has been weaved into many roles and integrated into various other industries, such as the banking industry.

For banks such as OCBC, tech is nothing new – the bank has been embedding technology in banking since the advent of computers and the Internet, from OCBC’s mobile app to its internal chatbot ‘Buddy’.

To further ramp up its digital capabilities, OCBC announced earlier in March that it plans to hire 1,500 tech talent over the next three years. The bank is currently looking to hire more tech talents to fill roles in areas such as application development, cyber security, data science and AI.

According to Praveen Raina, head of group operations and technology at OCBC Bank, the bank aims to continuously invest in digitalisation and create greater value for its customers.

“To do this, it is vital to have the right workforce – not just in terms of size, but in quality as well,” he emphasised.

In line with this, OCBC has rolled out various initiatives, which include partnering with tertiary institutions to identify talents earlier.

An example of this is the OCBC IGNITE internship, a one-year customised tech internship programme co-designed with Ngee Ann Polytechnic, that started earlier in March this year. It offers polytechnic students the opportunity to gain practical work experience and will have its intake doubled for the second run in 2023.

“The programme gives students ample time to deepen their understanding of the financial sector, develop industry-current tech skills, and amass real-world work experience early, all of which will prepare them for the workplace upon graduation,” said Praveen.

Upskilling and addressing employee pain points are as important as attracting new talent

With the rapidly evolving tech landscape, OCBC understands that the mindsets and capabilities of its people need to go hand in hand with infrastructure upgrades – which is why the bank places importance on the upskilling and reskilling of its current employees. This ensures that no one gets left behind, given the speed at which technology is changing.

Hence, OCBC has instilled programmes over the years to ‘bring its people along’ its digital journey.

For example, close to 300 of its staff have completed the Data Certification Pathway, an in-depth training in data analytics to enhance their current roles or help them get redeployed to other roles.

Its staff working in operations are also on the bank’s Career Conversion Programmes, with about 550 of them on track to be retrained and redeployed into new or enhanced roles by the end of 2022.

Besides upskilling their employees, Keith Wong, the head of group digital office and end user services at OCBC Bank said that the bank’s culture of mutual respect allows its employees hailing from different industries and backgrounds to flourish.

“Across the bank, we have a culture where our leaders encourage new ideas, reward continuous learning and most importantly, care for the well-being and growth of our staff.”

The open and collaborative culture in OCBC has empowered its staff to drive changes, including the birth of a ‘super app’ called HR-in-your-Pocket (HIP), which enhances the employee experience by bringing all work-related matters into a unified, easy-to-use platform.

“Companies or banks typically buy a product or a service that meet basic and general employee services needs. As such, it is often very challenging or expensive to customise or tailor the product to fit our process, let alone create a great employee experience,” said Keith.

Through HIP, OCBC can address specific employee pain points through conversations with its users, and design products to empower the employee. Some of the app’s most popular features include calendar-on-the-go, and hot desk booking.

More than 13,000 of OCBC’s employees use the platform monthly, with an average employee satisfaction score of over 4.5 out of 5 in the last year.

In addition to this, the usage of HIP allows OCBC to digitalise its processes.

“With HIP, over 200 service requests and processes across the OCBC Group have been digitised, automated, and streamlined to date,” said Praveen.

Aside from this, OCBC’s engagement with its employees ensures that the needs of its employees are met. For instance, the bank identified that 63 per cent of them found the experience of exchanging physical name cards to be cumbersome.

Hence, the company implemented an eNamecard feature on the HIP app for its employees, enabling them to exchange their name cards digitally with clients and partners through their mobile phones.

With all of these initiatives in place, OCBC can be a great choice for tech talents. The bank’s initiatives can create an engaging experience for employees, as well as bolster employees with the latest tech trends.

The people make the difference in an organisation

OCBC is calling on tech talents hailing from diverse backgrounds as the tech landscape rapidly evolves.

The bank sees huge potential and business opportunities in harnessing new technologies such as Web 3.0, Big Data and AI to curate innovative and personalised solutions. With the help of talented tech personnel, OCBC can ramp up its tech offerings and stay ahead of its competitors as more banks leverage data and analytics.

OCBC believes that it is the people that make the difference to an organisation. That’s why it also focuses on upskilling its current employees to keep up with digitalisation, while attracting new talent.

Check out OCBC’s career page to apply for the bank’s available tech roles.

This article was written in collaboration with OCBC Bank.

