4 hesitations M’sian SME bosses may have about providing insurance for their employees

[This is a sponsored article with Tune Protect Life.]

Good medical coverage was among the top three company benefits highly valued by employees, stated Hiredly’s 2022 Work Culture Report.

That said, the financial responsibility of SMEs to provide employee benefits insurance may be demanding, because it’s a commitment that needs to be maintained.

Even if a startup or SME faces “dry spells” in the business cycle, it’s tough to retract a company benefit after it’s promised to employees.

Noticing the challenges SMEs face in this area, Tune Protect Life (a subsidiary of Tune Protect Group) launched its SME EZY Employee Benefit Insurance.

In partnership with Tune Protect Life, here are some hesitations Malaysian SME owners have about providing this form of insurance for employees, and how Tune Protect Life intends to help.

Disclaimer: We interviewed a selected group of employers for their opinions, who chose to maintain anonymity, but have given permission for their opinions to be used.

Hesitation #1: Not many Employee Benefit Insurance cater to smaller-sized companies.

The SME bosses highlighted that Employee Benefit Insurance requires them to have a minimum number of employees, ranging from 100 to 150 full-timers.

This makes it difficult for newer, smaller enterprises with under 20 staff members to even consider offering the benefit. In fact, it’s common for SMEs to have fewer than 75 full-time workers and startups to only have about 25.

That’s why Tune Protect Life is lowering the barrier of entry. Companies with a minimum of five to a maximum of 250 full-time employees can be covered under SME EZY.

Hesitation #2: Employee Benefit Insurance is expensive, and prices may increase if employees make claims.

To larger corporations, Employee Benefit Insurance may seem like a small cost to pay for their team members’ welfare.

But to a small business still trying to find its footing, this seemingly small amount is impactful to its bottom line. Insurance plans also charge per pax, which adds up.

“The scale is high once you have a higher number of people [in the company]. Insurance becomes a fixed cost, and it will be difficult if [the company] has an issue with sustaining its revenue,” said one SME owner.

The entrepreneur added that insurance companies would increase the premium per pax if there are substantial claims made by an employee, who may be exempted from being covered the next year.

Empathising with SMEs’ financial situations, Tune Protect Life offers a simpler Employee Benefit Insurance plan.

As low as RM367 for a yearly premium per employee, Tune Protect Life will guarantee the same premium amount for three years after signup, regardless of the claims made.

Not every employee needs a comprehensive insurance plan, and a small coverage can already be meaningful to them, certain that their company cares for their well-being.

In fact, SME EZY also has options to cover the employee’s dependants, like their spouse and children. This can give staff members a better appreciation for the benefit, assuring them that their family’s health is protected by their company.

Hesitation #3: My employees already have personal insurance.

SME owners we spoke to were curious to know what benefits employees would get if they already have personal insurance.

“Why would I pay for my employee’s insurance if they already have personal insurance coverage?” they wondered.

Employers in such situations could find that they may end up paying for something their staff wouldn’t necessarily need because they’re already covered.

Other employers suggested that providing an allocated welfare amount employees can claim from might be more worth it.

“For example, provide a welfare reimbursement of RM1,000 a year per staff. They can buy their own insurance. Every staff member has their own personal needs (some want term, some want medical, some want personal accident),” an SME owner recommended.

Aware that every employee has different needs and requires different kinds of coverage for their insurance, SME EZY allows businesses to mix and match according to different employee tiers:

- Group outpatient clinical;

- Group medical (hospitalisation);

- Group term life.

Group outpatient clinical means employees and their dependants can have a cashless experience when going for checkups at panel clinics.

By the way: A cashless experience means that the medical bill is settled directly between the health provider and the insurance company.

With Tune Protect’s in-app e-medical card, employees won’t have to worry about bringing along physical cards, and employers won’t have to deal with additional paperwork with the insurer.

Similarly, group medical is where employees who are admitted to the hospital can enjoy cashless admission in any of Tune Protect’s panel hospitals, or they can opt for pay-first-claim-later (reimbursement basis) when admitted to a non-panel hospital.

In the event of a hospitalisation, employees who have both personal and employee benefit insurance can choose between either plans to claim from. And say their coverage limit bursts when using their company medical card, they can still cover the cost with their personal insurance.

Regardless of health status, group term life provides lump sum cash payout to the next of kin upon an employee’s death or total and permanent disability (TPD).

Hesitation #4: What if my employees don’t use the claims, and they don’t need it in the first place?

The employers we spoke to aren’t ignorant of the advantages of Employee Benefit Insurance; they do acknowledge that employees would appreciate their welfare being taken care of.

That said, committing to the annual premium must be factored into the business’s expenses, leading to the question: “What if employees don’t utilise their claims, and I’m paying it for nothing?”

With many SMEs and startups run by teams of younger generations, this is valid. And at the end of the day, employees who don’t utilise the insurance is a sign that they are healthy and productive.

But for employers who are concerned that employees might use their claims too frequently, SME EZY has a safeguard to promote and reward employees who practise healthy lifestyles.

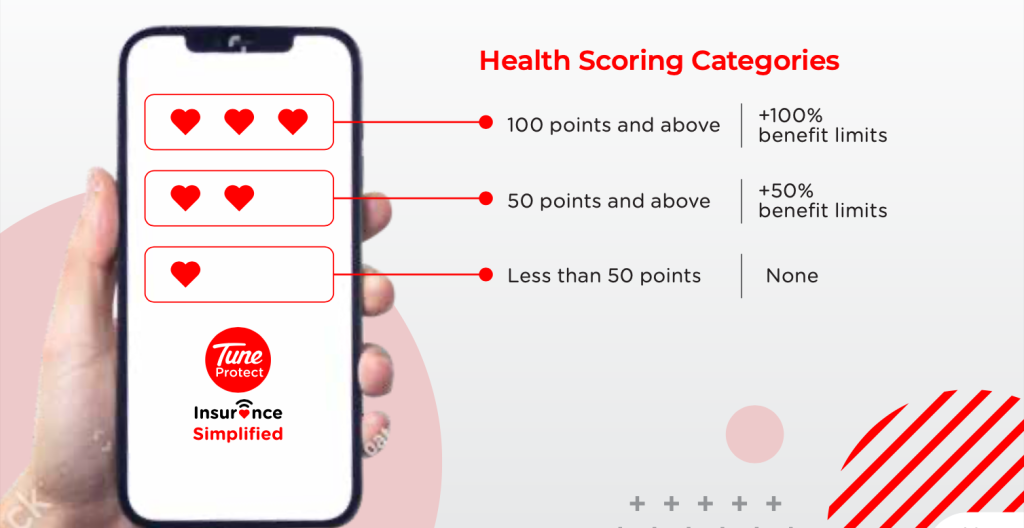

The three-year premium guarantee plan comes with a health rewards programme that does exactly that, called Activ8.

On Activ8, employees get access to health tools and coaching programmes to increase their scores on health metrics including BMI, blood pressure, blood sugar, and cholesterol level.

The higher the score, the higher their rewards, and their overall annual limit for coverage will be increased up to 100%.

Companies can also use this as an engagement platform to encourage employees in leading active lifestyles, so that they can be the best version of themselves in life, and at work.

-//-

Ultimately, Employee Benefit Insurance can be a safety net in case something unfortunate happens.

Affording this benefit is still dependent on a company’s budget, and its financial readiness to commit to this annual expense.

Even if your company hasn’t reached the state to provide Employee Benefit Insurance in its package, it’s reassuring to know that there are options such as Tune Protect Life that serve the needs of SMEs with ease, convenience, and affordability.

Also Read: For RM210/hr, international teachers can prep M’sian students for all major exams

Featured Image Credit: Freepik

5 health success stories from M’sians to inspire your physical & mental goals for 2023

[This is a sponsored article with Tune Protect.]

Taking control of our health and wellness can be a challenging task, especially when progress isn’t tracked. I’ve tried to improve my diet, workout, and sleep year after year, with little success because I wasn’t staying consistent, or tracking my progress.

Recently, Tune Protect Group (Tune Protect) has made it easier for individuals to improve their overall well-being by launching PUMP, a free health and wellness feature in its app.

PUMP allows users to track their fitness, overall lifestyle, mental health, fibre intake, and sleep, making it a holistic platform, regardless of age and fitness levels.