Featured Image Credit: OCBC Bank

Also Read: OCBC announces mass hiring of 1,500 tech workers with majority of roles to be based in S’pore

From Getting A Degree To Renovating A House, Here’s How Much It Costs To Achieve These Milestones

Everyone has aspirations — it could be as simple as studying overseas, to living in a swanky penthouse.

Regardless of what your dreams are, they all have one thing in common: they cost money. With the high cost of living in Singapore, the price tags of these life milestones are also set to increase.

Here’s when financial planning comes into play. It involves defining our goals and priorities, allowing us to understand how much each goal costs so we can better budget and manage our cash flow.

With that, we deep-dived into how much each major milestone of a typical Singaporean costs so that you can have an idea of how much money you will need and start your financial planning early.

1. Getting A Degree

Since young, we have been instilled with the ritual of studying hard, doing well in exams, getting a degree and scoring a well-paid job. It almost sounds formulaic but this has been the norm for many Singaporeans.

While having a degree doesn’t necessarily mean job stability, it can help pave the way for a comfortable life.

With Singapore’s strong focus on sophisticated skill sets to drive the economy, a degree may simply serve as an added protection against competition in an increasingly globalised world.

In fact, according to data from SingStat, Singapore residents aged 25 years and above with a university education consists of 23.7 per cent of the entire local population in 2010, and that figure has increased to 31.6 per cent in 2018.

If you are thinking of getting a degree, the estimated course fees at the local universities (both public and private institutions) range between S$24,600 and S$39,600 for Singaporeans if we look at the latest numbers from the 2020 intake.

| University | Estimated Course Fee For 2020 Intake |

| National University of Singapore (NUS) | S$24,600 – S$28,800 |

| Nanyang Technological University (NTU) | S$24,600 – S$28,800 |

| Singapore Management University (SMU) | S$34,350 – S$37,950 |

| Singapore University of Technology and Design (SUTD) | S$39,600 |

| Singapore University of Social Sciences (SUSS) | S$30,000 – $33,440 (for a 4-year course) |

| Singapore Institute of Technology (SIT) | S$22,500 – S$43,080 |

| Australian Universities | S$34,135 – S$45,398 |

| Hong Kong Universities | S$21,121 – S$25,693 |

| UK Universities | S$33,186 – S$55,068 |

| US Universities | S$56,086 – S$66,134 |

These are estimations based on three-year general courses, and exclude the more expensive courses like medicine, dentistry and music.

If you are thinking of studying overseas however, the tuition fees are generally more costly and you will also have to consider accommodation and other living expenses.

At this point, you may want to consider getting an Education Loan at a low interest rate of 4.5 per cent and with flexible repayment options, whether you would like to study at a local private institution or overseas institution.

How much you would need to get a degree: At least S$25,000

2. Starting A Business

Instead of being a salaried employee, there are some Singaporeans who yearn to start their own business and be their own boss.

The basics of starting a business is to first identify a consumer pain point before coming up with a product or service that helps to resolve it and meet their needs.

Let’s say you are planning to set up an IT software startup. You may need to hire a developer to create the software, a salesperson to sell your software, and a part-time accountant for the company’s finances for a start. Depending on their work experience, salaries may work up to between S$132,000 and S$195,000 a year, using the EDB calculator.

In the first year of operation, you may be looking at renting a co-working space or hot desk (as we ease back to the ‘new normal’ of work) since the company size will be small. With the same calculator, office space costs alone will come up to between S$14,400 and S$25,200.

There are also services that are typically required when setting up a company in Singapore such as incorporation and company secretarial services, which cost from S$1,000 to S$2,000.

The total first-year expenses would come up to between S$167,100 and S$252,000. Of course, you can choose to do away with some of these costs such as opting for remote working to save on office costs, or undertake some of the paperwork yourself to reduce expenses.

This calculator from the Economic Development Board (EDB) is a helpful tool that lets you have a rough idea of what you need to consider before setting up your company.

How much you would need to start a business: Up to S$252,000

3. Getting Married

A wedding in Singapore typically costs somewhere between S$30,000 and S$50,000, though extravagant weddings can cost significantly more (i.e. more than S$100,000).

The biggest components are the wedding banquet, bridal package and honeymoon. There are also other costs to consider such as wedding rings, dowry, solemnisation and wedding photography.

Wedding banquets form the biggest bulk of the costs, averaging about S$30,000, while the bridal package can cost up to S$6,000 and the honeymoon up to S$8,000.