A key aspect of PUMP is that it rewards users who keep up with its recommended habits for a healthy lifestyle. Therefore, increasing your PUMP Score will earn you e-vouchers from popular brands like Decathlon, Adidas, and HealthLand.

And to inspire Malaysians to stick to their health goals in 2023, Tune Protect has challenged us to look for individuals who have successfully achieved theirs in 2022.

Conquered Mount Kinabalu after getting back in shape

To start off, we spoke to Mike Chu, an active outdoor adventurer who lost a grip on his fitness over the two-year lockdowns. After nearly fainting from his first hike post-pandemic, he realised it was time to get back in shape.

In May 2022, Mike signed up for a Mount Kinabalu hike, so he couldn’t easily back out from the challenge. The goal was simple: to reach Mount Kinabalu’s peak like it was a leisurely hike, instead of a “suffer-fest,” as Mike put it, referring to the first time he attempted to reach the summit.

His weekly training routine alternated between gym sessions, hikes, and 30-minute walks.

“Aside from consistency, I made sure I had fun and varied things up along the way, so I mixed it up with things like Muay Thai class and rock climbing with my friends as well,” he detailed.

In the end, Mike managed to hit his goal of climbing Mount Kinabalu in November 2022 with little to no struggle.

Keeping up the momentum in 2023, Mike intends to conquer bigger mountains like Mount Raung in Indonesia, and Island Peak in Nepal, along with international running events.

Rebuilt physical strength and regained self-esteem

Sarah Enxhi shared her goal to build up not just her strength, but also her self-esteem.

This was coupled with her worsening endometriosis condition causing hormonal issues, fatigue, bloating, and lower abdomen cramps. In February 2022, Sarah decided that she was going to take back control of her health.

“I went back to weightlifting, something that I used to do many years back, and hired a personal trainer to train me properly and keep me accountable,” Sarah said.

On top of two to three weekly training sessions, she even bought her own dumbbells, barbells, and plates to set up a mini personal gym at home. She also got a walking pad to help her reach 10,000 steps a day.

By the way: Even if you don’t plan to scale mountains like Mike, or invest in home workout equipment like Sarah, you can always start small. Try brisk walking around your neighbourhood or moving around in the office to increase your daily step count.

The PUMP app tracks this, resulting in higher PUMP Scores, and higher chances of earning rewards.

Sarah realised her physical and mental goals were achieved when she gained significant confidence in her body.

“I learnt to appreciate my strength and muscles, instead of nitpicking and self-loathing over flabby or fatty body parts of mine,” Sarah reflected.

Of course, there come days when work gets tiring, and her endometriosis cramps would demotivate her from working out.

In such moments, Sarah shared, “I will always remind myself that ‘done is better than perfect’. I also listen to my body, if I really am unable to do it for that day, then I just don’t, and I rest.”

Prioritised mental health with the help of professionals

On the subject of mental health, Ain Nasir shared her story of healing after losing her late father in March 2022. Ain’s grief left her feeling lost, and in a state where she no longer enjoyed the activities she once loved.

Consulting professionals, Ain was diagnosed with ADHD and BPD by psychiatrists, which pushed her to work on her mental health.

Did you know: Attention-deficit and hyperactivity disorder (ADHD) in adults can lead to anxiety and depression due to difficulties in focusing, concentration, and impulsivity.

Meanwhile, borderline personality disorder (BPD) is a mental illness that severely impacts a person’s ability to regulate their emotions.

When these problems aren’t managed effectively, they can lead to feelings of frustration, irritability, and low self-esteem.

Aside from medication, Ain saw a therapist at least twice a week, and found comfort in religion. She also convinced herself to find joy in her hobbies again, including music, swimming, and weightlifting.

“I’m only human, and I can’t force myself to always be strong,” Ain recognised.

Over time, Ain began seeing things in a new light. Though she wouldn’t claim to be 100% where she hopes to be mentally, she’s confident that she’s in a better state of mind, and intends to keep trying, no matter what it takes.

By the way: More than working on your fitness, PUMP has features to stay on top of your mental health. You can set mind goals, note down entries in the in-app thought journal, practise guided meditation, and more.

Mind goals achieved add up to your overall PUMP Scores to earn rewards as well.

Overcame insomnia through consistent sleep training

Although Fadhilah Amaani has struggled with sleep for seven years, her insomnia worsened during the MCO, where she’d only get around five hours of sleep per night.

Did you know: Sleeping between seven and nine hours is essential for your health and can have beneficial effects on your heart, metabolism, and productivity.

Getting a good night’s sleep can increase your PUMP Score.

“Believe me, I’ve tried sleeping early, but my body was just used to living with a night owl’s schedule,” she recalled. “Sometimes at night, I’d get anxious that I won’t wake up on time for the next working day, and I’d end up not sleeping to avoid that altogether.”

In January 2022, Fadhilah decided enough was enough and was determined to reset her body clock.

Each night, she’d start her sleep routine at 10PM, tucking herself in with a weighted blanket. Then, she’ll scroll social media on her phone for an hour or so, which calms her mind enough to fall asleep.

Though this conflicts with commonly known advice, what’s important is that Fadhilah has found a solution that works for her sleep routine, and is sticking to it.

After months of staying disciplined, Fadhilah proudly stated that her body naturally feels tired by 11PM each night, even without going through the routine that once helped her.

“I have to avoid thinking about things that’ll worry me at night. I tell myself to think about it the next day. To me, it’s not running away from problems. It’s more like dealing with it at the right time,” Fadhilah reflected.

Managed the effects of a disease by cooking a nutritious diet

Timothy Wong has suffered from atopic dermatitis (eczema) for over 20 years, where he’s dealt with constant itching, inflamed skin, and open wounds that have led to infections. “I also had nights where I couldn’t sleep because of how itchy it was,” he shared.

He recently learnt about how diet affects his condition, and began keeping a food diary to observe the reactions his body had to certain foods.

A physician advised Timothy to cut out canned, frozen, and processed foods, and introduce more fruits and vegetables, cooked fresh every day.

“I didn’t have any experience cooking in the kitchen, but knowing my health was on the line, I had to try and just learn from experience,” Timothy decided.

Although sticking to clean eating habits isn’t easy whenever socialising comes into the picture, Timothy would still try to pack his pre-cooked meals and join loved ones at restaurants.

When it comes to cheat days, Timothy gets creative and cooks himself a dessert of sorts using ingredients he knows are safe for his body.

“For example, I made myself baked potatoes or pumpkin purée. That helped my weekly sweet cravings,” he shared.

“I just had to change the idea of what a ‘cheat day’ meant for me.”

By the way: Using PUMP, you can check your daily fibre intake and try cooking high-fibre recipes listed on the app as a guide to a balanced lifestyle.

“[By the end of 2022], although my skin is still inflamed and itchy, there are fewer open wounds, and I can at least have a good night’s rest,” Timothy observed.

-//-

A word from our sponsor: Tune Protect’s PUMP can complement your fitness and wellness journeys, you’ll have a tracking tool to look back at how far you’ve come in your goals, be they for your diet, mental health, sleep, or fitness.

Ultimately, a common theme shared by our interviewees is that improving your health and wellness is a continuous process.

Success comes not just from consistency, but from making the right choice for yourself in the moment too.

As demonstrated by our interviewees, it’s alright to take a break for a day or two if that means bouncing back stronger.

Also Read: Hopping into a festive Peranakan house, what does a DJ rabbit have to say about CNY?

Featured Image Credit: Fadhilah Amaani / Sarah Enxhi / Timothy Wong

What Tune Protect’s travel insurance covers and how it works when unfortunate events happen

[This is a sponsored article with Tune Protect Malaysia.]

Since country borders reopened post-pandemic, revenge travellers have leveraged tourism deals offered worldwide.

With the lure of gorgeous sights and delicious food awaiting us, safety might take a backseat in our minds.

Sure, we’ll usually ensure that we’re staying in a decent neighbourhood, keep our belongings secure with us or in a safe, and other precautions.

But sometimes, our health and mother nature can suddenly take a turn for the worst, and in those cases, how can we be better prepared?

Tune Protect Malaysia had us highlight five benefits of how travel insurance can be handy if unfortunate scenarios were to happen while going abroad, via the brand’s Travel Easy plan. The insurance package comes in two options: with, and without COVID-19 coverage.