How much you would need to get married: S$50,000

4. Renovating A House

Buying a house is a huge investment and you may find your savings exhausted after paying for the down payment and fees.

Receiving the keys to your new home doesn’t mean that you can move in right away. You would still have to spend on renovation and furnishing before you can move in, which typically averages $46,806, unless you buy a furnished condo which can lower down the costs.

There are also maintenance costs, property taxes and other miscellaneous fees to add to the final figure.

How much you would need to renovate a house: S$48,806

5. Raising A Kid

Image Credit: Mindchamps

Having a child is not just an emotional commitment; it’s a financial one as well. Parents have to provide for their children until they are old enough to care for themselves financially.

This usually amounts to about 20 years of financial responsibility for your child. What does that mean in dollars?

There is no universal standard cost for raising a child but it is possible to crunch some figures and get a rough estimate of what it would cost to have a child.

Parenting magazine SmartParents came up with a summary of the costs associated with each stage of a child’s life:

| Life Stage | How Much It Would Cost |

| Pregnancy | At least S$8,000 |

| Age 0 to 2 | At least S$60,000 |

| Age 3 to 6 | At least S$40,000 |

| Age 7 to 12 | At least S$70,000 |

| Age 13 to 16 | At least S$70,000 |

| Age 17 to 19 | At least S$16,000 (JC) or S$35,000 (poly) |

| Age 19 to 22 | At least S$40,940 (private) or S$118,000 (local university) or S$232,000 (overseas university) |

| Total | S$670,000 |

The grand total cost of raising a child in Singapore easily totals to more than half a million dollars — and that’s not even taking inflation into account.

How much you would need to raise a kid: at least S$670,000

Achieve Your Life Goals With A Personal Loan

It’s clear that the different life stages cost substantial money and you may be cash-strapped to achieve these milestones, especially when you are still in the early years of your career and have not accumulated much savings.

That doesn’t mean that it’s not possible for us to achieve these life goals. To lessen the financial burden, you can consider getting some financial help from the bank instead.

There is nothing wrong with taking a personal loan. It does not mean that you have a cash flow problem — in fact, it helps you to have better cash flow management so that you wouldn’t find your savings depleted suddenly.

Many might not know this, but the cost of borrowing via a personal loan is lower than a credit card interest charge (typically 25 per cent per annum). This means that borrowers can stand to enjoy interest savings and a higher loan balance.

The cost of taking a personal loan is also typically lower than that of an SME loan (typically 7 to 13 per cent). That said, taking a personal loan is a worthy consideration for entrepreneurs to fund their business.

Here’s a detailed breakdown of the different personal loans from OCBC Bank:

| EasiCredit | Balance Transfer | Cash-On-Instalments | ExtraCash Loan | |

| Pre-requisites | – | Must be an existing OCBC Credit Card or OCBC EasiCredit account holder | Must be an existing OCBC Credit Card or OCBC EasiCredit account holder | – |

| Income requirement | Ideal for low-income individuals as it requires a relatively low minimum annual income of S$20,000 | Minimum annual income of S$20,000 | Minimum annual income of S$20,000 | Minimum annual income of S$20,000 |

| Interest rate | 20.90% – 29.80% per annum depending on your annual income | 0% per annum (Effective interest rate from 5.20% per annum) | Interest rates starting from 4.70% per annum (Effective Interest Rate from 9.06%) | From 5.54% per annum (Effective Interest Rate from 10.96%) |

| Fees | Annual fee of S$120 (First year fee will be waived for customers with annual incomes of S$30,000 and above | A one-time processing fee of 4.5% | 1% of the approved loan amount | S$200 or 2% of the approved loan amount, whichever is higher |

| Minimum monthly repayment | Flexible repayments of 3% of outstanding amount OR S$50 (whichever is higher) | Flexible repayments of 3% or S$50 of your total outstanding balance (whichever is higher) | Fixed monthly instalments of 12 to 60 months | Fixed monthly instalments of 12 to 60 months |

If you would like to find out how much you have to repay monthly based on the amount you would like to borrow, you can use the online loan calculator which can be found on the personal loan pages. From there, you can decide which loan is ideal for you. It’s really easy and convenient!

For more information on personal loans from OCBC Bank or to apply for one, you can check out its website here.

This article was written in collaboration with OCBC Bank.

Featured Image Credit: First Cry Parenting / TWENTY20 / GettyImages / Property Guru / Patkoproperty

Also Read: Not Just Free Lunch: These Are The HR Benefits That S’pore Millennials Actually Care About