1. Reimbursement for overseas medical expenses

While on a trip to Italy earlier this year, my boss’s husband contracted COVID-19, and it was only a matter of time before she caught it too.

Although they didn’t have to seek medical or hospitalisation care while in Europe, it’s something that might have been required in another country.

Serious illnesses can still affect us no matter where we are, and access to emergency care then and there can’t be guaranteed.

Tune Protect’s Travel Easy with COVID-19 coverage ensures your medical expenses are covered for overseas treatments. Those who’ve purchased the COVID Plus plan could claim up to RM250,000 of their sum insured for Stage 3 to Stage 5 treatment (such as cases where breathing difficulties need to be treated).

Did you know: The sum insured is an amount that insurance companies pay to the policyholder in the case of an unpredictable event, as specified in the policy.

In the event of an emergency evacuation and repatriation (transporting someone back to their home country), the sum insured is up to RM500,000.

Taking COVID-19 into consideration, the Travel Easy plan also includes a sum insured value of up to RM1,400 (RM100 per full day) for quarantine costs. Under the COVID Plus plan for hospitalisation, the value is up to RM10,500 (RM350 per full day).

2. Coverage for travel inconveniences

2.1. Coverage for travel cancellations, delays, or curtailment

While travelling alone, my colleague Claudia, was in a frenzy during a 21-hour flight delay after her plane ticket was cancelled for her flight from the US.

The airport went into lockdown, and she learnt that all flights were halted due to bad weather as winter approached.

With no food or accommodation provided by the airport for almost a whole day, Claudia had to use her family’s flight credits to purchase another plane ticket to the next closest city.

No reimbursement or additional credits were provided by the flight for her misfortune.

If such curtailment were to happen with travel insurance, you could claim up to RM18,000 through Tune Protect’s Travel Easy basic plan. This protection also covers air tickets, cancelled car rentals, hotels, and tours.

The coverage extends to trip cancellations made by the traveller due to health or safety concerns insured with the COVID Plus plan, as long as it’s within 14 days prior to your scheduled departure date.

The sum insured for delays is up to RM3,000, and you could also claim up to RM500 for missed departures.

However, customers cannot make claims for scenarios simply where changes in their schedule occur.

2.2. Protection for lost, damaged, or delayed baggage

Another revenge travel misfortune my boss experienced was on a trip back from Singapore.

It was an hour into waiting at KLIA’s baggage claims that it dawned on her: none of the luggage she brought boarded the plane with her.

The only way she could get her luggage back was to wait for the next flight to land, which wouldn’t be for another two to three hours.

Luckily for her, she managed to recover all her belongings in the end.

If my boss had Tune Protect’s Basic Travel Easy insurance at the time, she may have been able to claim a maximum of RM1,000 of the sum insured for baggage delays (RM200 per six hours of the delay).

But say the situation turned out to be worse, and her baggage was completely lost or damaged. If so, she could have gotten reimbursement with travel insurance. With Travel Easy, she could claim up to RM5,000 in such a scenario if the issue is raised within 30 days of the incident.

2.3. Protection for lost travel documents

My mum once faced a situation where all her travel documents—even her Malaysian IC, driving licence, and credit cards—were pick-pocketed in Greece.

She had kept all important documents in her backpack, which was then sliced open by someone on the street, and her belongings were stolen for good.

My mum ended up having to make numerous police reports in Greece and extending her stay to make a temporary passport that could bring her home to Malaysia.

With the current economic situation, people have become more desperate, and may prey on unassuming tourists.

Hence, via the Travel Easy plan, any loss of travel documents like passports and Visas is covered with a sum insured of up to RM5,000.

3. Coverage for personal accidents

Lastly, Tune Protect’s Travel Easy plan has a sum insured value of up to RM300,000 should personal accidents happen. These include any events that occur beyond control by violent, accidental, and external means, such as natural disasters or other unforeseen accidents.

Based on Tune Protect’s policy, 100% of the sum insured will be paid if permanent or total disablement, or death due to accidents is suffered through the incident.

-//-

Complications can and will happen whether we like it or not, and we often can’t do much about them. It’s all the more reason to be protected with travel insurance outside your home country, or risk incurring more cost than necessary in a different currency.

Getting travel insurance like Tune Protect’s Travel Easy plan ensures that you’ll be compensated if ever any of the scenarios above happen during your international trip.

According to Tune Protect, its Travel Easy insurance is also priced competitively, and depends on the destination country. The cost of the individual insurance plan can range between RM69 to RM107.25.

There is also the option of getting the plan for a single trip, or annual coverage regardless of the frequency you’ll travel in one year.

The COVID Plus Plan and COVID Lite Plan are only applicable to international travel.

There is a 15% Early Bird discount if you buy the Travel Easy insurance 30 days before your departure date. This promotion is ongoing from now till March 31, 2023, and those travelling abroad for the new year, such as Chinese New Year could take advantage of it.

Malaysian adults aged 18-80 may purchase Tune Protect’s travel insurance, while children must be part of a family plan.

- Learn more about Tune Protect’s Travel Easy insurance here.

- Read other insurance-related articles here.

Also Read: 5 reasons to treat your employees with an office at Colony’s luxury coworking spaces

Featured Image Credit: Pexels

4 factors why Millennials and Zillennials still don’t have a critical illness insurance

[This is a sponsored article with Tune Protect Malaysia.]

I’ll be honest. As a 27-year-old that actively does rock climbing at least three times a week, I don’t have the most comprehensive insurance plan, even when I’m fully aware of the risk the sport carries.

To give a bit of context, my medical insurance plan only covers hospitalisation with a limit of RM100,000 annually.

Even if I don’t plan on upgrading my current insurance coverage, I should, at the very least, sign up for a critical illness insurance plan to bolster my already limited coverage, right?

While the answer to that would be a resounding “yes, you should”, the thought of booking an appointment with an insurance agent and sitting through their sales pitch seems rather daunting.

I’m sure I’m not the only one who thinks this way, too. To find out why Millennials (born from 1981 to 1992) or Zillennials (born from 1993 to 1998) do not have critical illness coverage, Tune Protect Malaysia had us ask our colleagues and friends. Here are some of our findings.

1. A lack of understanding about the insurance policy

Unlike medical insurance, a standalone critical illness insurance plan is not as well-known in terms of the benefits it provides.

When we asked interviewees whether they knew the difference between the two, four out of five respondents either had not heard of a critical illness plan, or had heard of it, but were not entirely sure what it does.

Our resident cosplayer and video editor, Loke, who’s a Zillennial at age 27, even mistook it for a personal accident coverage plan, which provides financial coverage for bodily injury, permanent disability, or accidental death.

Thus, not having a complete understanding of what sets a critical illness insurance plan apart from a medical insurance plan makes it one of the factors why Millennials and Zillennials are not signing up for it.

Matthew, our head of content production and another Zillennial at the age of 29, added, “My knowledge towards insurance is very limited, and no one had told me the differences and the benefits.”

And I understand him. If I’m going to fork out a sizeable amount of money throughout my lifetime to pay for something, I would, at the very least, want to know what kind of benefits I’ll be getting.

To shed light on the differences between the two insurance plans mentioned, a medical insurance plan pays for the cost of hospital treatment and medication when the patient is hospitalised.

A critical illness insurance plan, on the other hand, provides a lump sum payout upon diagnosis of a critical illness such as a heart attack, cancer, stroke, and kidney failure.

2. Insurance policies which can be overly complicated

Another reason why many are not familiar with the difference between a critical illness insurance plan and a medical insurance plan, is that insurance policies on what they cover can sometimes come off as vague and complicated.

To put things into perspective, my insurance plan, which is considered one of the more affordable ones covering only hospitalisation, is still 66 pages long. Not to mention, they’re filled with complex jargon and sentences, in my opinion.

Our business development executive, Rikco, a Millennial aged 31, agreed, saying, “Some insurance policies can be complicated, and sometimes you’ll need someone like an insurance agent to better explain the policies and what you’re entitled to receive.”

Sade, our Managing Editor and a Zillennial aged 25, said that her medical insurance planning was handled entirely by her mother, and all she has to do now is contribute some money to the monthly premium.

Even then, she is still unaware of what her policy exactly covers, and admitted to being a little too lazy to learn about it now.

While not many of our interviewees have had a bad experience as a result of not understanding their policies fully, Zhareef, our social media executive, and also a fellow Zillennial at age 25, had read stories and watched documentaries where loopholes were exploited in order to benefit the insurance provider.

Even though these stories are somewhat anecdotal, they’re still enough to cause hesitation among those seeking to sign up for their own critical illness insurance plan.

3. Other financial commitments take priority over having a critical illness insurance

Signing up for a critical illness plan might not currently be financially feasible for some of the Millennials and Zillennials we spoke to.

For example, Matthew highlighted that because he’s living on his own, he has to set aside cash for rent, groceries, and other financial obligations.

Sade is in the same boat, with the addition of having a pet to care for, which contributes significantly to her monthly expenses.

Idris, a freelance painter who’s a 30-year-old Millennial, mentioned that he would sign up for a critical illness plan if it’s affordable, and once his finances have stabilised.

The perception that critical illness insurance plans are expensive plays into the decision of not signing up for one, too.

To solidify this theory further, we asked the interviewees how much they think a critical illness plan with a coverage of up to RM100,000 annually should cost. The responses we received ranged from RM50 to RM400 a month.

However, if you do a bit of digging, it is actually possible to find affordable critical illness plans like Tune Protect Critical Safe+, which covers up to 39 critical illnesses with sum insured of up to RM200,000 from RM20 a month, depending on one’s gender, age, chosen sum insured, and more (terms and conditions apply).

Tune Protect Critical Safe+ also offers the option of making a monthly premium payment to ease their financial commitment.

However, if you’re able to comfortably afford to pay premiums annually, you’ll be entitled to some savings compared to paying monthly.

4. Lengthy sign-up processes and pushy agents

When it comes to purchasing insurance, many of our interviewees also expressed that they feel hindered by insurance agents who can be intimidating and pushy.

For Loke, it sometimes felt like they just wanted to sell him a more expensive plan than to help guide him through the insurance process.

Zhareef, on the other hand, raises an interesting point. “Personally I wouldn’t really trust insurance agents, not because of who they are, but simply because they only know how to sell insurance plans for a single brand.”

“Ideally, I’d like to compare plans from various different brands and choose the best one,” he followed up.

As for Idris, he found that insurance agents can be quite annoying to deal with because they tend to upsell instead of offering a plan that best fits his needs.

After the initial consultation, the entire sign-up process with an agent can also sometimes take up to a week, which means that you would have to further take time off to collect the insurance card and the policy booklet.

However, the process of signing up for a critical illness insurance plan does not need to be time-consuming or convoluted.

For example, Tune Protect Critical Safe+’s sign-up process is relatively straightforward as you can sign up directly from their website or mobile app.

Also, there’s no need to book an appointment with an insurance agent, which is a plus for those who prefer not to meet one.

On top of that, another benefit of signing up for Critical Safe+ online is that you will be able to submit your claims without needing to go through an insurance agent.

They are also committed to providing an appealing customer experience by allowing users to buy the plan within three minutes, receive a response within three hours, and have their claims paid within three working days upon approval.

In addition, if they miss or delay your payout, Tune Protect will add an additional 1% of the total sum insured for claims paid beyond 3 working days from the approval date.

Insurance coverage is better late than never

Even though our interview is limited to just a few Millennials and Zillennials, there is no “right” age to sign up for a critical insurance plan as medical complications can happen at any moment.

According to the national health and morbidity survey 2019, the number of Malaysian adults with high cholesterol levels, hypertension, and diabetes are on the rise, among other critical illnesses.

The scariest thing is that many aren’t aware that they’re part of the statistics until it’s too late. Therefore, even if you’re healthy, critical illness insurance plans can bolster your coverage in case something does happen.

If you only decide to get it after falling ill or becoming disabled, it might be too late to get one then as insurance typically will not cover preexisting conditions.

Critical Safe+ by Tune Protect covers Malaysians, permanent residents of Malaysia, and non-Malaysians that are legally working in the country, across the age range of 15 days old to 60 years old.

- Find out more about Tune Protect Critical Safe+ here.

- Read more about the National Health and Morbidity Survey here.

Also Read: 4 M’sian entrepreneurs share their worst business crisis, and how they triumphed through